-

Holders of the token decided to send many XRPs to cold wallets moments after Ripple’s action

Declining volumes and price suggested the altcoin might rebound in the short term

As an experienced analyst, I believe that Ripple’s (XRP) recent token locking activity did not go unnoticed by the market this time around. The increase in active addresses on the XRP Ledger and the decline in Mean Coin Age suggest that more participants are moving their tokens to cold wallets, possibly in anticipation of a price rebound.

As a researcher studying blockchain transactions, on the first of the month, I observed Ripple executing its routine token lock-up procedure. In contrast to previous occasions, this process was carried out in two distinct transactions, each involving 500 million XRP units, based on data from Whale Alert.

As a researcher studying the cryptocurrency market, I’d like to clarify that Ripple has held back a significant portion of its XRP token supply since 2017. The rationale behind this decision is to offer protection for the extensive token inventory over a period of approximately 55 months. This implies that about half of the total XRP supply would be involved in this plan. Typically, XRP’s response to this news has not resulted in significant market reactions.

Hence, the question – Was it the case this time too?

Times have changed

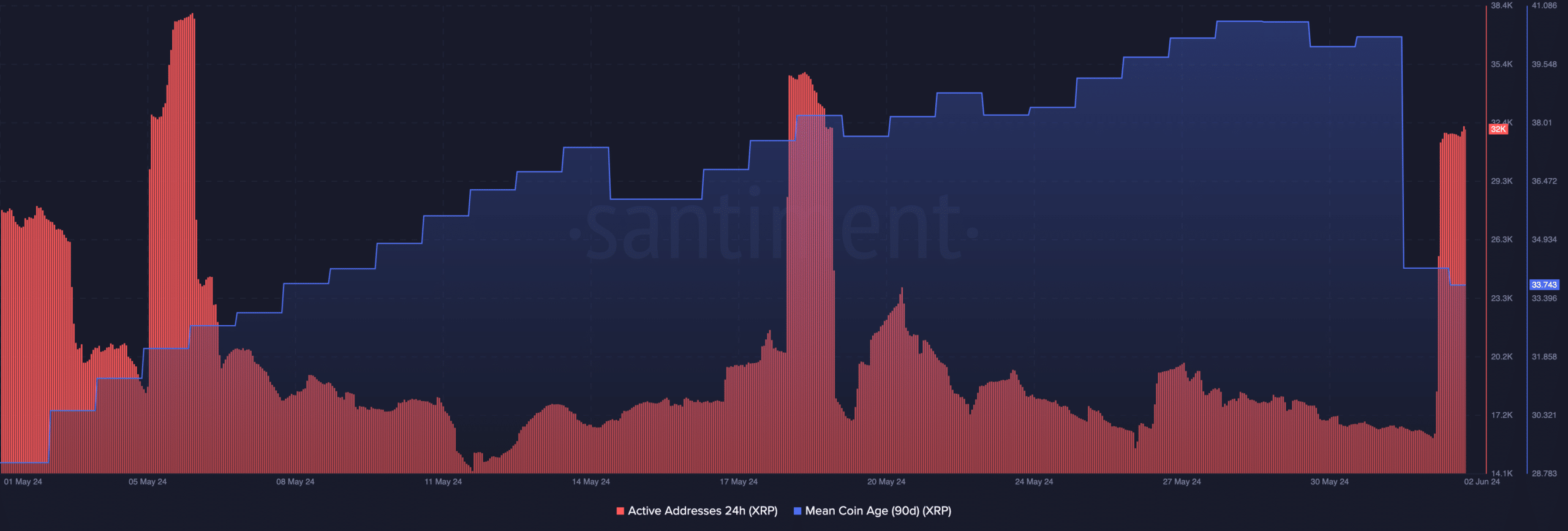

Well, not quite. AMBCrypto noticed a change on the XRP Ledger this time, with the first observation being a notable increase in active addresses.

Currently, there are approximately 32,000 unique XRP addresses with transaction activity within the past 24 hours – nearly a doubling of the reported numbers from 1 June. This surge in active addresses signifies a significant increase in user engagement and successful token transactions over the recent 12-24 hour period.

Despite an increase in network activity, which sometimes results in a stalled or declining price, XRP‘s price dropped slightly to $0.51 on the charts during this instance. However, based on the Mean Coin Age (MCA) indicator, it appears that this correction may not continue.

The Mastercoin Age (MCA) represents the typical age of all cryptocurrency units within the blockchain. A surge in this metric signifies that older coins are being transferred, potentially leading to increased selling pressure and subsequent price decreases.

