-

The rise in market inflation indicated that BTC holders were selling some of their assets.

Data showed that the price could rise toward $72,000 before a major correction.

As a seasoned crypto investor with a keen interest in on-chain data and market trends, I’ve closely monitored the recent developments in Bitcoin (BTC). The rise in market inflation, as indicated by Glassnode’s data, has me concerned. Long-term holders (LTHs) seem to be selling their assets, which could put downward pressure on BTC’s price.

Based on the information AMBCrypto received from Glassnode’s on-chain data, there are indications that Bitcoin (BTC) may experience a notable price drop.

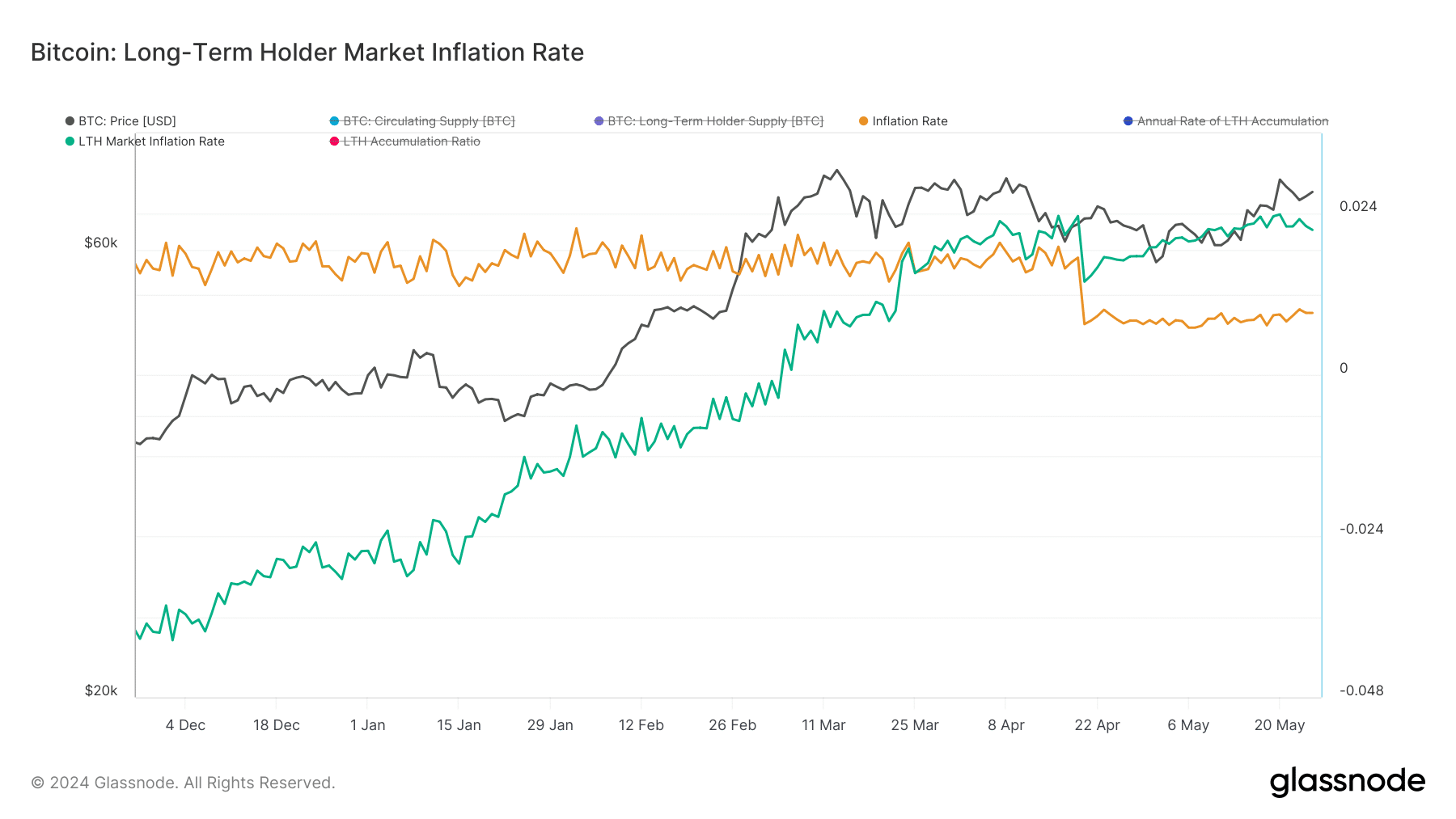

As a researcher studying market trends, I would highlight that the Long-Term Holder (LTH) Inflation Rate takes the helm in my predictions. LTHs refer to investors who have held onto their cryptocurrencies or other assets for extended periods.

As a crypto investor, I believe in closely monitoring the Long-Term Holder (LTH) market inflation rate to gain insights into Bitcoin’s potential price movements. This rate is calculated based on the level of accumulation or distribution within the LTH cohort. Essentially, when more Bitcoins are being held by long-term investors than being sold, the accumulation rate rises, indicating a bullish trend. Conversely, when there’s a higher distribution rate, meaning more Bitcoin is being sold than accumulated, we might be seeing a bearish signal. Keeping an eye on this metric can help inform my investment decisions and provide valuable context in the ever-evolving world of cryptocurrencies.

Two lines are depicted on this chart with different colors. The green line signifies the market inflation rate, whereas the manila-colored line represents the nominal inflation rate.

Investor belief does not equate their actions

During bull markets, when market inflation decreases below the regular inflation rate, it’s a sign that long-term investors are actively buying and hoarding Bitcoin. This trend could potentially lead to an uptick in Bitcoin’s price.

Conversely, when the inflation rate exceeds the stated price increase, investors are likely increasing their selling activity.

As a researcher observing the Bitcoin market, I notice that at this moment, the price trend appears to form a pattern suggesting a potential significant drop for Bitcoin (BTC) may be imminent.

As a financial analyst, I can tell you that I observed Bitcoin’s price reaching $69,164 during my latest market analysis, marking a 2.98% growth over the past week.

