- Bitcoin saw a positive reaction on the price charts, but social metrics underlined weakness.

- The high demand for Bitcoin in May could propel prices past the ATH soon.

As a seasoned crypto investor, I’ve witnessed my fair share of market volatility and trends. The recent price action of Bitcoin has been intriguing, with its sudden surge past the local range high at $67k was a welcome sight. However, as someone who pays close attention to social metrics and on-chain activity, I couldn’t help but notice some concerning signs.

Bitcoin (BTC) experienced some excitement in its price movement last week. On May 20th, it made a notable breakthrough, surpassing the previous resistance level at $67,000.

bitcoin underwent two tests of resistance at $66,300 and $66,600 on May 23rd and 24th respectively. Following these tests, its price rose to $69,100 as of the current report.

More gains are likely to follow as demand for the king of crypto continues to grow.

In a discussion between Jack Mallers, the CEO of Strike’s blockchain payments app, and Anthony Pomplianio, Mallers strongly expressed his belief that “Bitcoin is the most valuable asset to possess.”

The social metrics and on-chain activity were weakening

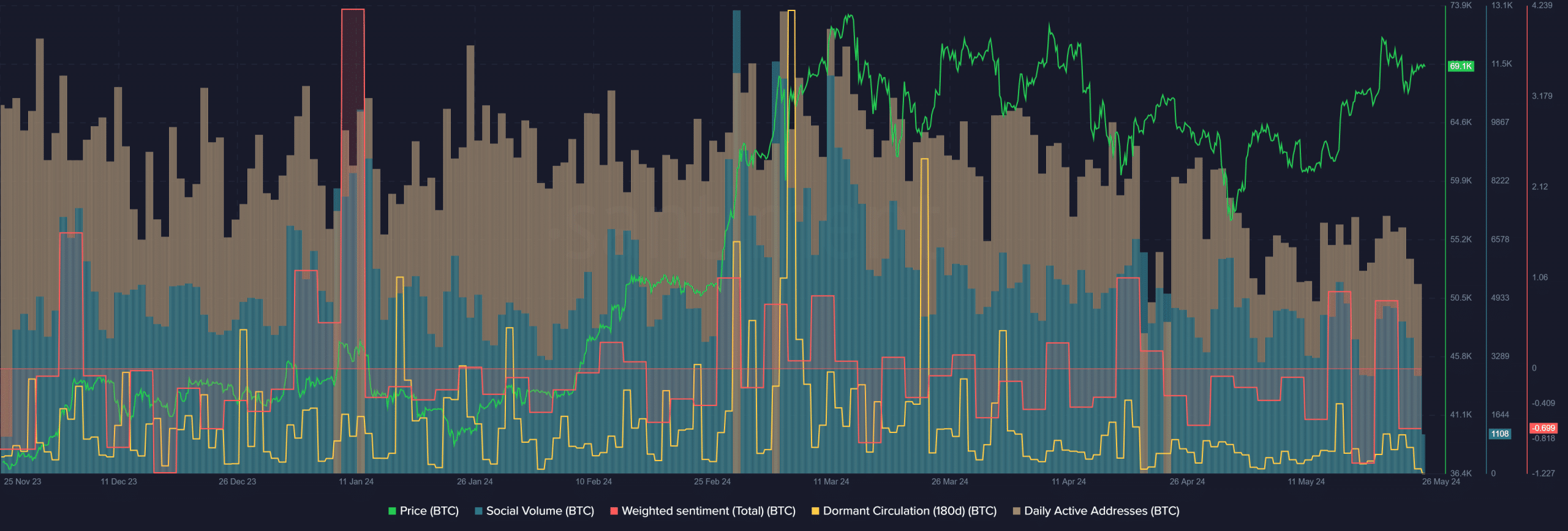

Since March 11th, the social buzz surrounding Bitcoin has gradually decreased. Throughout May, the weighted sentiment showed predominantly negative trends, interrupted by two brief periods of positivity around mid-month.

Together, they pointed toward reduced social media engagement.

As a researcher studying this data, I’ve observed that the daily activity levels have been trending downward since mid-March. Contrastingly, there were notable increases in dormant circulation on the 18th of April and the 15th of May.

However, their size did not rival the ones in March or late February.

As a researcher studying Bitcoin’s on-chain activity, I discovered that the recent absence of dormant Bitcoin movements indicated a lack of imminent large-scale selling waves. This is a positive sign because it implies reduced selling pressure in the market.

Is the demand for Bitcoin higher than ever before?

