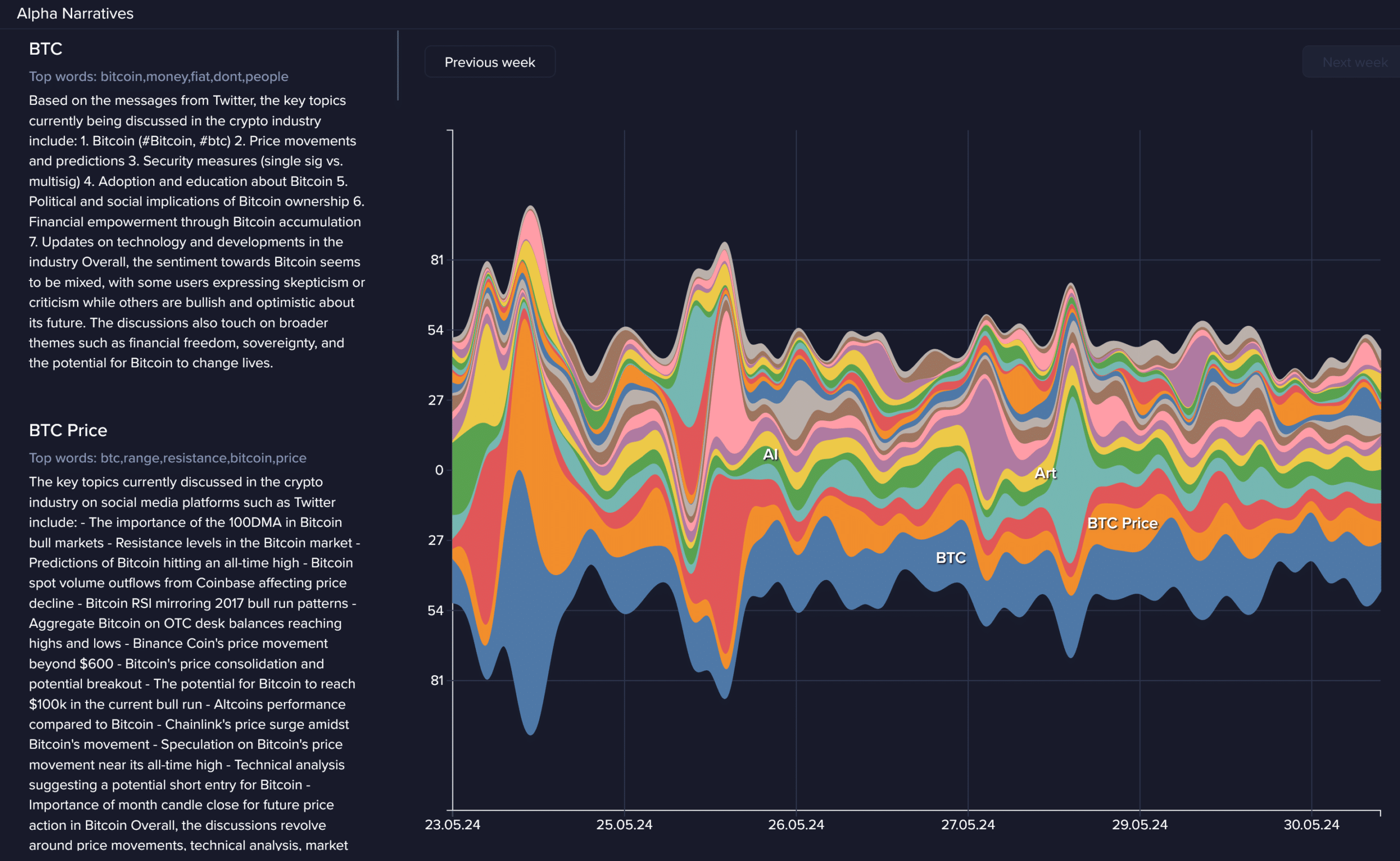

- Bitcoin discussions seem to be slipping, with traders now more focused on altcoins

- Memecoin mania going strong, but this could be a warning for traders

As an experienced analyst, I’ve seen my fair share of market trends come and go. Bitcoin’s recent retracement is a reminder that even the most dominant cryptocurrency can experience volatility. The focus on memecoins and their meteoric rises could be a warning sign for traders, as these tokens often lack substance and sustainability.

Bitcoin’s price surged past the $67,000 mark on May 20th, reaching a new high of $71,900. However, it subsequently retreated and retested the $67,000 level on May 23rd, almost completely erasing its recent gains.

The consolidation signifies that Bitcoin’s bullish power may not be as robust as anticipated by investors. A recent analysis by AMBCrypto revealed that several key Bitcoin indicators presented a bearish outlook.

