- Ethereum momentarily hit $4,000, backed by ETF enthusiasm.

- Technical indicators suggest a retest of $4,000, breaking it sustainably soon.

As a researcher with extensive experience in cryptocurrency markets and technical analysis, I believe that Ethereum’s [ETH] temporary surge past $4,000 is not a mere fluke but rather a strong indication of an ongoing bullish trend. The recent ETF approval news undoubtedly fueled this momentum, but it’s the consistent buying pressure and favorable technical indicators that suggest Ethereum will attempt another break above $4,000 sustainably soon.

As a crypto investor, I’ve witnessed Ethereum [ETH] maintain its upward trend fueled by the ETF approval. Just moments ago, it reached an impressive peak of $4,000, only to momentarily retreat and currently hover around $3,947 at this writing.

Supporters of Ethereum (ETH) are currently in charge, but when might the token consistently remain over $4,000?

Ethereum’s key levels

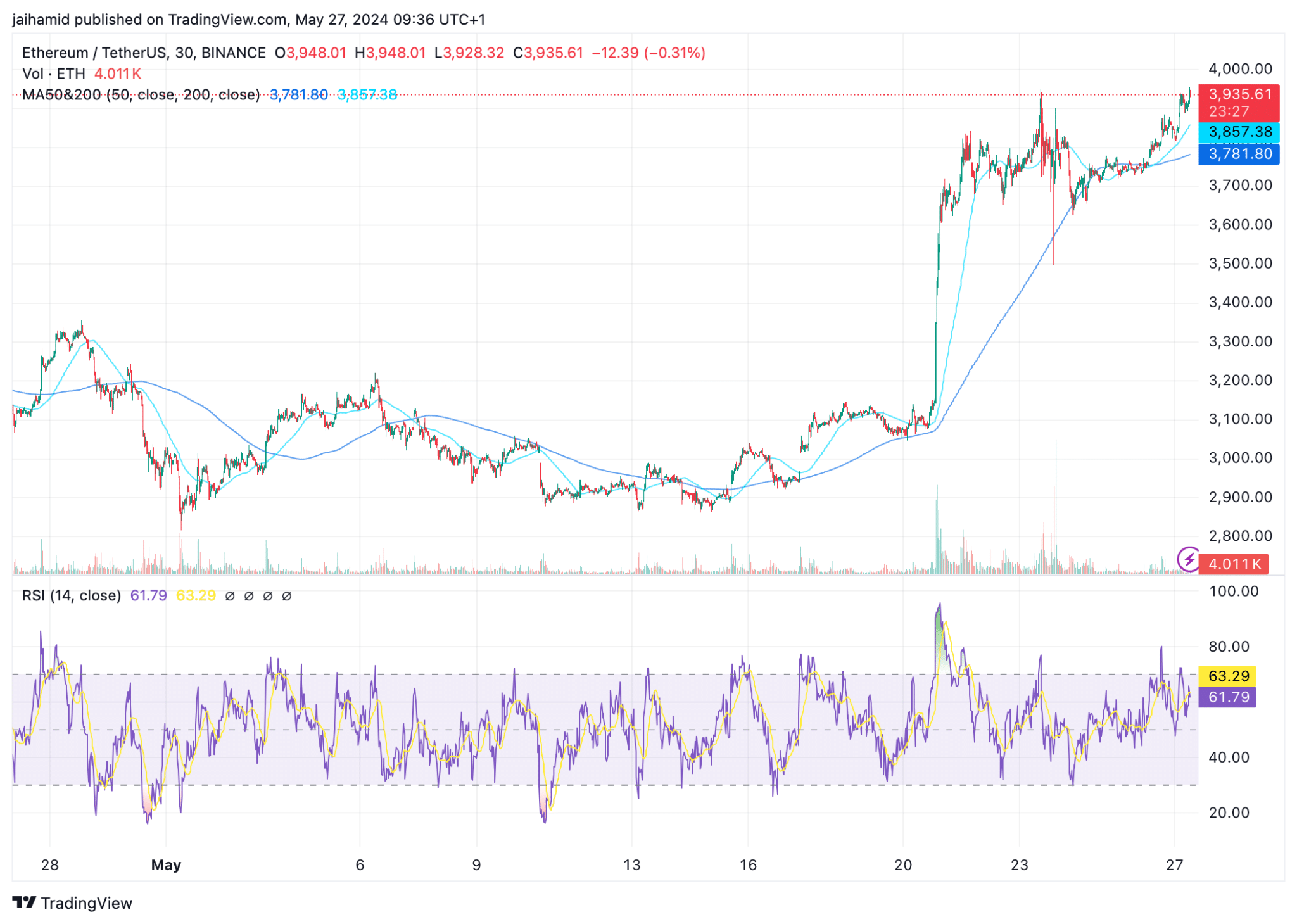

At present, the ETH-USDT exchange rate exhibited a noticeable surge, reaching over $4,000 momentarily before entering a period of stabilization.

