-

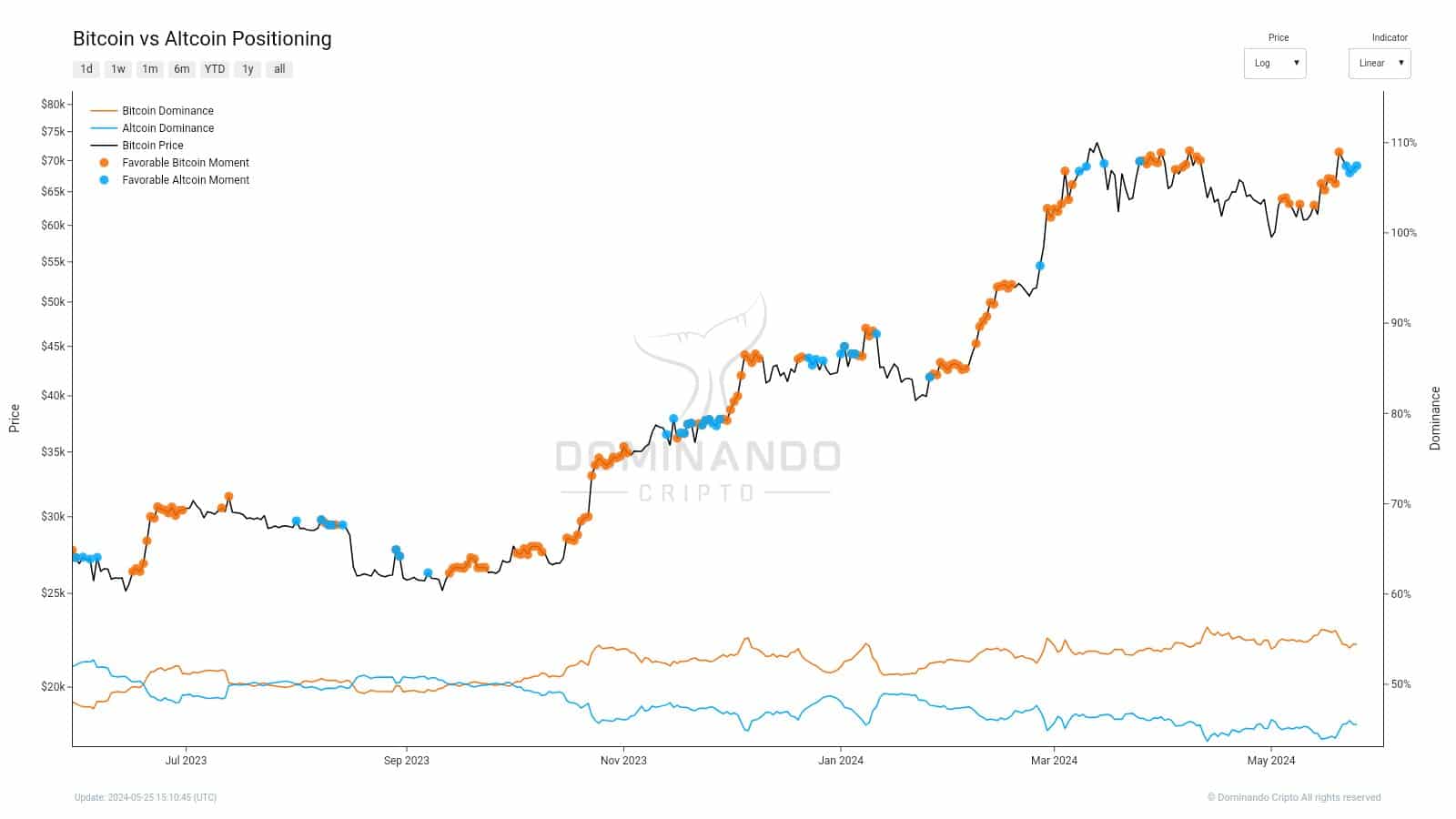

The altcoin positioning chart showed that alts performed well relative to Bitcoin recently.

Their market capitalization has steadily grown alongside BTC’s price gains.

As a seasoned crypto investor with several years of experience under my belt, I’ve learned to keep a close eye on market trends and patterns. The recent performance of altcoins relative to Bitcoin has been intriguing, with their strong showing in the past month. According to the data from the positioning chart, alts have outperformed Bitcoin in terms of market capitalization gains.

As a researcher studying the cryptocurrency market, I’ve observed that the downturn in Bitcoin’s value during the first week of May was brief-lived. Initially, there were outflows from Bitcoin Exchange-Traded Funds (ETFs), but these trends reversed rather swiftly since then.

The past two weeks saw consistent inflows which highlighted the presence of demand behind Bitcoin.

