- TapSwap had a weak bearish outlook at press time despite the weekend volatility.

- The volume indicator showed some hope, but bulls will need to flip this level to support.

As an experienced analyst, I’ve seen my fair share of volatile small-cap coins like TapSwap [TAPSWAP]. While the weekend volatility brought some hope with a brief spike in price, my technical analysis indicates a weak bearish outlook at press time.

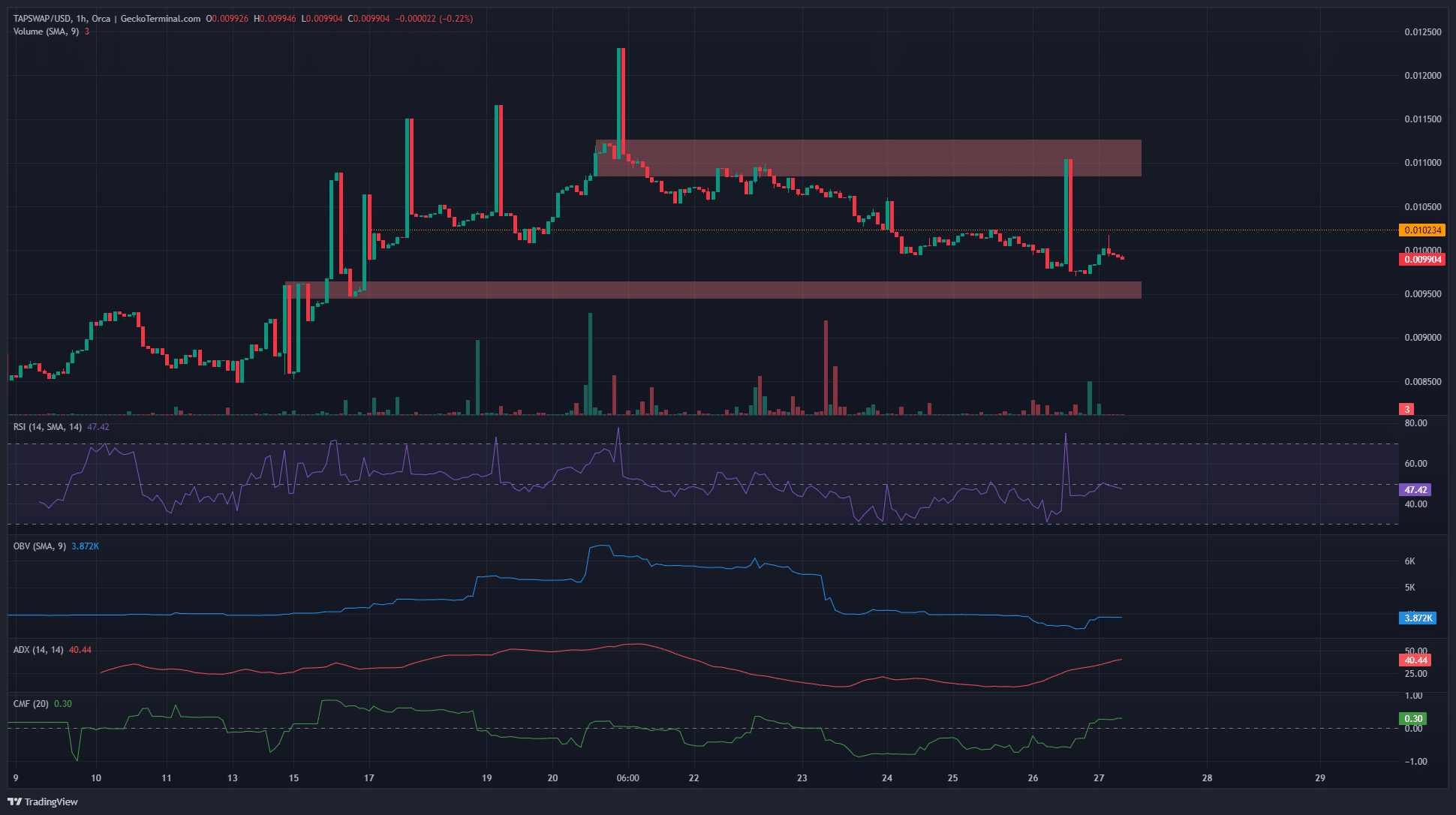

On May 26, Sunday, TapSwap experienced significant price fluctuations. The token surged from $0.0098 to $0.011, marking a 12.4% increase in less than an hour. However, this upward trend was short-lived as the price dipped back down to $0.00974 within a couple of hours.

The unpredictability is a typical trait for smaller cryptocurrencies with minimal trading activity. Regarding your question, I’d be happy to help analyze the short-term TapSwap price trend using technical analysis. However, please keep in mind that predictions are not guaranteed and should be taken as suggestions only.

The past week’s trend was concerning

Over the past week, the price trend on the 1-hour chart exhibited a clear downward bias. Following the $0.011 level’s flip from support to resistance on May 22nd, the price formed a succession of lower peaks.

In the recent past, the Relative Strength Index (RSI) consistently remained below the threshold of 50, indicating a persistent bearish trend.

As of the current moment of reporting, TAPSWAP was pulling back towards the $0.0095 mark, indicated by the red box on the chart. Over the last four days, the On-Balance Volume (OBV) has descended, pointing to a heightened level of selling activity.

However, the CMF contradicted this finding and threw a wrench in the TapSwap price prediction.

As a crypto investor, I’d interpret a CMF reading of +0.3 as a clear sign that substantial amounts of capital have been flowing into the market recently. This indicates that buyers are currently in the driver’s seat and have the upper hand. However, it’s important to note that there was some discordance among the volume indicators, which could be a cause for concern for traders. This means that while buying pressure has been strong, there may be underlying imbalances or inconsistencies in the market’s volume data that could potentially impact price movements going forward.

The ADX showed a strong trend in progress with its reading of 40.

Is your portfolio green? Check the TapSwap Profit Calculator

As a Bitcoin analyst, I’ve observed that the digital currency surpassed its previous resistance level of $67,000 last week, signaling a potential trend reversal. Consequently, there is a high likelihood of a Trend Asset Price Swap (TAPS) recovery in the near future. This means that the market sentiment, which had been bearish due to the prolonged consolidation phase, may shift to become more bullish as investors regain confidence in Bitcoin’s price momentum.

To summarize, it’s expected that TapSwap’s price will rebound from its current support at $0.0095, according to the analysis of its price movement.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-05-27 16:07