-

Bitcoin’s current retracement is seen as a precursor to a potential major rally towards $73,000.

Market metrics and analysis indicate strong foundations for BTC, despite a drop in active addresses.

As a seasoned crypto investor, I closely monitor Bitcoin’s price movements and market trends. The recent retracement from Bitcoin’s high of $71,000 to its current price of $68,659 has not deterred my optimism. Instead, it is being viewed as a precursor to a potential major rally towards the crucial $73,000 price point.

As a researcher studying the cryptocurrency market, I’ve observed some noteworthy bullish trends in Bitcoin [BTC] over the past few days. The price has surged by almost 10%, rising from a low of $65,000 last week to reaching a high of $71,000 this week.

As a researcher studying the cryptocurrency market, I’ve observed a momentary dip in prices with the coin now valued at around $68,659. Some analysts believe this temporary setback might be indicative of an impending significant surge.

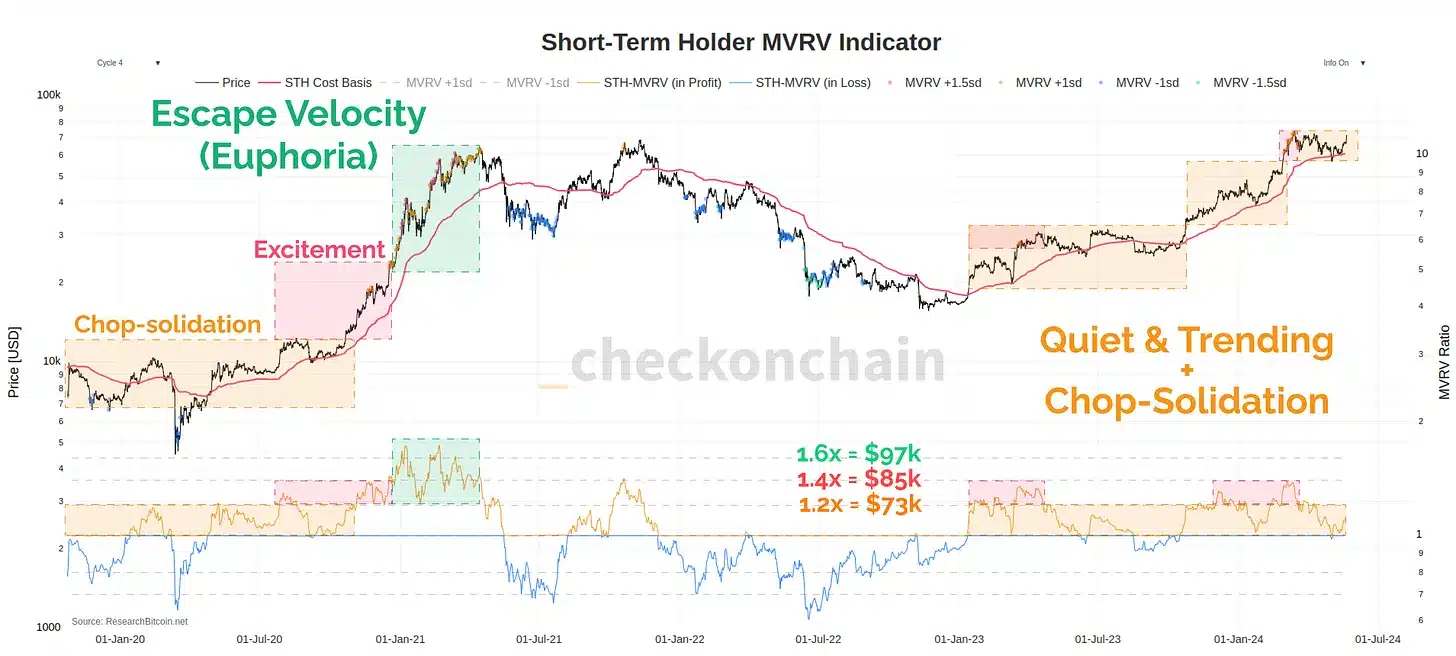

Reaching a price of $73,000 once more might mark the beginning of Bitcoin’s “escape velocity” stage. This signifies a potential surge beyond present pricing and toward new height records.

