-

ETH’s supply on exchanges hiked over the last few days

A metric revealed that ETH was undervalued, hinting at a price uptick on the charts

As an experienced analyst, I believe that the recent approval of Ethereum [ETH] ETFs by the U.S Securities and Exchange Commission (SEC) was a significant development for the cryptocurrency market. However, the price action following this event has been quite unexpected, with ETH experiencing a bearish trend instead of the anticipated bull run.

As an excited crypto investor, I’ve been eagerly awaiting the SEC’s approval of the long-anticipated spot Ethereum (ETH) ETFs for just two short days now. However, the reality hasn’t lived up to my expectations as Ethereum has unexpectedly taken a bearish turn on the charts following the announcement. To better understand this shift, it’s essential to delve deeper into the situation.

Ethereum ETF approval goes wrong

Back in May, the Securities and Exchange Commission (SEC) gave its green light to eight Ethereum [ETH] exchange-traded fund (ETF) proposals. Among these applicants were industry giants like BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton. The SEC granted them the necessary approval by signing off on their 19b-4 forms.

Despite the anticipation of a significant price increase for ETH following that event, the currency experienced a surprising decline instead. As reported by CoinMarketCap, ETH’s week-long bullish trend concluded as its value dropped approximately 2% in the previous 24 hours. Currently, ETH is being exchanged at $3,766.04 and boasts a market capitalization exceeding $452 billion according to current market figures.

Recently, crypto analyst Ali expressed on Twitter that there were several explanations for the recent downturn in price, specifically pointing to Ethereum which experienced a substantial sell-off following its approval. One potential reason suggested was profit-taking by investors, as exemplified by Jeffrey Wilke, one of Ethereum’s founders, who offloaded 10,000 ETH, equivalent to roughly $37.38 million.

The ruler of alternate coins witnessed an increase in its availability on trading platforms, indicating significant selling activity. Moreover, the TD sequential marker signaled a sell position on Ethereum’s price graph as well.

Under certain circumstances, the downward trend in ETH‘s price could reverse. According to Ali’s analysis, there is a resistance range for Ether between $3,940 and $4,054. If Ethereum successfully records a daily candlestick closure above $4,170, the bearish trend may be halted.

Are bears willing to let go?

