-

DOGE prices have stagnated below $0.17 amidst a drop in interest in the derivatives market.

Will DOGE interest improve after the reported change in traders’ focus to higher beta memecoins?

As an experienced analyst, I believe that the recent shift in focus from Bitcoin to memecoins like Dogecoin (DOGE) is a notable trend worth monitoring. The reported decline in open interest rates for DOGE could be a bearish sign, but it’s important to consider the broader context of market sentiment and trader behavior.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin‘s [BTC] price has been relatively stable since May 23rd, hovering above $67K. However, there’s an upcoming supply glut from the Mt Gox exchange that could potentially impact the market. In response, some traders have started paying closer attention to memecoins as an alternative investment option. Among these, Dogecoin [DOGE] has gained particular popularity due to its legacy status.

As a researcher studying trends in the cryptocurrency market, I’ve observed a shift in focus among traders towards legacy memecoins, based on data from QCP Capital, a leading crypto-trading firm based in Singapore.

Traders are increasingly paying attention to meme tokens such as Shiba Inu (SHIBA), Dogecoin (DOGE), and Pepe (PEPE), which have experienced significant growth of around 10-20% and currently rank among the most popular in terms of Open Interest.

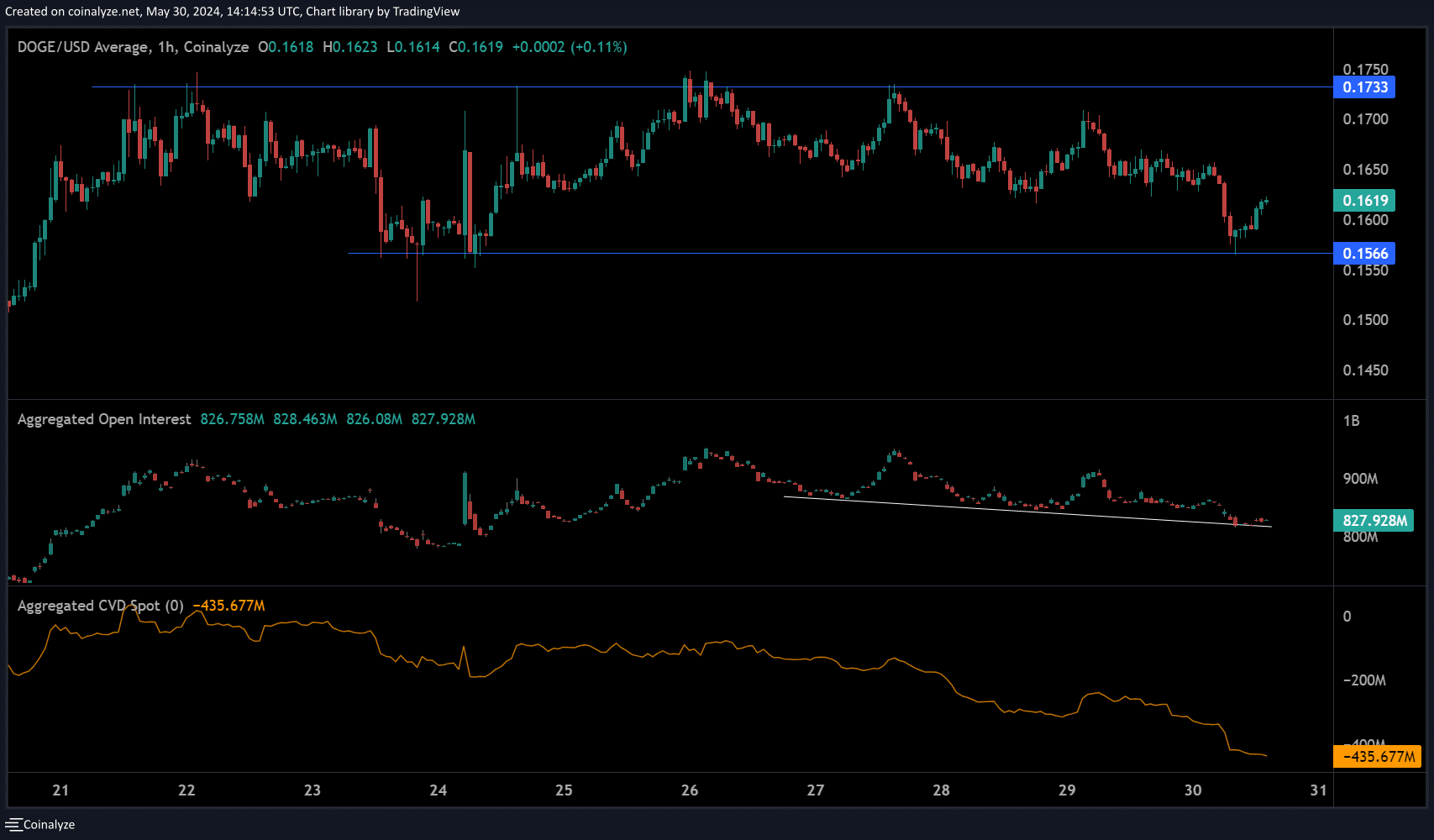

A spot check on the Coinalyze showed that Pepe [PEPE] and Floki [FLOKI] recorded an upswing in open interest rates in the past 24 hours. However, Dogecoin’s OI was still negative at the time of writing, down about 5%, which could delay a strong short-term recovery for DOGE.

