-

Even as LTC makes no appearance in a lot of portfolios, data shows that it is more stable than BTC and ETH.

Both the RSI and MACD are showing clear bull signals.

As a long-term crypto investor with a keen interest in altcoins, I’ve been closely watching Litecoin (LTC) for quite some time now. Despite its older age and relatively smaller market capitalization compared to Bitcoin (BTC) and Ethereum (ETH), LTC has consistently proven itself to be more stable than the two major cryptocurrencies in recent years.

Litecoin (LTC), which was established among the earliest cryptocurrencies, often flies under the radar despite its historical significance and stability compared to Ethereum (ETH) and Bitcoin (BTC) in more recent periods. However, it has consistently garnered less investor attention than these two digital currencies.

Expert analysis often overlooks or even mocks the suggestion of Litecoin’s significance. However, data reveals promising prospects for Litecoin during this bull market. Here’s a breakdown:

Examining LTC’s True Potential

Examining the price chart of Litecoin (LTC), it’s apparent that the Relative Strength Index (RSI) hovers around its lower threshold. This signifies that Litecoin might be underpriced based on current market conditions. For investors or traders with faith in its underlying value and future potential, this could represent an excellent buying opportunity.

As a researcher studying the price trends of an undervalued altcoin, I’ve noticed an intriguing development in the Moving Average Convergence Divergence (MACD) indicator. Specifically, the shorter-term moving average has recently crossed above the longer-term moving average, a sign of convergence. This event is often followed by increasing bullish momentum, which lends credence to the possibility that an upswing may be on the horizon for this altcoin.

