This text provides a comprehensive guide on how to use TradingView for backtesting trading strategies. Here’s a summary of the key points:

For individuals engaged in trading, it’s essential to trust that their chosen trading methodology delivers consistent profits. This need is particularly acute for newcomers. Employing a platform such as TradingView for backtesting trading strategies can serve as an effective means to validate the profitability and reliability of your trading approach.

Backtesting is an essential process in creating trading strategies by evaluating past performance using historical market data. TradingView is a widely-used platform for this purpose, enabling traders to analyze, test, and execute strategies. With its array of tools and features for technical analysis, backtesting, and strategy development, TradingView is a robust and adaptable solution for traders.

As a crypto investor, I’m always on the lookout for effective strategies to maximize my returns. In this article, I’ll walk you through the process of understanding and implementing the backtesting concept using TradingView as a tool. By doing so, we’ll be able to evaluate the performance of potential trading strategies with historical data, giving us valuable insights before putting real money at risk.

Key Takeaways

- TradingView is a platform for real-time interactive charts and technical analysis tools.

- Backtesting helps in identifying the strengths and weaknesses of your strategy and fine-tuning its parameters.

- To succeed in backtesting, use a wide timeframe and avoid overfitting.

What Is TradingView?

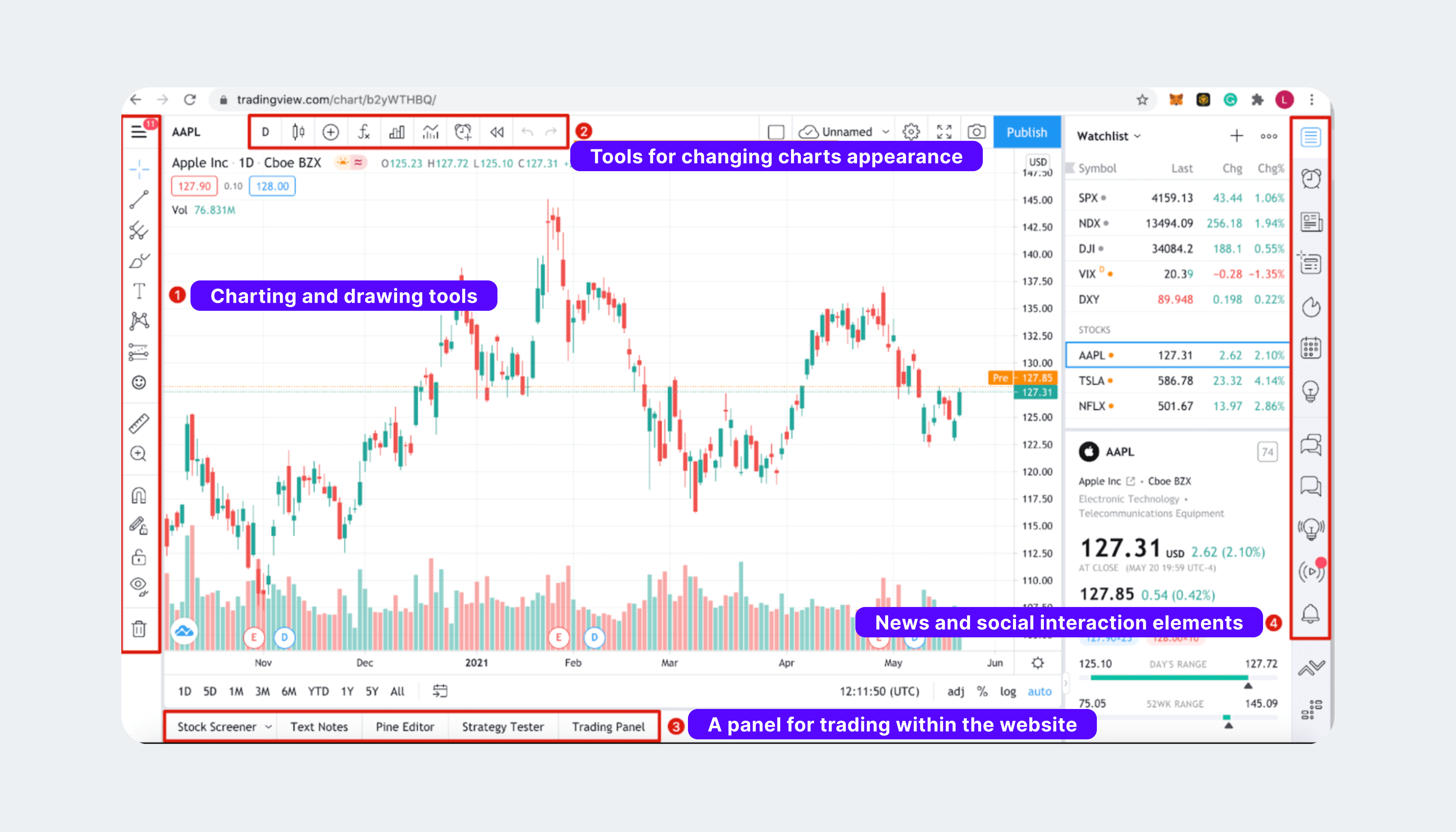

As a researcher studying trading platforms, I would describe TradingView as a user-friendly web application where I can access real-time market data and create customizable charts for in-depth technical analysis. The platform comes equipped with an extensive collection of indicators and drawing tools that facilitate detailed market examination.

This platform caters to novices and provides mobile apps compatible with iOS and Android systems. Users can conveniently view their graphs at any time and location. A complimentary version is available, but advanced features and live data require paid subscriptions.

With its user-friendly design and robust backtesting capabilities, TradingView enables traders to evaluate their strategies using historical market information.

The platform offers various strategies for backtesting, including the following:

- Technical analysis: analyzing past price movements to identify future opportunities.

- Momentum strategies: they focus on stocks with strong price movements, using technical indicators like candlesticks and momentum oscillators.

- Fundamental analysis: this method analyzes company financials to identify undervalued stocks.

- Portfolio strategies: the analysis involves creating a portfolio of stocks based on specific criteria and monitoring their performance over time.