Analyzing market metrics and investor behavior

As a crypto analyst, I recently highlighted in my market report on the 21st of May that the $73,000 mark holds significant importance for Bitcoin’s future direction.

In this context, “escape velocity” refers to the minimal pace at which Bitcoin must move beyond its present price range for a stronger upward trend to emerge, unaided by external influences.

James Check emphasizes the significance of the Short-Term Holder (STH) Market Value to Realized Value (MVRV) ratio. According to him, this metric indicates that the market has not reached extreme levels of being “overvalued,” “overbought,” or “oversold.”

The market’s excitement doesn’t signify full-blown euphoria yet, which typically comes before a major correction.

An analyst revealed that the market is laying solid groundwork for a Bitcoin price surge, with $73,000 serving as a pivotal threshold that could trigger a significant uptick.

At the current price, there is a need to exercise caution. Those holding Bitcoin for under 155 days, categorized as short-term investors, have already made a profit. This could result in resistance due to the likelihood of some sellers entering the market.

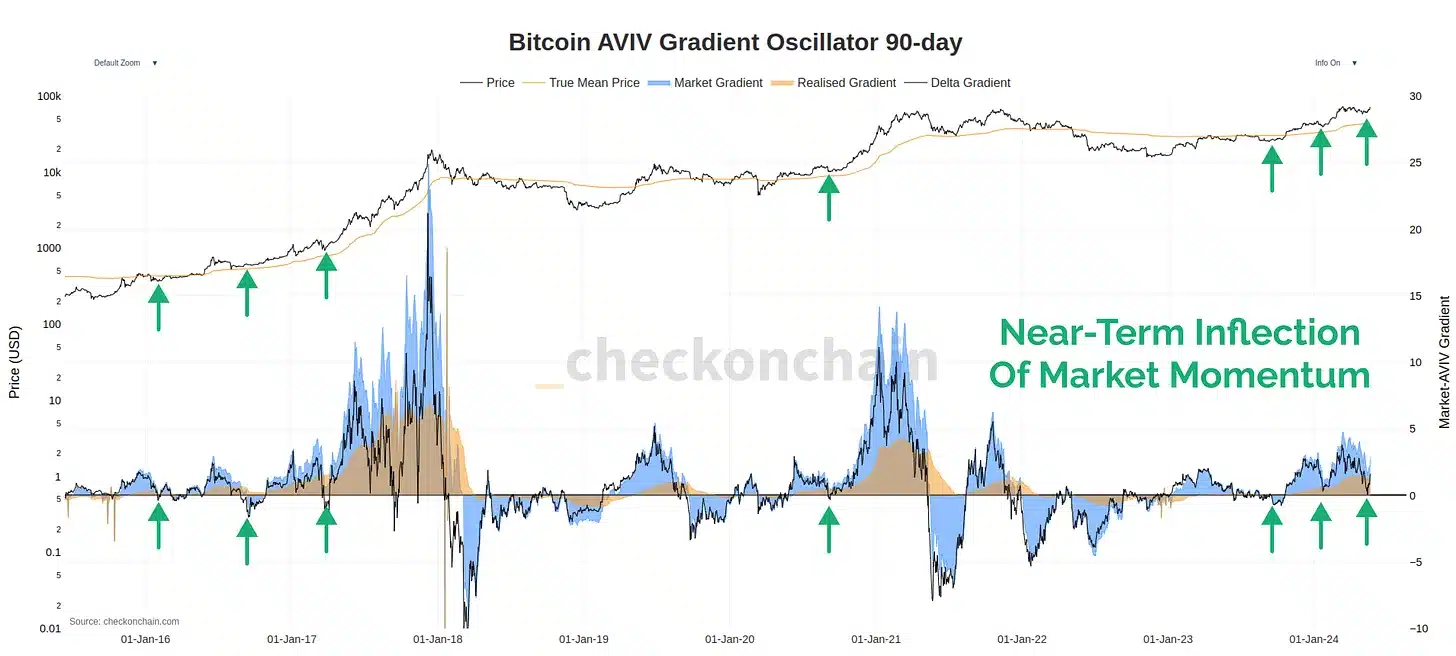

Over the past 90 days, the AVIV momentum oscillator has displayed noteworthy strength. This indicator suggests that price trends, in relation to on-chain capital inflows, have been rebounding robustly – a common trait observed during the advance phase of a bull market.

