-

The Mt.Gox BTC transfer was worth over $9 billion.

The BTC price has now dropped below the $68,000 range.

As an experienced analyst, I believe the recent transfer of approximately $9.4 billion worth of Bitcoin from Mt. Gox has not significantly impacted the market due to the absence of noticeable exchange flow or changes in supply on exchanges. Although the transfer was a substantial one, it did not cause any unusual trends or volatility in Bitcoin prices.

As a crypto investor, I’ve noticed some intriguing Bitcoin (BTC) transactions originating from the defunct Mt. Gox exchange lately. However, based on available data, it seems that these Bitcoins haven’t been sold or transferred to new wallets yet. Therefore, their impact on the market has been minimal so far.

The Mt.Gox Bitcoin move

An examination of Mt. Gox’s Bitcoin reserves, as shown on CryptoQuant, has uncovered a significant reduction in their Bitcoin stash recently.

Based on the chart’s assessment, roughly 140,000 Bitcoins, worth about $9.4 billion, were moved from the defunct platform.

As a data analyst, I discovered that these transfers significantly decreased the amount of Bitcoin available on Mount Gox exchanges to roughly 0.1 Bitcoins.

Mount Gox notoriously halted trading and shut down its website in February 2014, subsequently filing for bankruptcy protection after suffering the loss of around 850,000 Bitcoins, which was partly attributed to a hacking incident. Surprisingly, Bitcoin transactions on other exchanges have continued uninterrupted.

