- PlanB uses the Stock-to-Flow model to predict Bitcoin’s surge to $500,000.

- Recent Bitcoin consolidation near $70,000 sets the stage for a bullish trend, according to PlanB’s analysis.

As a researcher with a background in financial markets and experience following the crypto space closely, I find PlanB’s analysis of Bitcoin’s price trend based on the Stock-to-Flow model intriguing. His prediction of a potential surge to $500,000, backed by historical data and various indicators, is compelling. However, it’s essential to remember that past performance does not guarantee future results in financial markets.

Bitcoin [BTC] remains a focal point of interest, particularly after the latest market stabilizations took place.

Although Bitcoin’s current trading price hovers around $69,000 without much change in the previous week, well-known crypto analyst PlanB has provided intriguing predictions suggesting a potential substantial increase in the future.

Experienced analyst PlanB forecasts a possible price increase for Bitcoin following the most recent halving occasion based on his meticulous prediction skills.

As a seasoned crypto investor, I’ve delved deeply into the market trends using my unique Bitcoin Stock-to-Flow model (S2F) and complementary chart indicators. By drawing comparisons with historical bull cycles, I believe we’re on the brink of an exhilarating new uptrend.

Understanding the S2F model and market cycles

The Stock-to-Flow model, a method for evaluating the relationship between existing supplies and the supply rate of a commodity, suggests that Bitcoin’s price could experience significant growth based on its current stock levels and production flow.

Based on PlanB’s most recent assessment, reaching over $67,000 at the end of the previous month could mark the beginning of a fresh cycle, possibly echoing the price uptrends that followed past Bitcoin halvings.

An analyst’s predictions estimate that Bitcoin could reach an astonishing $500,000 during the next cycle, highlighting the similarities to previous bull markets.

The Bitcoin Market Cycle analysis conducted by PlanB lends credence to this forecast, signaling the beginning of a bull market period.

As a researcher, I would recommend exhibiting patience, as the genuine surge is predicted to start only after a significant and swift rise in prices has taken place.

The RSI readings, similar to those prior to the 2012 stock market surge, further support this early indication of a bullish trend based on their current representation.

As an analyst, I’d like to add my perspective to the optimistic viewpoint. Following the discussion by PlanB, it’s important to note the significant uptrend in Bitcoin’s 200 Week Moving Average (WMA). Historically, this trend has been seen as a potential indicator of an approaching bull market.

As a market analyst, based on my analysis of the aligning market signals and the 200-day moving average (WMA) of Bitcoin’s price chart, I believe we could be on the verge of seeing Bitcoin surpass the $100,000 mark soon.

As a financial analyst, I’ve observed that the Bitcoin Realized Price indicator provides valuable insights into the profitability of past transactions on the blockchain. This indicator aligns well with historical data, suggesting that a significant number of coins were bought at lower prices than their current market value. Given this information, it seems plausible to assume a bullish trend in Bitcoin’s price movement.

According to PlanB’s prediction, Bitcoin’s price won’t dip below $64,000 prior to its projected surge.

Tracing PlanB’s Bitcoin predictions

PlanB is not new to making bold forecasts in the cryptocurrency space.

In 2020, the analyst made precises forecasts that earned him acclaim. Amidst skepticism, market anxiety, and a general atmosphere of fear, uncertainty, and doubt (FUD), he boldly predicted Bitcoin would reach a price of $55,000.

True to his projection, by 2021, Bitcoin not only hit that mark but soared past it.

As a researcher studying financial markets, I must acknowledge that these markets come with an inherent degree of uncertainty. While some predictions made by PlanB have proven accurate, not all of them have materialized as initially anticipated. For example, his long-held belief that Bitcoin would surpass the $100k mark has yet to be realized in full.

Despite his prediction that Bitcoin would reach a certain milestone in 2021, falling short of the $100,000 mark, Bitcoin nonetheless made a notable achievement by exceeding $69,000 for the initial time during that year.