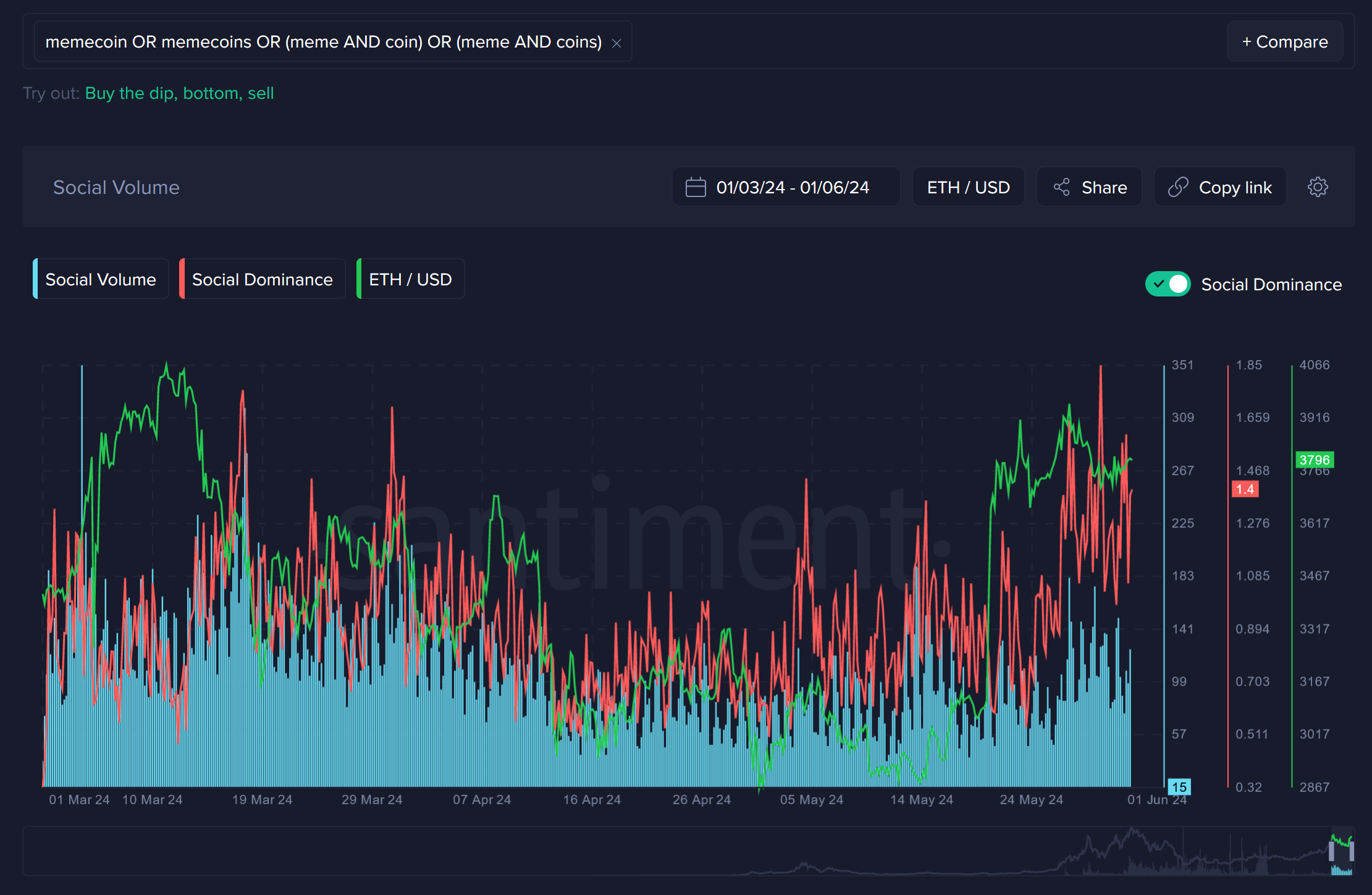

Memecoins have succeeded in capturing the public interest

On X, or what was previously known as Twitter, Santiment provided some intriguing perspectives regarding crypto trends. There has been a significant increase in public interest towards memecoins since mid-April, mainly due to their outstanding performance within the crypto market sector.

Over the last week, coins such as Dogecoin (WIF), Shiba Inu (SHIB), and FLOKI put in impressive showings. Pepe (PEPE) experienced significant growth over the past two weeks, surging by 63% since April 20th. This period saw Bitcoin attempting to surpass $67,000, but failing to generate a strongly bullish trend.

A high level of involvement with meme coins might indicate that the market is driven by greed and speculation rather than undergoing an organic growth phase, during which the general population seeks out tokens based on solid technology and practical use.

As an analyst, I’ve observed a noteworthy trend in Bitcoin Exchange-Traded Fund (ETF) investments recently. There has been a surge in inflows during the past few days, and May’s performance concluded on a positive note. Nonetheless, it remains uncertain whether this development alone will trigger another bullish rally in the coming week.

