- Ethereum was trading at over $3,600 as of this writing.

- Over $80 million was liquidated in short positions with the recent price rise.

As a seasoned crypto investor, I’ve seen my fair share of price swings and market volatility. But the recent surge in Ethereum [ETH] has truly piqued my interest. With ETH trading at over $3,600 as of this writing, it’s an exciting time for investors.

Recently, the price of Ethereum [ETH] has risen again to exceed $3,000. This development might set a new foundation for support since numerous investors purchased the cryptocurrency at this cost.

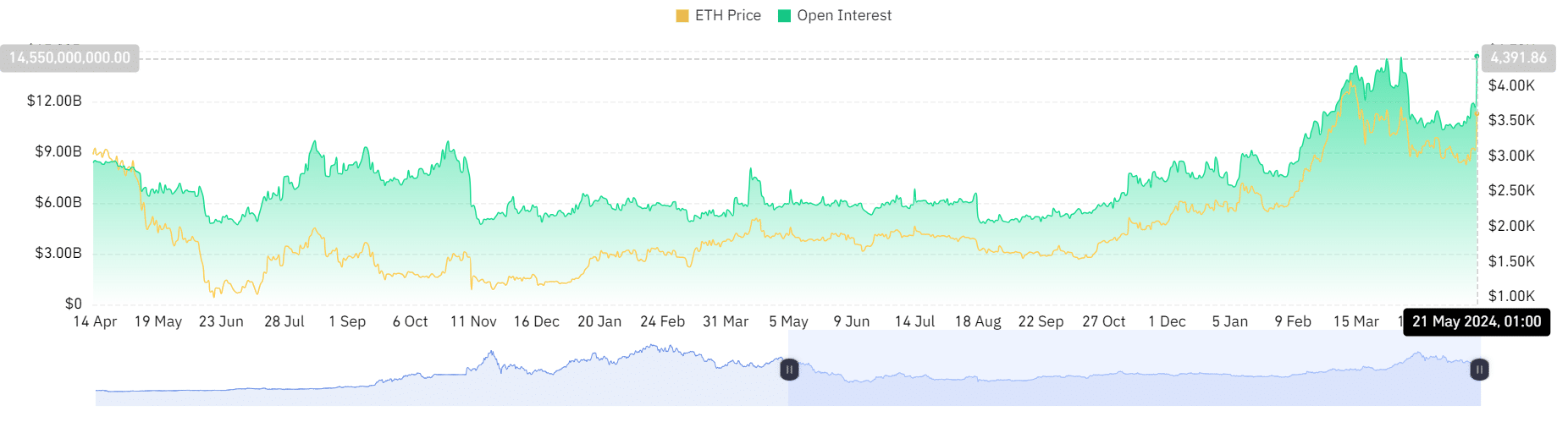

The recent increase in ETH Open Interest, reaching a multi-month high, provides additional evidence for this proposed new support level.

Ethereum price hits demand zone

Based on information from IntoTheBlock, the surge in Ethereum’s price beyond $3,000 has positioned it in a noteworthy area of high demand.

At the given price level, Ethereum witnessed substantial buying activity, with approximately 5 million ETH being amassed by around 2.96 million wallets. The collective worth of this accumulated Ethereum is now estimated to be over $18.3 billion based on current market prices.

As I pen this down, Ethereum’s market capitalization stood at around $440.5 billion. With the amount of ETH purchased at that price point, the $3,000 mark might serve as a robust support level for the digital currency.

