-

The XRP Ledger [XRPL] saw an uptick in network activity in Q1.

This led to a growth in its quarterly revenue.

As a researcher with a background in blockchain technology and market analysis, I find the recent trends observed on the XRP Ledger (XRPL) quite intriguing. The network’s Q1 performance was impressive, as evidenced by the surge in user activity and subsequent revenue growth. Messari’s report reveals that the average daily count of addresses completing transactions on XRPL increased by 37% from the previous quarter, leading to a notable rise in daily transactions – up by 113%.

As a researcher examining the XRP Ledger (XRPL) market trends, I discovered an intriguing increase in quarterly user demand during the transition from January to March. According to my recent findings in a comprehensive report by Messari, this surge is noteworthy and deserves further investigation.

The on-chain data provider’s Q1 2024 report, named “State of XRP Ledger,” revealed that there was a significant increase in the need for XRPL during the previous 90-day span, resulting in a record-breaking quarterly income for the year.

Approximately 41,000 unique addresses engaged in at least one transaction on the blockchain each day during the recent quarter, marking a significant 37% increase from the 30,000 daily active addresses reported on XRPL in Q4 of 2023.

In the first quarter, there was a significant rise in the number of active addresses on the blockchain, leading to a surge in the total transactions processed on it. As reported by Messari, this increase brought about an average daily transaction growth of approximately 113%.

It’s worth noting that the fourth quarter saw a decrease in the formation of new addresses on XRPL, as reported by Messari.

The decline we experienced quarter over quarter can be attributed to the large number of new addresses generated in Q4, marking the start of the inscription activity. On an annual basis, there was a significant rise of 29.8% in newly created addresses between Q1 2023 and Q1 2024. Conversely, deleted addresses saw a substantial increase of 55.9% quarter over quarter, reaching 33,000. This surge in deletions occurred as the inscription activity began to wane.

Despite this development, XRPL’s quarterly revenue remained unchanged, reaching a peak of $205,000 from January to March.

During the recent quarter, the network generated revenue equivalent to 350,000 XRP tokens, representing a 10.3% increase in value compared to the previous period.

XRP returns gains, but…

As a crypto investor, I’d rephrase it as: At the current moment, XRP, the native token of Ripple (XRPL), is priced at $0.52 according to the latest market data. Over the past week, however, its value has decreased by around 2%.

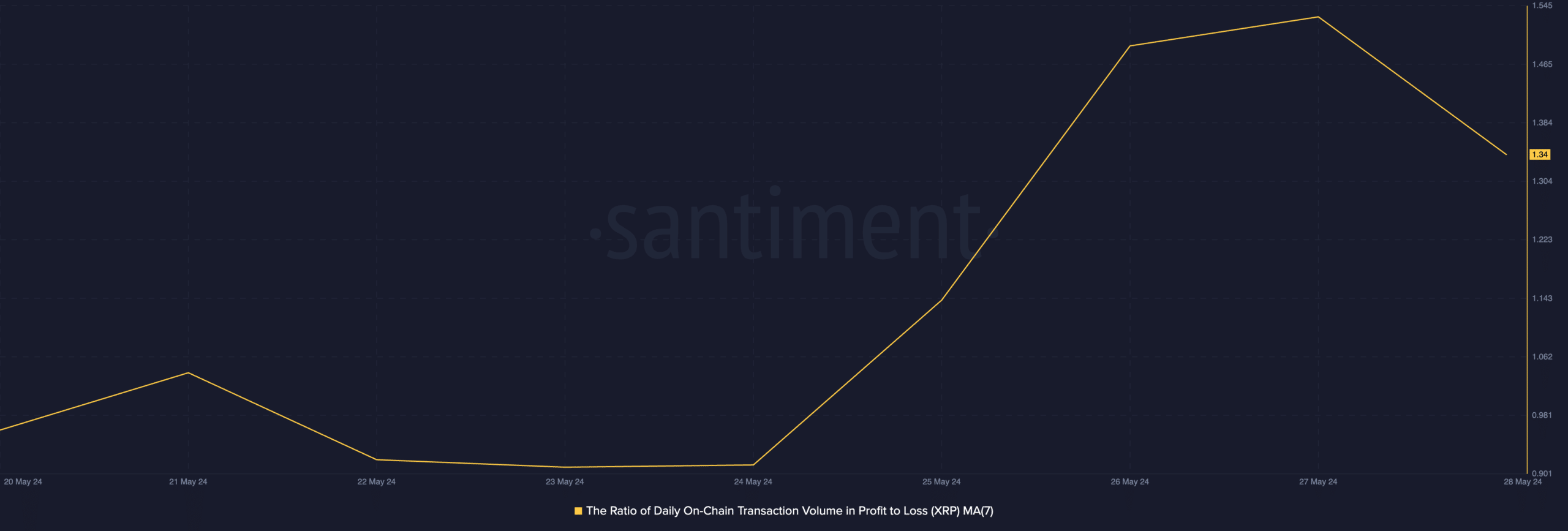

Based on my analysis of the market trends, I’ve noticed that the token’s demand has been waning, resulting in a 12% decrease in daily active addresses over the past week, as indicated by Santiment’s data.

Realistic or not, here’s XRP’s market cap in BTC’s terms

During the reviewed timeframe, XRP has experienced a decrease in demand despite a significant increase in the daily ratio of transactions with profitable outcomes versus those with losses, resulting in heightened transaction volume.

At the moment of publication, this ratio stood at 1.34, implying that on average, one XRP transaction resulting in a loss was offset by 1.34 profitable transactions.

Read More

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Fifty Shades Feud: What Really Happened Between Dakota Johnson and Jamie Dornan?

- Paige DeSorbo’s Sassy Message: A Clear Shade at Craig Conover?

- The Heartbreaking Reason Teen Mom’s Tyler and Catelynn Gave Up Their Daughter

- Lady Gaga’s ‘Edge of Glory’ Hair Revival: Back to Her Iconic Roots

2024-05-29 07:03