-

MATIC may be due for a double-digit rally, according to analyst Ali Martinez.

However, it might face headwinds in the short term.

As a seasoned crypto investor with a keen interest in Polygon [MATIC], I’m keeping a close eye on its price movements and market indicators. Based on the latest analysis by Ali Martinez, MATIC could be due for a 17% rally if it manages to break above its parallel channel resistance. This bullish outlook is supported by the token’s MVRV ratio, which currently indicates that MATIC is undervalued based on historical purchase prices.

According to cryptocurrency analyst Ali Martinez, posted on X (previously known as Twitter), Polygon [MATIC] is predicted to experience a 17% price surge once it manages to breach its parallel channel.

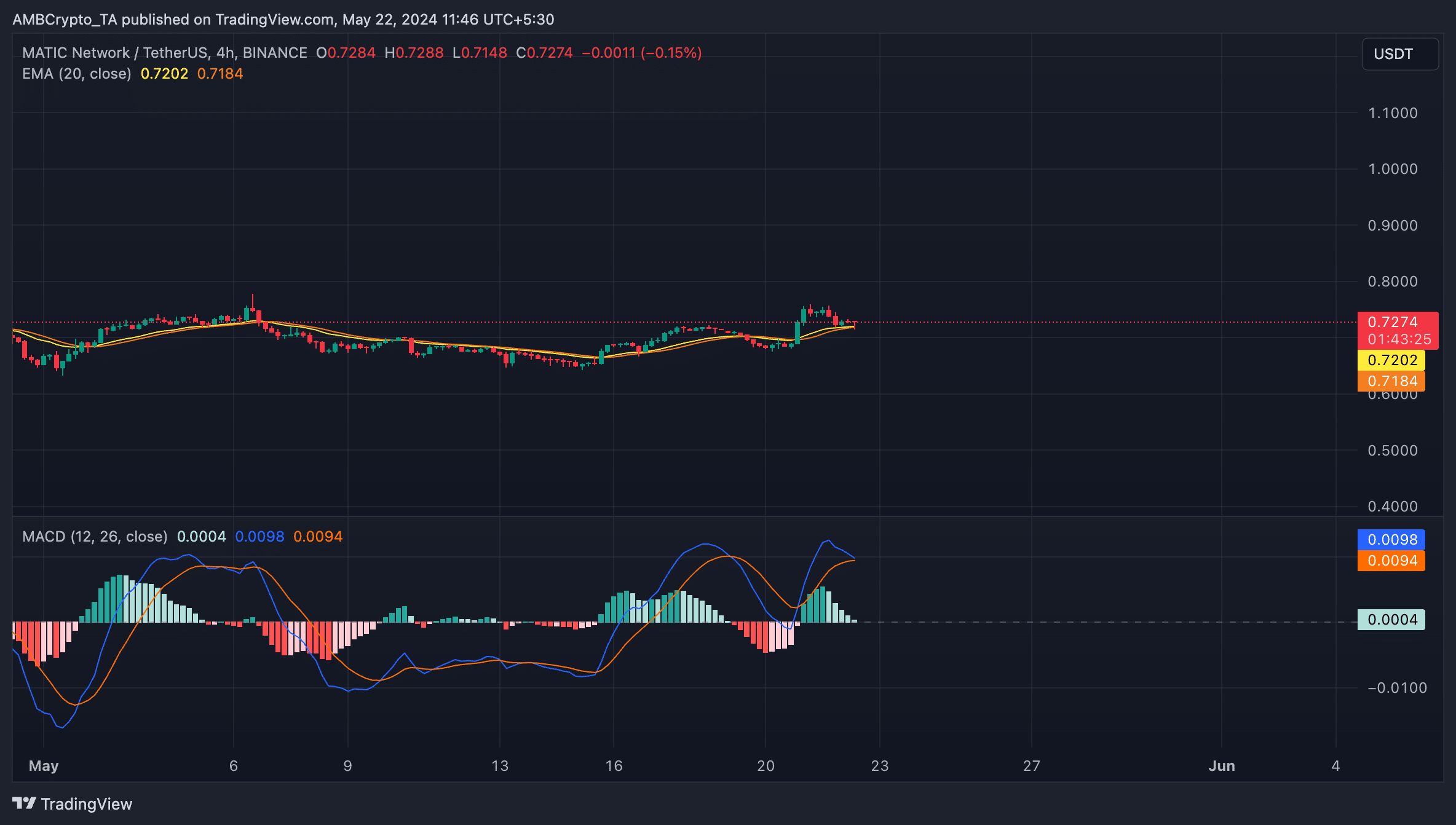

Examining the 4-hour price chart for the L2 token, Martinez observed that it has been confined to a particular range since early April, forming a parallel channel pattern.

When an asset’s price moves between two trendlines, it signifies a phase of price stability or consolidation.

