-

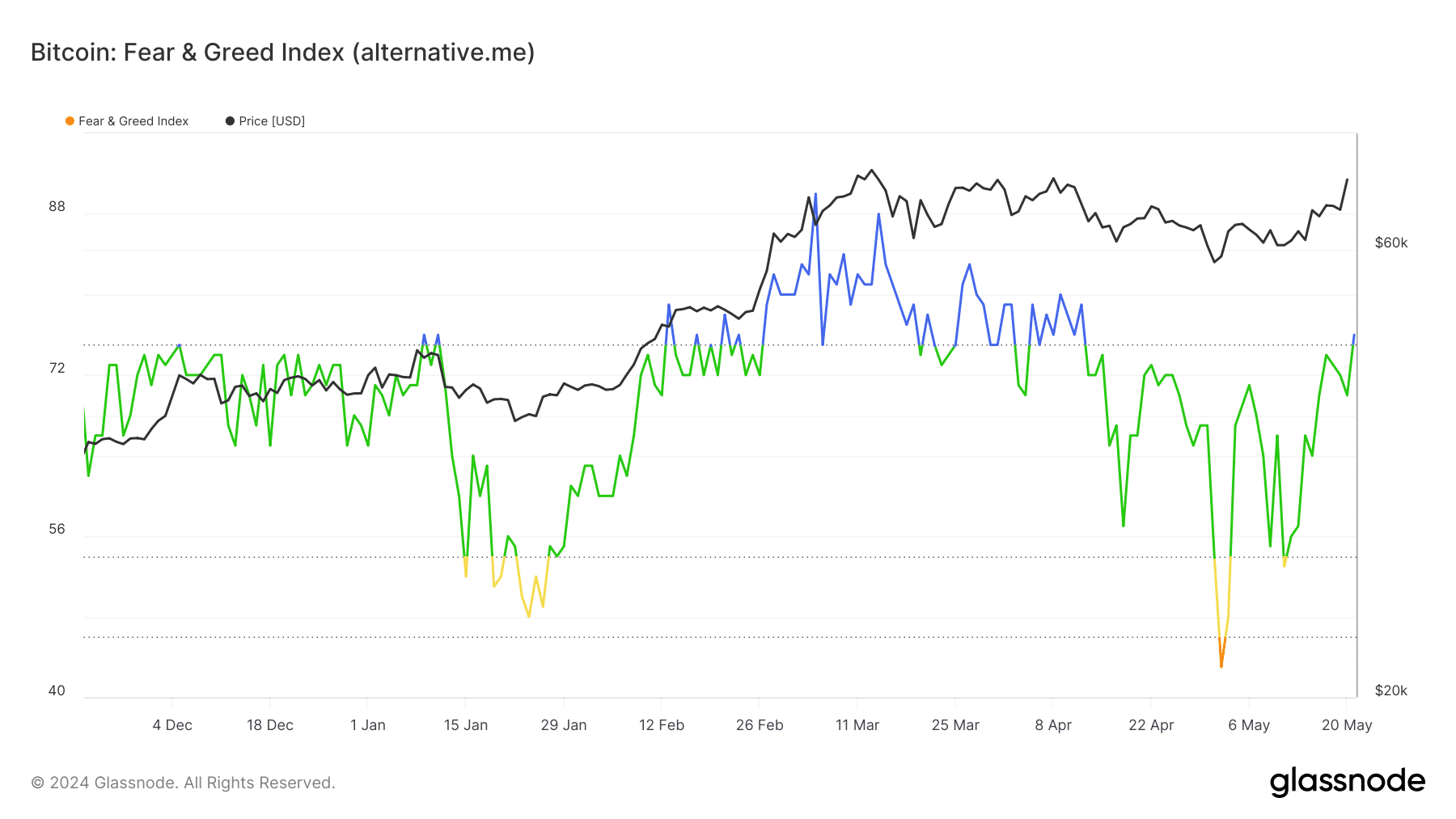

Bitcoin price hit $71,000, leading the market to hit a fear and greed index of 76.

The liquidation heatmap pinpointed $76.900 as the next target for BTC.

As a seasoned crypto investor with a keen eye for market trends, I’m thrilled to see Bitcoin’s price surge above $71,000 once again. The fear and greed index hitting 76 is an encouraging sign that optimism has returned to the market. However, it’s essential to remember that this isn’t the first time we’ve seen such a spike in price – and history tells us that Bitcoin can be volatile.