Ethereum sets single-day spike record

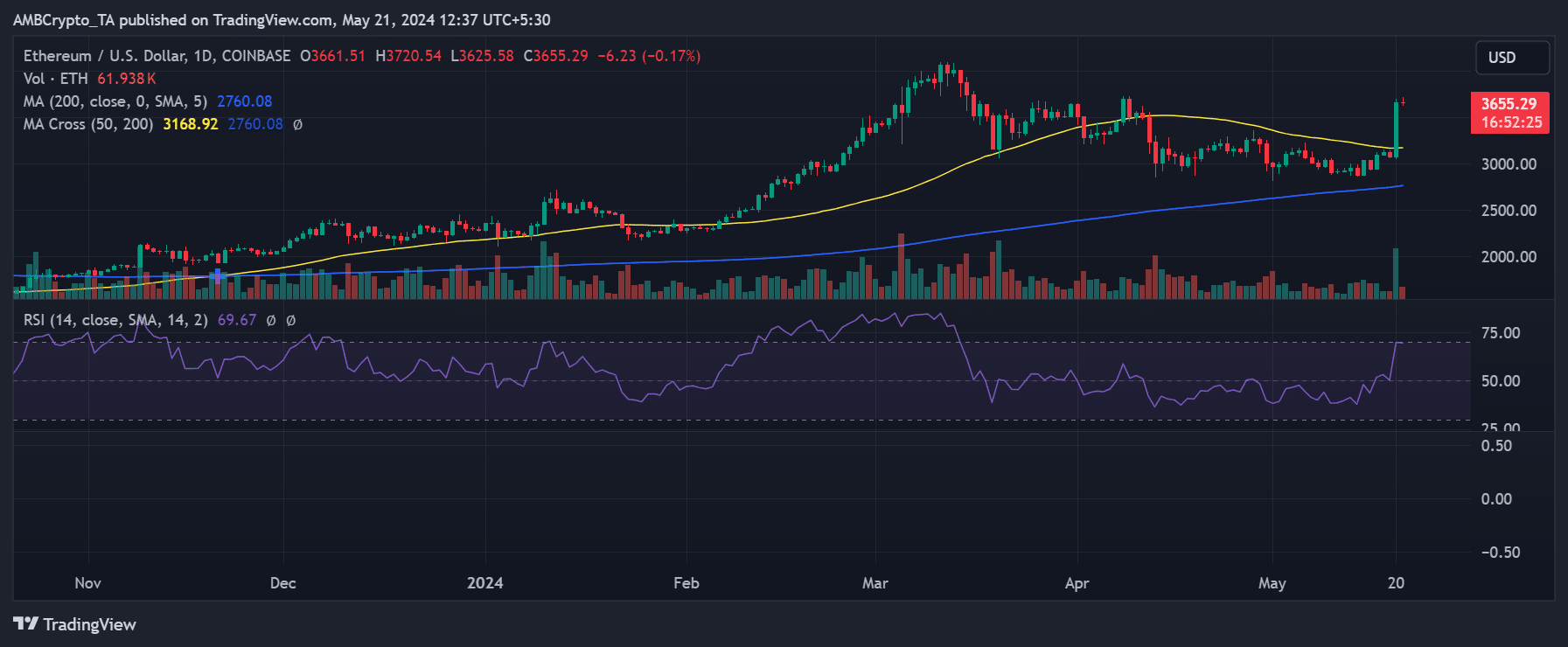

According to AMBCrypto’s examination, Ethereum’s value experienced a substantial jump of more than 19% on May 20th. On the chart displaying daily data, the price peaked at approximately $3,661, representing a notable rise of 19.23%.

As a researcher studying the cryptocurrency market trends, I came across an intriguing observation: Ethereum had not witnessed a one-day surge exceeding 19% in over a year. Moreover, this remarkable increase brought its value back to the $3,600 range for the first time since April.

Currently, ETH is priced approximately at $3,650 during my writing, representing a minimal decrease of below 1%. It’s worth mentioning that the price has reversed the role of the yellow moving average line, which had functioned as resistance around $3,100 and now acts as support.

One potential way to rephrase this statement in clear and conversational language is: Analyzing past data, the significant number of Ethereum (ETH) purchases at around $3,000 and the substantial volume traded at that price point could make $3,000 a robust support level for ETH.

Additionally, whales buying ETH at the current price level might further reinforce this support.

