-

BNB started to trade above a long-term resistance level.

The coin’s price might reclaim its two-year-old all-time high.

As a researcher with extensive experience in cryptocurrency markets, I find the recent price action of Binance Coin (BNB) particularly intriguing. The altcoin’s break above the long-term resistance level at $595 is a significant development that could lead BNB to reclaim its two-year-old all-time high.

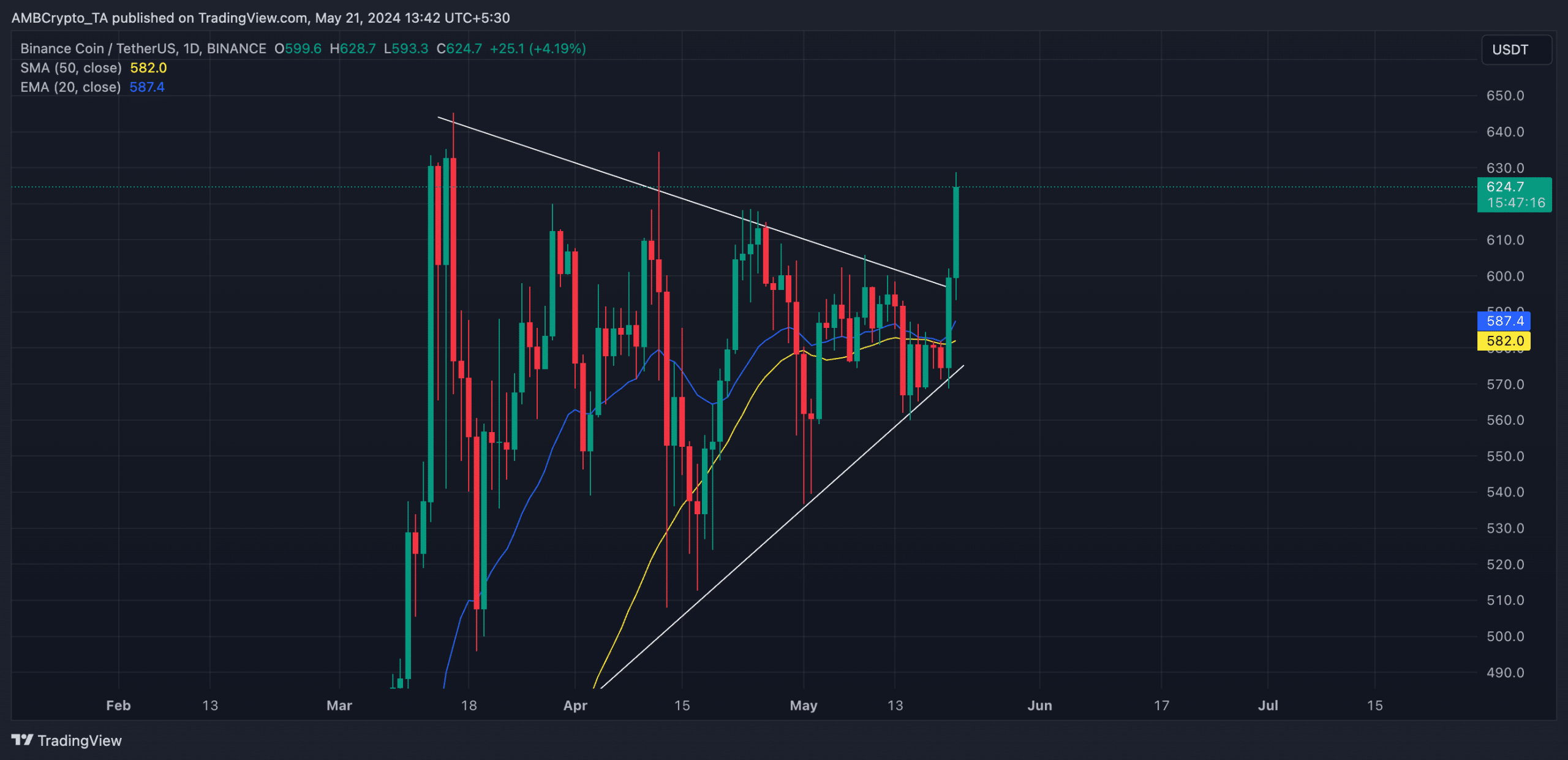

The price of Binance Coin (BNB) has surpassed the upper boundary of its prolonged symmetric triangle formation, implying a significant uptick in purchasing demand.

At present, I observe the altcoin trading at a price of $623, surpassing the previous resistance zone established around $595 since March.

In the context of financial markets, when an asset is confined between the upper and lower bounds of a symmetrical triangle pattern on the chart, it exhibits a series of alternating higher lows and lower highs in its price movement.

The asset’s price seems to be trading between a narrow band, as buyers attempt to drive it higher into resistance areas while sellers aim for support levels.

