-

MATIC has a bullish outlook based on the on-chain metrics, but fears of selling pressure were valid

The range highs need to be reclaimed as support for the bulls to maintain the upward move

As a seasoned crypto investor, I’ve seen my fair share of market ups and downs. The bullish outlook for MATIC based on on-chain metrics is promising, but I can’t ignore the valid concerns about selling pressure. The range highs need to be reclaimed as support for the bulls to maintain the upward move.

According to crypto analyst Ali Martinez’s analysis, the TD Sequential indicator for Polygon (MATIC) on its weekly chart has triggered a buy signal. This potential buying opportunity might lead to a lasting uptrend, spanning from one to four weeks.

On May 27th, Bitcoin (BTC) displayed a bullish attitude, with potential for further increases. Such growth in Bitcoin may foster optimism throughout the cryptocurrency sector, potentially boosting Matic’s (MATIC) price surge as well.

The high on-chain activity might spur organic MATIC demand

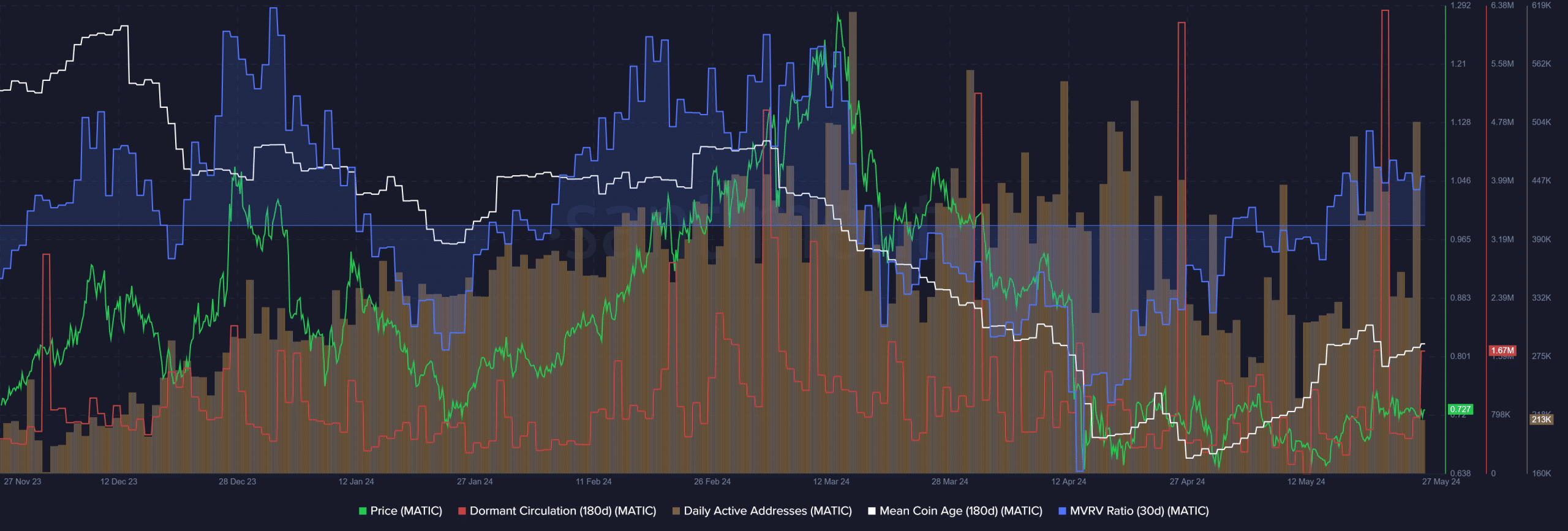

Mid-March saw the highest number of daily active users, which then decreased until early May. Remarkably, the user count remained stable between 400,000 and 500,000 during this period, even with the significant price drop.

Over the past month, the average age of mean coins in the network started to climb, signaling a broader accumulation process. Despite the price remaining within a narrow band between $0.65 and $0.75 during this period, the MVRV ratio – which had plunged significantly in mid-April – has rebounded noticeably.

After surpassing the previous resistance level at $0.75, there is a likelihood of profits being taken by investors, which could potentially lead to further price increases. However, the sudden increase in circulating coins that had previously been inactive has raised concerns among traders about a potential increase in selling pressure.

Can the range-bound Polygon token take off?