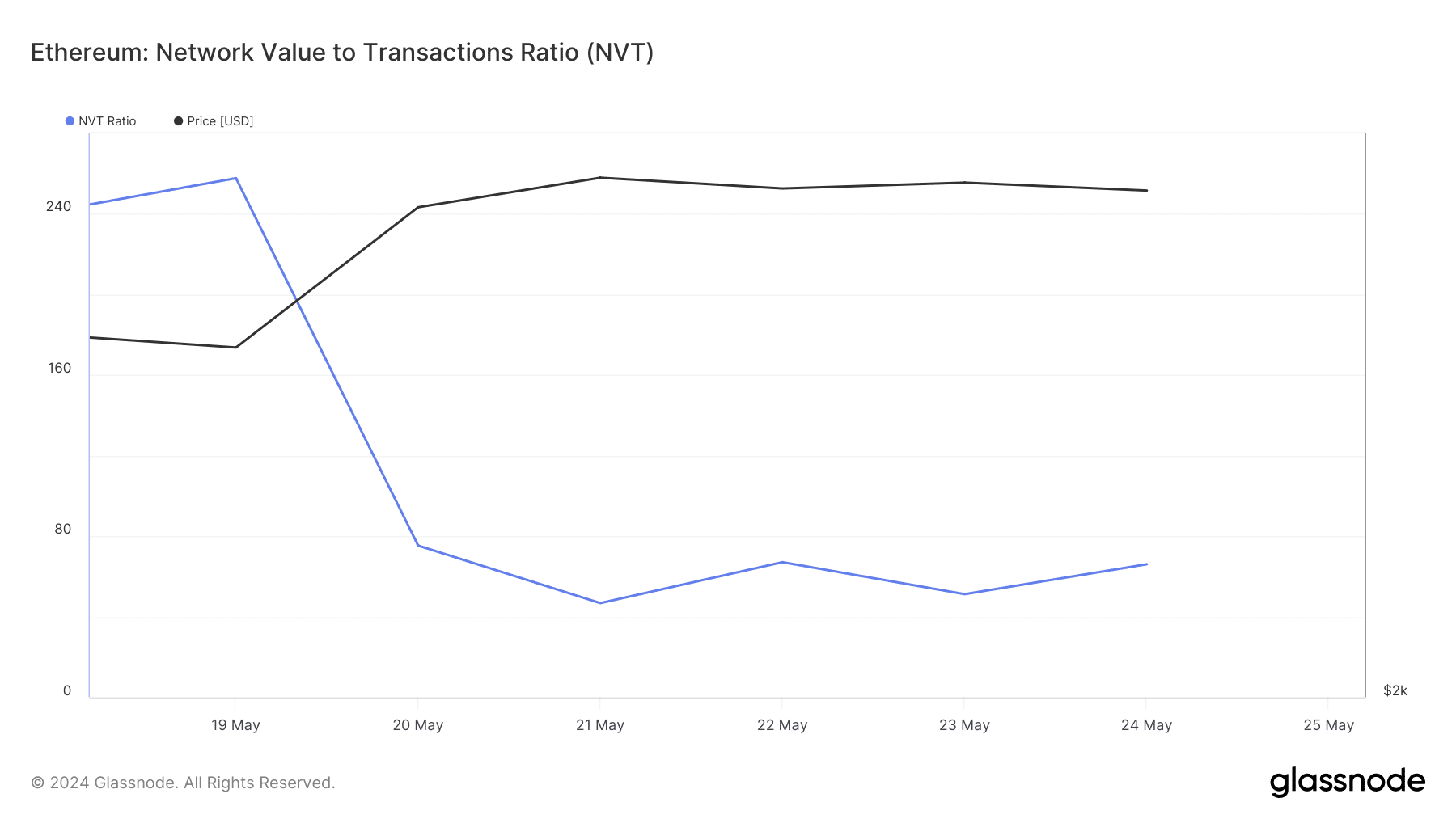

After examining Ethereum’s on-chain statistics provided by AMBCrypto, our team investigated if there were any indications of Ethereum surpassing the mentioned resistance level based on the data from Glassnode. Our analysis revealed that Ethereum’s NVT (Network Value to Transactions) ratio experienced a significant decrease. When this metric drops, it implies that the asset is underpriced, potentially leading to an increase in price.

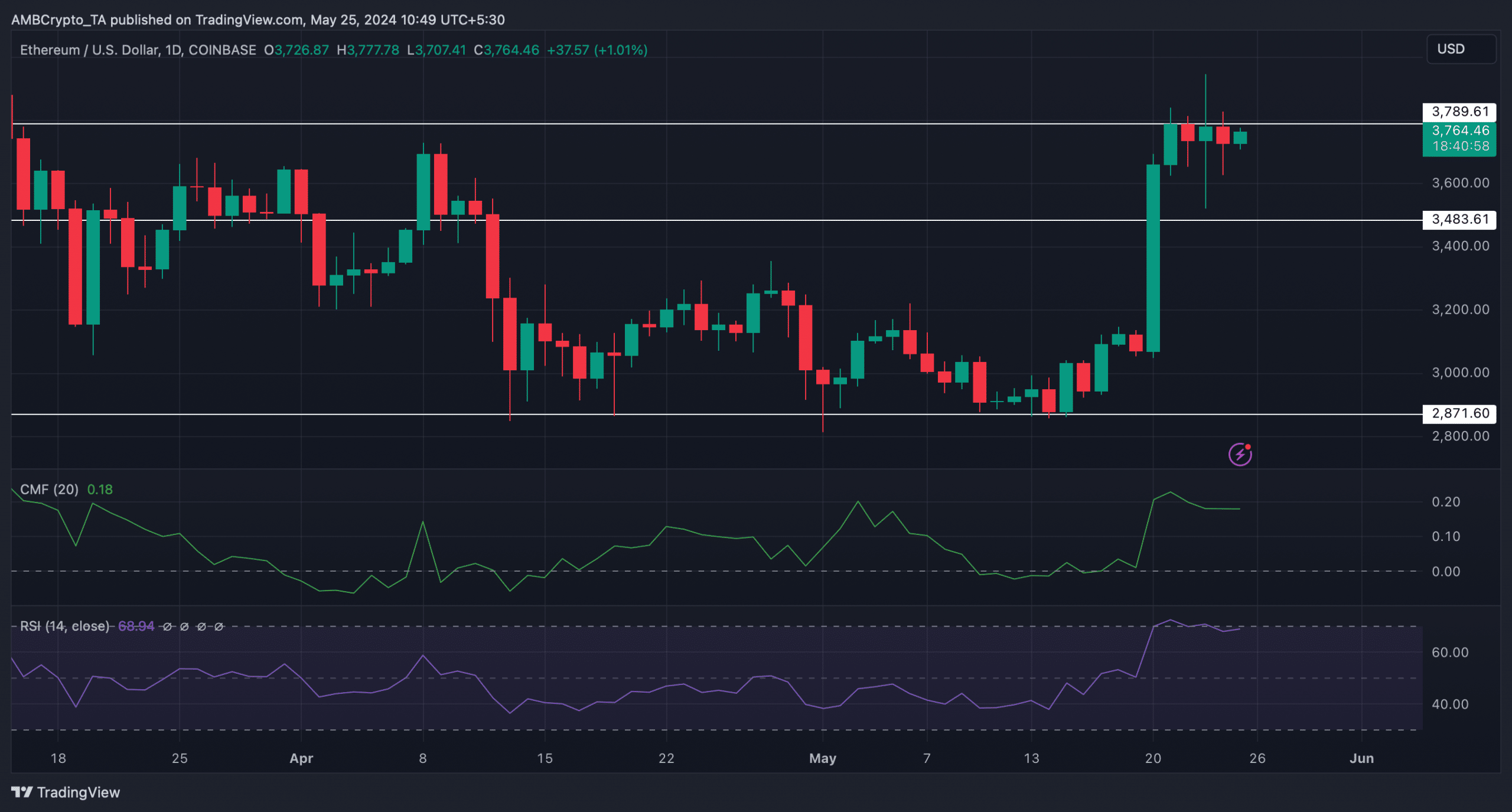

At present, Ethereum’s fear and greed index stood at 67%, implying that the market was in a “greedy” state based on this indicator. This level typically suggests a heightened probability of a price correction occurring. For a clearer perspective, AMBCrypto examined Ethereum’s daily chart.

As a researcher, I discovered that ETH‘s Chaikin Money Flow (CMF) exhibited a horizontal movement in recent days. Likewise, the Relative Strength Index (RSI) displayed a comparable trend.

These indicators suggested that investors might witness a few more slow-moving days.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-05-25 14:15