-

Ethereum’s price had dropped by over 2% in the last seven days

A metric indicated that ETH was overvalued

As an experienced crypto analyst, I have closely followed Ethereum’s price movements and market trends. Based on the latest developments and data analysis, here’s my take:

In the cryptocurrency world, Ethereum [ETH] generated significant excitement following the green light from the US Securities and Exchange Commission for Ethereum-based Exchange Traded Funds (ETFs). Despite the lack of a noticeable price surge after the approval, the situation may evolve in the near future.

Is buying pressure high?

As a financial analyst, I can tell you that prior to the approval of Exchange-Traded Funds (ETFs), there was a great deal of excitement and expectation surrounding their potential impact on the market. Simultaneously, the price movement of Ether (ETH) became increasingly erratic and headed northward during this period.

Following the approval of the proposal, however, tensions have eased. Lately, Ethereum has experienced some difficulties.

As an analyst, I’d put it this way: Based on data from CoinMarketCap, Ethereum (ETH) experienced a decline of more than 2% in the previous week. At present, ETH is priced at around $3,814.82 and boasts a market cap above $458 billion.

Recently, well-known crypto analyst Ali drew attention to an intriguing occurrence through a tweet of his.

According to the tweet, around 777,000 Ethereum, worth roughly $3 billion, have been taken out of cryptocurrency exchanges since the ETF approval. This significant withdrawal suggests strong buying demand, potentially boosting the token’s value further.

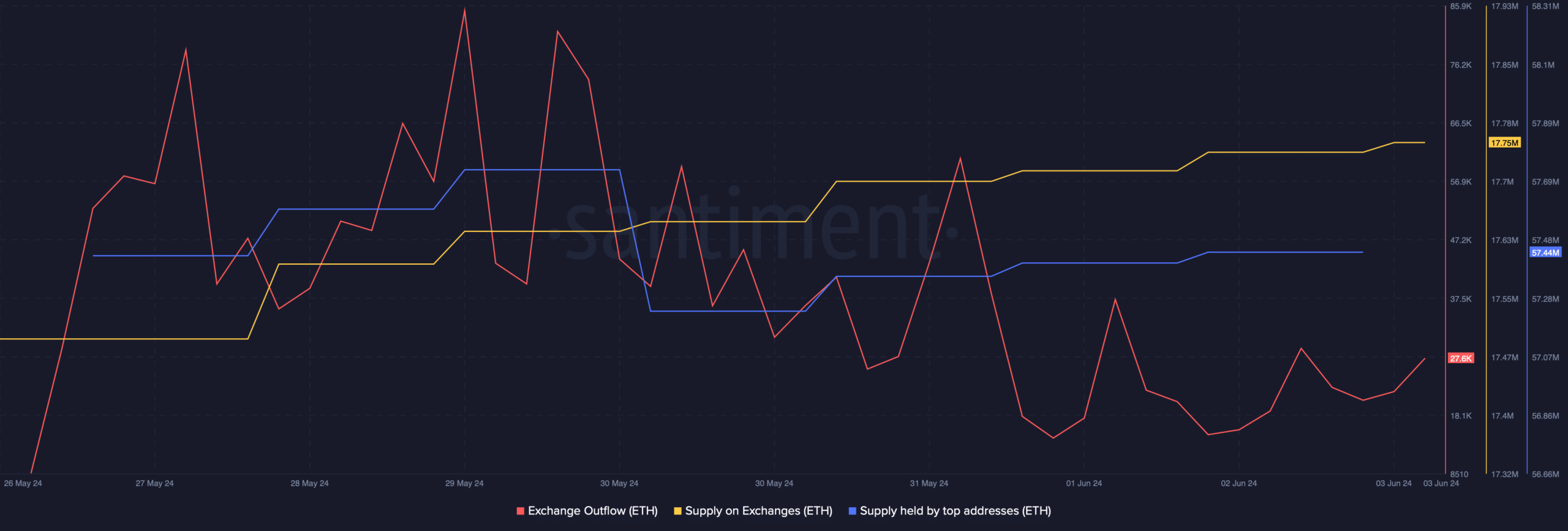

As an analyst at AMBCrypto, I delved into our on-chart metrics to assess if the reported buying pressure was indeed substantial. Upon examining the data from Santiment, I discovered a noteworthy decrease in Ethereum’s exchange outflows over the past week.

Its supply on exchanges increased, meaning that investors were rather selling ETH.

