-

AVAX has traded within a range over the past six weeks

Momentum and volume were in favor of the sellers at press time

As a crypto investor with some experience under my belt, I’ve seen my fair share of market fluctuations and range formations. The current situation with Avalanche [AVAX] seems reminiscent of previous experiences where an asset consolidates within a specific price range for an extended period.

At present, AVAX, the cryptocurrency represented by Avalanche, appeared to be in a period of holding steady, according to earlier reports from AMBCrypto. This report brought attention to AVAX’s sluggish progress and decreasing social media activity. Consequently, the altcoin was being traded near its $36 support level.

From my analysis perspective, the technical indicators did not point to an imminent AVAX price surge. Instead, a potential downtrend towards $30 appeared more plausible based on the significant selling pressure observed over the previous six weeks.

Range formation still in play

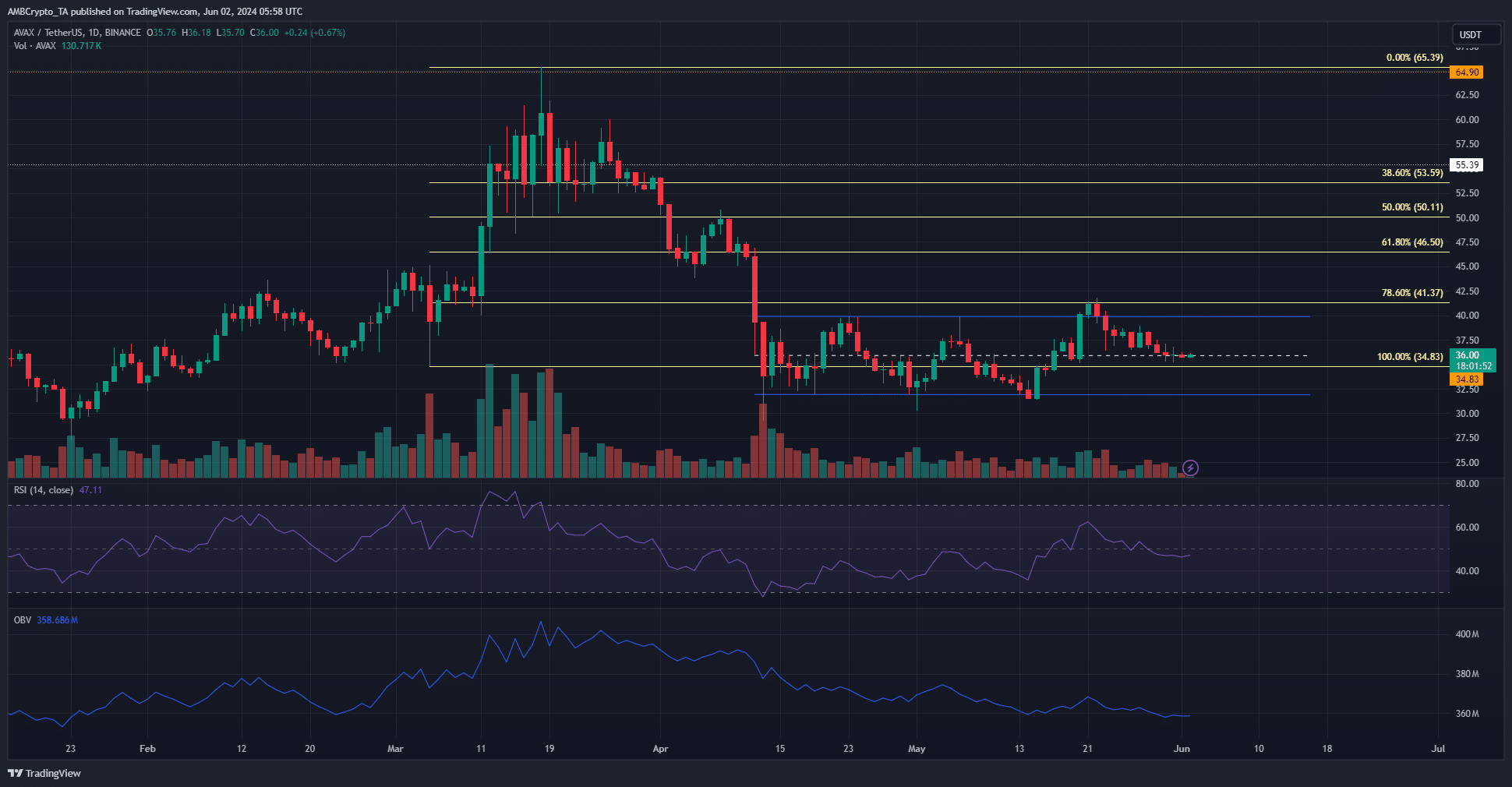

From mid-April, AVAX has been trading between $36.1 and $39.9. The white line marked at $35.9 signifies the middle of this range and is a noteworthy short-term level. At the moment of writing, the bulls were struggling to keep hold of it as the bears showed signs of taking over.