Key observations from on-chain data

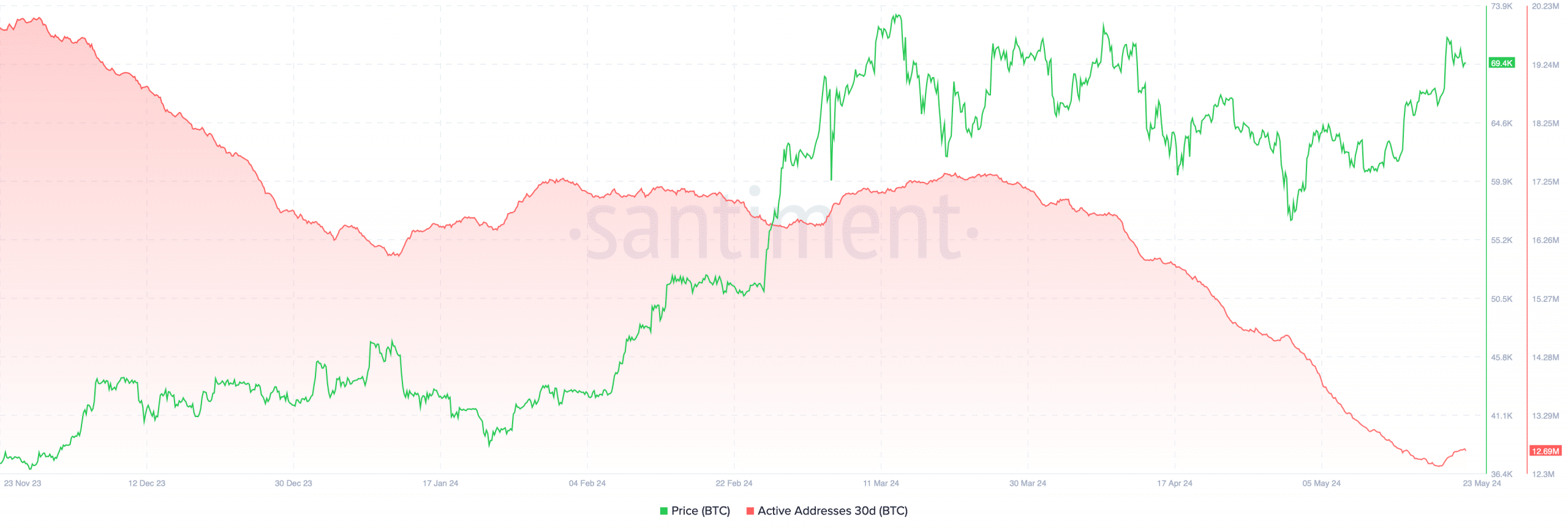

Based on the findings from AMBcrypto, as corroborated by data from Santiment, the number of active Bitcoin addresses has decreased significantly. From approximately 17.2 million in March, it has dropped to around 13 million at present.

In spite of a decline, Bitcoin has persisted in exhibiting bullish tendencies, shattering various resistance thresholds. This indicates that although the transactional activity on the network is diminishing, upward price pressures are being fueled by other influential elements.