As a researcher observing the Ethereum market, I’ve noticed that the amount of ETH tokens held by major address holders decreased somewhat last week. Consequently, these “whale” investors were among those selling Ethereum as it failed to reach the $4k mark.

Looking forward

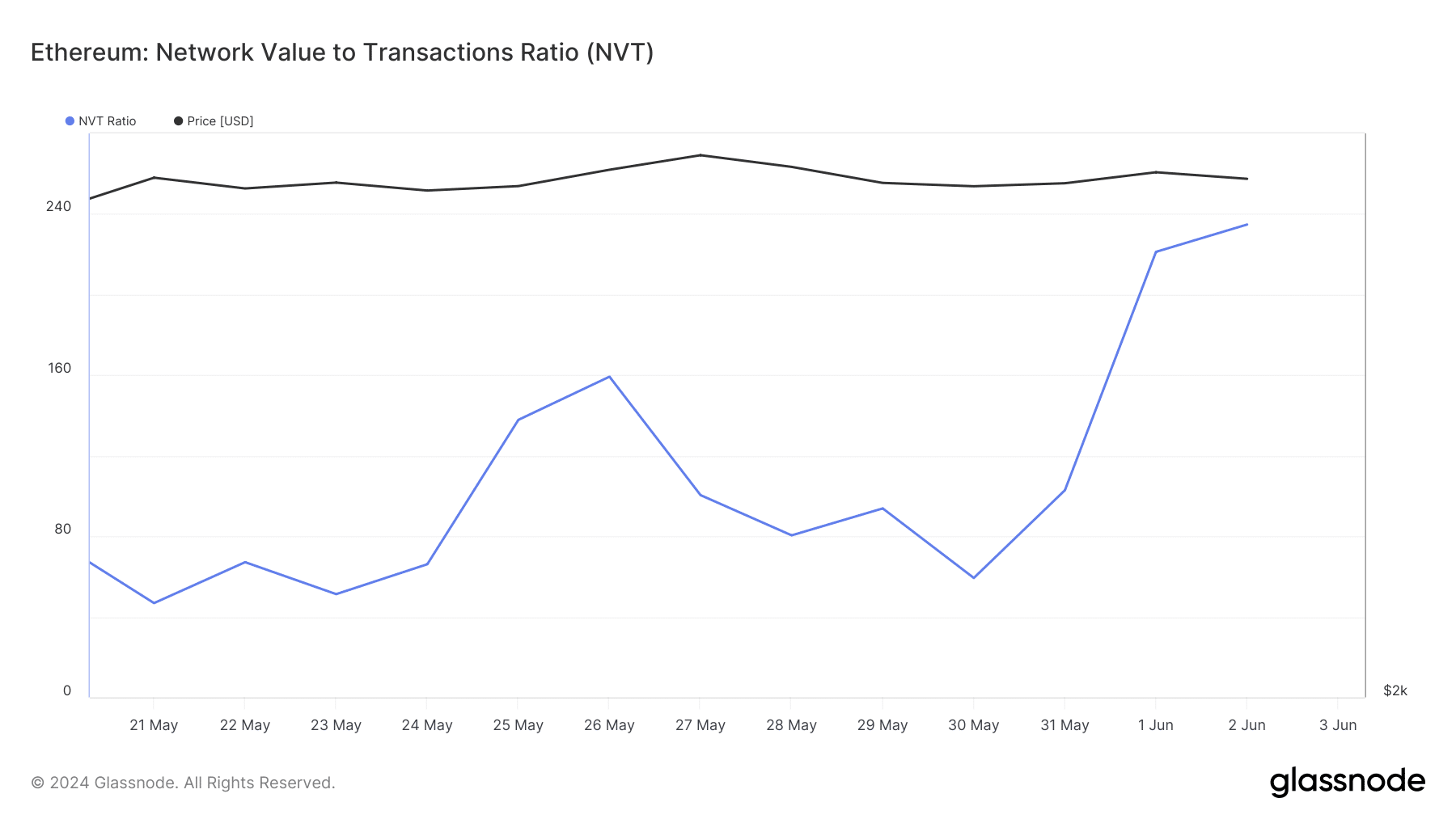

As demand to buy Ethereum intensified, a significant indicator showed signs of becoming negative based on Glassnode’s data. Specifically, we observed a noticeable surge in Ethereum’s NVT ratio on June 1st.

To begin with, this metric is calculated by taking the market capitalization and dividing it by the on-chain volume, expressed in US dollars.

When the metric increases, it signifies that the asset may be overpriced, implying a potential for a price adjustment.

