-

ONDO has a strongly bullish bias on the lower and higher timeframes.

Another 15% move higher is possible, provided the bulls can convert a key resistance to support.

As a researcher with a background in technical analysis and experience in following the cryptocurrency market, I find ONDO‘s recent performance incredibly bullish. Its 56% gains since May 23rd and breaking out of a two-month-old range formation are strong signs of a robust uptrend.

Since May 23rd, Ondo (ONDO) achieved a rise of 56%. This asset surpassed its two-month-old consolidation phase, while the significant milestone of $1 psychologically was transformed into a supportive level for the bullish forces.

The lack of movement in Bitcoin (BTC) recently hasn’t harmed ONDO. Is this a sign of resilience for ONDO, or will it give back its advances? Based on technical analysis, there are compelling indicators pointing to which direction the altcoin may go.

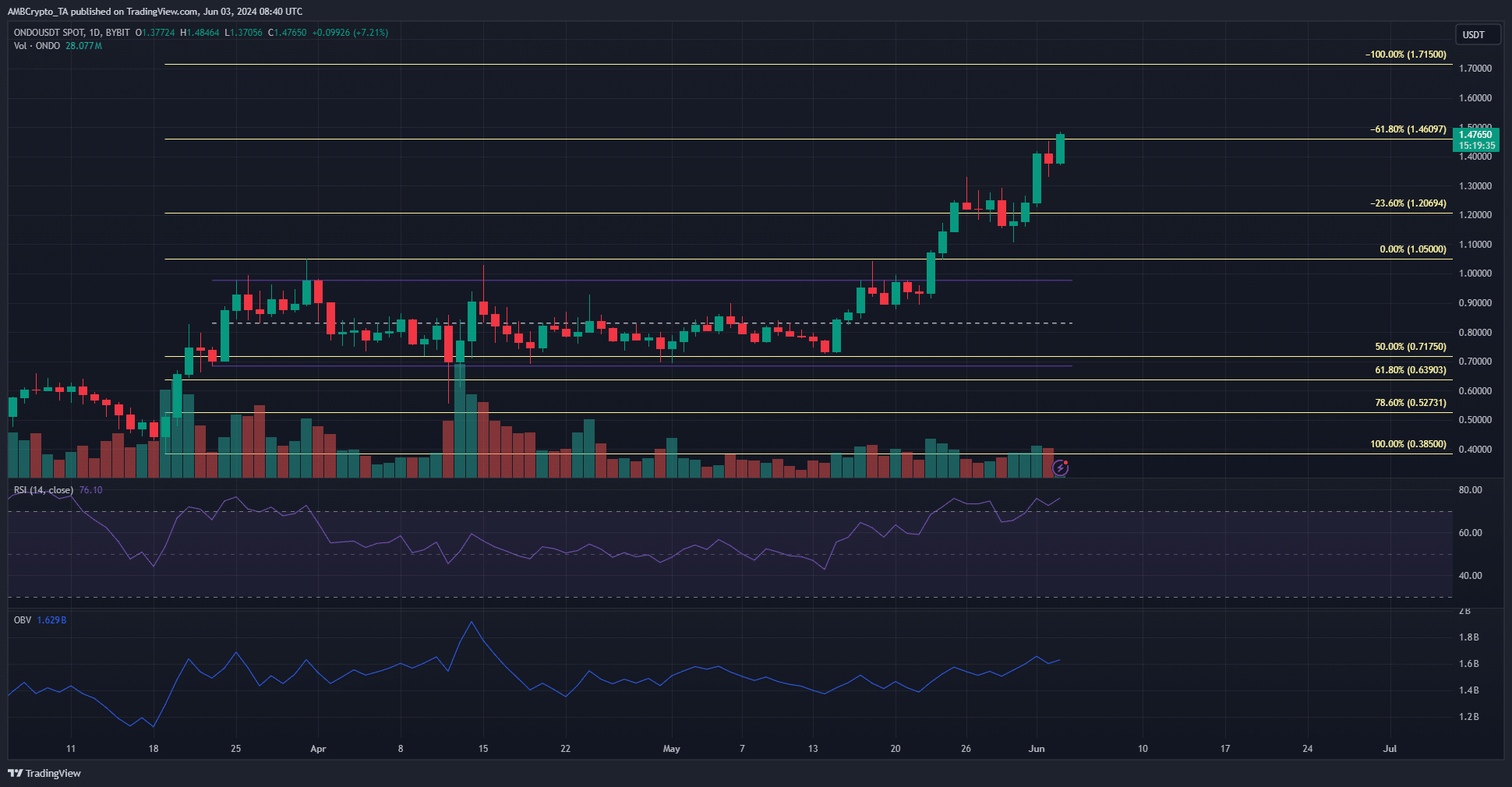

The Fibonacci extension levels presented the next bullish targets

In mid-March, a rally occurred which allowed for identifying key Fibonacci levels (depicted in pale yellow). Notably, the price action from the previous two months’ range revealed that it had found support at the 50% retracement point, specifically at $0.717.