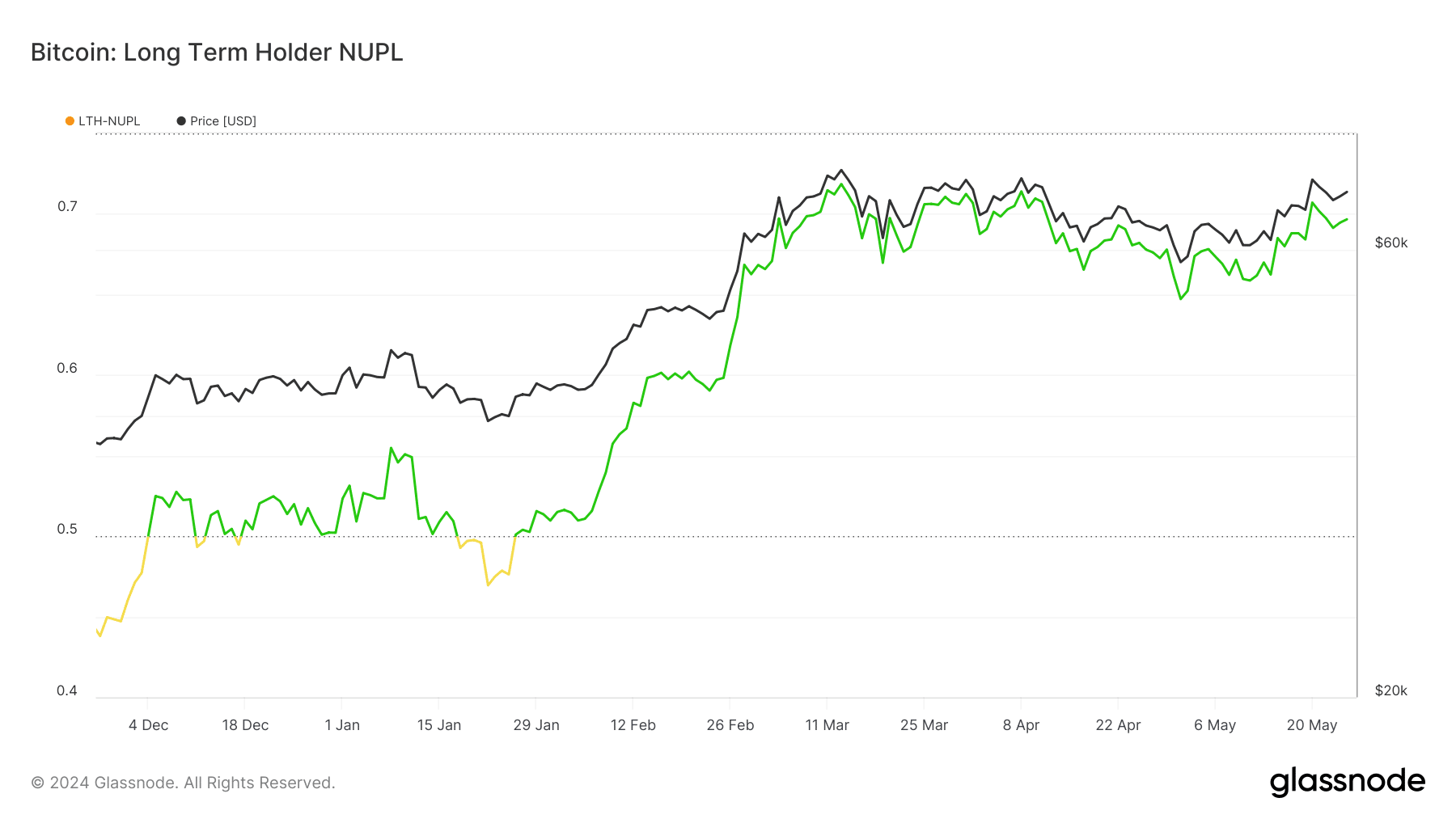

Prior to reaching a decision that holders could potentially drive Bitcoin (BTC) lower, AMBCrypto examined the attitudes of these holders towards the cryptocurrency.

One method to understand long-term holder actions is by examining the LTH-NUPL (Long Term Holder – Net Unrealized Profit/Loss) metric. This acronym signifies the unrealized profits or losses for long-term investors who have not yet sold their assets. Analyzing this figure provides insights into the behavior patterns of these investors.

At present, the LTH-NUPL is situated within the confidence area denoted by the green zone. This signifies that investors holding this coin for a minimum of 155 days have expressed their optimism towards Bitcoin’s prospects.

This may not yield immediate results, as the same individuals could continue influencing Bitcoin’s circulation.

