-

The ETH price decline has led to consecutive long liquidations.

ETH has declined by over 3% in the last three days.

As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market volatility. The recent Ethereum [ETH] price decline and consecutive long liquidations have been a tough blow for me and many other investors in the community.

Recently, Ethereum [ETH] saw a series of upward price movements that came very close to reaching its previous record high. Yet, there was a shift in market sentiment leading to a reversal trend, causing substantial losses for investors who had bought and held over the last several days.

Ethereum uptrend stalls

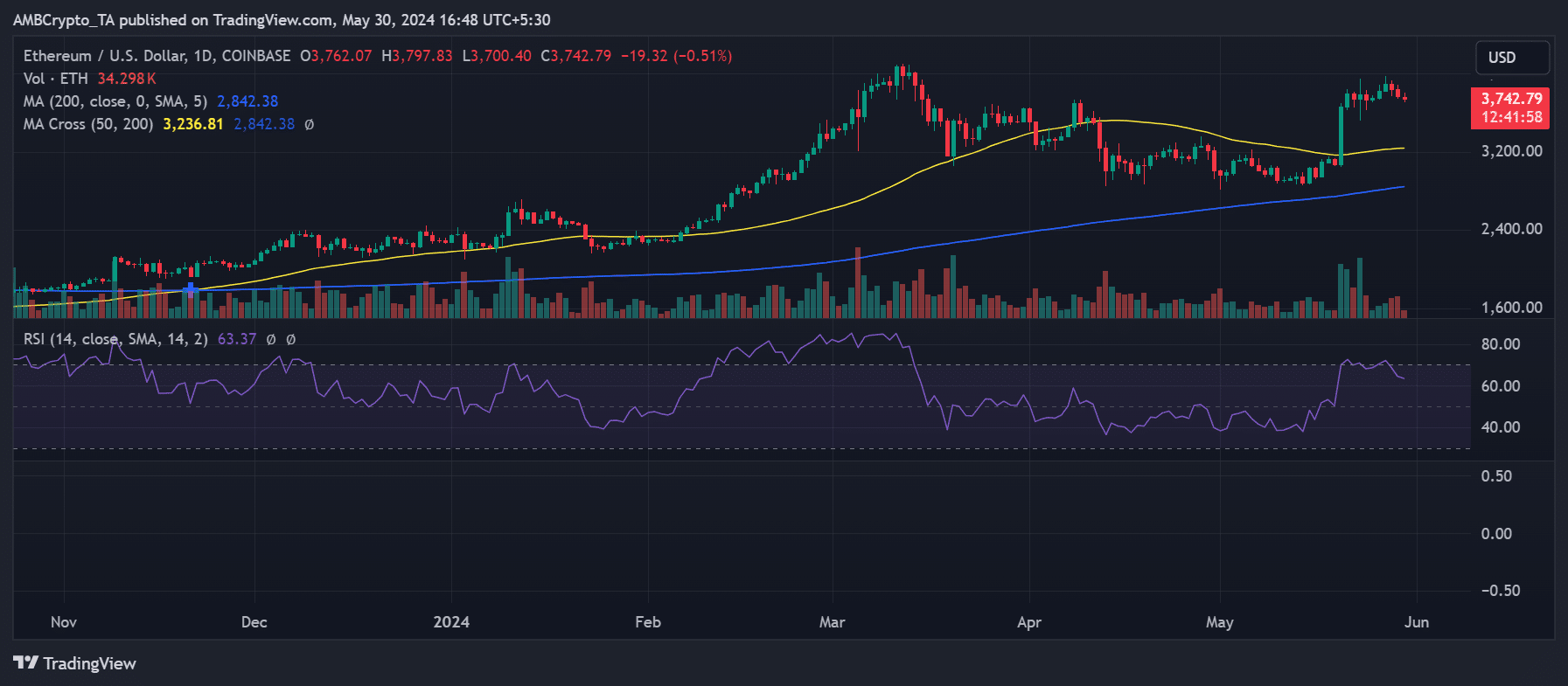

Over the past three days, Ethereum’s daily analysis shows a succession of price declines.

Lately, there have been price drops after previous gains, pushing ETH‘s value to approximately $3,890 on the 27th of May. At present, Ethereum is being exchanged around $3,740, representing a minimal decrease of almost 1%.