Over the past two weeks, ONDO has shifted its position at the $1.2 mark, which represents a 23.6% extension level, to serve as support. It has been making an effort to surpass the $1.46 mark, representing a 61.8% extension level, next. The price level of $1.71, signifying a 100% extension, is its upcoming objective.

On the daily chart, the Relative Strength Index (RSI) stood at 76, indicating robust buying power and bullish momentum. No divergence, which could have signaled a shift in trend, had emerged on this timeframe, suggesting that the bullish trend remained intact. Meanwhile, the On-Balance Volume (OBV), an alternate indicator of price trends, was growing more gradually.

Like the rest of the market, the trading volume was weak, but the price action was bullish.

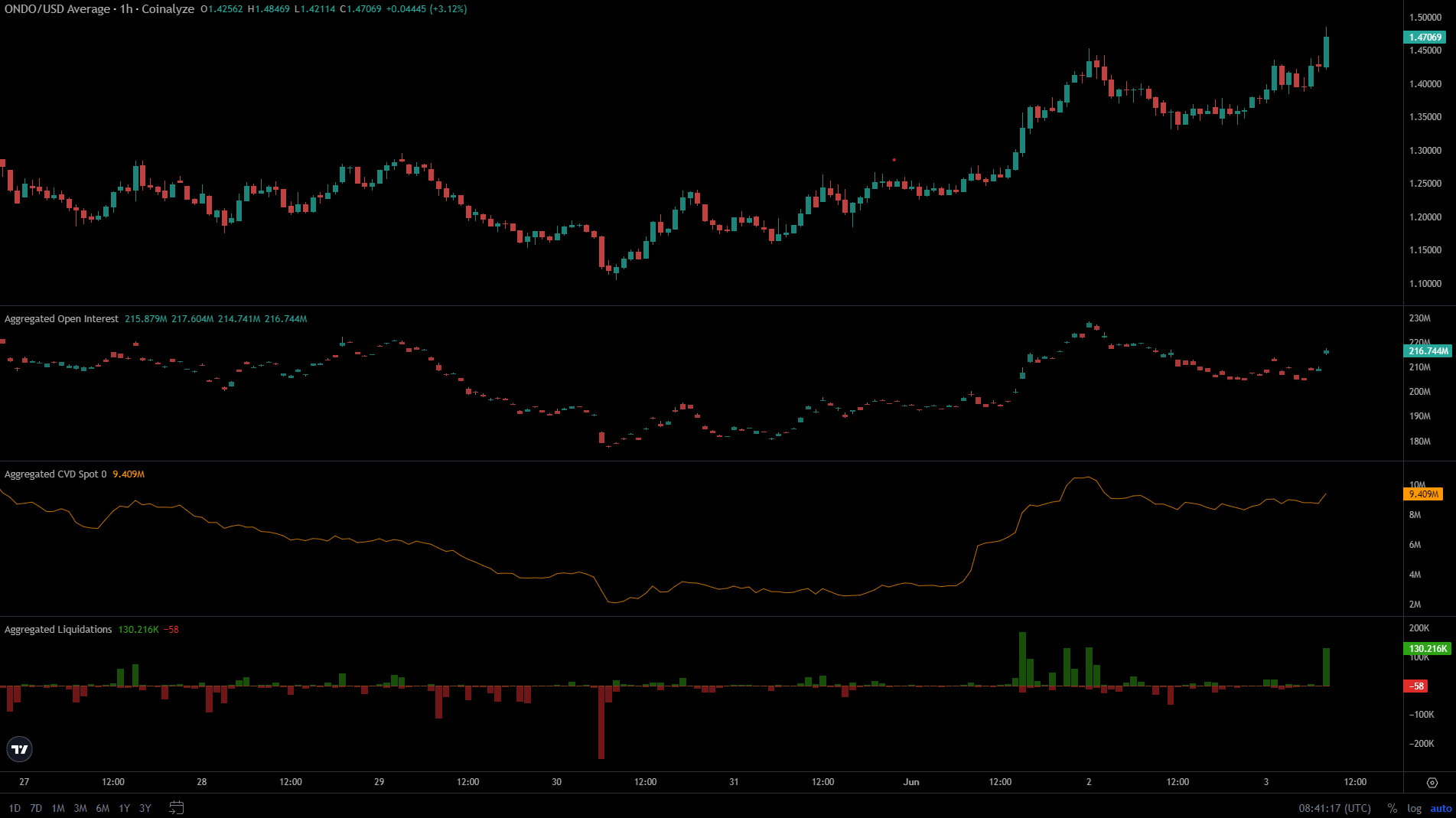

The spot demand and speculative interest were encouraging

The Open Interest, as indicated by Coinalyze’s data, exhibited fluctuations that mirrored ONDO‘s price trends. This observation implies that traders held a positive outlook and were eager to purchase more, contributing to the increasing prices.

Read Ondo’s [ONDO] Price Prediction 2024-25

The spot CVD also maintained its uptrend, although it has slowed down over the past two days.

In simpler terms, the quick sales triggered by the recent price increase contributed to the market purchases. The demand to buy was noticeable in the shorter time periods.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-04 00:07