-

BlackRock’s IBIT flipped GBTC as the top spot BTC ETF

IBIT could eye Gold ETF as the next target.

As a seasoned crypto investor with a keen eye on the market trends, I’m thrilled to see BlackRock’s iShares Bitcoin Trust (IBIT) flipping Grayscale’s GBTC as the world’s largest BTC ETF. The $20 billion in assets that IBIT has amassed is a remarkable feat, especially considering it was only launched in October 2021.

As a crypto investor, I’m excited to share that the BlackRock Bitcoin iShares ETF (IBIT) has surpassed Grayscale’s Bitcoin Trust (GBTC) as the world’s largest Bitcoin exchange-traded fund (ETF), with an impressive $20 billion in assets under management.

On May 29th, IBIT owned approximately 288,670 Bitcoins. With Bitcoin currently valued at around $67,700 each, this translates to a total worth of roughly $19.5 billion.

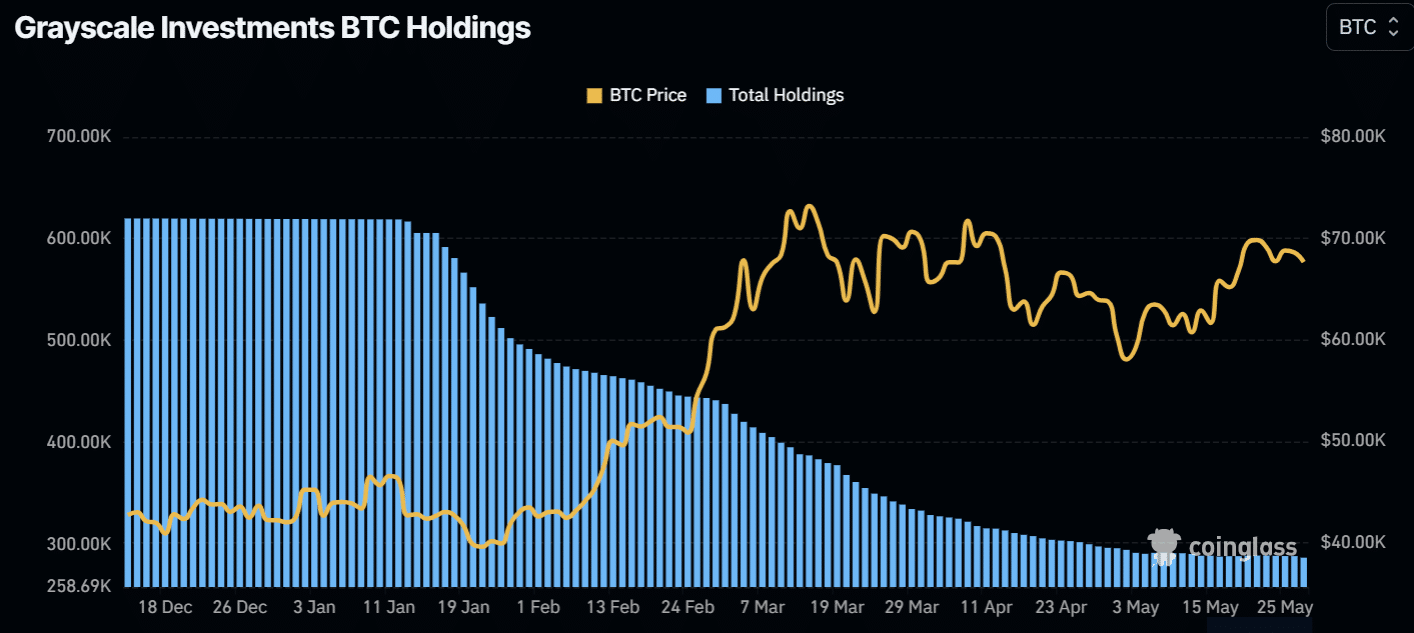

According to Grayscale’s latest update on their website, I noticed that they held approximately 287,000 Bitcoins as of May 29th.

Based on the observation of one market analyst, the exchange between Grayscale Bitcoin Trust (GBTC) and iBit saw a shift after GBTC experienced outflows totaling $105.2 million on May 28th, while iBit recorded inflows amounting to $102.5 million.

BlackRock Bitcoin ETF tops after GBTC’s massive outflows

As a crypto investor, I’ve noticed that since the GBTC (Grayscale Bitcoin Trust) conversion in January, Grayscale has experienced significant outflows totaling over 300,000 Bitcoins. This loss can be attributed to the firm’s continued maintenance of higher fees compared to newer entrants in the market. In simpler terms, a large number of investors have withdrawn their Bitcoins from Grayscale, resulting in a substantial decrease in the trust’s holdings.

At the conversion on January 10, 2024, Grayscale possessed approximately 620,000 Bitcoins, representing over 3% of the total circulating supply. Despite this significant holding, Grayscale remained unwilling to reduce its fee from 1.5%, which was significantly higher than the 0.2% charged by peers. This stance came after investors withdrew over 330,000 Bitcoins from the platform. The “differentiated” strategy, it seems, did not go as planned.

Based on Farside Investors’ findings, I’ve observed a significant shift in investment trends between Grayscale Bitcoin Trust (GBTC) and the BlackRock Bitcoin ETF. Specifically, GBTC recorded an all-time high of cumulative negative inflows totaling $17.7 billion as of May 29th. Conversely, the BlackRock Bitcoin ETF experienced notable positive inflows during the same timeframe, amounting to approximately $16.5 billion.

According to Bloomberg ETF analyst Eric Balchunas, the impressive $20 billion asset size of IBIT in the traditional ETF sector was noteworthy.

As an analyst, I would put the situation into perspective by saying: “The rapid growth of $IBIT is quite extraordinary when you consider that only one ETF has ever amassed $20 billion in assets within 1000 days. This was achieved by $JEPI in just 985 days. With $IBIT currently sitting at around 137 days, it’s truly an impressive feat.”

Nate Geracci of ETF Store predicts that the next potential acquisition for IBIT could be the iShares Gold ETF, boasting over $29 billion in assets.

“Would be something if IBIT caught it (iShares Gold ETF) before year-end.”

During that period, there was an influx of investments into Bitcoin ETFs as a whole, potentially fueling a rise in Bitcoin’s price movement.

At present, the King Coin was facing resistance from short-term sellers around the $67K mark. Nevertheless, the longer perspective remained optimistic as the ongoing uptrend could potentially represent just halfway to the market’s peak.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-05-30 17:12