-

SHIB’s value has dropped by almost 10% in the past 24 hours.

With significant bearish influence, the meme asset may witness a further decline.

As a researcher with extensive experience in cryptocurrency analysis, I find the recent price action of Shiba Inu (SHIB) concerning. Despite the approval of an ETF that includes Bitcoin and Ethereum, SHIB has failed to record any significant rally and instead experienced a sharp decline of almost 10% in the past 24 hours.

The leading meme cryptocurrency, Shiba Inu (SHIB), hasn’t shown any sign of growth following the ETF approval, resulting in a nearly 10% decrease in value within the last day.

According to CoinMarketCap, at press time, the meme asset exchanged hands at $0.000023.

SHIB poised for more losses

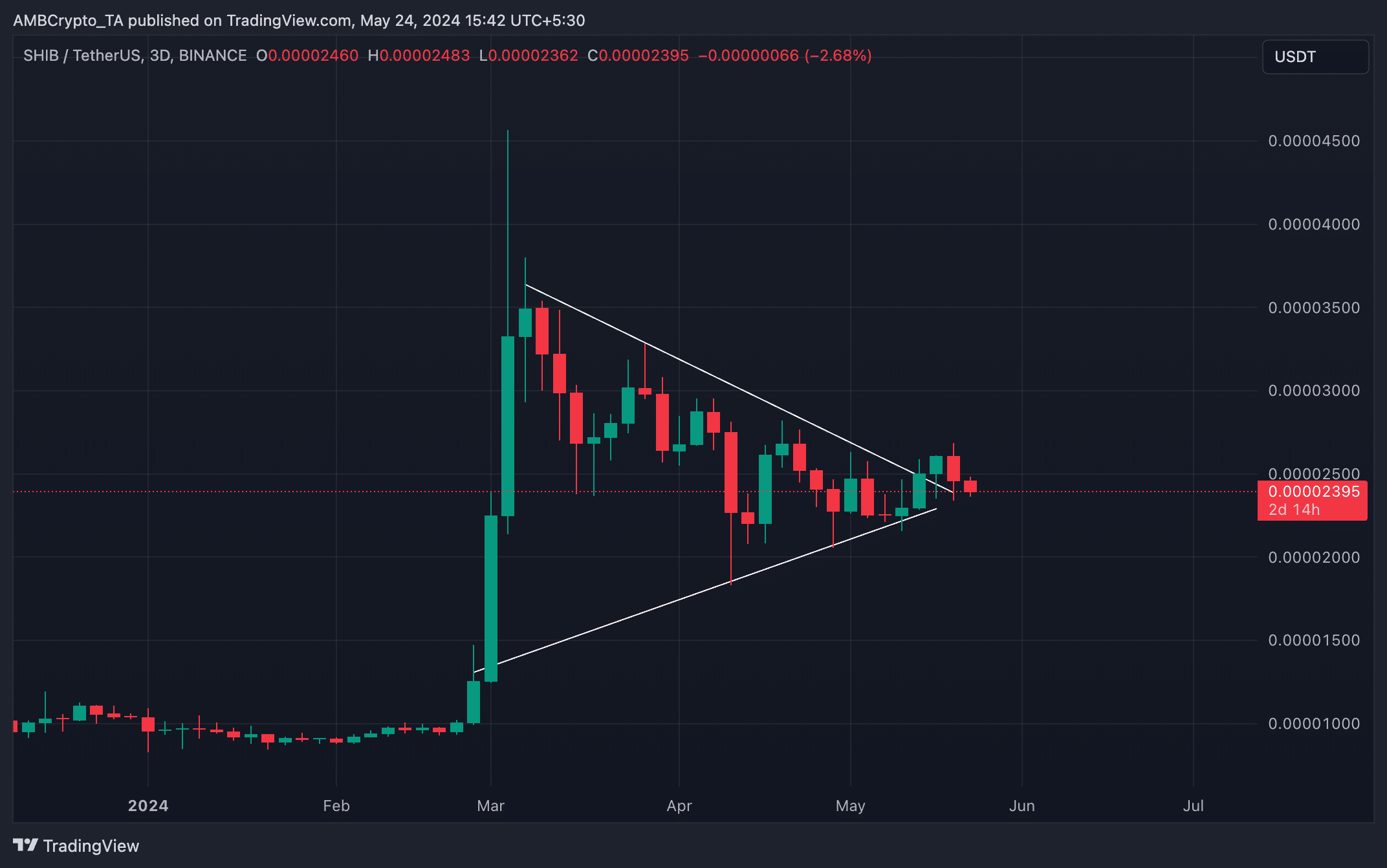

A analysis of SHIB‘s price pattern over the past three days indicated a breakout from a rising, symmetric triangle formation on May 18th, signaling a continuation of its upward trend.

However, the coin’s price peaked at a high of $0.000026 and has since dropped 12%.

Within a symmetrical triangle on the asset chart, the price oscillates between forming successive higher lows and lower highs. This pattern signifies that the asset’s value is consolidating within a narrow band as buyers attempt to propel it up against resistance levels, while sellers try to push it down towards support zones.

On May 18th, SHIB experienced a noteworthy surge above previous resistance levels, signifying an upward breakout. Nevertheless, following a substantial 12% drop in value over the past two days, its price has retreated towards the triangle’s lower boundary, acting as a source of support.

