-

BONK’s Open Interest rates and capital inflows in the futures market surged to record levels

Although the surge is bullish for BONK’s price, BTC losses could affect further upswing.

As a researcher with experience in the crypto market, I’m keeping a close eye on Bonk (BONK), the homegrown meme coin on Solana (SOL). The recent surge in BONK’s price and open interest rates is quite bullish, but it’s essential to consider potential factors that could impact further upswing.

As a Solana analyst, I’ve observed an intriguing development with Bonk [BONK], one of the native meme coins on our network. Over the past week, its price has surged by approximately 20%. Currently, it’s trading at $0.00004095, which is about a 17% decrease from its all-time record high of $0.00004770 that was reached on the 4th of March.

Reaching a price point above the all-time high (ATH) for BONK would propel it into unexplored pricing grounds. This means that the token would be entering new price realms that have not been previously attained.

In this situation, crypto trader Ninja Scalp predicted that the price of BONK could experience significant growth, drawing a comparison to its behavior during the early stages of March.

“The cryptocurrency represented by the symbol $BONK previously underwent price exploration in March, leading to substantial trading activity on the Solana blockchain. Approximately $2 billion worth of transactions were recorded daily following this discovery. Is it likely that we’ll witness a similar occurrence again?”

It’s worth noting that historical data doesn’t dictate future outcomes.

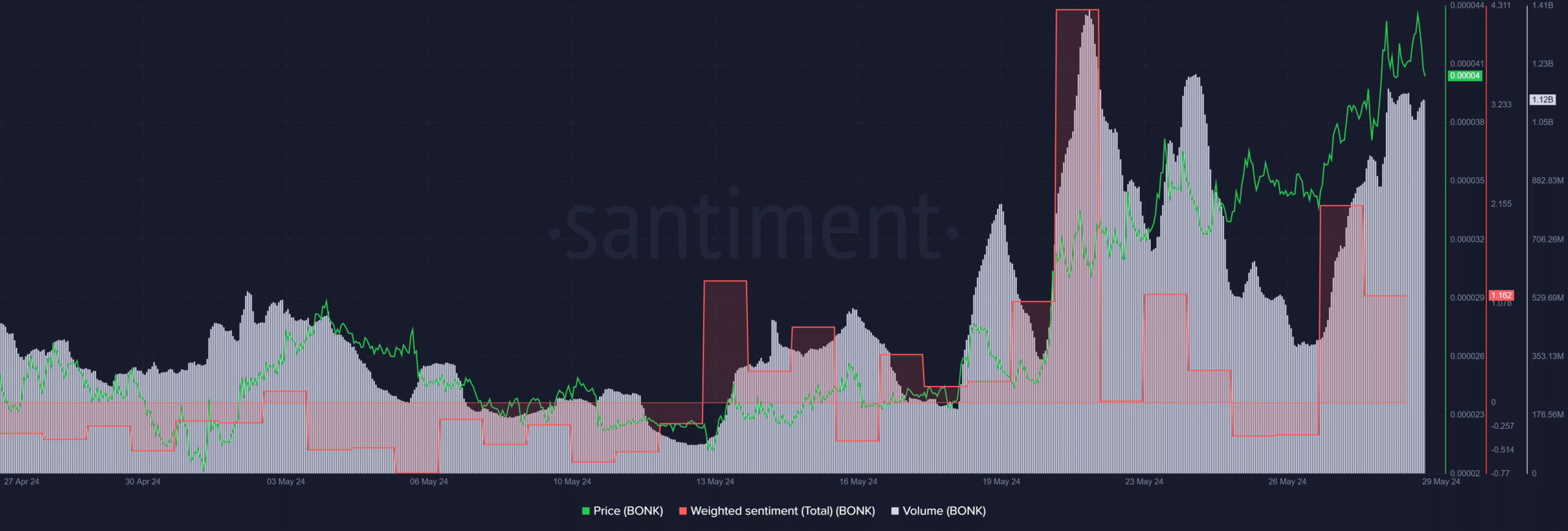

Despite a substantial increase in on-chain transactions for BONK, accompanied by robust optimism among investors, as evidenced by the Volume indicator (in white) and the Red Weighted Sentiment line.

This underscored BONK’s bullish set-up.

It’s intriguing that Ninja Scalp’s observation about the increase in Open Interest (OI) during the process of price formation was holding true at the moment. For those who may not be aware, Open Interest represents the total number of outstanding contracts in a futures market and reflects the level of capital flowing into it as well as the overall sentiment.

As an analyst, I’d express it this way: At the current moment, the Open Interest for BONK has reached a new high of $24 million, surpassing the previous peak of $20 million recorded during the early March price exploration.

The significant increase in Open Interest (OI) indicates that large amounts of capital have been pouring into BONK lately, reflecting a strong bullish attitude among investors in the futures market.

