-

DOGE’s price dropped by more than 5% in the last 24 hours.

A few metrics and technical indicators hinted at a trend reversal soon.

As a seasoned crypto investor with a keen interest in Dogecoin, I’ve witnessed its ups and downs over the years. The recent price drop of more than 5% within the last 24 hours has raised some concerns for me. While the surge in large transactions from whales was an interesting development, it couldn’t prevent the bearish trend that took hold of Dogecoin.

Once more, the focus returned to Dogecoin [DOGE], as this meme currency experienced a significant surge in transaction activity. Simultaneously, its price trend took a downturn. Let’s delve deeper into the current situation surrounding Dogecoin.

Dogecoin whales are gearing up

Coinpedia Market recently posted a tweet highlighting an interesting development around Dogecoin.

Based on the tweet, I’ve noticed a significant spike in large-value transactions involving the memecoin DOGE. This surge came amidst the Ethereum ETF speculation buzz. The total worth of these sizeable transactions jumped from $1.53 billion to an impressive $3.01 billion within a single day.

In the tweeted message, it was noted that the surge was accompanied by a substantial rise in the amount of Dogecoin (DOGE) being transferred between large holders, or whales. The quantity jumped from 9.74 billion to 17.97 billion coins.

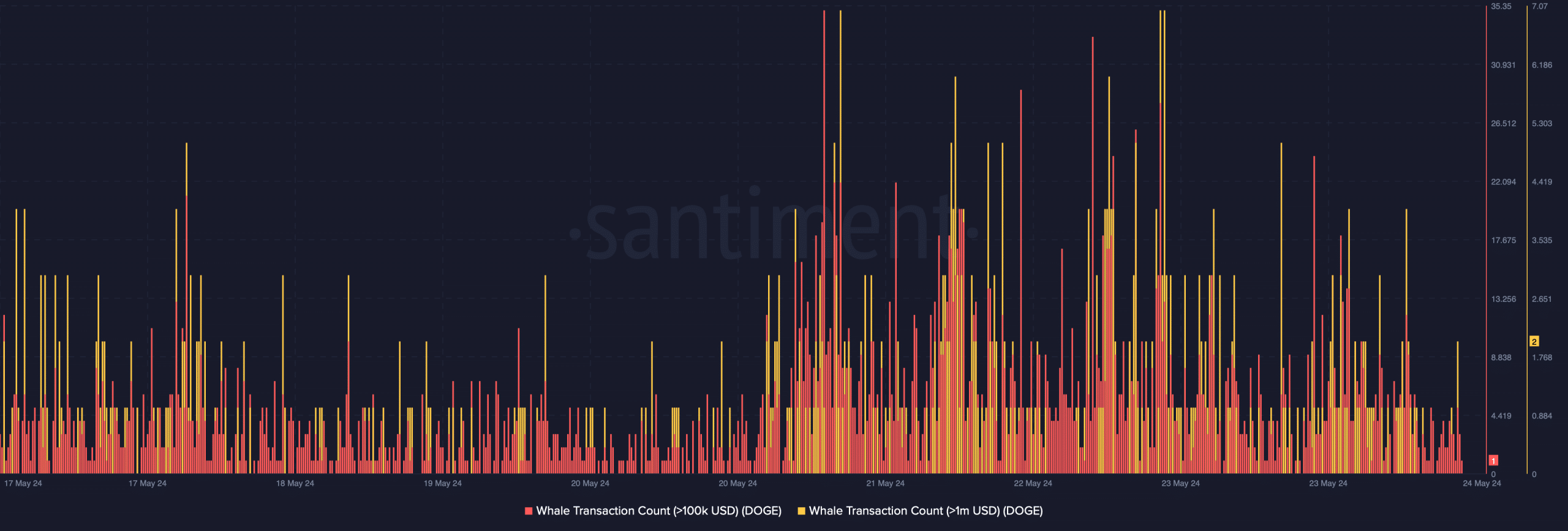

Based on AMBCrypto’s interpretation of Santiment’s findings, there has been a notable surge in whale transactions as observed in our analysis.