I’ve noticed an intriguing decrease in XRP‘s Mean Coin Age (MCA) recently, which is a sign that more XRP tokens are being moved into cold storage. At the current moment, XRP’s MCA has dropped from 40.29 to 33.74 over the past 90 days.

Based on the rules previously stated, it appears that the selling pressure for XRP may soon abate. Consequently, the price could rebound and potentially reach $0.55.

XRP to fall to $0.50, following which…

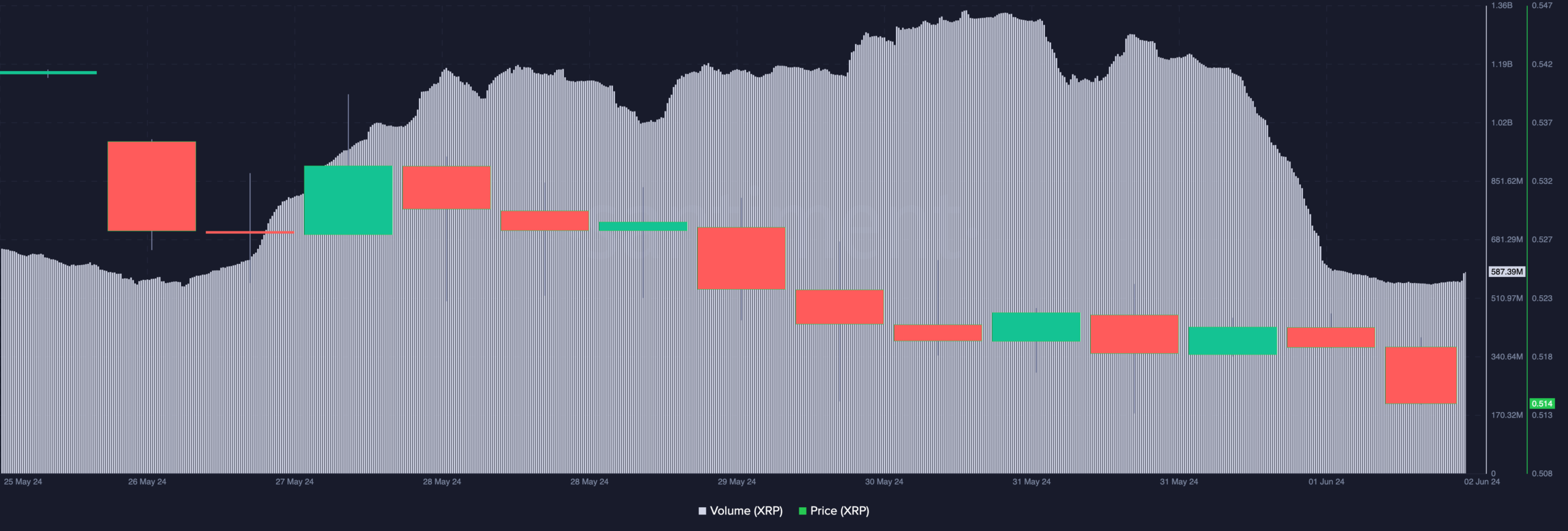

As a crypto investor, I cannot stress enough the importance of monitoring an altcoin’s trading volume. At the current moment, this coin’s trading volume stands at approximately $587.39 million. Keep in mind that volume plays a significant role in determining the strength and direction of a cryptocurrency’s price movement. A high trading volume can act as a solid foundation for potential price gains or losses.

A decrease in the decline of XRP‘s value suggests that its downtrend may be weakening. Although XRP’s price could drop to $0.50, a rebound might be imminent as diminishing volume and price reduction could be seen as bullish signals.

If XRP recovers, it’s possible that the forecasted price of $0.55 could be achieved. In an optimistic market condition, XRP’s value may even surge up to $0.60.

Read Ripple’s [XRP] Price Prediction 2024-2025

Although there is reason for hope, XRP investors ought to remain cautious about potential market shifts, particularly those that may impact Bitcoin (BTC) significantly.

If the price of Bitcoin increases, it’s possible that XRP‘s price may follow suit. Conversely, if Bitcoin experiences a decline in value, the argument presented could be rendered invalid for XRP.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Elder Scrolls Oblivion: Best Thief Build

- Gold Rate Forecast

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- OM PREDICTION. OM cryptocurrency

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- EUR PKR PREDICTION

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

2024-06-02 23:03