In the previous month, altcoins as a whole have exhibited favorable growth. Notably, memecoins have stood out with impressive individual gains. Yet, it’s important to mention that the expansion in market value wasn’t limited to just memecoins; other altcoins contributed to the overall increase in the altcoin market capitalization as well.

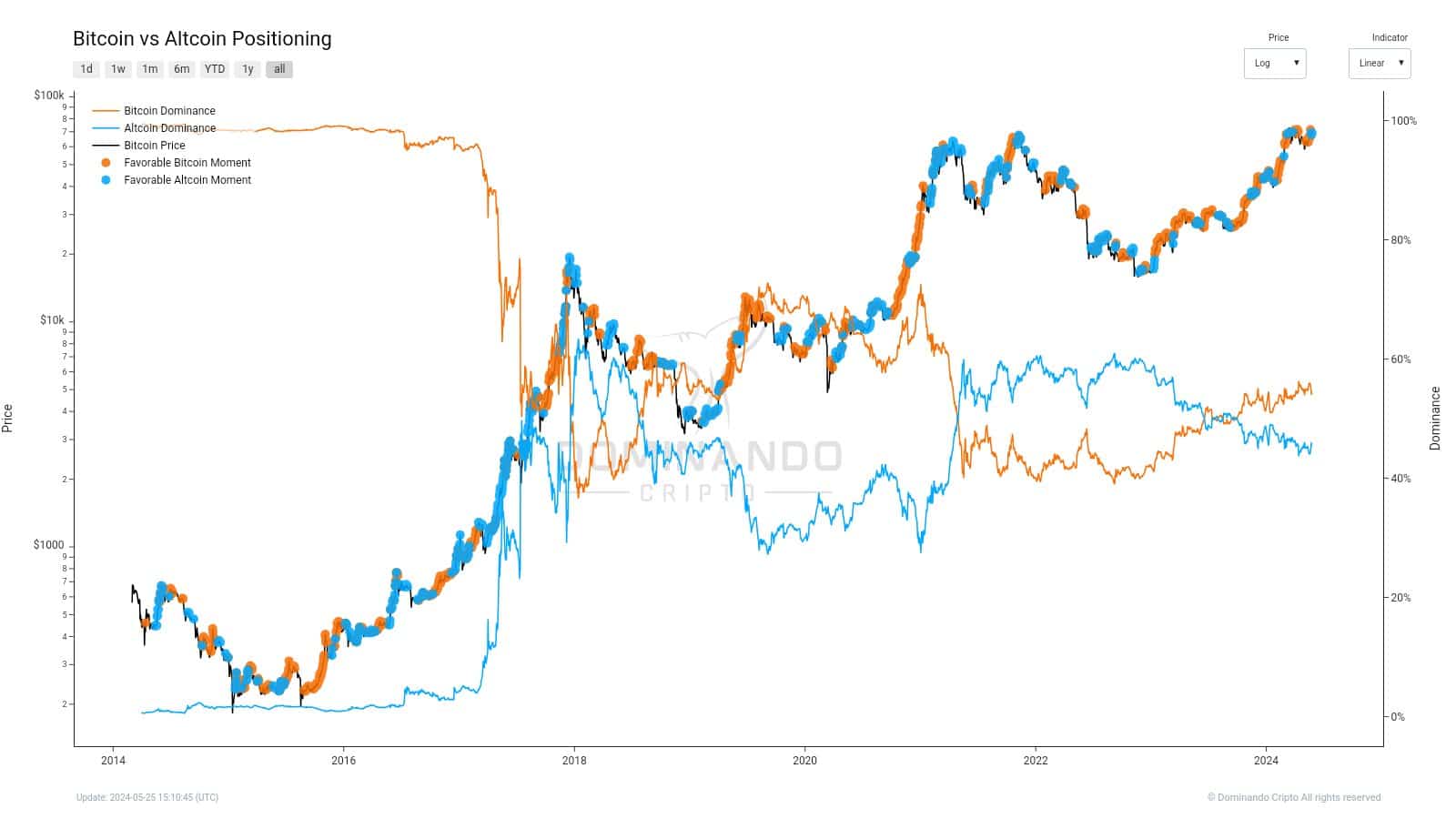

Will the past nine months’ pattern repeat once more?