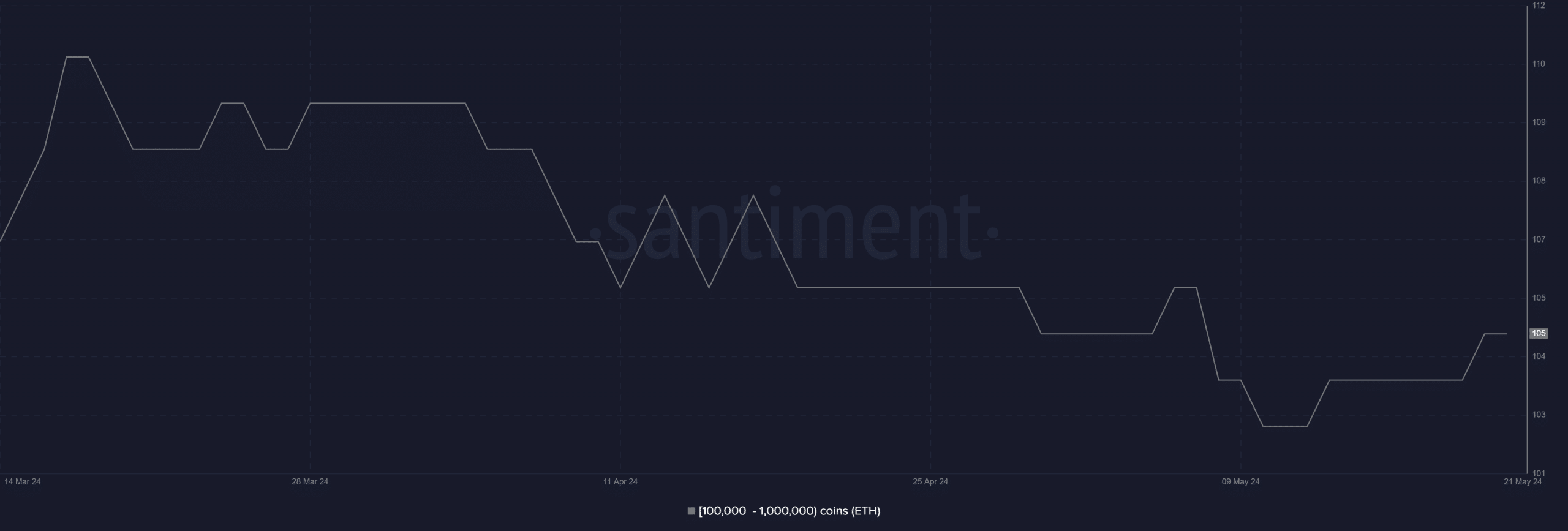

Whales accumulate more ETH

As a data analyst, I have delved into Ethereum’s supply distribution and uncovered heightened activity amongst the whale community within the last 24 hours. Based on my analysis of Santiment charts in the first person perspective, I noticed an uptick in the number of active addresses over the past few days.

Over the past day, wallets belonging to whales (significant investors) have bought approximately 110,000 Ether (ETH), worth around $360 million at present prices, with each of these wallets holding between 100,000 and 1 million ETH.

The inflow of funds into Ethereum as shown by another measurement is increasing, fueling its price rise.

Ethereum’s Open Interest surge to record-high

As an analyst, I’ve conducted an in-depth examination of Ethereum’s open interest data and identified a notable surge. This increase has brought the figure to its peak in over twelve months.

Based on AMBCrypto’s analysis of Coinglass data, the Open Interest for Ethereum was around $16.8 billion at the point of publication. This significant increase in Open Interest suggests a substantial influx of cash into Ethereum as its price exceeded $3,500, suggesting a bullish market trend.

Read Ethereum (ETH) Price Prediction 2024-25

As a researcher, I’ve observed an uptick in the optimistic outlook based on the current funding rate. This figure has surged to its peak since April, reaching approximately 0.02% at the moment of my investigation.

The upward trend signifies growing optimism among buyers and investors holding long positions, who are currently leading the market’s activity.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-21 18:16