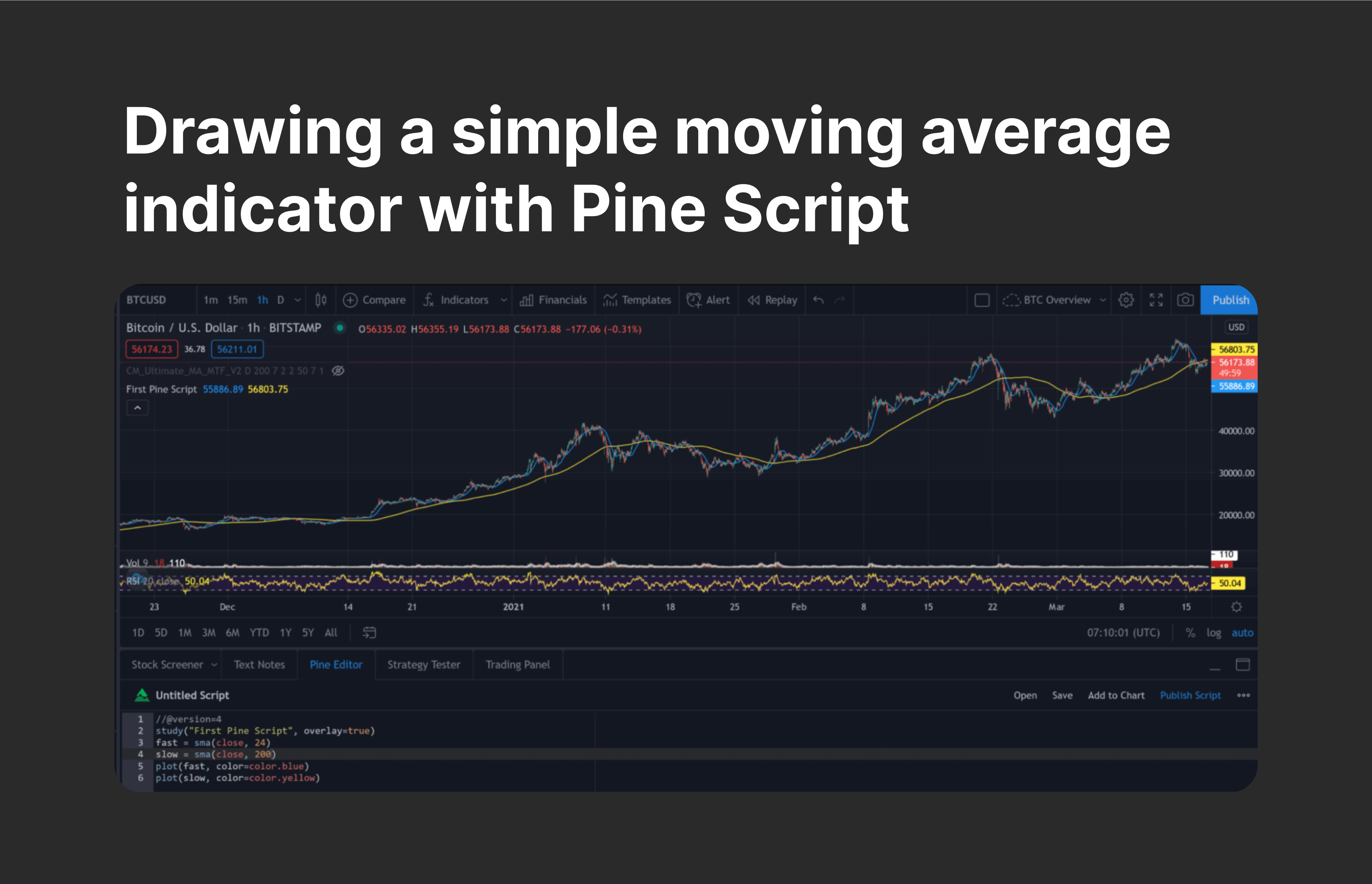

As a crypto investor, I’ve found using TradingView’s Pine Script to be incredibly convenient. Unlike complex high-level programming languages, this scripting language is accessible and easy to understand for me. With its rich collection of functions, I can effortlessly backtest custom strategies and create indicators, strategies, and libraries. This simplifies my idea generation and execution process.

Pine Script comes with comprehensive documentation, enabling users to evaluate any asset and timeframe for testing purposes, thereby reducing the need for extensive screen time and enhancing data analysis capabilities.

Why Backtest Your Tradng Strategies

Paraphrasing: Trading strategies’ effectiveness is assessed through backtesting, which involves simulating past trades. This process helps uncover any weaknesses, fine-tune entry and exit points, and establish risk management guidelines. It further offers vital information regarding a strategy’s profitability, losses (drawdowns), and overall performance, empowering traders to make well-informed decisions and enhance their strategies accordingly.

As a diligent crypto investor, I firmly believe in the significance of backtesting my trading strategies. By revisiting past market data, I can assess various aspects of a strategy’s performance, enabling me to make informed decisions about its potential for profitability. This valuable exercise helps me gauge whether the strategy exhibits positive expectancy, necessitates refinements, or aligns with other successful approaches in my investment portfolio.

An alternate expression could be: This approach offers the advantage of risk-free strategy evaluation, enabling a comprehensive review in just a few hours. Although demo accounts are commonly employed, backtest results are generally more reliable since they don’t mirror real-time trading.

Through this approach, traders can analyze up to 30-50 trades in a short timeframe, enabling them to grasp the intricacies of their strategy. This swift comprehension significantly strengthens their confidence by delivering a clear picture of the strategy’s efficacy, an essential aspect for successful live trading. By examining key performance indicators such as average win rate, holding duration, and frequent losing sequences, traders can bolster their self-assurance and effectively manage drawdowns with a resilient frame of mind.

How to Perform Backtesting: A Step-by-Step Guide

Here is a detailed guide on how to use TradingView for backtesting.

1. Picking the Market and the Time Frame