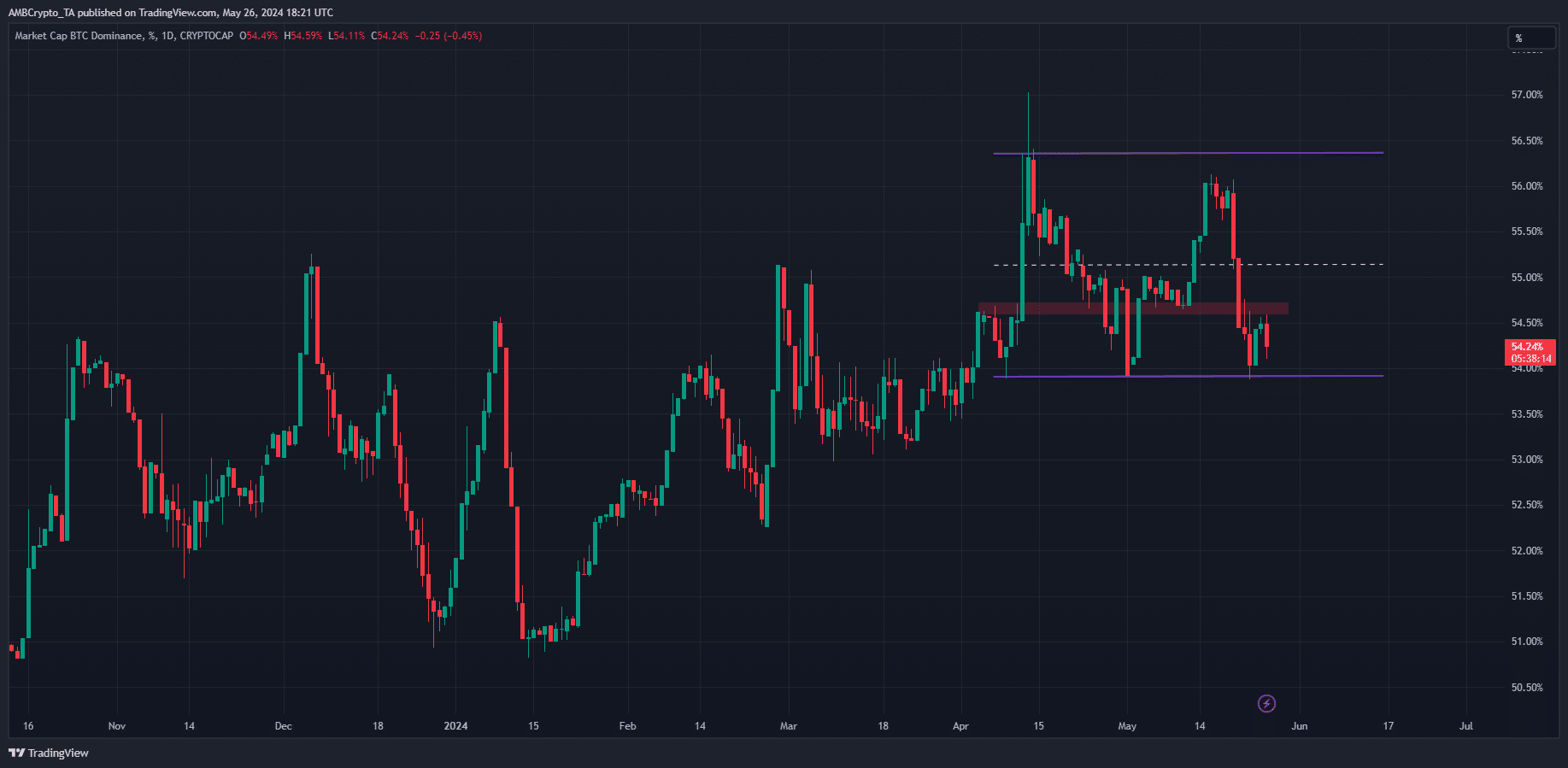

In her recent post on X, formerly known as Twitter, crypto analyst Jessica Miranda noted a notable shift in market dominance. Although Bitcoin retained approximately 54% of the total market share, altcoins had outperformed Bitcoin in recent times.

As a researcher studying Bitcoin price trends, I’ve observed that these rallies don’t typically persist for an extended period and are often preceded by a decline in BTC prices. This pattern has been evident for much of the previous nine months, with the significant uptrend starting in September 2023.

As a researcher studying the cryptocurrency market, I’ve observed that while Bitcoin dominates during prolonged bull runs, altcoins can sometimes take center stage. This was particularly evident during the 2016-17 bull run, which saw numerous instances of altcoin outperformance. The 2020-21 rally also had fewer such occurrences, but there were moments when a Bitcoin rally favored altcoins as well.

During the significant uptrend of 2022-2023, the trend became increasingly apparent. Should it recur one more time, Bitcoin could experience a potential decline within the next week or two.

Considering the latest surge of Bitcoin surpassing the $67k barrier, a price drop at this point seemed improbable. However, traders should still stay vigilant and be prepared for such an eventuality.

What does the Bitcoin dominance chart reveal?

As a market analyst, I’ve observed that Bitcoin’s (BTC) dominance was approaching a brief dip below the 54% mark. This indicates that a rebound could be imminent.