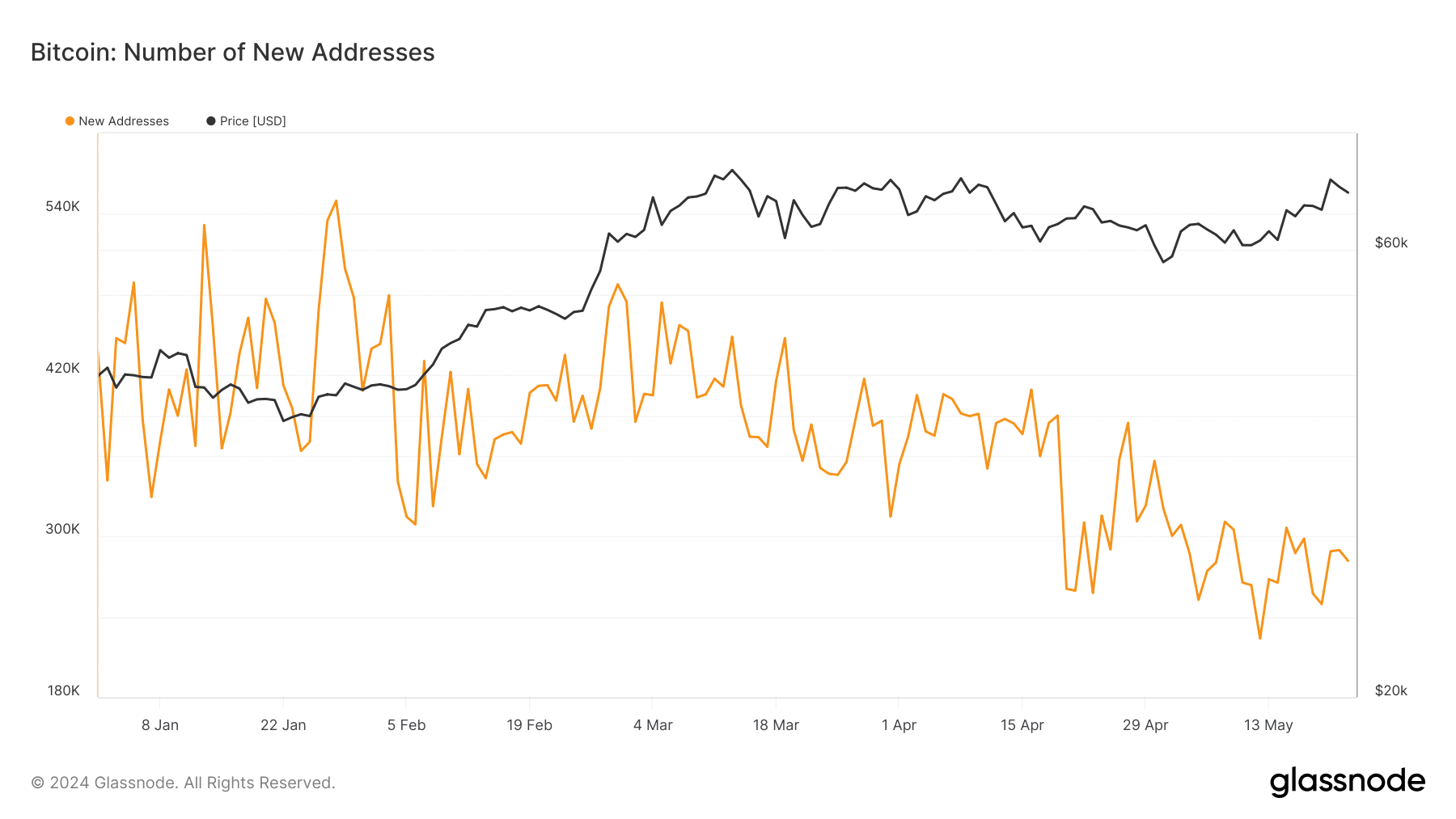

According to Glassnode’s analysis, the number of new Bitcoin addresses has been decreasing, resulting in fewer peak highs and lows. This observation aligns with Check’s perspective that the Bitcoin market hasn’t yet displayed signs of euphoria, which can indicate an overexcited market.