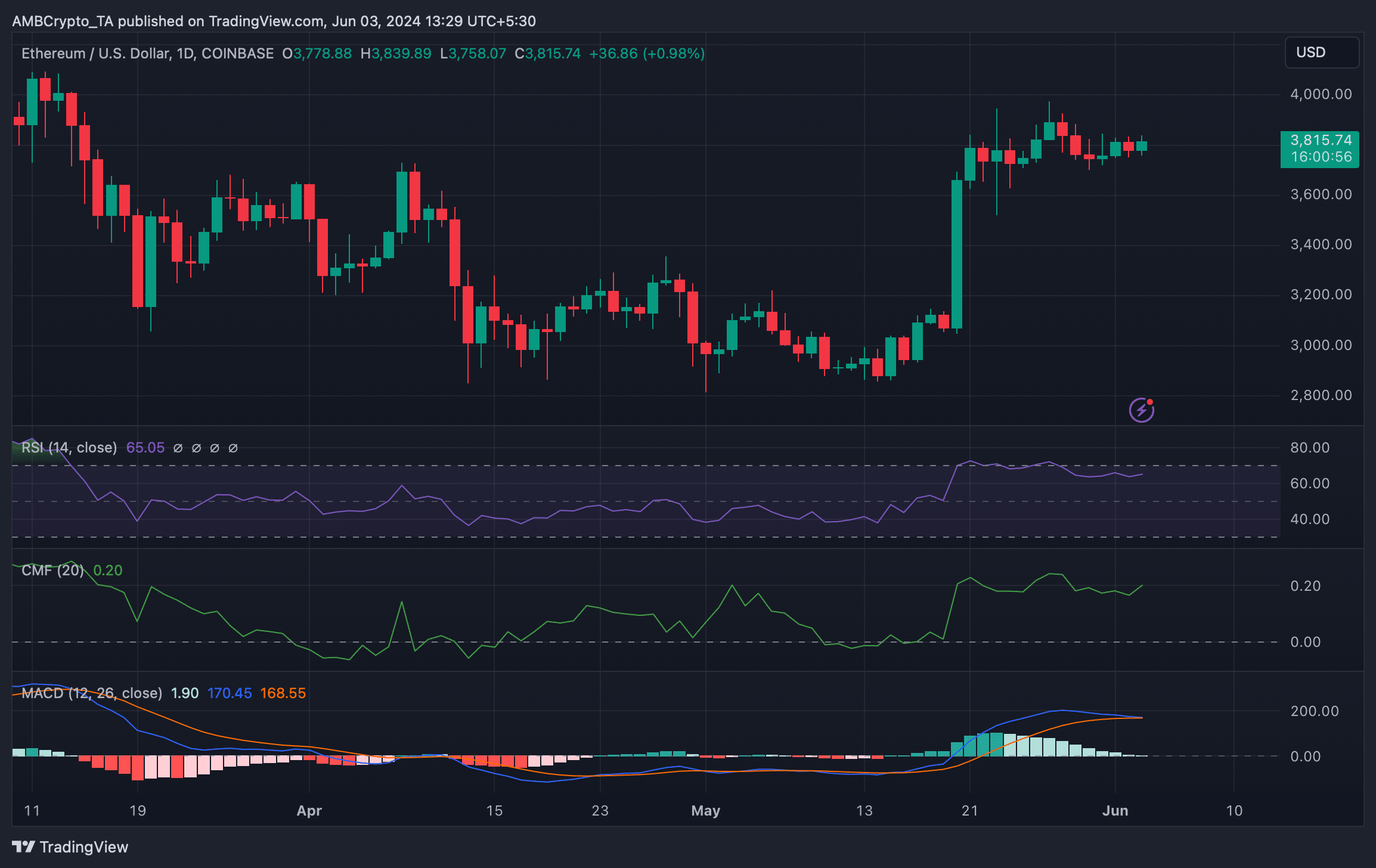

I examined Ethereum’s daily chart from a technical perspective to gauge its future direction. The MACD indicator signaled a bearish crossover, implying an imminent price correction.

Read Ethereum’s [ETH] Price Prediction 2024-25

Nonetheless, the Chaikin Money Flow (CMF) had registered an uptick.

Additionally, the RSI indicator, which measures the magnitude of recent price changes to determine overbought or oversold conditions, showed a bullish sign by sitting comfortably above the neutral threshold. This, in conjunction with the other technical analysis, points towards a potential price rise.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-03 19:03