Despite a recent downturn, Ethereum’s long-term trajectory has been upward, as signified by the trendline in the graph. At present, the cryptocurrency is trading above its short-term moving average (represented by the yellow line), suggesting a favorable outlook.

As an analyst, I’ve examined the stock’s Relative Strength Index (RSI), and my assessment reveals a value surpassing 60. This finding underscores the current robust uptrend.

Ethereum long traders take hits

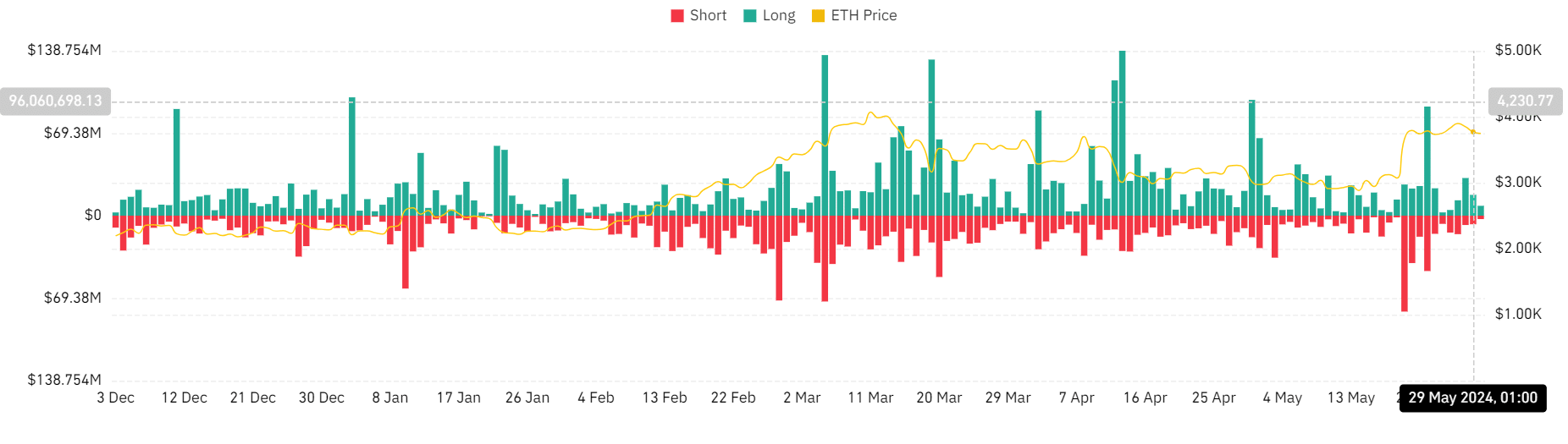

Based on the examination of Ethereum liquidation records on Coinglass, there has been a rise in the number of long positions being liquidated in recent days.

As a crypto investor, I noticed that on May 28th, around $31.6 million worth of long positions were liquidated when the price started declining.

As a researcher, I discovered that the value had increased significantly since the previous day. It was approximately $17.5 million then, but now, at the time of writing this, it has surpassed $8 million.

Over the past three days, the accumulated long liquidation volume has exceeded $57 million, whereas the short liquidation volume only reached approximately $18 million.

Ethereum Open Interest remains high

As a crypto investor, I’ve noticed that despite the recent dip in Ethereum’s price, there’s still a significant amount of enthusiasm for this digital asset. When I checked the Open Interest chart on Coinglass, I was amazed to find that it had reached an all-time high of $17 billion on May 28th – a level not seen in over a year. This strong figure indicates that there’s still a considerable amount of ongoing trading activity surrounding Ethereum.

From my perspective as a researcher, the current Open Interest for Ethereum hovers around $16.7 billion at present. This figure ranks among the upper echelons seen within the past year. Such a high Open Interest signifies robust investor involvement and enduring interest in Ethereum.

Read Ethereum (ETH) Price Prediction 2024-25

Moreover, the analysis of Ethereum’s funding rate revealed a bullish attitude towards the cryptocurrency. The graph demonstrated that the funding rate continued to be positive, with a current reading of 0.013%.

This implies that the buying trend persists, reflecting a firm conviction among investors that Ethereum’s price may still increase.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-05-31 02:15