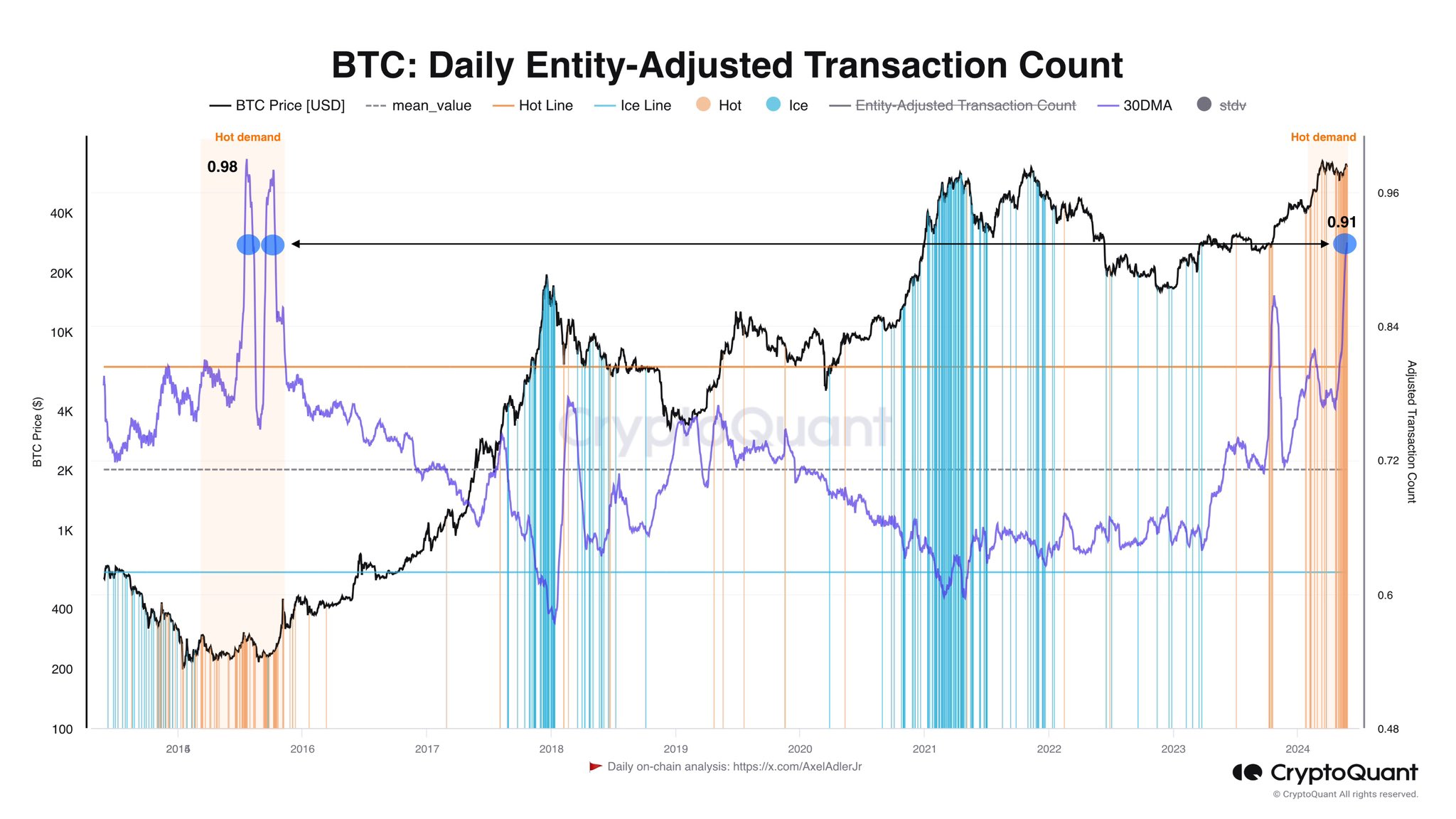

On X, crypto analyst Axel Adler posted an analysis indicating robust demand based on the adjusted count of transactions involving entities.

Based on the chart’s readings, the demand was close to the levels of the 2016 rally.

Read Bitcoin’s [BTC] price prediction 2024-25

Eight years ago, the cost of Bitcoin was only $300, but its current value stands at an impressive $69,100. Consequently, the required investment has grown substantially since then.

As a crypto investor, I’ve noticed an increased appetite for Bitcoin among both individual and institutional buyers. Simultaneously, the dormant circulating supply has decreased, leading me to believe that Bitcoin could potentially surge beyond the $71.4k mark once more.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-27 04:07