BNB poised for further growth

BNB’s price hike in the past 24 hours has led its price to rally above key moving averages.

The coin’s price at the time of publication was higher than both its 20-day Exponential Moving Average (EMA) and 50-day Simple Moving Average (SMA).

Five consecutive trading days saw BNB‘s price hover around these moving averages, signaling a standoff between buyers and sellers prior to the market surge on May 20th.

The market has been experiencing a prolonged uptrend following this crossover event, leading traders to believe that there’s a shift taking place, with the focus turning towards buying and hoarding coins.

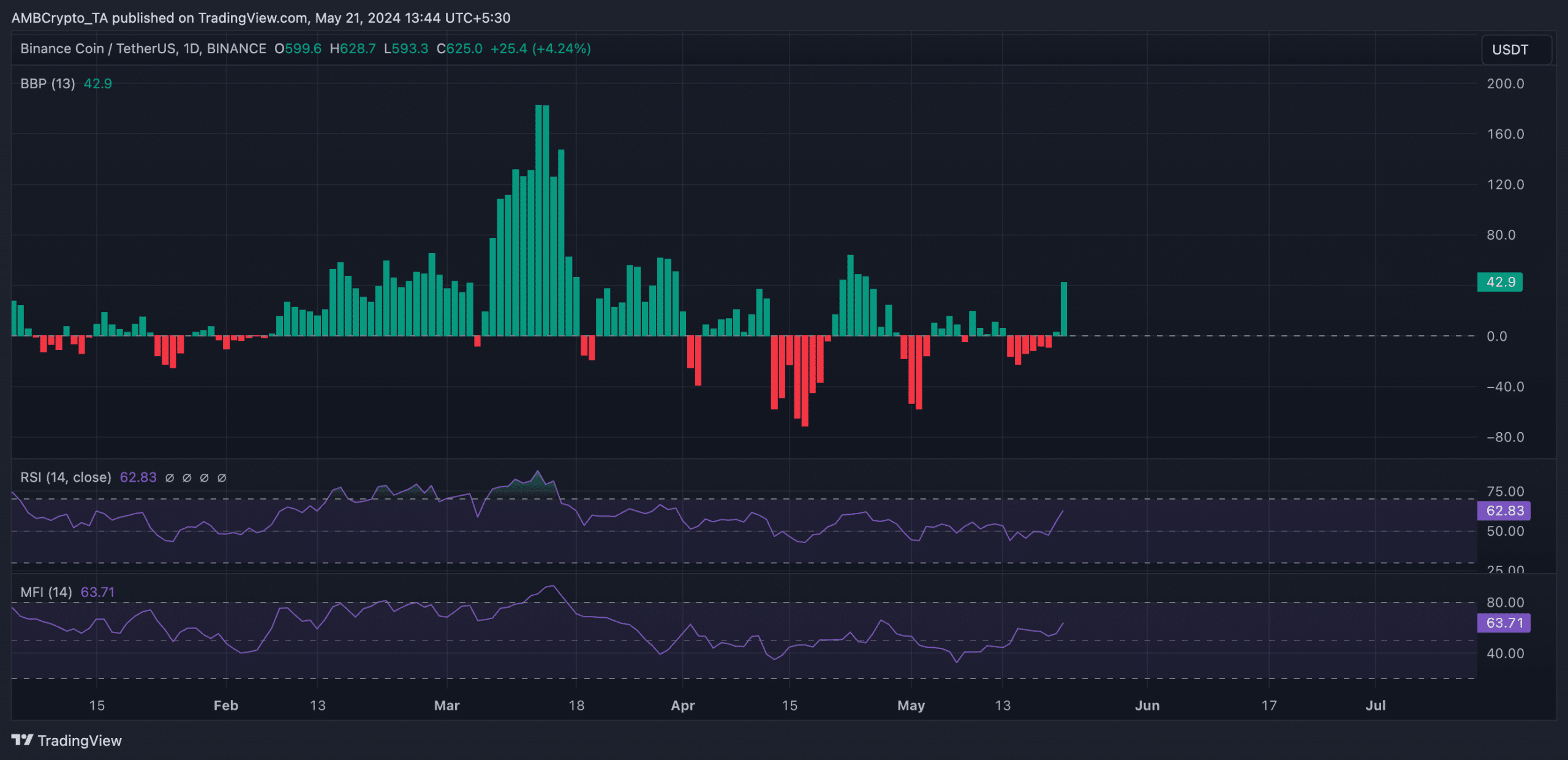

As a crypto investor, I’m excited to share that the Elder-Ray Index for Binance Coin (BNB) has turned positive for the first time since May 14th. This development is an encouraging sign that the uptrend is still in play. The Elder-Ray Index is a useful indicator that measures the balance between buying and selling pressure in the market by calculating the relationship between these two forces.

