-

Bitcoin shows signs of continued consolidation, with a potential breakout if it closes above $71,500.

Historical patterns and strong holder sentiment suggest a bullish future for BTC.

As a researcher with extensive experience in the cryptocurrency market, I believe that Bitcoin’s current consolidation is a normal market behavior following its recent surge. The historical patterns and strong holder sentiment indicate a bullish future for BTC. However, it is essential to remain cautious as the market can be volatile, and there might be brief pullbacks like the one we are seeing now.

Over the last week, Bitcoin’s price has noticeably increased by around 12.8%.

The surge can be attributed to several reasons, including the upcoming potential listing of an Ethereum [ETH] Exchange-Traded Fund (ETF) and former President Donald Trump’s recent decision to accept Bitcoin for campaign contributions.

In the past day, there’s been an uptick in the value of this cryptocurrency, but it has experienced a small dip and is now worth 1.8% less than its peak of $71,422, currently priced at $69,823.

While the overall trend remains bullish, there are signs of a brief pullback in the market.

Bitcoin: Levels to watch

As a crypto investor observing the volatile market, I’ve taken note of Rekt Capital’s analysis on Bitcoin’s price movements. He advises a cautious approach due to the current unpredictable market conditions.

Based on historical trends, Bitcoin might keep trading between its current price limits for a few more weeks, as suggested by some analysts.

One significant level to keep an eye on is approximately $71,500. If Bitcoin’s weekly candlestick closes above this price point, it may trigger a surge leading the cryptocurrency out of its current Re-Accumulation Range.

According to Rekt Capital’s analysis, the prolonged period of Bitcoin’s price stabilization aligns with its past halving cycles, which could extend the duration of the ongoing bull market.

In simpler terms, the recent increase in Bitcoin’s price growth cycle, approximately every 190 days, represents a positive shift compared to the 260-day price acceleration witnessed back in mid-March when Bitcoin reached new peak prices.

As a researcher studying historical trends in the cryptocurrency market, I’ve observed that Bitcoin tends to experience prolonged price movements above or below certain levels. Given this context, one would expect a significant weekly close below the $71,500 range high to go against the historical trend. However, if we observe a weekly close even just one dollar above the $71,500 mark, it could potentially signify an intriguing deviation from the norm.

As a crypto investor, I cannot stress enough the significance of this development. This situation has the potential to catapult Bitcoin to uncharted territory, reaching new peaks and setting a new all-time high (ATH) in its price journey.

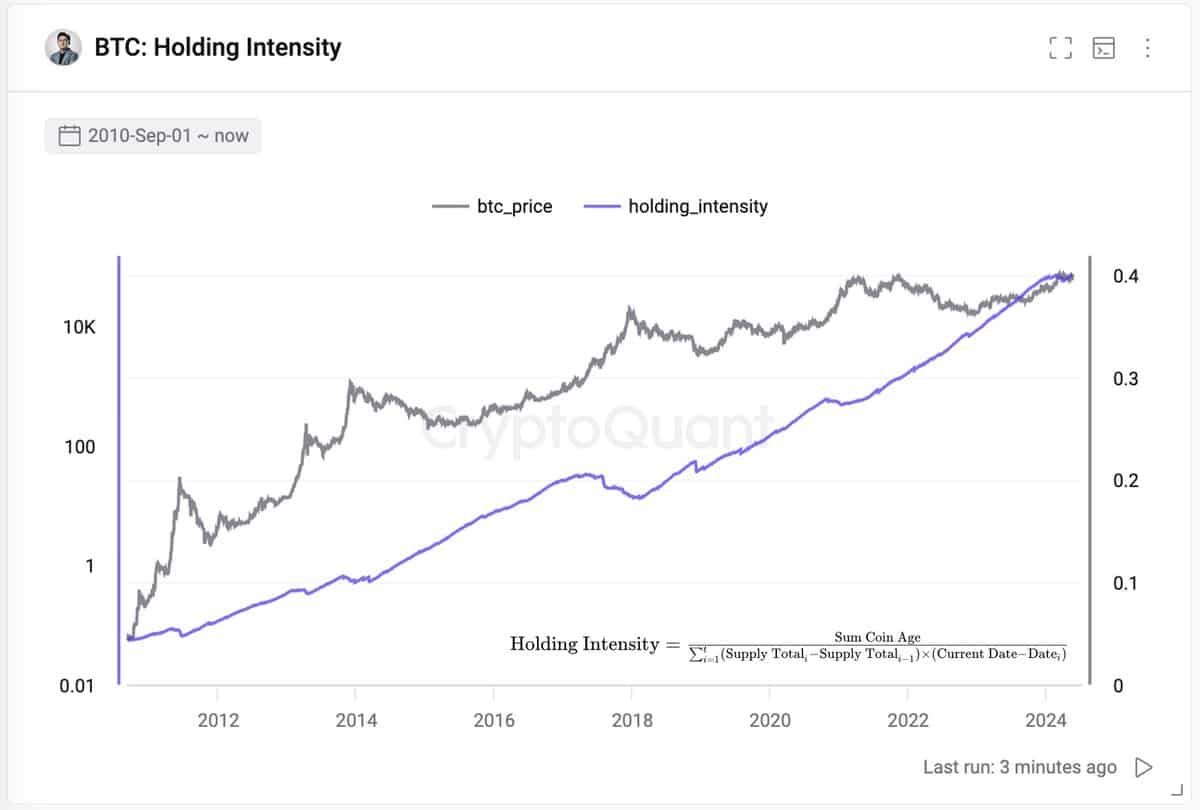

As a researcher examining the current state of the Bitcoin market, I’d like to share some intriguing insights from CryptoQuant, a renowned data analytics platform. According to its CEO, Ki Young Ju, Bitcoin holders seem to be increasingly reluctant to sell their assets, despite the prices climbing close to $70,000. This trend could potentially signify a bullish outlook on the market.