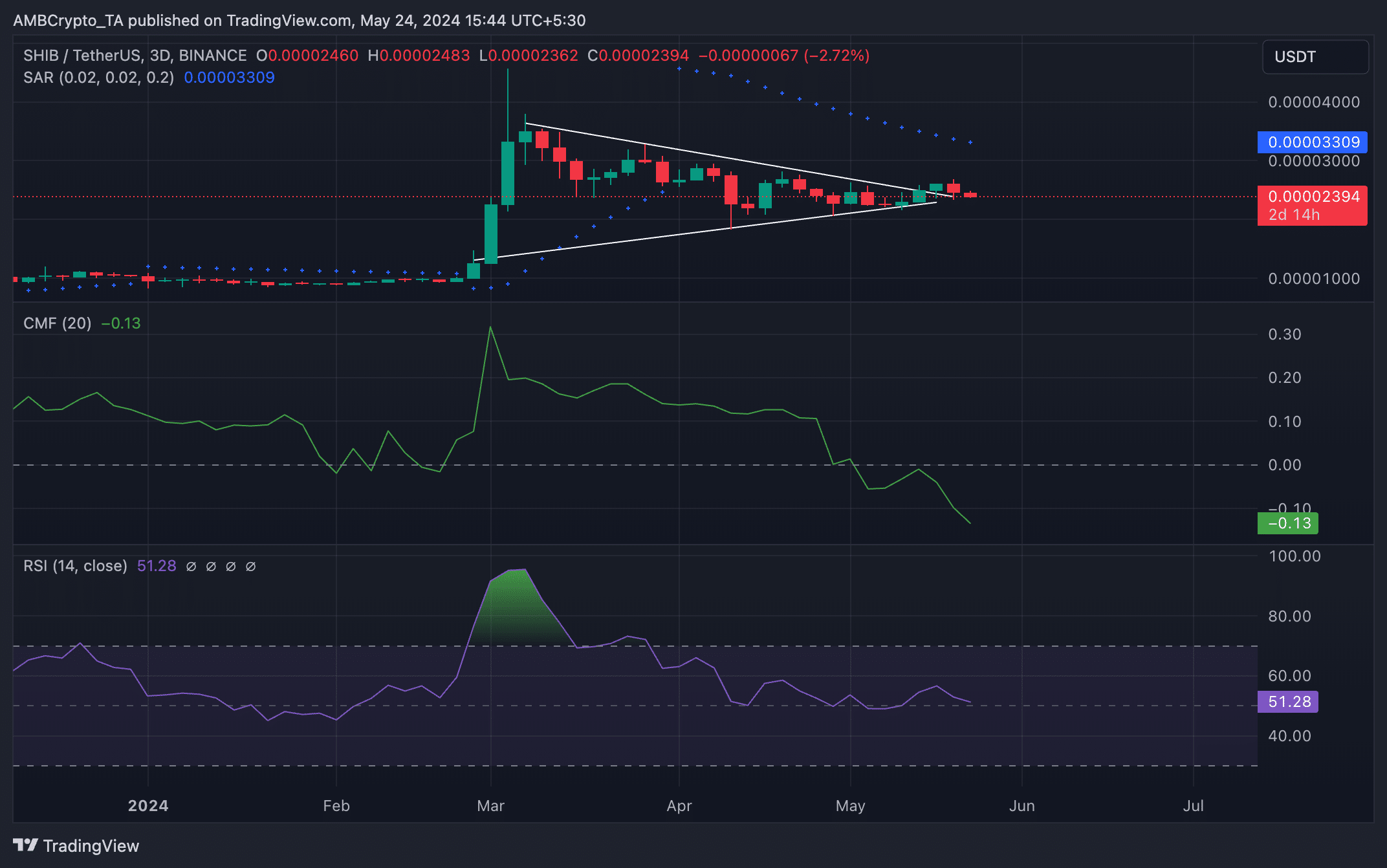

Based on AMBCrypto’s analysis, certain technical indicators of Shiba Inu (SHIB) suggest that the price trend may persist in a downward direction.

As a crypto investor, I’m closely monitoring the meme coin’s Chaikin Money Flow (CMF). Unfortunately, at present, this indicator has returned a negative value of -0.13 and is continuing to trend downwards. When a CMF is in the red, it suggests an increase in selling pressure among traders, which can lead to a drop in price. Therefore, I would advise caution when considering any new investments or additions to your portfolio in this particular asset.

As an analyst, I can confirm that SHIB‘s Money Flow Index (MFI) being at 44.59, which is below the 50-neutral mark, indicates a prevailing selling trend among market participants. This implies that more coins are being sold in the market than bought, suggesting a bearish outlook for SHIB.

At the current moment, the Parabolic SAR indicator’s points for SHIB were located above its current value. This indicator plays a crucial role in determining SHIB’s possible trend trajectory and signaling any potential price shifts.

Read Shiba Inu’s [SHIB] Price Prediction 2024-2025

When the price of an asset is depicted with upward-pointing dotted lines above it on a chart, this signifies a downward trend in the market. This implies that the asset’s value has been decreasing and might potentially carry on doing so.

As a crypto investor, I’ve noticed that despite the current market conditions, those trading Shiba Inu (SHIB) futures have persisted in opening long positions. According to data from Coinglass, SHIB’s futures funding rate has stayed positive. This indicates that there is a strong demand for more long positions than short ones among market participants.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-25 05:11