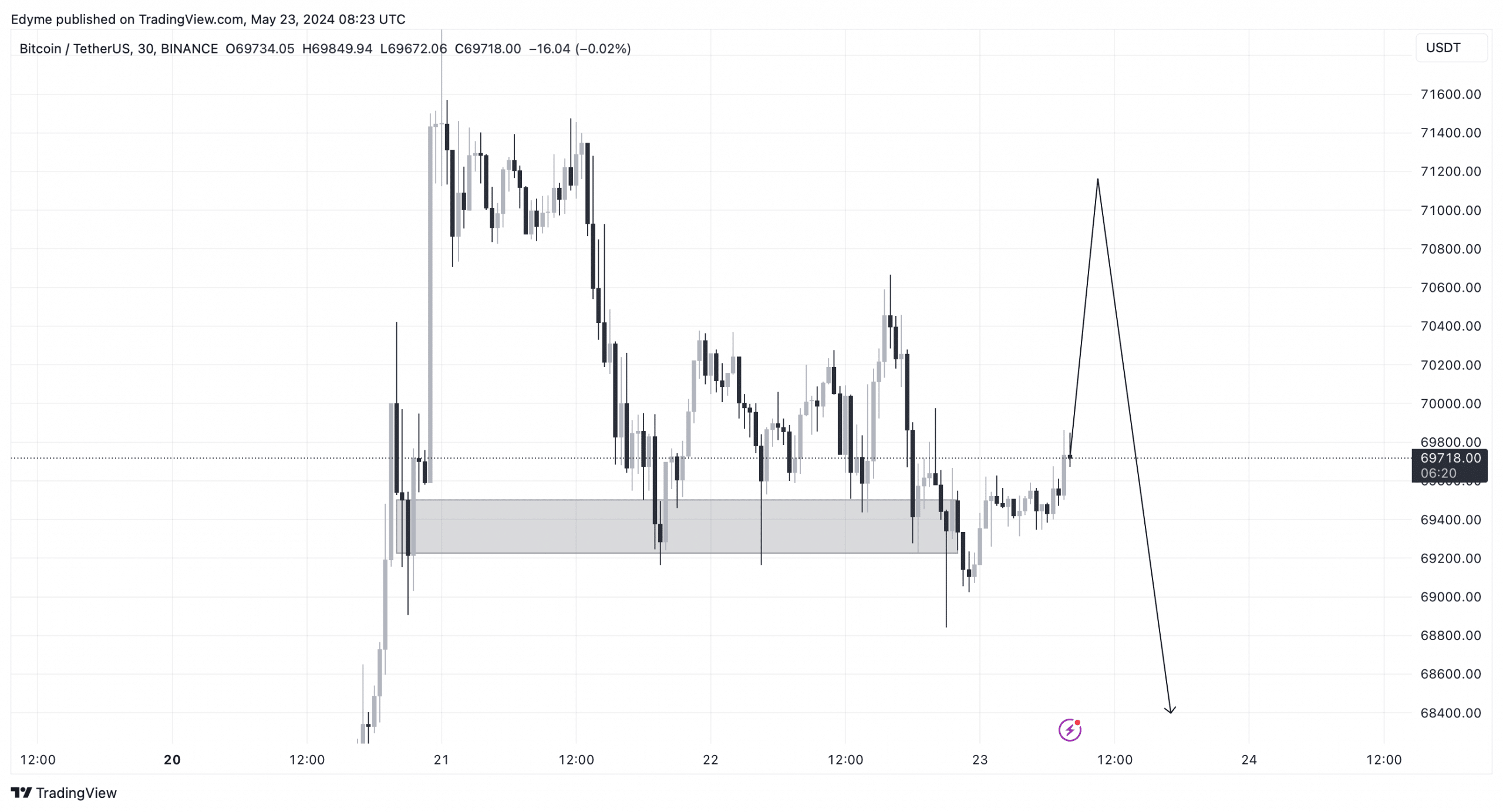

Bitcoin has breached a significant demand area on the 30-minute chart, indicating a possible retreat for the asset to accumulate more buying power and continue its upward trend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to AMBCrypto’s latest analysis, a significant level to keep an eye on is approximately $71,500. If Bitcoin manages to finish the weekly candle above this point, it may lead to a breakout from its current consolidation phase.

Reaching this point could trigger Check’s assessment that Bitcoin’s price might surge beyond $73,000, igniting the hyperdrive phase and signaling an intensified development in its market trend.

Read More

- OM PREDICTION. OM cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered – Ring of Namira Quest Guide

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

2024-05-24 03:03