-

SOL maintained its trend above its 50 MA.

Derivative metrics flashed positive signals.

As a researcher with experience in analyzing cryptocurrency markets, I’ve observed Solana’s [SOL] recent price movements with great interest. Based on the data I’ve gathered from various sources and tools like AMBCrypto and Santiment, Solana has shown contrasting trends over the past 14 days.

Over the last two weeks, I’ve noticed some substantial price swings with Solana [SOL]. At one point, it seemed like it was just a hop away from hitting another all-time high.

The next week, it faced declines that threatened to push it below a critical threshold.

Solana hops between gains and losses

Based on AMBCrypto’s assessment of the Solana daily chart, there have been diverging patterns observed over the past few weeks.

As a crypto investor, I closely monitor price movements using tools like the price range feature. During the period between May 14th and 20th, I observed an impressive surge in Solana’s value. The price began at roughly $141.9 but experienced a significant rise, reaching over $186 – a notable increase of approximately 23%.

The climb indicated a possibility of Solana returning to the $200 level it touched in March. Yet, following its reach of $186, the price took a turn and went in the opposite direction.

As a researcher, I’ve analyzed the data from our price range tool and found that during the past week, specifically from the 21st of May up until now, there has been a significant decrease in price by more than 21%.

On the 21st of May, following a nearly 9% rise that brought the price to around $180, there was a subsequent drop of over 4%.

Afterward, the price dropped further, and although there were some minor rises, they weren’t enough to make up for those decreases. Currently, Solana is being traded at approximately $166, representing a 1.70% growth.

Significantly, the price surpassed its short-term moving average (represented by the yellow line), serving as a supportive level around $154. Nevertheless, other significant indicators will be crucial in deciding whether this current support will remain intact.

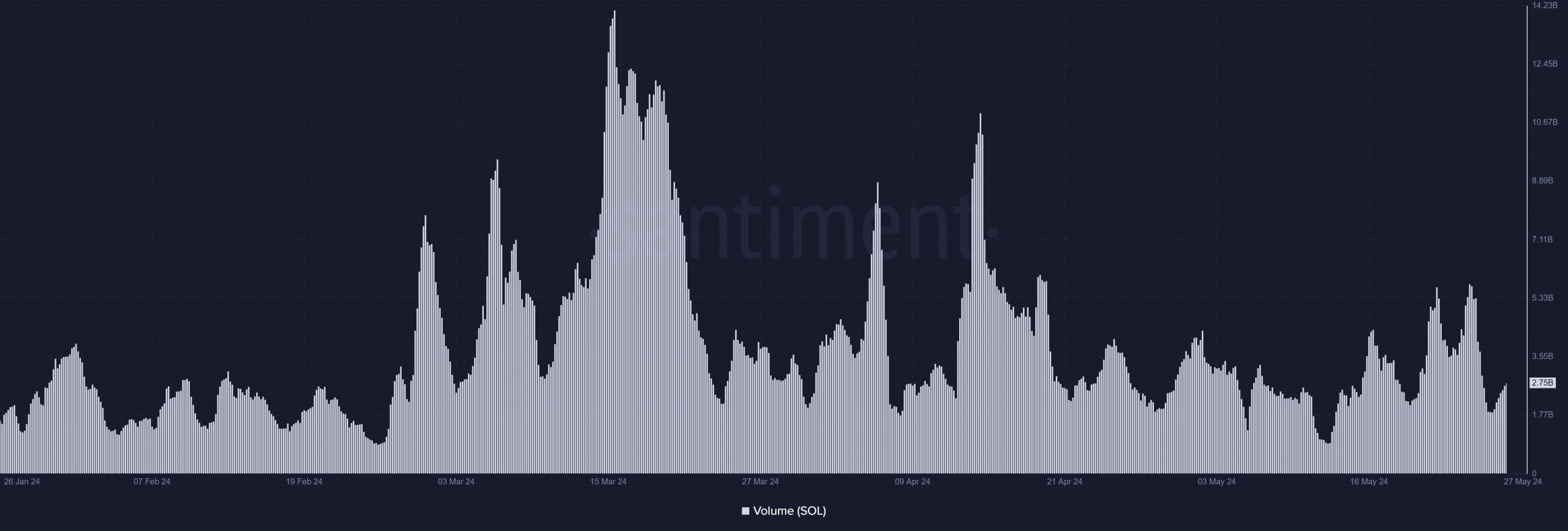

Solana volume rise above $2 billion

A thorough examination of Solana’s trading activity uncovered a substantial decrease in volume. Specifically, according to data from Santiment, the volume plummeted from approximately $5 billion to about $1.8 billion on the 25th of May.

Starting from the 26th of May, I observed a gradual increase in the trading volume, which eventually reached approximately $2.5 billion.

As I pen down this analysis, the trading volume for Solana surpasses the $2.7 billion mark. Despite the recent price downturn, this substantial volume suggests an ongoing level of activity and engagement within the Solana ecosystem.

SOL interest and Funding Rate flash positive signals

A study of the current funding rate for Solana on Coinglass reveals a noteworthy uptick, sitting at approximately 0.019%. This trend suggests that an elevated number of purchasers are currently placing wagers on the coin’s price surge.

An examination of the Open Interest figures showed a modest rise. At the time of reporting, Solana’s Open Interest stood around $2.4 billion. This surge in funds is indicative of a bullish trend.

Based on the current trading activity and related indicators, Solana’s present support level may remain robust for an extended period.

Read Solana’s [SOL] Price Prediction 2024-25

The surging trading activity signifies continued engagement, while the heightened Open Interest points to an influx of cash entering the SOL market.

The price may be driven up further, and there’s a slim chance it might dip below its current support level despite this.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Kidnapped Boy Found Alive After 7 Years

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Solo Leveling Arise Amamiya Mirei Guide

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2024-05-27 18:15