A sudden reversal in the altcoin market’s uptrend could dampen any budding rallies, yet it might also undermine predictions of a Bitcoin price decline based on analysis of altcoin holdings.

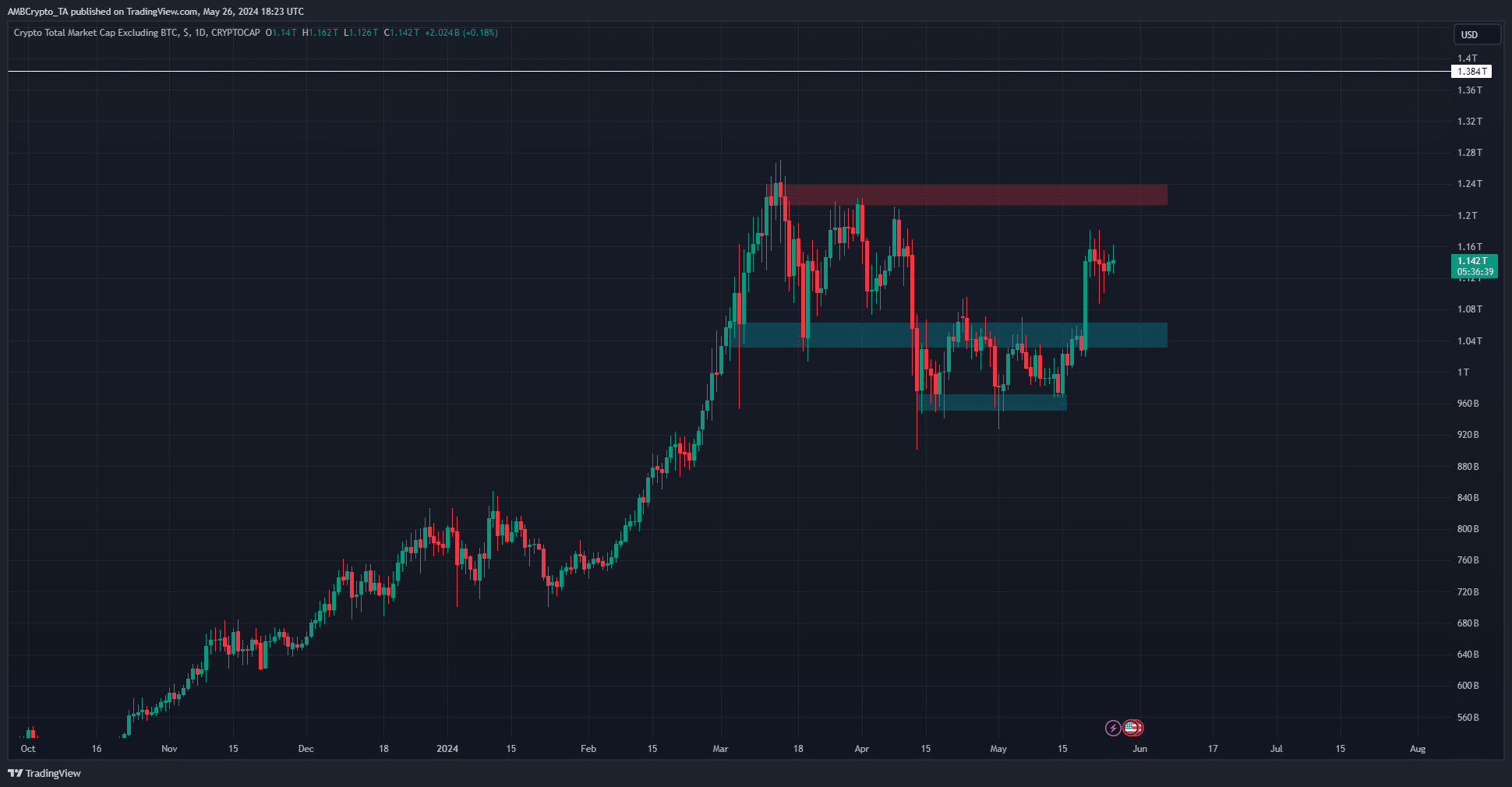

As an analyst, I’ve noticed that the proposition of an altcoin market correction has become more compelling after examining the market capitalization trend. Specifically, I’ve looked at the altcoin market cap, which represents the total value of all cryptocurrencies except Bitcoin in the entire crypto ecosystem.

Is your portfolio green? Check the Bitcoin Profit Calculator

From a technical standpoint, the stock market’s value neared a significant barrier at 1.24 trillion dollars. It was anticipated that a refusal to advance beyond this point would occur, according to analysis. However, due to the robust upward trend over the previous eight months, this resistance was ultimately expected to be breached.

As a technical analyst, I have identified indicators that suggest a potential Bitcoin price increase and a temporary correction for altcoins in the initial phase of June.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-05-27 11:03