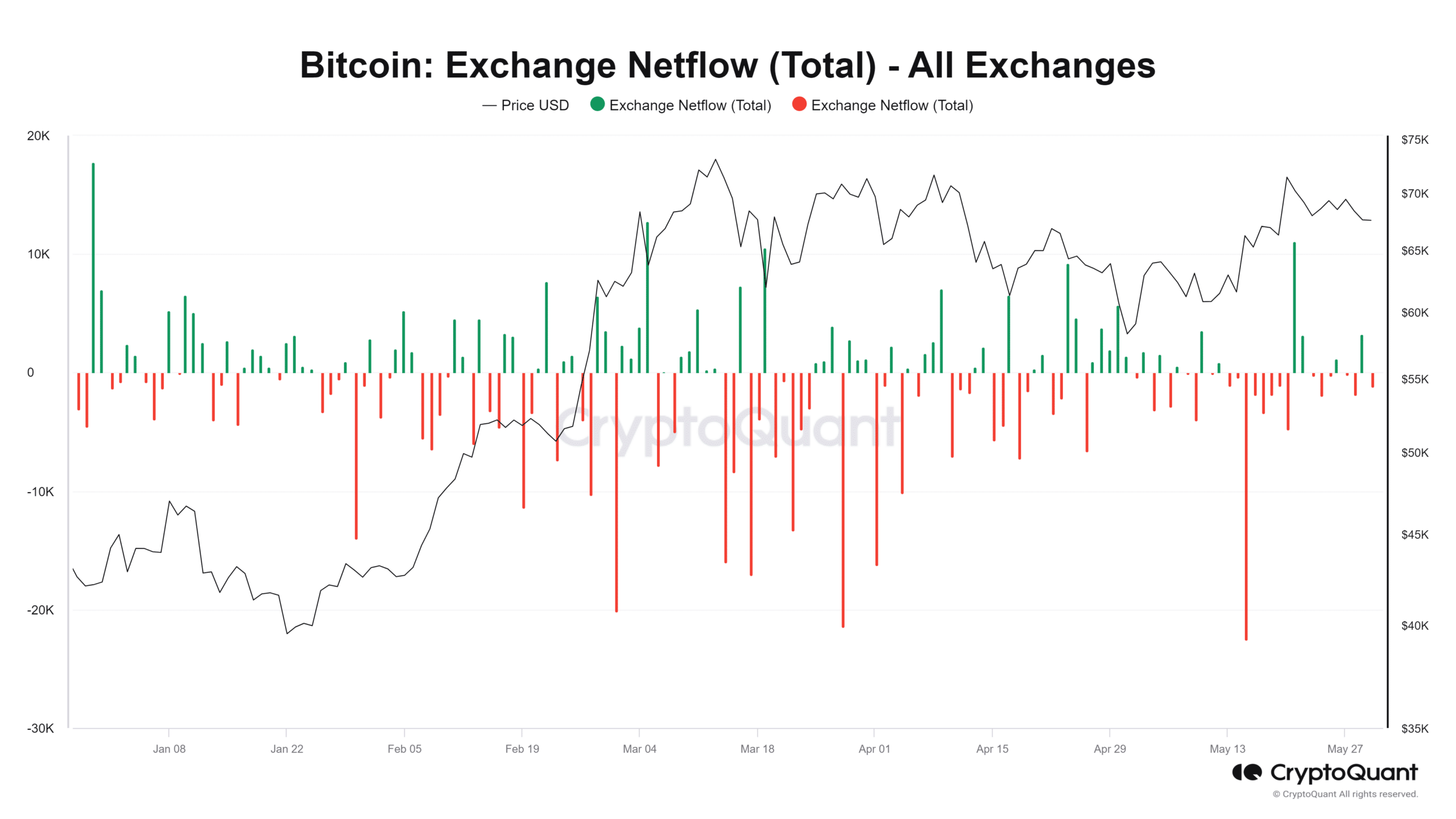

Analysing impact on Bitcoin exchange flow

According to the Bitcoin network traffic analysis conducted on CryptoQuant, there hasn’t been any noticeable trend emerging in the past few days. However, on May 27th, there was a notable outflow of around 178 Bitcoins, with a value exceeding $12 million.

On the contrary, on May 29th, approximately 3,270 Bitcoin, valued at more than $248 million, moved in a positive direction. Despite being significant, these numbers aren’t particularly extraordinary.

The impact of the recent activity from the failed exchange on the market was insignificant.