The data indicated a decline in Bitcoin-related conversations based on Santiment’s analysis. Traders seemed more intrigued by altcoins, as they held greater interest due to their potential for higher returns, leaving Bitcoin lingering below the $70k resistance threshold.

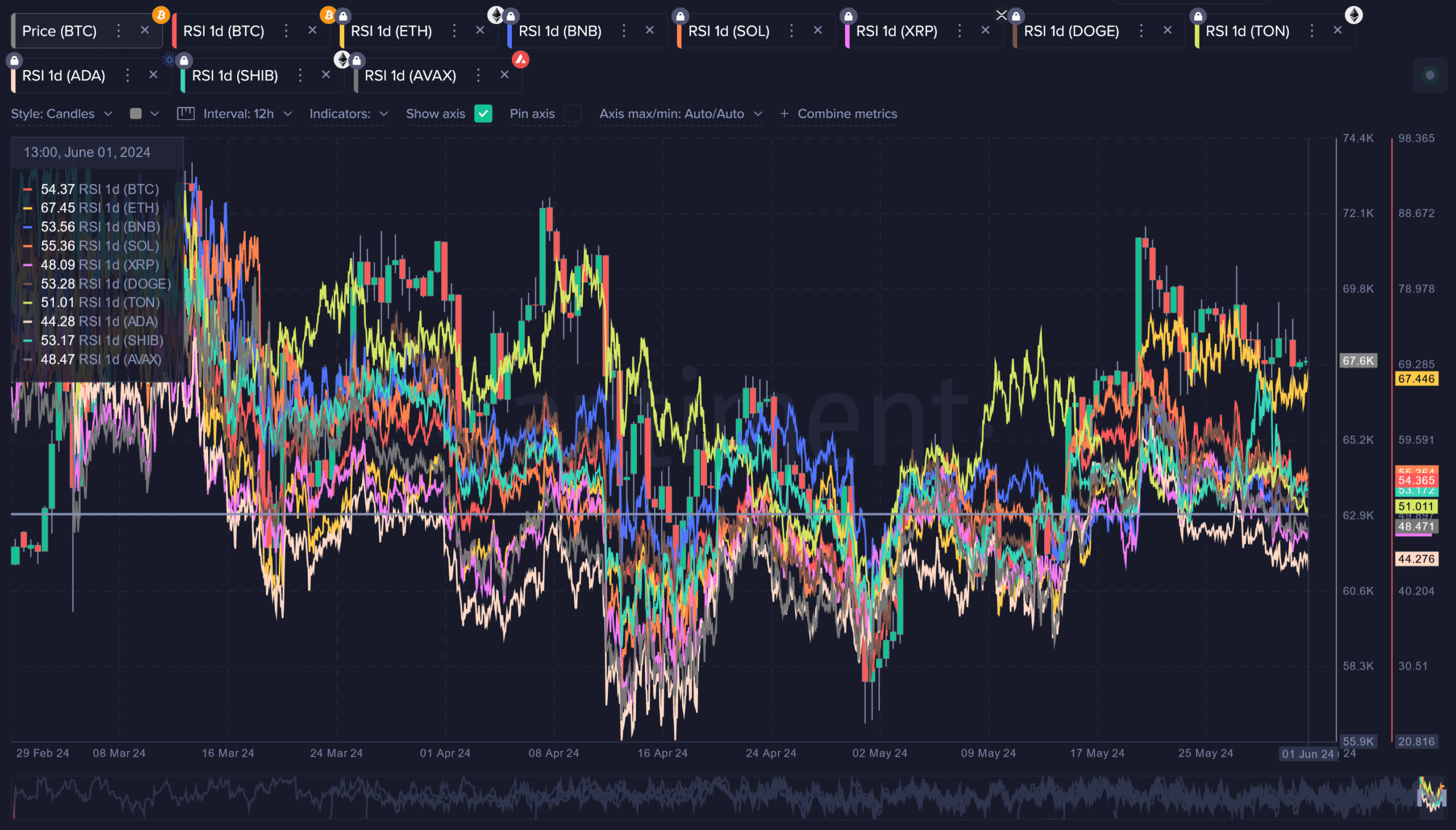

Large-cap momentum was bullish for the most part

Based on the daily RSI reading, most major tokens showed values close to or above the neutral 50 level, indicating a bullish trend. Among them, Ethereum [ETH] and Solana [SOL] exhibited particularly strong signals with readings of 67 and 55 respectively.

During this period, the price charts of Cardano (ADA), Ripple (XRP), and Avalanche (AVAX) experienced difficulty in generating a sustained bullish trend.

