-

PayPal has launched its stablecoin on Solana, a year after debuting it on Ethereum.

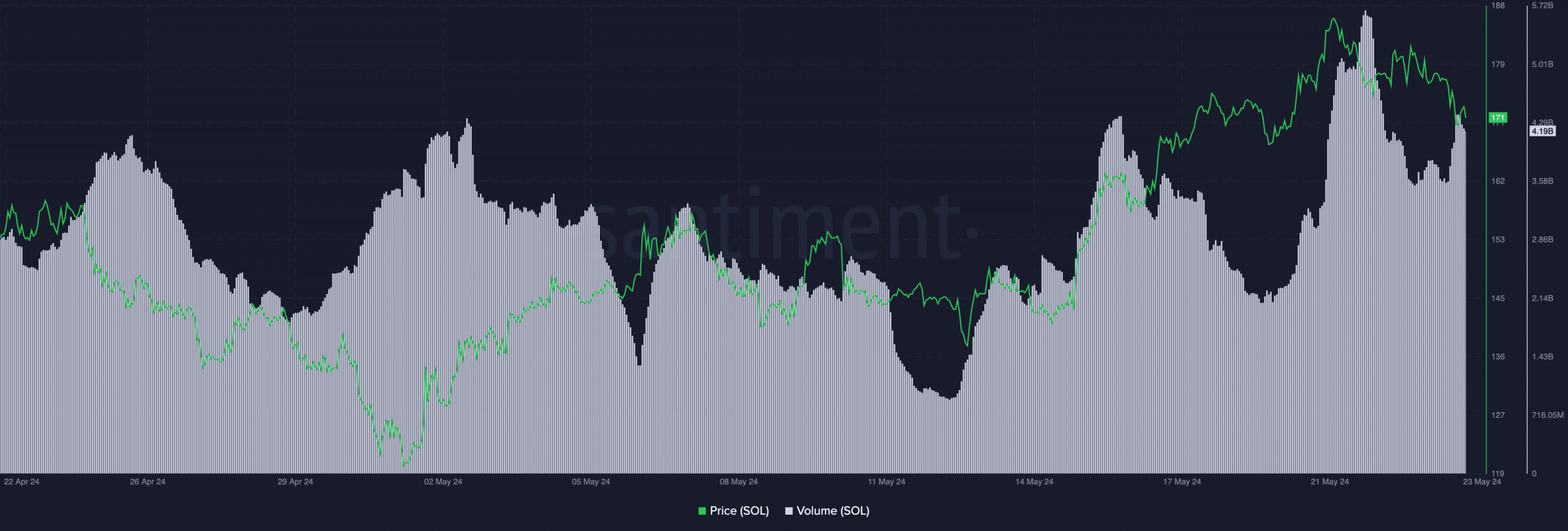

The price of SOL declined, along with its volume.

As a long-term crypto investor with experience in the market, I’ve witnessed Solana [SOL] make significant strides this year, particularly in the realm of tokenized transactions and stablecoin transfers. However, recent developments have left me feeling cautiously optimistic about the asset’s near-term prospects.

Since the start of the year, there’s been a significant increase in activity on the Solana (SOL) network. Lately, though, the expansion has slowed down noticeably.

New developments

A new stablecoin introduced on Solana has the potential to reignite excitement for the platform, as payments heavyweight PayPal’s stablecoin, PYUSD, makes its way to Solana following its initial release on Ethereum about a year ago.

As a crypto investor, I can tell you that a launch could generate fresh excitement for a relatively lesser-known digital asset, which until now has failed to ignite significant demand, despite having notable backers behind it.

According to PayPal’s announcement, the ability of Solana to process a large number of transactions swiftly and affordably was a key factor in introducing the stablecoin PYUSD onto its platform.

According to blockchain analysis firm Artemis, Solana stands out as the prime blockchain for carrying out token exchanges and transferring stablecoins. PayPal has acknowledged that Solana brings substantial advantages for commercial applications.

Last summer, I was part of the team at PayPal that introduced our stablecoin, named PYUSD, to the market. Despite the regulatory uncertainties surrounding stablecoins in the US, we forged ahead as one of the first major financial institutions to do so.

As a financial analyst, I would describe it this way: I have observed that the stablecoin’s primary objective is to simplify virtual transactions by allowing for swift value transfers, remittances, and international transactions. It was engineered to provide seamless channels for developers and content creators to receive payments directly. This strategy aligns with PayPal’s broader initiative to expand its digital asset offerings.

Industry insiders and rivals, including Tether’s CEO Paolo Ardoino, warmly received the debut of PYUSD.

As a crypto investor, I received news that the SEC had taken further interest in PayPal’s stablecoin project. Specifically, they issued a subpoena to the company for more information.

Outside the watchful eye of regulators, Pyusd encounters robust competition from industry veterans like USDT and Circle’s USDC. USDT boasts a market capitalization of $112 billion, while USDC boasts $32 billion. In contrast, Pyusd’s market value hovers around $400 million.

Read Solana’s [SOL] Price Prediction 2024-25

How is Solana doing?

At press time, SOL was trading at $166.79 and its price had fallen by 3% in the last 24 hours.

Moreover, the volume at which it was trading at declined by 12.01% during this period.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-30 15:03