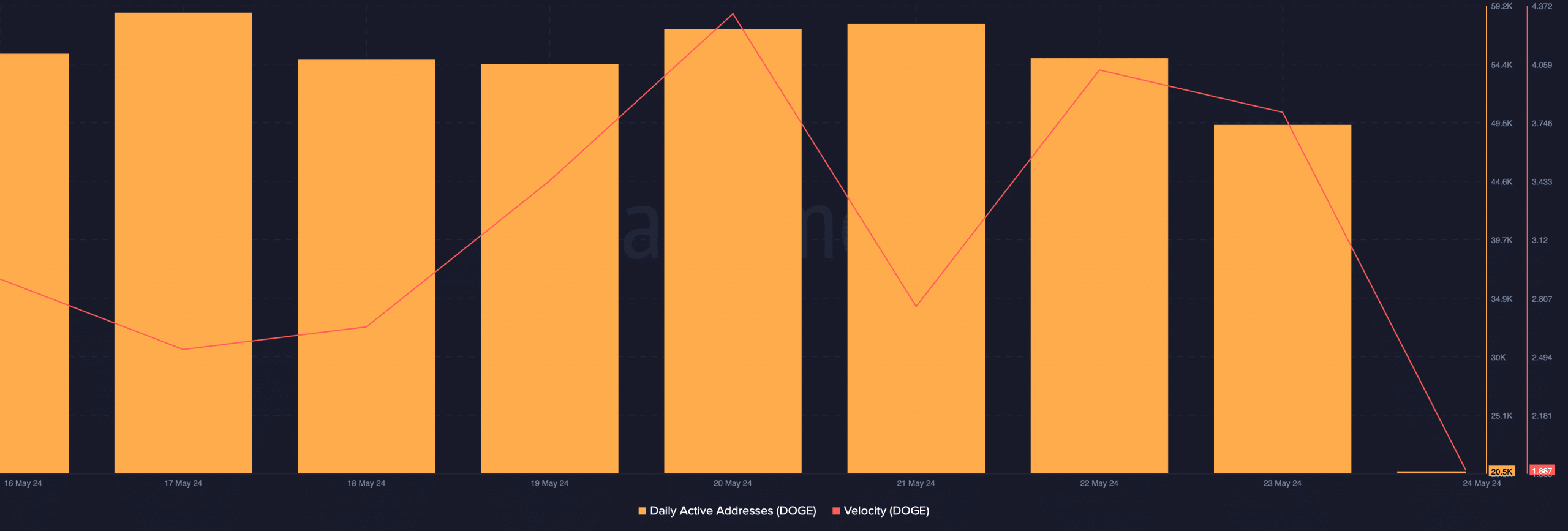

Last week, both whale transactions and overall network activity showed heightened levels of activity. Consistently, the number of daily active addresses for the memecoin remained steady.

Furthermore, the number of times DOGE was employed in transactions during a specified period increased, resulting in a higher velocity.

Bears make an entry

As Dogecoin was dominated by significant transfers of coins among large investors, the bearish sentiment gained traction, leading to a price decrease for the memecoin.

As an analyst, I’d rephrase it as follows: Based on data from CoinMarketCap, Dogecoin experienced a decline of more than 5% within the past 24 hours. At present, Dogecoin is being traded at $0.1578, and its market capitalization exceeds $22.7 billion.

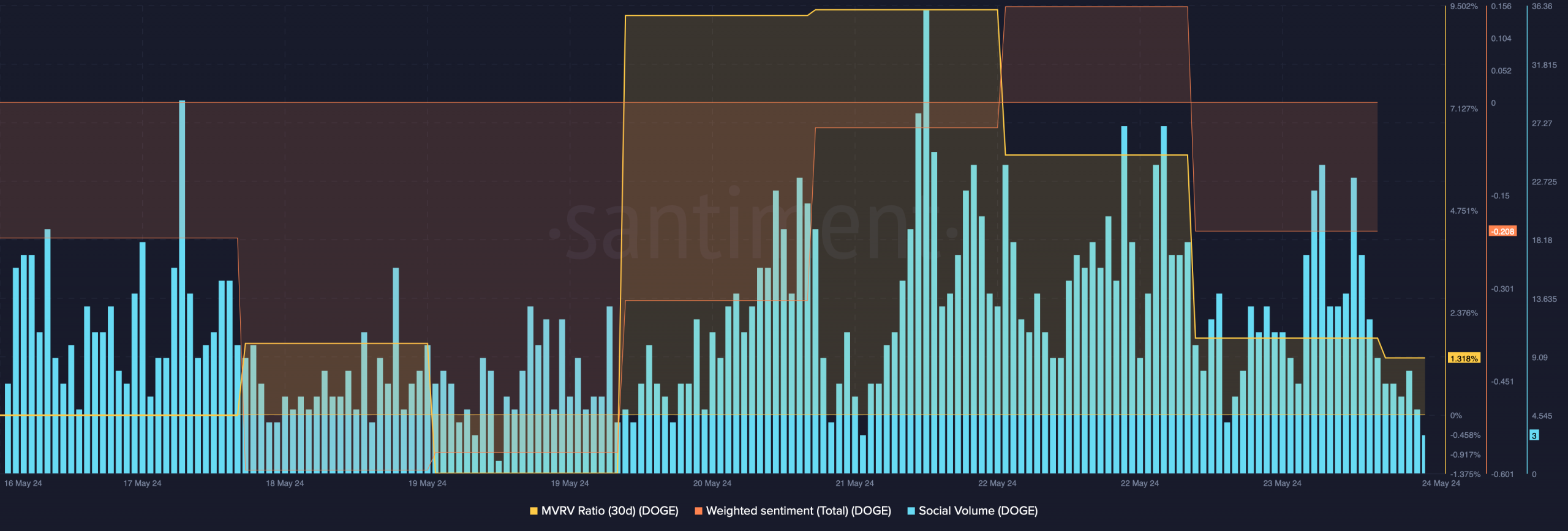

The decline in price recently led to a decrease in its social media activity as well. For example, its social mentions reached a peak on May 21st and subsequently dropped.