Over the last ten days, the RSI on the daily chart has shown a consistent decline. This indicator dropped below the 50-neutral mark, signaling an early warning of a bearish trend emerging. Additionally, the On-Balance Volume (OBV) has been trending downward since mid-April with considerable strength.

The persistent selling activity caused a noticeable drop in AVAX‘s value. Despite a slight letup in the selling momentum over the last fortnight, the market bore a bearish complexion and displayed insufficient buying interest. Until this dynamic shifts, it is anticipated that AVAX will experience further price decreases.

Speculative detachment contributes to AVAX’s woes

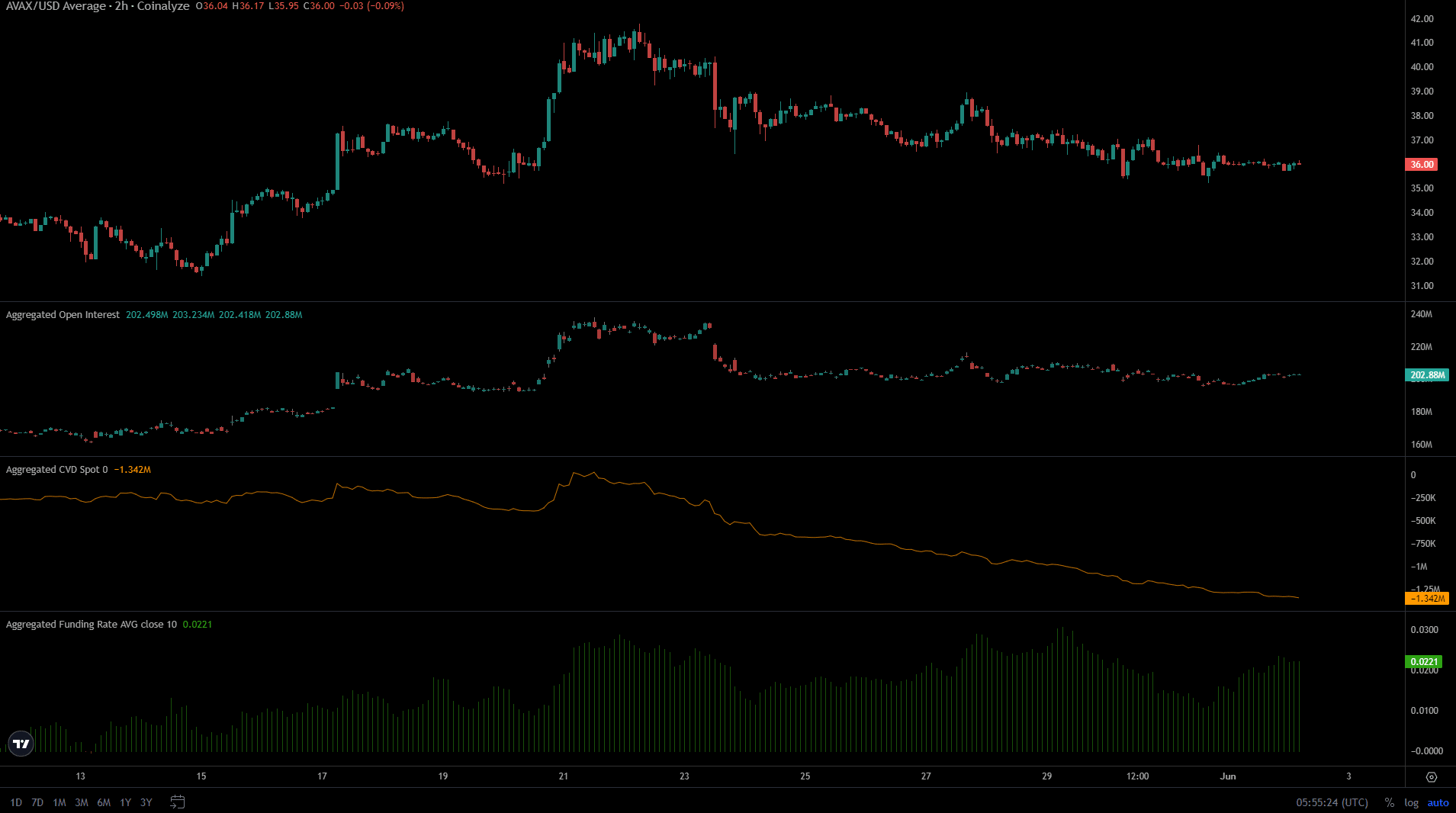

Beginning on May 23rd, Open Interest has remained close to the $200 million threshold. Simultaneously, the price descended gradually from $38 to $36. The apathy of futures traders towards retesting the mid-range level suggests that further declines are imminent.

Read Avalanche’s [AVAX] Price Prediction 2024-25

It’s important to mention that the funding rate has continued to be positive, indicating that traders haven’t heavily bet against AVAX yet. On the other hand, the CVD (Cost Basis Difference) and OBV (On Balance Volume) have both been trending downwards. In simpler terms, given the prevailing selling pressure, it seems unlikely for AVAX to recover in the short term.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-06-02 16:39