MATIC may not be ready

At the moment of publication, MATIC was being traded for approximately $0.72, and it was moving upward within its parallel channel’s upper boundary.

When an asset approaches the upper boundary of a parallel trendline channel, this action is often seen as a sign that the asset is trying to challenge or push against its resistance level.

Should the current market position weaken and give way to a significant price movement, the value of the specific asset could reach new record-high prices.

As a crypto investor, I’ve noticed that MATIC has been trying to break above its current resistance level, but according to AMBCrypto’s analysis, this might not be an easy feat in the near future.

The token’s price tends to stay quite near its 20-day Exponential Moving Average (EMA), resulting in a notable resemblance between the two.

As a researcher observing the market, when I notice an asset’s price oscillating near its moving average, I interpret this as a sign of market ambiguity. In such situations, it seems that neither buyers nor sellers have managed to assert clear control over the asset’s price direction.

To cause a rise above the resistance level, strong purchasing activity is required, giving the bulls dominance over the market.

With MATIC‘s moving average convergence divergence (MACD) line about to drop below its signaling line, there may be an increase in selling pressure.

When the moving average convergence divergence (MACD) line of an asset is about to drop beneath its signaling line, this is often seen as a bearish indication. It implies that the asset’s upward momentum may be waning and there could be a transition towards a downward trend.

A good place to buy?

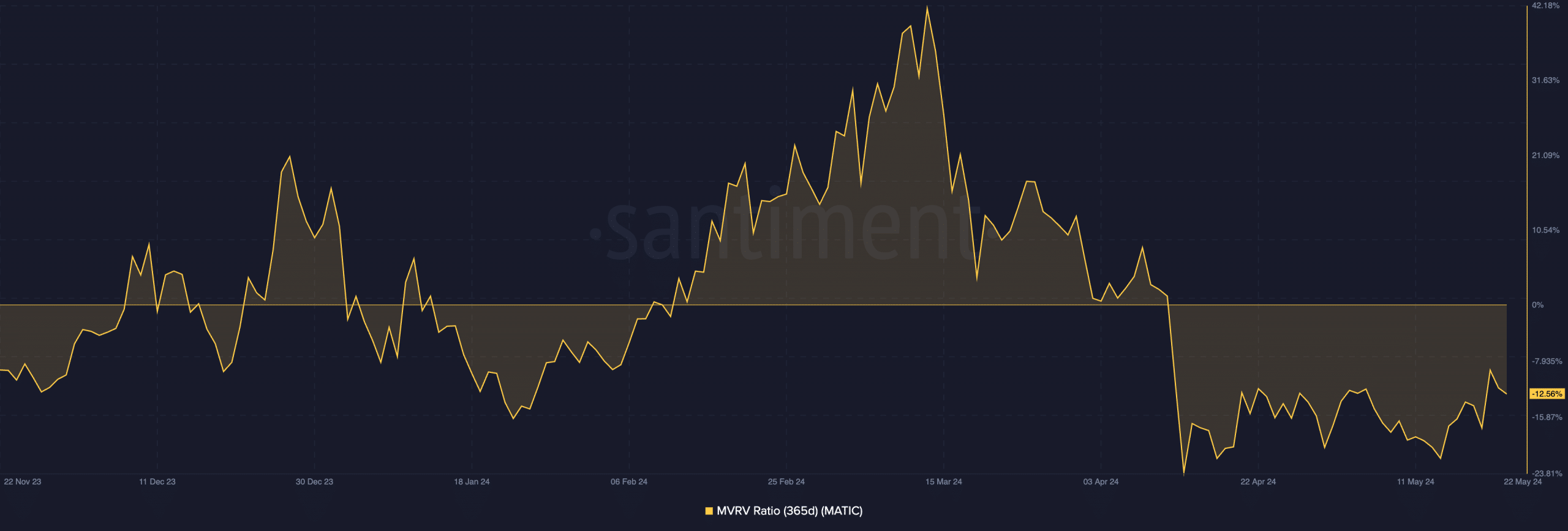

As an analyst, I have observed that MATIC‘s Market Value to Realized Value (MVRV) ratio, calculated based on a 365-day moving average, has signaled a buying opportunity.

Based on the latest information from Santiment, I’ve calculated that the ratio of MATIC‘s current market price to the average price of tokens purchased stands at a figure of -12.58%. In simpler terms, this indicates that on average, MATIC was bought for a higher price than its current value.

Read Polygon’s [MATIC] Price Prediction 2024-2025

As a market analyst, I would interpret a negative return value for MATIC as an indication that the current market price is lower than the average cost basis for all circulating tokens. In simpler terms, MATIC appears to be underpriced based on this data point.

Traders view this occurrence as a buying opportunity due to the potential for acquiring the token at a lower price than its previous average cost.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-05-22 22:15