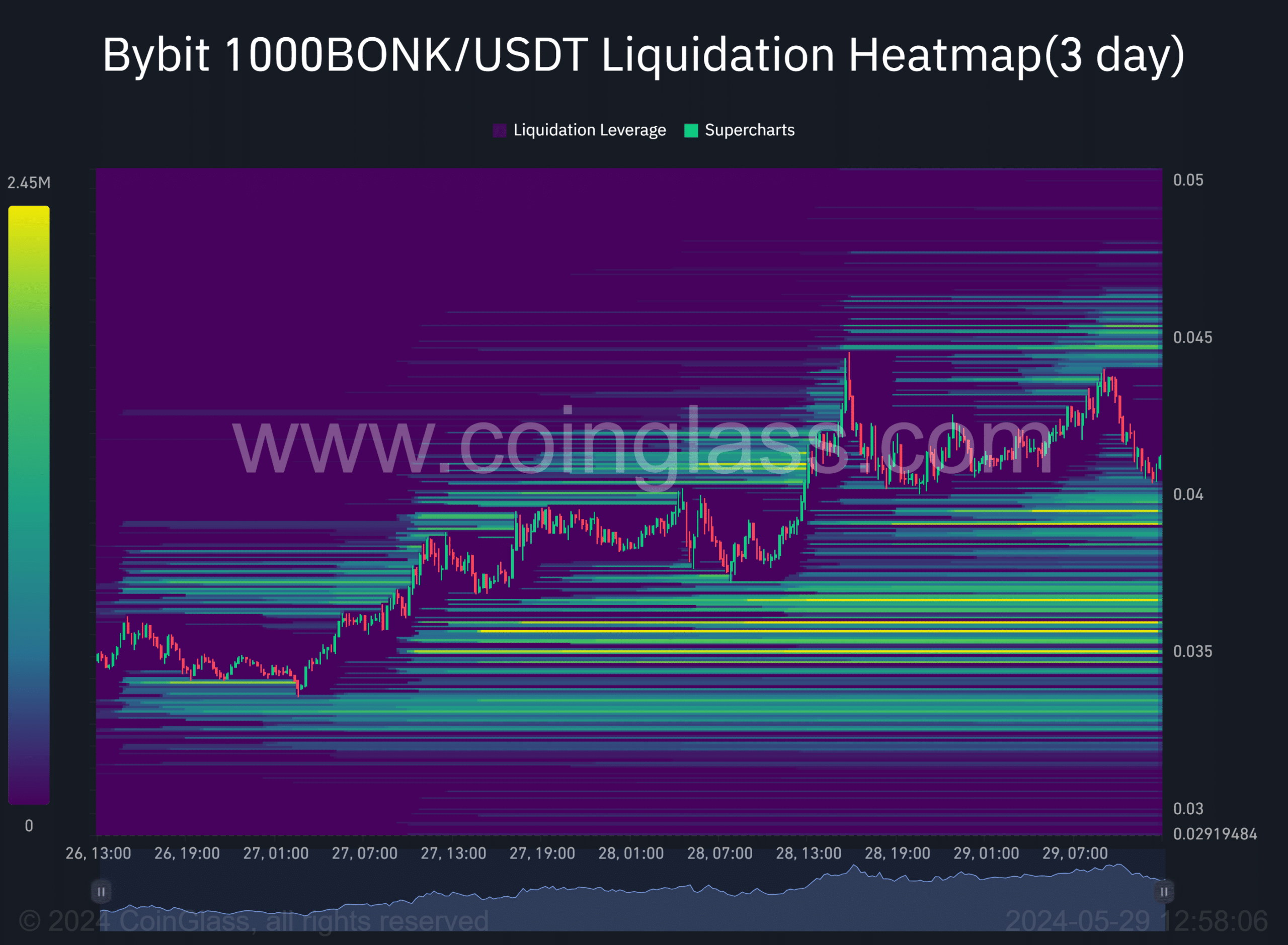

The liquidity analysis revealed significant selling pressure at certain price points, notably around $0.000035 and $0.000040, as indicated by the orange marks on the chart.

As a researcher studying price action trends, I’ve observed that prices often gravitate towards areas with high liquidity (represented by the orange levels on the chart). Should this pattern unfold for BONK, we may first see the price dip to around $0.000040 or even $0.000035 before rebounding and advancing towards $0.000045.

On the price charts, the above liquidity clusters aligned with 23.6% and 38.6% Fib levels.

If the bulls manage to hold the 23.6% Fibonacci resistance level for BONK, there is potential for further growth. The next significant milestones could be reaching the previous all-time high (ATH) at 0.000048 and another potential target at $0.000056.

Despite the strong buying demand indicated by the high RSI value, the Chaikin Money Flow (CMF) has yet to surpass its average level.

As a researcher studying market trends, I’ve noticed an intriguing pattern: When BONK reached its price discovery level previously, Chaikin Money Flow (CMF) indicated positive capital inflows. However, in the recent analysis, I found that CMF was below its March reading. This discrepancy between past and present CMF readings warrants further investigation to determine if this trend will persist or if it represents a potential shift in market sentiment.

Realistic or not, here’s BONK’s market cap in SOL terms

If Bitcoin (BTC) is unable to maintain its position above the $67K mark, the potential growth of BONK may be postponed.

According to Ninja Scalp’s observation, there has been a notable increase in open interest (OI) as the price of BONK approaches a new discovery level. Nevertheless, the bullish trend may weaken if Bitcoin experiences further declines.

Read More

2024-05-29 23:10