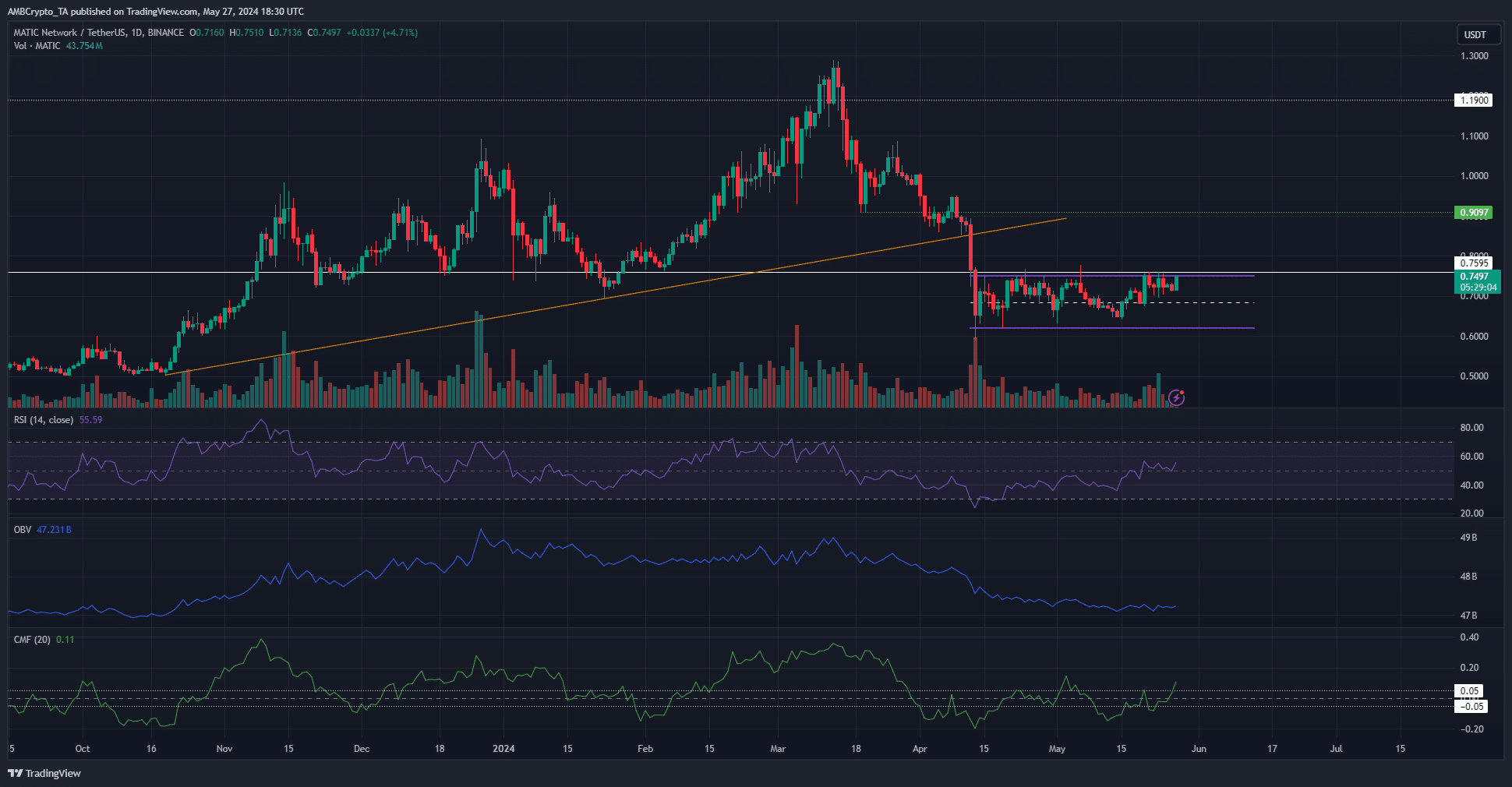

In April, the upward trendline (represented by orange) didn’t manage to keep the price from falling. Instead, the price has fluctuated between a price range (illustrated by purple), which spans from $0.75 to $0.65. Currently, the price is hovering just above the upper limit of this range and could potentially break through soon.

As a crypto investor, I’ve noticed an intriguing development in the daily chart’s RSI (Relative Strength Index). It surged above the neutral 50 mark and subsequently transformed that level into support. This shift signaled a surge in buying power and was a strong indication of follow-through from the bullish forces. Furthermore, the Cumulative Moving Average (CMF) concurred with this optimistic outlook.

At the current moment, the MATIC market was showing a reading of +0.11, signifying substantial investment inflows. As a result, it is expected that the market will continue to experience growth.

Read Polygon’s [MATIC] Price Prediction 2024-25

Despite the contradictory signal from the OBV, the trend has remained downward for the security since mid-March. The weekly TD Sequential and the daily momentum indicator, however, may indicate an impending breakout.

Reaching or closing a daily session above the $0.75 mark could trigger significant buying interest, thereby boosting the required volume to sustain the ongoing uptrend.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Gold Rate Forecast

- OM PREDICTION. OM cryptocurrency

2024-05-28 14:47