This behavior suggests that Bitcoin is increasingly viewed as a store of value.

Ki Young Ju explains that Bitcoin’s Holding Intensity ratio indicates a strong correlation between the cryptocurrency’s holding pattern and situations where coins remain untouched. This finding underscores Bitcoin’s role as a long-term investment.

Technical analysis and liquidation trends

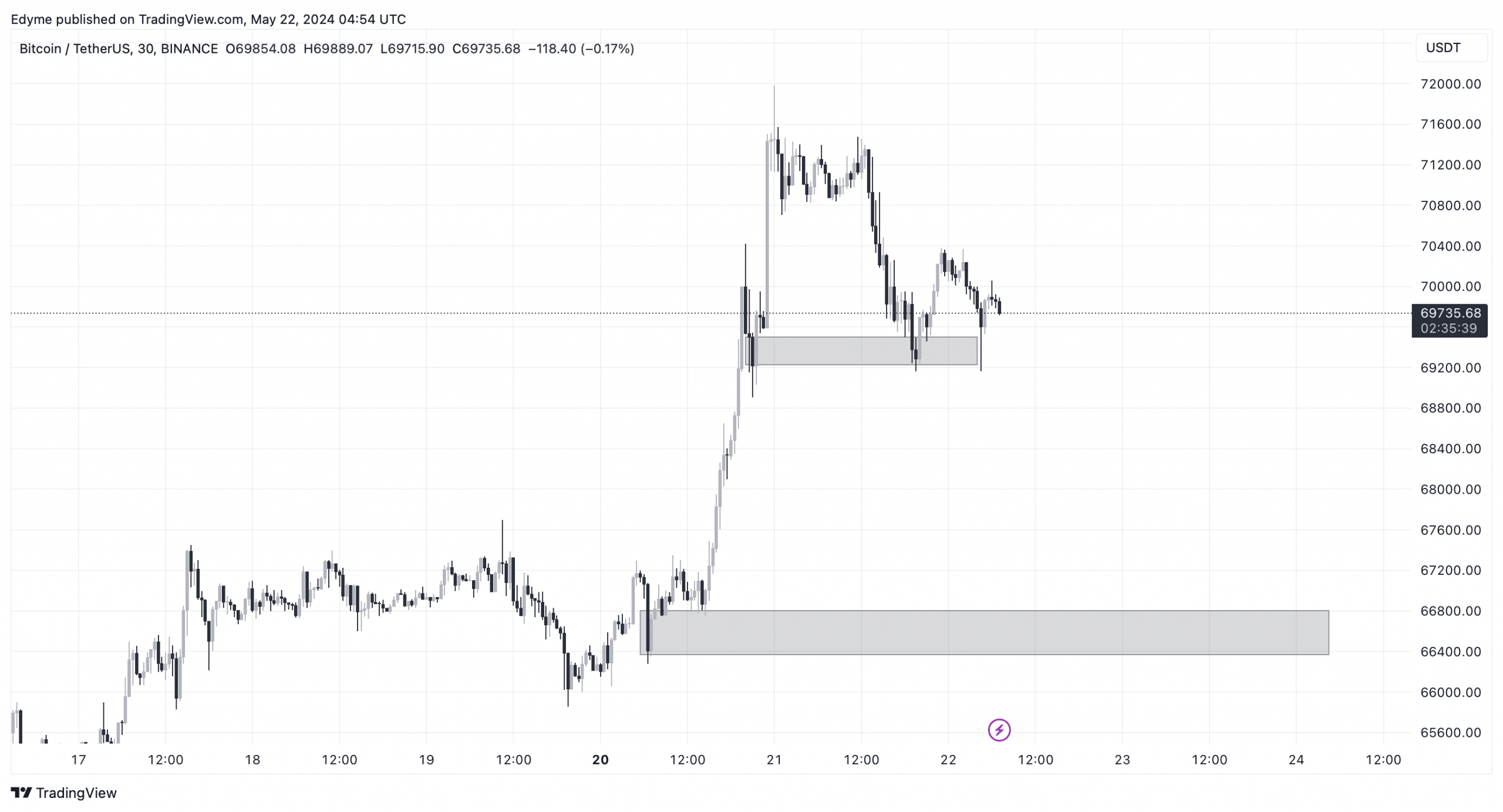

According to AMBCrypto’s analysis of Bitcoin’s 30-minute chart, the cryptocurrency encountered a demand zone in its recent price action but did not exhibit any clear indications of a forthcoming price increase.

Normally, hitting a demand zone indicates that Bitcoin is likely to continue rising. But if Bitcoin can’t hold above this level, we could witness a decline towards the $66,000 mark before the bullish trend picks up again.

According to AMBCrypto’s examination of the liquidation map, a notable amount of liquidity was identifiable starting from $73,300 and above.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I believe there’s a strong possibility that Bitcoin could reach new heights and even surpass its previous all-time high. My analysis points to a potential peak of around $76,900 in the future.

As a researcher studying market dynamics, I can’t stress enough the importance of using liquidation heatmaps in my analysis. These visual representations highlight liquidity hotspots where significant market participants may be forced to sell or close their positions, potentially leading to noticeable price shifts.

Read More

- OM/USD

- ETH/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Solo Leveling Season 3: What Fans Are Really Speculating!

2024-05-22 18:16