As a market analyst, I’ve observed an exciting development: Bitcoin’s price reached a new milestone of $71,000 for the first time in about 40 days. This uptick has rekindled optimism within the crypto community, as my recent analysis with AMBCrypto suggested that the bull run was far from finished.

According to the article, there were additional factors contributing to Bitcoin’s recovery beyond the indicated metrics. The first of these was the Bitcoin Exchange-Traded Funds (ETFs). It’s important to note that an Bitcoin ETF is a distinct entity from Bitcoin itself.

The ETF implies that an investor holds some Bitcoin. Consequently, should the cryptocurrency’s price rise, so too would the ETF’s Net Asset Value (NAV) per share.

The heavyweights are back

During the first quarter of 2024, Bitcoin ETFs received massive inflows of funds totalling billions of dollars. Consequently, Bitcoin’s price peaked at a new record high before the scheduled halving event. Yet, in the early stages of the second quarter, these issuers encountered difficulty in drawing in the level of investment they had previously enjoyed during the initial phase.

The price of Bitcoin dipped, falling beneath $59,000 momentarily. But things have improved since then. By the 20th of May, a net inflow of $235 million had been recorded in Bitcoin Exchange-Traded Funds (ETFs).

Over the past four consecutive days, ARK, BlackRock, Fidelity, and Grayscale have reportedly seen increasing investments in Bitcoin. If this trend continues, Bitcoin’s value may surge beyond $73,000 by the end of May.

As a researcher studying the cryptocurrency market, I also examined the data provided by AMBCrypto, in addition to checking out the fear and greed index from Glassnode. The Bitcoin fear and greed index showed a surge, reaching a score of 76—representing an 8.57% rise within the past 24 hours.

As an analyst, I would interpret this data point signified by the green hue as suggesting the market had entered a phase of excessive optimism or greed. Previously, Bitcoin (BTC) reached new peaks when this metric registered at 90—a reading indicative of extremely high levels of investor euphoria or “greed” (represented by the blue).

Liquidations pour in: What’s next for BTC?

Currently, Bitcoin hadn’t yet reached a stage where investor enthusiasm was overinflated. Consequently, its value could continue to rise, potentially approaching $75,000 within the next few days.

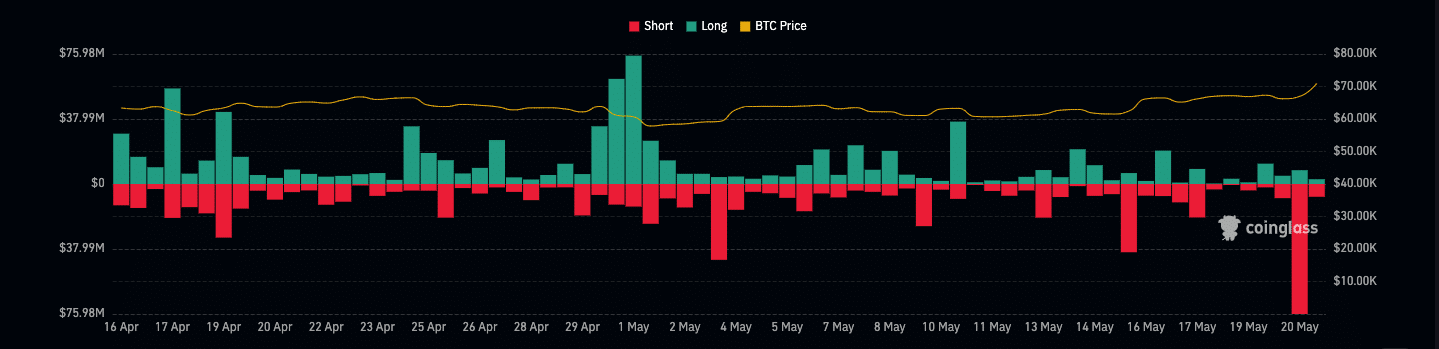

It’s important to note that approximately $96.87 million in Bitcoin contracts were terminated in the previous day, with data from Coinglass revealing that around $79.6 million of these were short liquidations and the remainder being long positions.

As a cryptocurrency investor, I can explain that shorting and longing are two different trading strategies. When I short an asset, I’m essentially borrowing the coins and selling them with the hope of buying them back later at a lower price to repay my debt and pocket the difference. Conversely, when I go long on an asset, I’m buying the coins with the expectation that their value will increase over time.