Will DOGE see a short-term reprieve?

As a crypto investor, I’m always on the lookout for valuable insights that can help me make informed decisions about my investments. One such metric that I find particularly interesting is Open Interest (OI). For those who may not be familiar, OI refers to the number of opened futures contracts, along with the money associated with them.

As a market analyst, I’ve noticed that the open interest (OI) for DOGE has been decreasing consistently since May 27th. At the current moment, the OI stands below $900 million. This decline indicates a bearish outlook among traders regarding DOGE’s future price direction.

Starting on May 27th, the declining area in the Cumulative Volume Delta (CVD) chart clearly illustrated the power of sellers in the market.

If DOGE was trending towards a significant short-term support level of around $0.15, a surge in brief buying interest might propel it towards the nearby short-term resistance levels of $0.17 or $0.2.

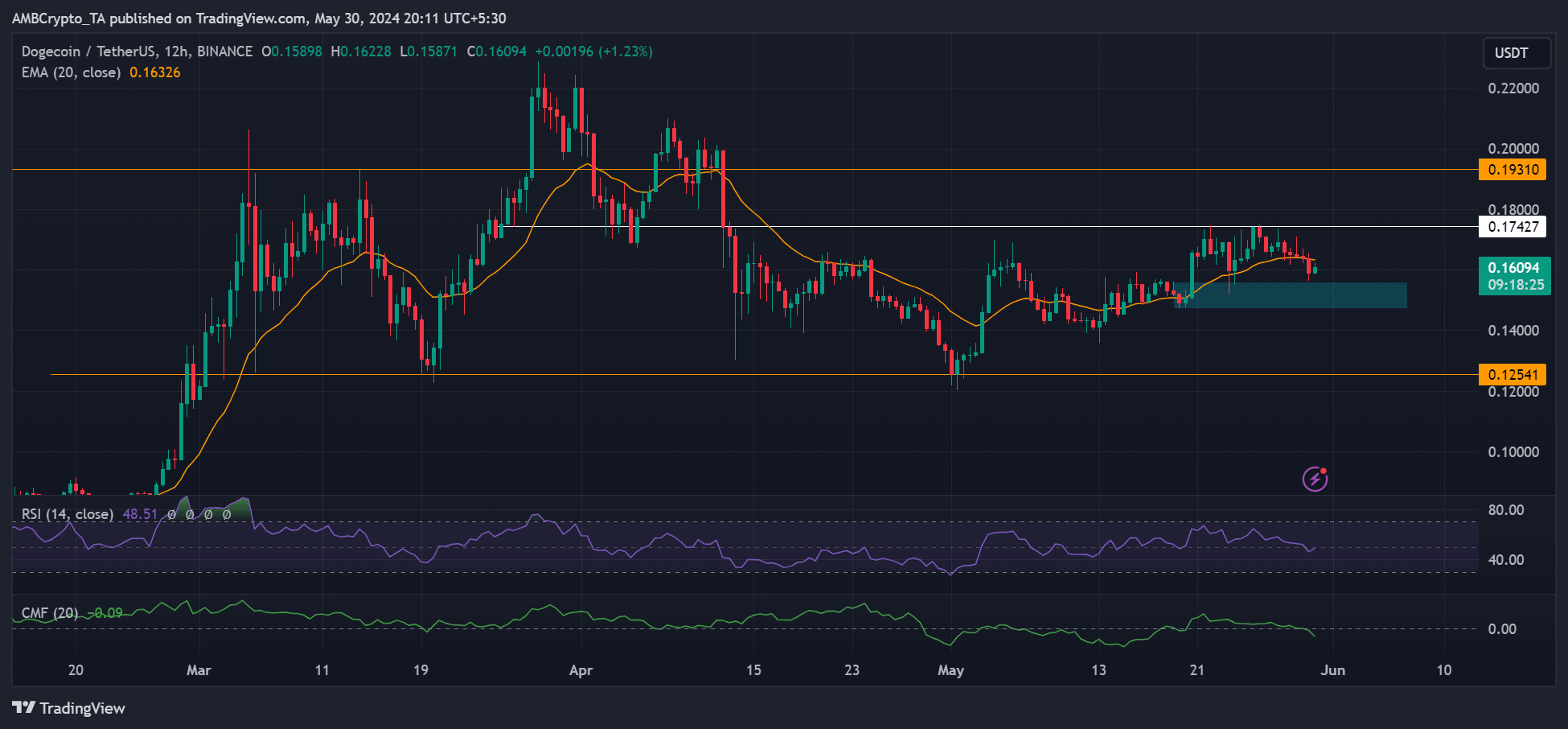

With subpar readings on the RSI (Relative Strength Index) and CMF (Chaikin Money Flow), there’s a likelihood of a return to the demand zone, indicated by cyan. A significant increase in Open Interest (OI) could serve as confirmation for this potential rebound or reversal.

However, a breach below $0.15 could drag DOGE to multi-month support at $0.13.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-05-31 09:11