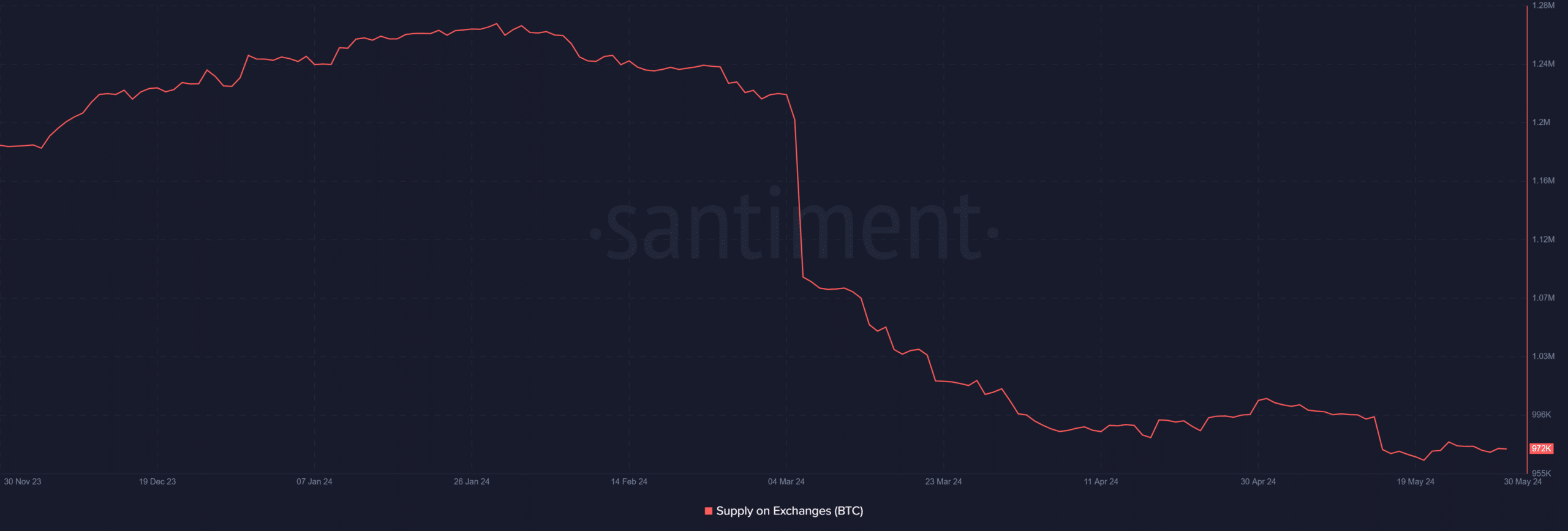

Based on my examination of the Bitcoin supply data from Santiment, I didn’t observe any substantial shifts or fluctuations in the amount of Bitcoin held on exchanges.

From the 27th of May up until now, there was a roughly 2,000 unit rise in the supply listed on exchanges.

Over the past three days, a noticeable amount of Bitcoin has been transferred to exchanges, yet this influx hasn’t significantly impacted the cryptocurrency’s price. Currently, there are over 972,000 Bitcoins on exchanges.

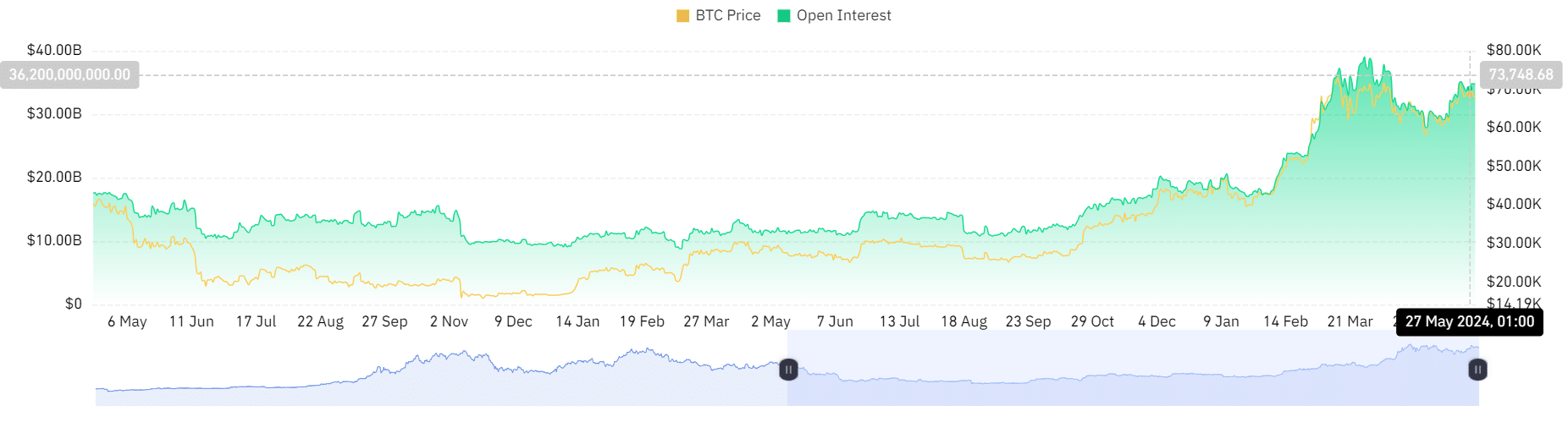

Bitcoin sentiment remains positive

An examination of Bitcoin’s open interest data on Coinglass revealed a significant surge in activity, implying a substantial influx of funds into the market.

Based on our latest evaluation, the Open Interest stood at approximately $35 billion. At its highest point in recent times, it had reached roughly $39 billion.

An examination of the funding rate trend uncovered that it has persistently stayed above the zero line, implying a favorable rate currently, as demand from buyers outweighs the supply from sellers in the market.

In simpler terms, the data suggests a generally optimistic outlook towards Bitcoin, as indicated by various factors, despite the past transactions from Mt. Gox.

Read Bitcoin (BTC) Price prediction 2024-25

As of the latest update, Bitcoin was trading at around $67,120, experiencing a decline of over 1%.

The RSI indicator on its day-to-day price chart showed that it was maintaining an uptrend, as indicated by its value.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-05-30 22:15