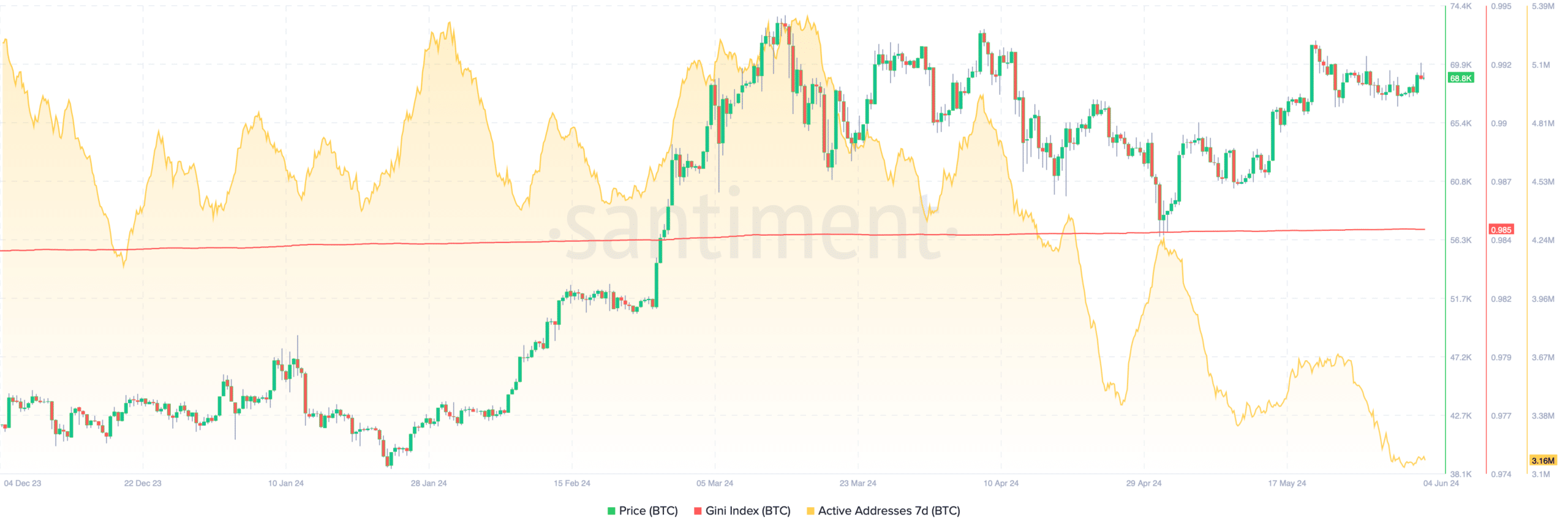

As I revisit my prediction of Bitcoin reaching $100,000, it’s essential to delve into the fundamental aspects of the cryptocurrency market. According to data from Santiment, the number of active Bitcoin addresses over the past week has been on a downtrend. This observation could indicate a potential decrease in market engagement or trading activity.

As a crypto investor, I’ve noticed that the Gini index for Bitcoin is currently at 0.985. This statistic suggests a significant concentration of wealth among Bitcoin holders. Consequently, this level of wealth inequality could potentially influence price fluctuations and trading patterns in the future.

In a more optimistic light, the open interest for Bitcoin derivatives contracts has experienced substantial expansion.

In just the previous day, there was a growth of 1.36% for this metric, resulting in a new total valuation of $35.83 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

As a crypto investor, I’ve noticed an intriguing development in the market. The price of my chosen cryptocurrency has seen a significant upward trend, and interestingly enough, the open interest value has nearly doubled during this timeframe. This data suggests that bullish sentiment is on the rise among traders, increasing the demand for this asset and potentially pushing prices even higher.

In line with the positive perspective, AMBCrypto indicates that Bitcoin has shaped an asymmetrical triangle on its 4-hour chart. This pattern is known to trigger substantial price shifts, possibly pushing Bitcoin up to reach a peak of $74,400.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-04 16:09