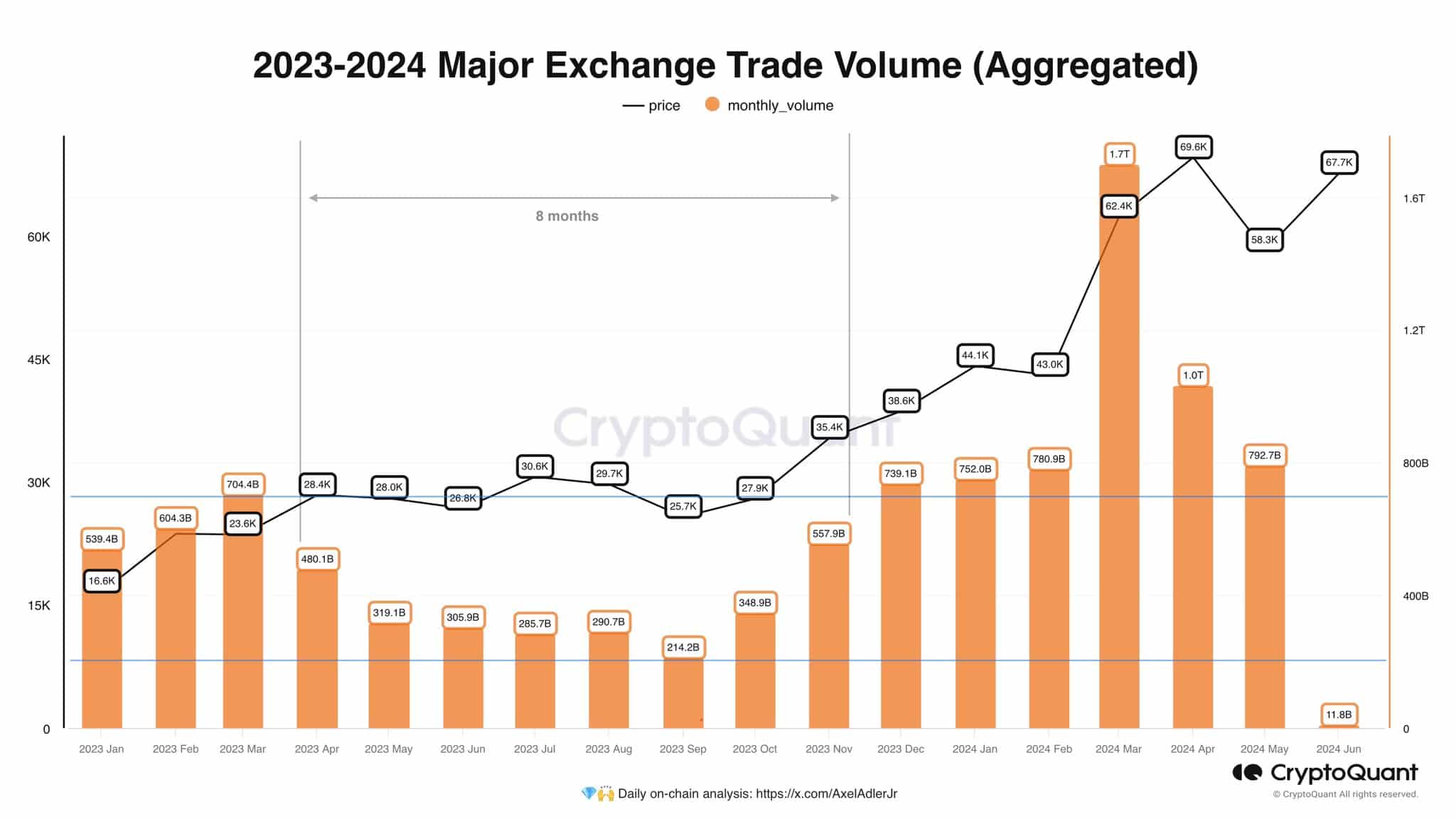

It’s important to mention here that the trading volume of prominent altcoins has significantly decreased compared to March levels. This observation was made by crypto analyst Axel Adler in a recent post, suggesting that Bitcoin’s weak performance may be influencing investor sentiment throughout the market.

Is your portfolio green? Check the Bitcoin Profit Calculator

As an analyst, I’ve observed that Bitcoin’s volatility and trading volume have decreased significantly since March. The cryptocurrency’s price has been confined to a narrow range of around $60,000 to $72,000. For investors, it is essential to exercise patience during this period, as the market may take some time before making its next significant move. On the other hand, traders must remain vigilant and keep an eye out for potential range formations to avoid getting caught in false breakouts.

Read More

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Paige DeSorbo’s Sassy Message: A Clear Shade at Craig Conover?

- Fifty Shades Feud: What Really Happened Between Dakota Johnson and Jamie Dornan?

- Lady Gaga’s ‘Edge of Glory’ Hair Revival: Back to Her Iconic Roots

2024-06-03 04:07