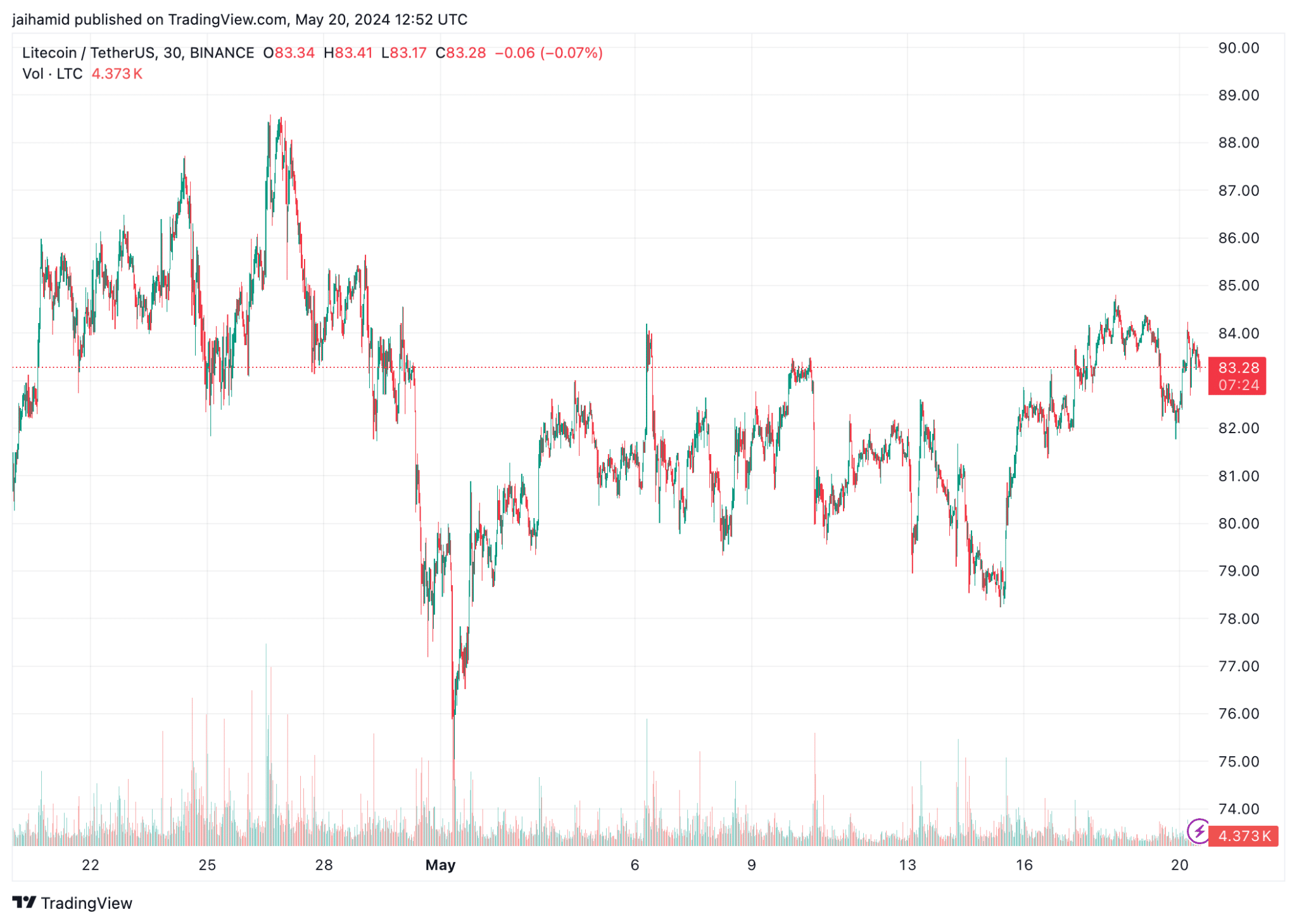

Currently, Litecoin (LTC) is priced at around $87 in the media. Notably, during the past month, the price of $77 has emerged as a significant support point, triggering several price rebound instances.

Litecoin has proven its strength as a psychologically and technically robust support during this period. Despite Bitcoin and Ether experiencing significant declines since February, Litecoin has managed to avoid falling below its support level.

For about a month, Litecoin has frequently bounced between the price ranges of $81 and $85. Once it surpasses $85, we can expect Litecoin to target a short-term goal of $90.

Are investors waking up?

It’s intriguing to note that whales appear to have become more active in the market as of May 10th. According to IntoTheBlock’s latest data, they purchased approximately 3 million LTC coins, equating to over $900k at current market prices.

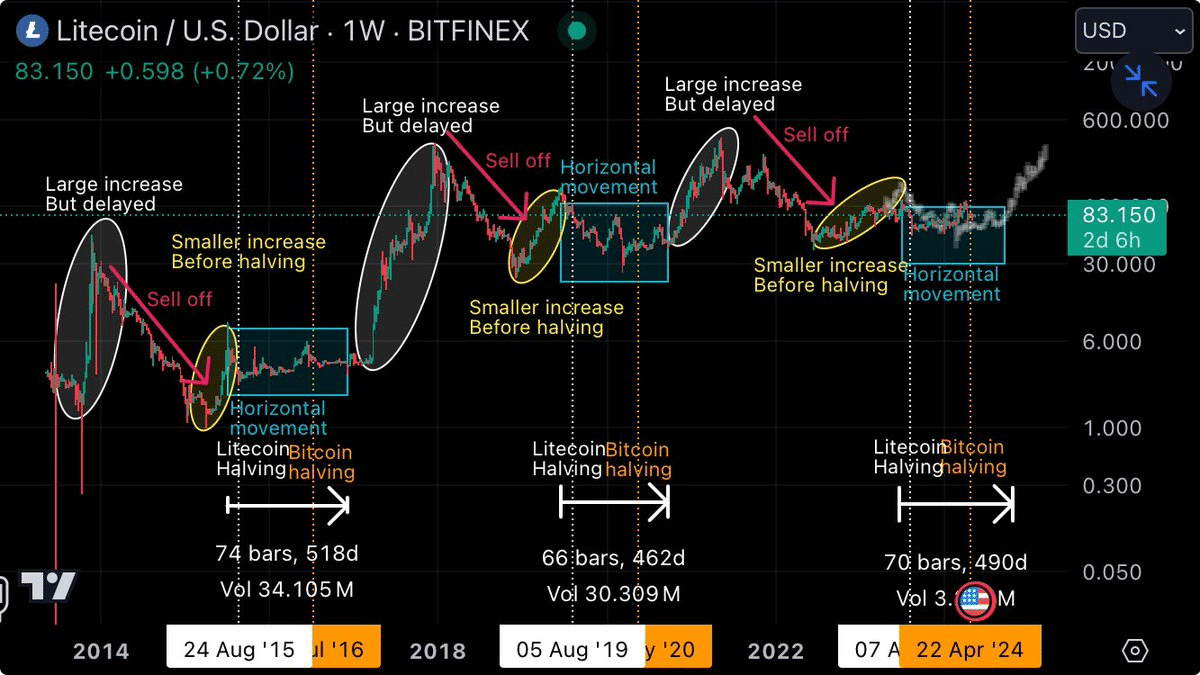

Based on historical trends, LTC‘s price remains relatively stable leading up to approximately 4-5 months following a Bitcoin halving event. Subsequently, there is typically a significant price increase. Given this pattern, it can be inferred that the LTC price may experience an uptick towards the end of Q3 this year.

The whale purchases have reignited talks of LTC on crypto Twitter, albeit only slightly.

Based on available data, it reveals more information than public opinion alone. An analysis of past trends indicates a potential significant increase in the price of LTC, possibly commencing around August or September.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Gold Rate Forecast

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

2024-05-21 11:03