When its value is advantageous, the influence of bull power prevails in the market. At present, the Elder-Ray Index for BNB stands at 41.44.

Additionally, the crucial indicators of the coin’s momentum showed an uptrend, implying that the recent increase in price for BNB was driven by genuine market demand.

Its Relative Strength Index (RSI) was 62.49, while its Money Flow Index (MFI) was 63.37.

At these values, market indicators signaled a stronger demand for purchasing BNB tokens over supplying them for sale.

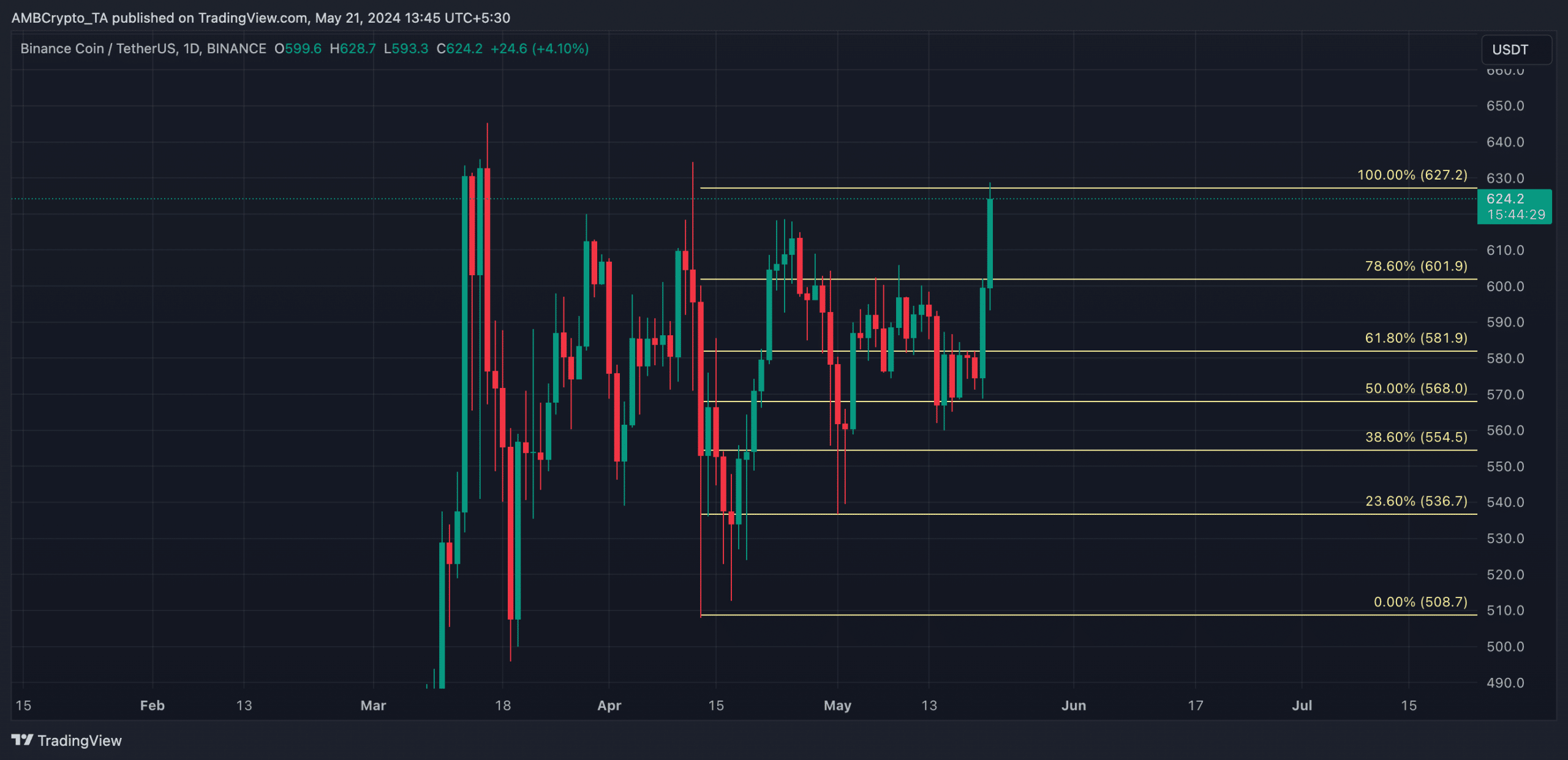

As a researcher studying the cryptocurrency market, I have observed a strong buying trend for Binance Coin (BNB). If this momentum persists, BNB could potentially regain its historic peak price of $690 – a level it last achieved three years ago.

If the buyers lose steam and the bears take over, Binance Coin (BNB) could potentially retreat and fall back towards the resistance level below $600.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-22 08:07