- Toncoin has seen an uptick in whale accumulation.

- However, it remains at risk of decline.

As an experienced analyst, I have seen my fair share of cryptocurrency market trends and price movements. Based on the available data, Toncoin [TON]’s recent surge in whale accumulation is indeed a positive signal for the altcoin. However, it seems that the market may not be ready to fully embrace this trend just yet.

In recent weeks, there’s been a notable increase in large-scale transactions on the Toncoin (TON) blockchain, according to a recent analysis by CryptoQuant expert Joao Wedson.

I’ve analyzed the data provided by Wedson, and I’ve observed a significant increase in the number of TON wallets containing between 100,000 and 1 million Tokens.

Wedson argued that:

The actions of significant market participants toward TON often reflect its promising potential and worth. Their increasing holdings suggest a favorable perspective and faith in TON’s ongoing expansion and resilience.

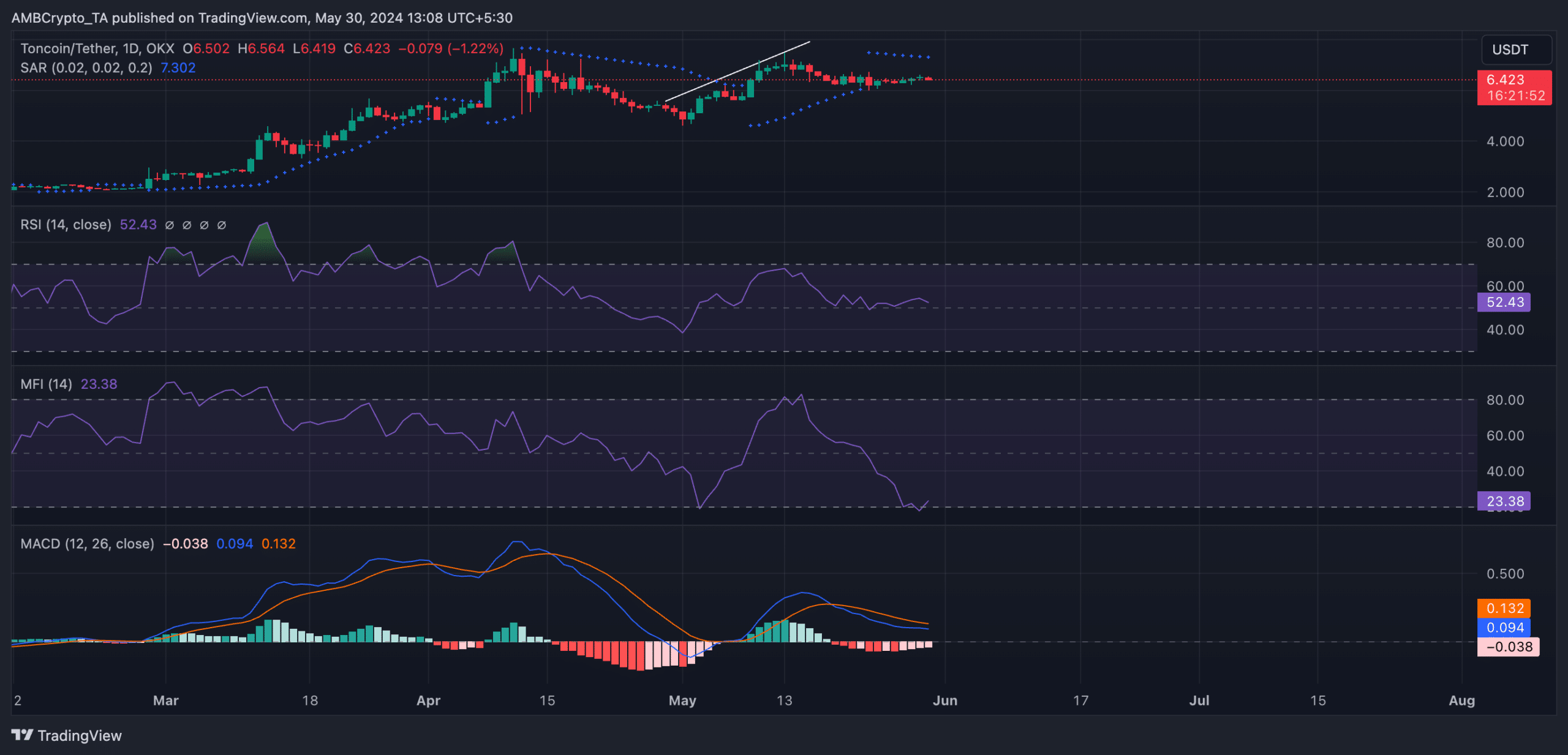

As a researcher studying the current trends in the whale market, I’ve noticed that their continued buying efforts have yet to significantly impact the price of TON. Based on my analysis of the price chart, there are signs suggesting a potential short-term downturn for this cryptocurrency.

TON has a rough road ahead of it

Currently, TON‘s price is at $6.43 during this news update. Despite a 20% increase over the past month, TON could experience some losses and potentially give back some of its recent gains.

Although the cost of TON has risen, its Relative Strength Index (RSI) and Money Flow Index (MFI) have decreased, indicating a bearish discrepancy. Currently, TON’s RSI is at 52.57, while its MFI stands at 23.39.

Based on these readings, it seems that despite TON‘s recent price increase, the underlying demand for purchasing may be starting to wane.

A formed divergence signals to investors that an uptrend may be losing steam, implying a possible reversal or downturn approaching.

Affirming the potential for a downward trend, the TON Parabolic SAR’s points sat above its corresponding price.

This metric signifies an asset’s probable trend and price fluctuations. When its dashed lines lie above an asset’s value, the market is considered bearish. This implies that demand for purchasing is insufficient, potentially leading to a decrease in the asset’s price.

In addition, TON’s MACD line (blue) rested below its signal line (orange) as of this writing.

Is your portfolio green? Check the Toncoin [TON] Profit Calculator

As a researcher studying the price movements of TON, I would interpret this setup as follows: The current configuration is considered bearish because it indicates that TON’s recent price gains have lost steam, and the shorter-term moving average (MACD line) is now declining more rapidly than the longer-term moving average.

Traders often interpret it as a sign to exit short and take long positions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-05-31 06:15