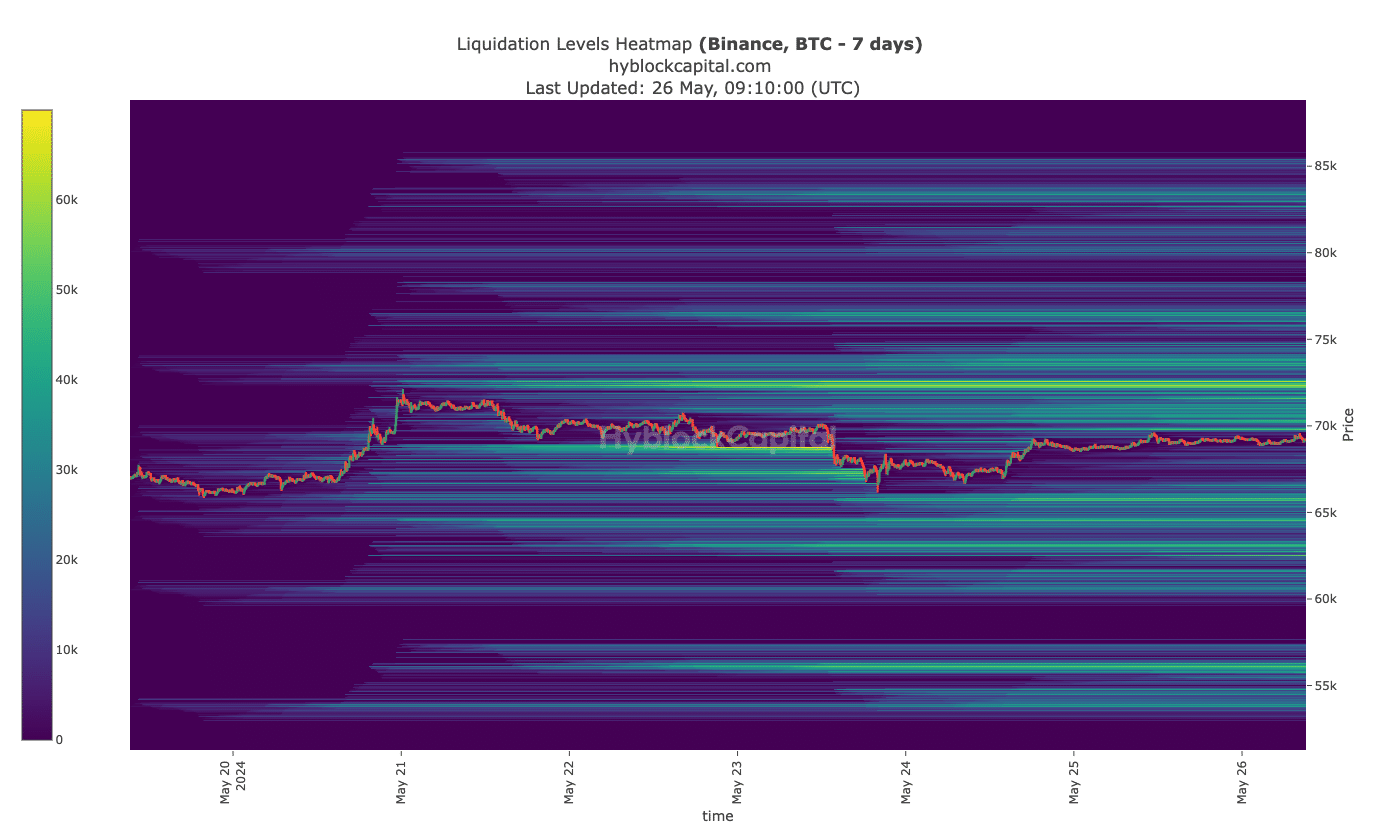

In terms of price prediction, the liquidation heatmap provided insights into the coin’s movement.

$72K, then $63K

As a researcher studying market dynamics, I would recommend utilizing a liquidation heatmap to identify optimal positions for traders based on liquidity distribution. Concentrated liquidity can lead to price shifts in that direction; yet, these areas may also function as resistance or support levels.

Based on information obtained from Hyblock, AMBCrypto detected a magnetically significant level around $72,350 for Bitcoin’s price movement.

Alternatively, if Bitcoin reaches the mentioned price but fails to advance, that level might function as a significant barrier to further progress, potentially signaling troubles for the cryptocurrency.

This is because the other major high-liquidity area was at $63,050.

Based on the signs I’ve seen, I believe Bitcoin’s value may rise. However, when a correction occurs, it might prove challenging for the coin to bounce back.

As a crypto investor, if Bitcoin (BTC) fails to hold above $63,050, there’s a possibility that the price could drop down to around $56,200. But, should this not materialize, BTC may attempt to rebound and reach closer to $70,000 once more.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- OM PREDICTION. OM cryptocurrency

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- EUR PKR PREDICTION

2024-05-26 20:07