Choose a specific market, like forex, stocks, or cryptocurrencies, and decide on a preferred time frame for analysis. This decision is crucial depending on the trading approach you aim to evaluate, such as intraday trading in stocks.

2. Setting Up the Chart

Create a candlestick chart to examine the historical price trends and test market performance. Equip it with technical indicators, drawing instruments, and overlay charts. Activate the strategy testing function to display extended price data that goes beyond the visible chart limits.

3. Adding Strategy Logic

At TradingView, there are two methods for incorporating strategy rules and logic: writing a personalized strategy through Pine Script or employing the Visual Strategy Builder. The former allows for extensive control over entries, exits, and risk management, but it necessitates programming knowledge. In contrast, the latter is a user-friendly, no-code alternative that simplifies the process of defining strategy logic, although it offers fewer customization options than writing a custom strategy from scratch.

4. Running the Backtest

To perform a backtest, create your strategy rules using code or the Visual Builder. Choose a specific timeframe in the past and hit “run” to simulate trades. Begin with a one-year backtest and then progressively expand the timeframe to evaluate performance over extended periods.

5. Analysing the Results

Examining results from multiple perspectives is essential for assessing a strategy’s effectiveness. TradingView provides extensive analysis tools to evaluate strategy success, featuring a trade history, portfolio statistics, graphs, among other resources. Users can scrutinize individual trades, sort by profitability, generate equity curves, and fine-tune parameters to enhance the strategy’s profitability.

6. Refining and Re-Testing

One way to rephrase this expert advice in natural and easy-to-read language is: “To improve the performance of your trading strategy, consider making adjustments such as modifying entry and exit conditions, optimizing trade sizes, fine-tuning parameters, and excluding unsuccessful trades. Run the backtest again and analyze the results until you’re satisfied with the historical performance.”

7. Forward Testing and Implementing

As a crypto investor, I’ll tell you this: The last leg of the process calls for more trials and launching it to the public. This phase encompasses backtesting on current market data, simulating trades through virtual funds in paper trading, and ultimately, investing real capital when confident in the strategy’s success.

