- The FOMC’s rate decision draws criticism; Peter Schiff and David Solomon predict ‘no cuts’ soon.

- The crypto market faces a downturn — resilience is observed, with a focus on long-term strategies.

As a researcher with a background in economics and finance, I find the recent FOMC decision to hold interest rates steady quite intriguing. The minutes from their meeting revealed that policymakers are concerned about inflation remaining above their 2% target, which is understandable given the current economic conditions.

In light of growing apprehensions regarding inflation increases in the United States, the Federal Reserve opted to keep interest rates unchanged.

The minutes of the Federal Open Market Committee (FOMC) meeting indicated that the policymakers expressed concern over the prospect of reducing interest rates.

The clock hands indicated that while some advancement had occurred, inflation persisted at levels exceeding the Federal Open Market Committee’s (FOMC) 2% benchmark. Numerous consumer confidence polls revealed increasing concerns over potential inflationary trends in the future.

FOMC’s decision receives criticism

In a recent post on X (previously known as Twitter), Peter Schiff, the CEO and Chief Global Strategist of Euro Pacific Capital, expressed his disapproval with the decision at hand.

At a recent Boston College event, Goldman Sachs Group Inc.’s CEO, David Solomon, expressed his belief that there would be no interest rate reductions in the near future based on current market trends.

“I still don’t see the data that’s compelling to see we’re going to cut rates here.”

Negative impact on the crypto market

Experts raised questions about how the FOMC’s decision would impact market conditions as a whole.

The impact was notably negative, as evidenced by its direct effect on leading cryptocurrencies.

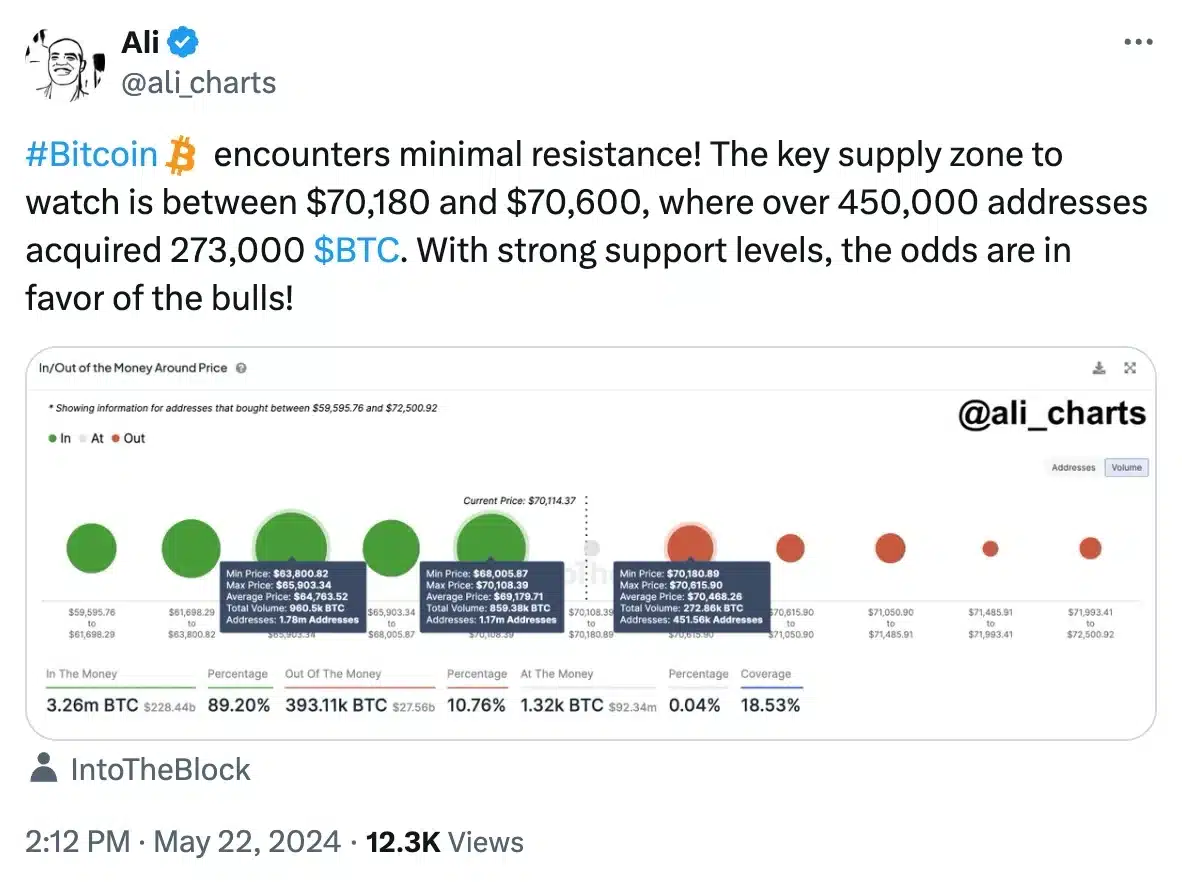

On May 22nd, Bitcoin‘s [BTC] price dipped below the $70,000 threshold, while Ethereum‘s [ETH], which had previously spiked from $3,064 to $3,790, shifted to a downward trend.

In fact, at the time of writing, most top coins showed red bars on the daily charts.

Positive sentiments persist

Despite the crypto market bleeding, @cryptosanthoshK, a Crypto & DeFi Analyst, noted,

Ali Martinez, the technical and on-chain analyst, echoed a similar sentiment and said,

According to Glassnode’s Bitcoin metric, there has been an increase in the number of new bitcoins being created compared to the number being sold, suggesting that more investors are adopting a long-term holding strategy rather than looking to make quick profits.

Anticipating that an approval for an exchange-traded fund (ETF) could lead to a substantial rise in ETH‘s price, investor/trader Satoshi Flipper expressed this viewpoint.

“$ETH will deliver an epic ETF pump this week. Market prices can’t stay irrational forever.”

Stock market declined

Although cryptocurrencies have been receiving favorable opinions lately, it’s important to keep in mind that the stock market took a dip on May 22nd as well.

“The Dow Jones Industrial Average experienced its steepest decline this month, dropping 201.95 points, or 0.51%, closing at 39,671.04.”

The S&P 500 declined by 0.27% to hit a new mark of 5,307.01, while the Nasdaq Composite experienced a 0.18% decrease, closing at 16,801.54 – primarily affected by tech stocks.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-23 14:15