The sharp rise preceding the consolidation showed strong buying pressure, fueled by the bulls.

Noting the relationship between the moving averages (50-day and 200-day), the former is currently surpassing the latter, a common bullish indicator.

The RSI, or Relative Strength Index, currently stands at approximately 63. This level signals robust momentum without pushing the market into overbought territory, suggesting there may be more gains ahead.

The latest price stabilization around $3,940 indicates potential opposition to further growth, causing Ether’s advance to pause momentarily.

As a researcher studying the Ethereum market, I believe that if the cryptocurrency manages to hold its ground above the moving average of 200 (MA200) line and builds upon the current bullish momentum, it may make another attempt at surpassing the $4,000 mark in a sustainable manner today.

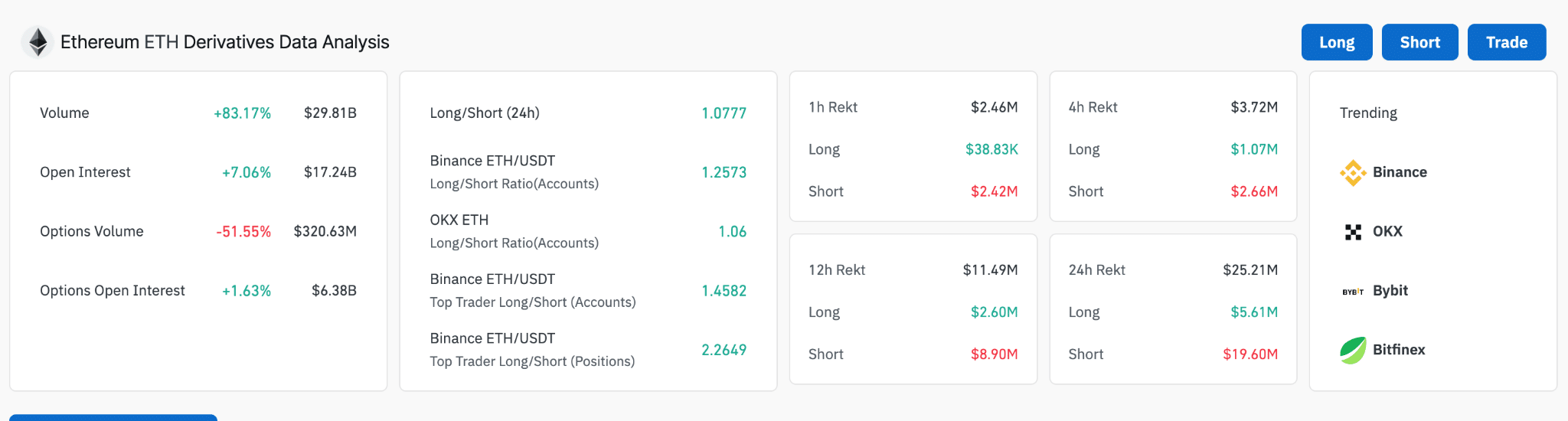

The Ethereum derivatives sector is experiencing robust buying momentum, as indicated by a significant surge in trading activity and Open Interest levels.

This suggested heightened trader engagement in anticipation of a sustained bull run.

Examining the long-to-short position ratios, specifically those of prominent traders on Binance [BNB] and OKX, indicates a strong bullish sentiment towards Ethereum as their long positions significantly outnumber short positions.

Supporting ETH‘s price stability above $4,000 and even propelling it to new records, favorable market circumstances and robust investor sentiment intertwine.

As a crypto investor, I’m closely monitoring the Ethereum market, and the latest reading of the Fear and Greed Index really catches my attention. With a score of 66%, this index indicates a dominant “Greed” emotion among investors. This suggests that the bullish sentiment is strong in the Ethereum market right now.

As a crypto investor, I can tell you that the bullish sentiment is reinforced by robust readings on various indicators. These include strong social media buzz, substantial trading volumes, and heightened market volatility.

In summary, the data indicates that Ethereum buyers are simply biding their time for the market to calm down a bit. It’s possible we could see a rise over $4,000 as soon as today, or by no later than tomorrow.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-27 15:03