Tips on Successful Backtesting

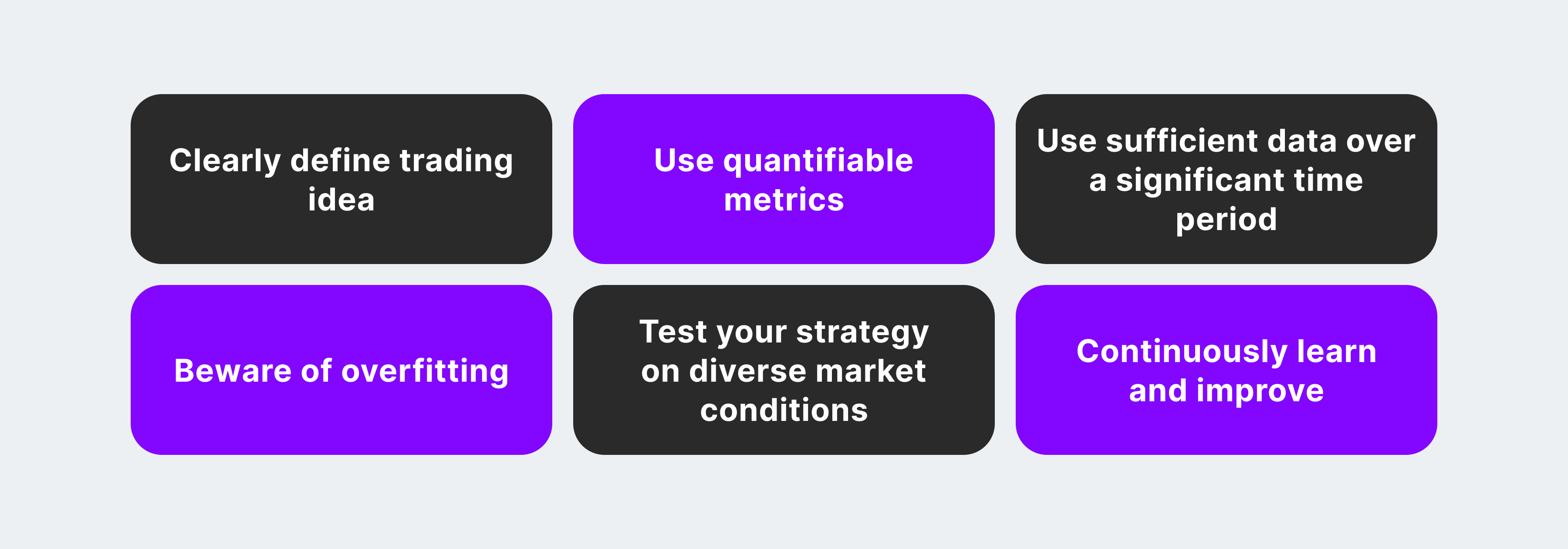

As a financial analyst, I recognize the importance of thorough backtesting in evaluating potential investment strategies. However, it’s essential to be mindful of common pitfalls that can undermine the validity of backtest results.

To achieve success in trading, it is essential to have a well-defined trading strategy with clear-cut objectives. Utilize measurable indicators such as the Sharpe ratio, maximum drawdown, or win rate for effective evaluation.

To achieve accurate results when testing trading strategies on TradingView, it’s crucial to utilize an ample amount of data covering a substantial time frame. Aim for a minimum of 100 trades and 10 years’ worth of historical data. Additionally, remember to factor in fees such as commissions, slippage, and spreads to obtain a more realistic assessment of potential costs.

Be mindful of the risk of overfitting, which occurs when a strategy is excessively molded to prior data, reducing its effectiveness when applied to new, unseen data. To minimize bias and ensure robustness:

Before putting actual funds at risk, experiment with different investment portfolios, assess potential risks and financial management metrics through simulation. Utilize techniques such as forward testing, paper trading, and live trading to monitor real-time strategy performance and validate its efficacy in various market conditions.

It’s important to consistently assess and make revisions to your backtesting strategy for maximum effectiveness. Trade with care and be mindful of managing risks appropriately.

Final Takeaways

TradingView is a flexible toolkit for traders, equipped with various features for technical analysis. It supports both manual testing using historical data for simulated trades, as well as automated strategy testing that generates performance reports. New traders finding their footing in the stock market will particularly benefit from utilizing TradingView’s backtesting capabilities to plan and refine their strategies.

The capability of TradingView for backtesting is invaluable for simulating live trading situations. With approximately 5,000 tested hypotheses under its belt, it has demonstrated impressive results when applied in real trading scenarios.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-05-27 19:10