-

BTC mid-term holders are buying more coins.

However, price may trend within a narrow range before witnessing any significant rally.

As an experienced analyst, I believe that BTC mid-term holders are indeed buying more coins, indicating growing confidence and a preference to hold onto their assets. However, based on historical trends, it seems plausible that the price may trend within a narrow range before experiencing any significant rally.

As a researcher studying the Bitcoin market, I’ve observed an intriguing trend emerging: medium-term holders have been steadily accumulating coins. This insightful observation was recently highlighted in a report by the well-known pseudonymous analyst SignalQuant from CryptoQuant.

Individuals who have owned their assets for a duration ranging from half a year to nearly seven years fall under the category of medium-term investors.

As a researcher studying Bitcoin (BTC) market trends, I’ve noticed an intriguing shift among this specific group of BTC holders. Despite the resistance at the $70,000 price level, their behavior indicates growing confidence in the cryptocurrency. This is evident from their decision to keep holding onto their assets instead of selling them off.

BTC to trend in a tight range?

Based on the coin’s historical trends, SignalQuant identified a pattern among Bitcoin’s medium-term investors in the third quarter of 2019 that was comparable to the current situation. In response to this similarity, Bitcoin’s price remained relatively stable for approximately six months before subsequently surging.

It is possible to make the case that the historical background offers a comparable perspective for today’s market situation.

There are signs suggesting that a sideways trend may continue for an extended period before a notable upward trend emerges.

A analysis of Bitcoin’s major technical signals on the daily chart indicated that the price was beginning to level off.

At present, Bitcoin hovers around its 20-day Exponential Moving Average (EMA), a trend that has persisted since May 23rd from my analysis.

The moving average signifies the mean value of a coin’s daily price over the last 20 days. If Bitcoin transacts at a rate higher than this figure, then the coin is being bought and sold for more than its average price during the preceding twenty-day period.

When the moving average of Bitcoin (BTC) is higher than its current price, it means that the price has been decreasing over the past 20 days. In other words, the price trend has been bearish. Contrarily, when BTC trades below this moving average, the current price is lower than the average price over the previous 20-day period. This implies that the price has been declining more rapidly than the average and the trend is considered downward.

If Bitcoin’s (BTC) price hovers around its 20-day Exponential Moving Average (EMA), this indicates a phase of price stability, where neither the bulls nor the bears have a clear advantage.

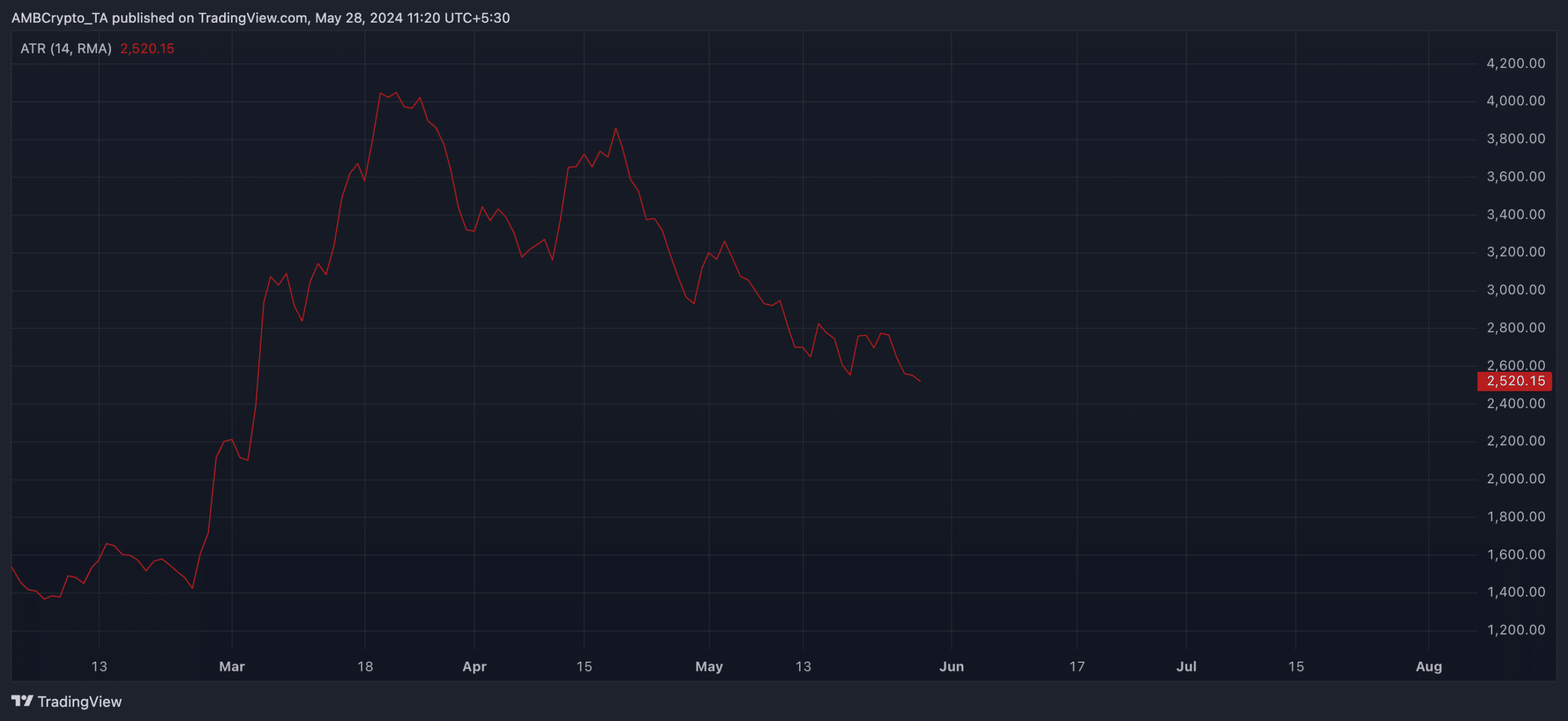

Additionally, the decreasing Average True Range (ATR) value of Bitcoin (BTC) supported the stated viewpoint. At present, the ATR stood at 2520, representing a 21% decrease from its May starting point.

this metric reflects the degree of price fluctuations for a particular asset. A decrease in its value implies that the asset’s price swings have narrowed down compared to the earlier time frame.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-05-28 15:03