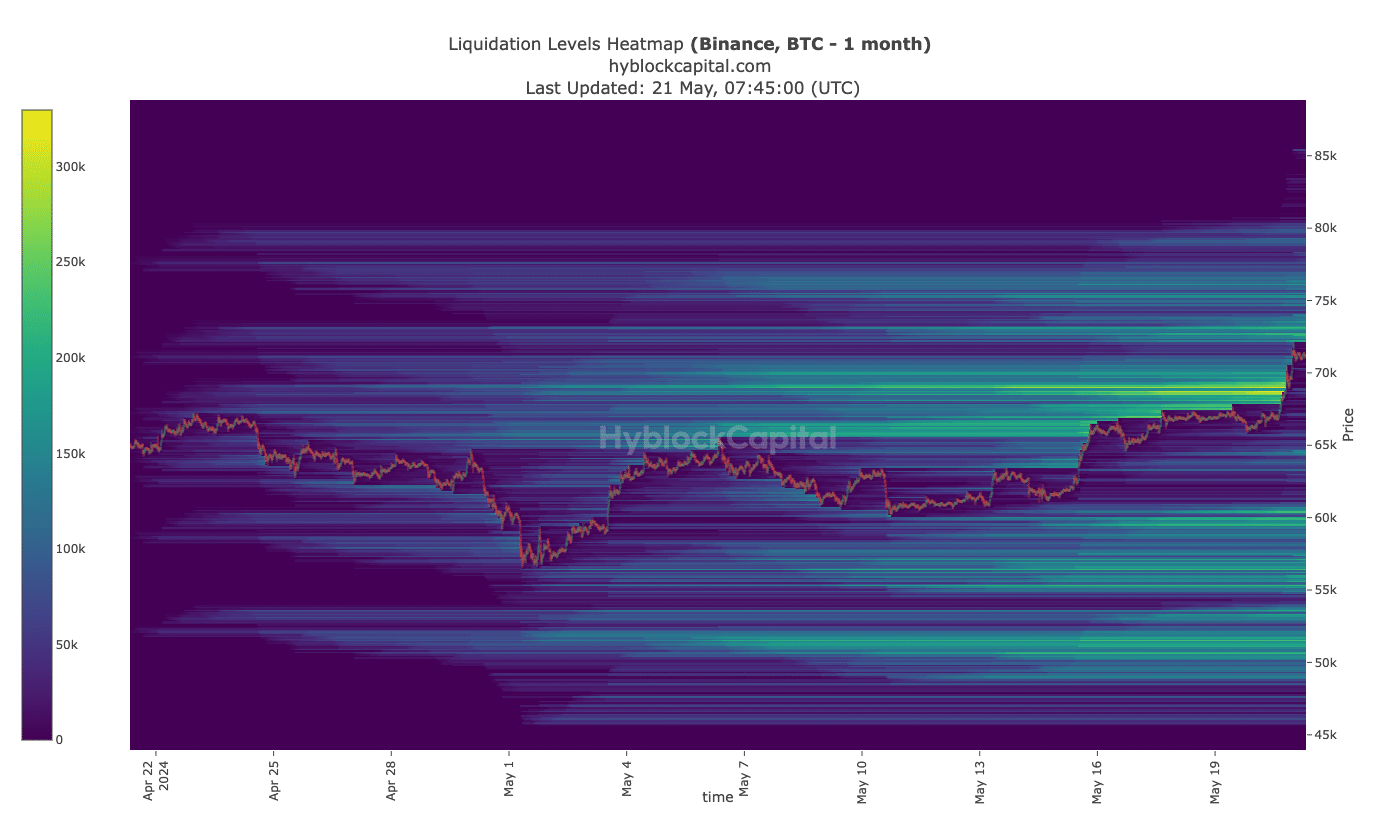

As a crypto investor, I also look at the liquidation heatmap provided by AMBCrypto to gauge potential price levels for Bitcoin. This tool assists traders in pinpointing regions with significant liquidity, allowing us to anticipate possible market reactions.

Is your portfolio green? Check the Bitcoin Profit Calculator

If a significant amount of liquidity resides in a particular price range, the market price may trend towards that zone. Additionally, large-scale sell-offs or buy-ins could transpire within this highly liquid region based on Hyblock’s data, revealing high liquidity levels at $73,300 and above.

Based on current trends, Bitcoin may surpass its previous record high and reach a new peak of around $76,900.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-21 21:12