The feeling of optimism associated with the memecoin decreased significantly, indicating that pessimistic views were more prevalent among investors. Additionally, a bearish sign was the sharp drop in the MVRV ratio over the past few days.

As a crypto investor, I’ve noticed the bearish trend in DOGE‘s price action, but I’m keeping an optimistic outlook. At the moment, the fear and greed index for DOGE stands at 37, which signals a “fear” phase in the market. Historically, when this metric reaches such levels, it has often preceded trend reversals. Thus, I believe we might see a shift in the market sentiment soon.

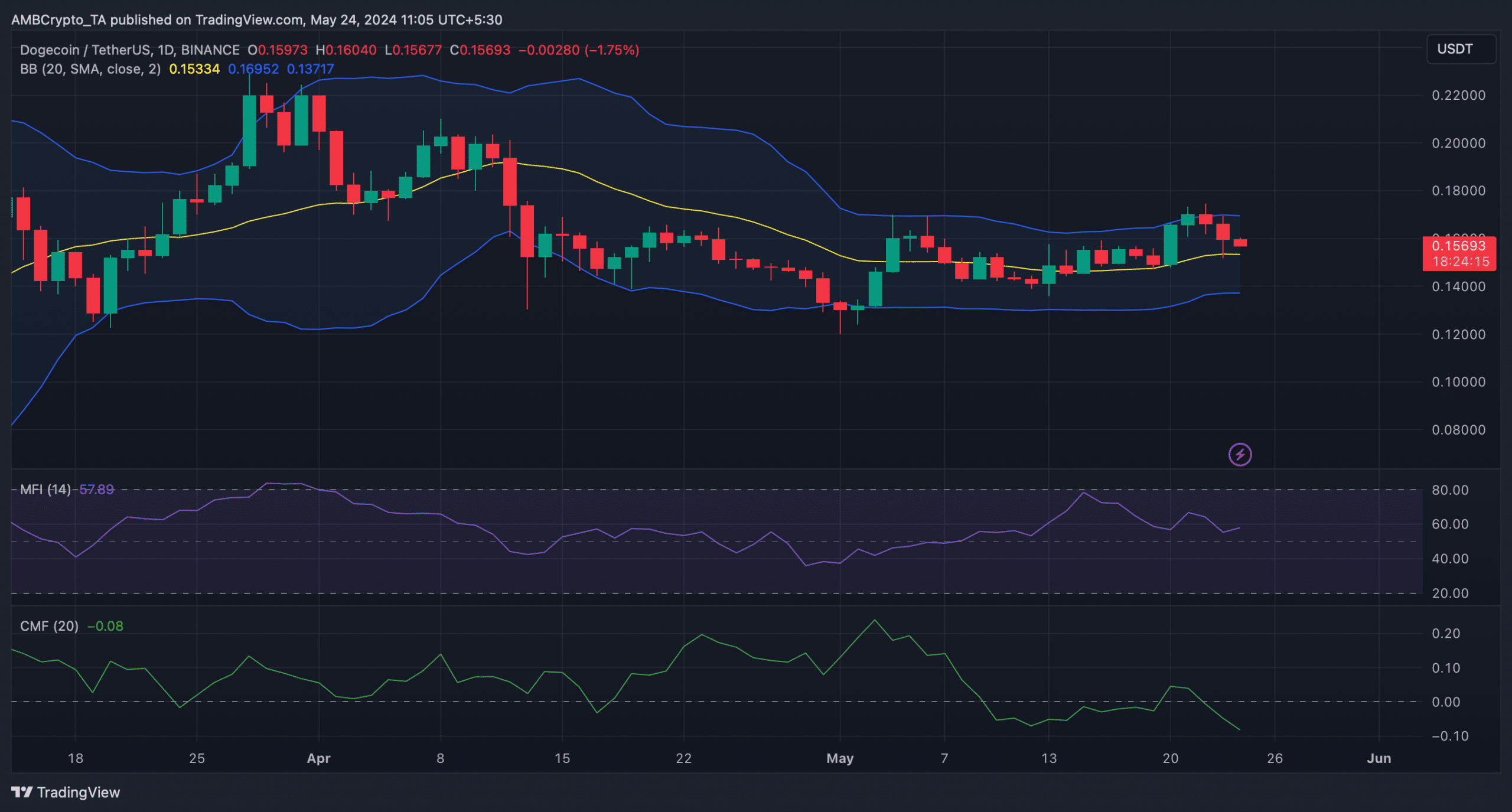

An analysis of DOGE‘s daily chart by AMBCrypto revealed that the Money Flow Index (MFI) has recently increased, indicating a potential trend reversal.

Is your portfolio green? Check the Dogecoin Profit Calculator

DOGE’s price was sitting at its support near its 20-day Simple Moving Average (SMA).

As an analyst, I would interpret this situation as follows: If the support is validated through testing, there’s a possibility that investors may observe a recovery. On the other hand, the Chaikin Money Flow (CMF) exhibited bearish signs, suggesting that the downward price trend might persist.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-05-24 20:08