- Bitcoin Miner Reserve drops to year-to-date low.

- This suggests an uptick in miner coin sell-offs.

As a seasoned crypto investor with a keen interest in Bitcoin’s (BTC) market dynamics, I find the recent development in Bitcoin Miner Reserve intriguing. The metric’s year-to-date low suggests an increase in miner coin sell-offs, which could potentially impact the market sentiment.

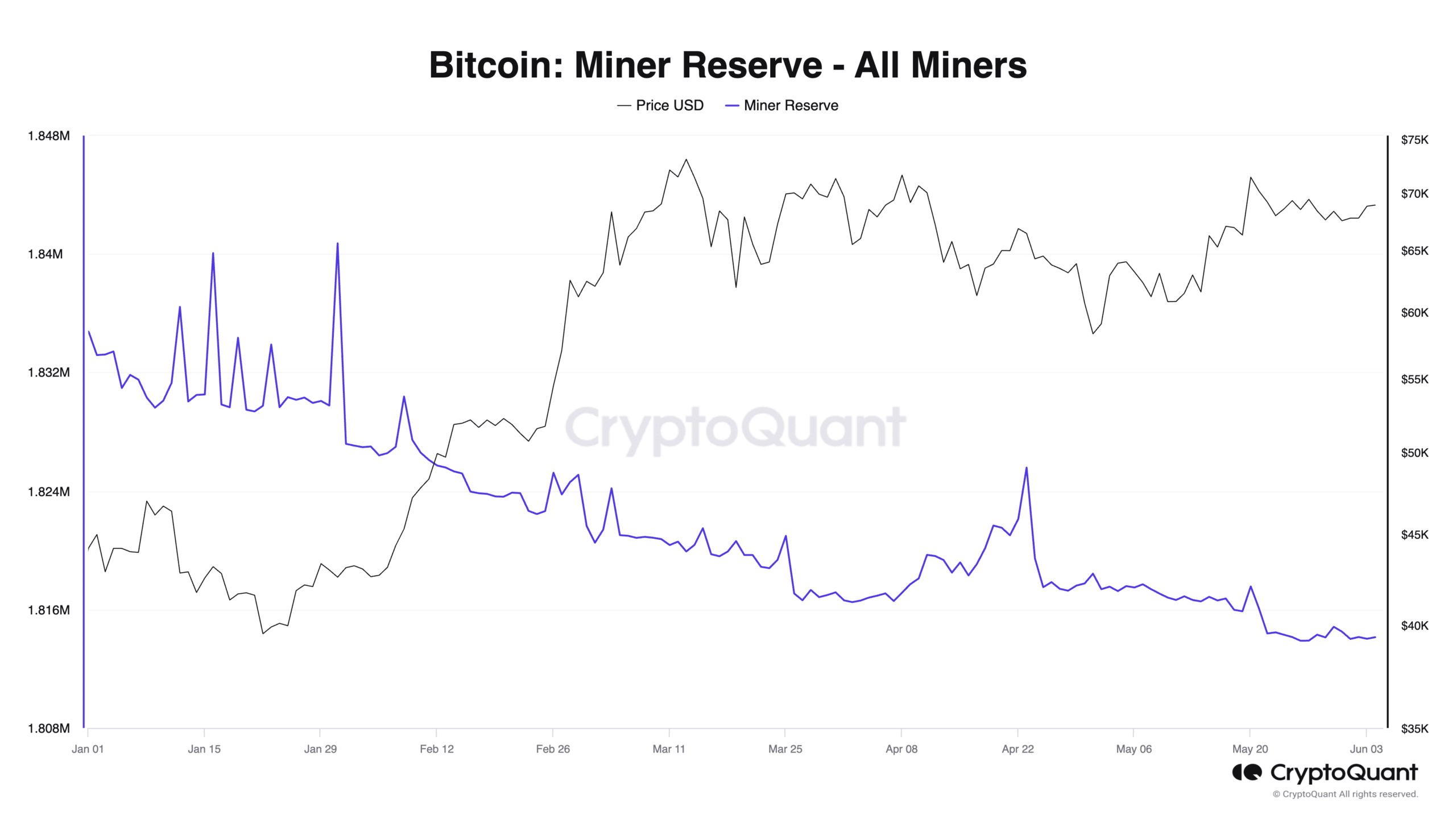

The reserve of Bitcoin miners, as indicated by data from CryptoQuant, has reached its minimum point since the start of the year.

This metric represents the quantity of Bitcoins stored in the digital wallets of affiliated miners. The figure signifies the unspent Bitcoin reserve. Currently, approximately 1.81 million BTC, equivalent to around $125 billion at present market rates, remain unexchanged within miner wallets.

A decrease in the Bitcoin Miner Reserve implies that miners on the Bitcoin network are selling their coins for financial gain or to cover mining expenses.

The data from CryptoQuant indicated that after a prolonged decrease, the Bitcoins held by miners started to increase on April 8th. This upward trend emerged as investors eagerly anticipated the upcoming Bitcoin halving event set for April 19th.

Following the halving in late April, the Bitcoin metric reached a high of 1.82 million BTC on the 23rd. However, this peak marked the beginning of another decline in the metric’s trend. Since then, there has been a decrease of approximately 1% in the amount of BTC held by miners.

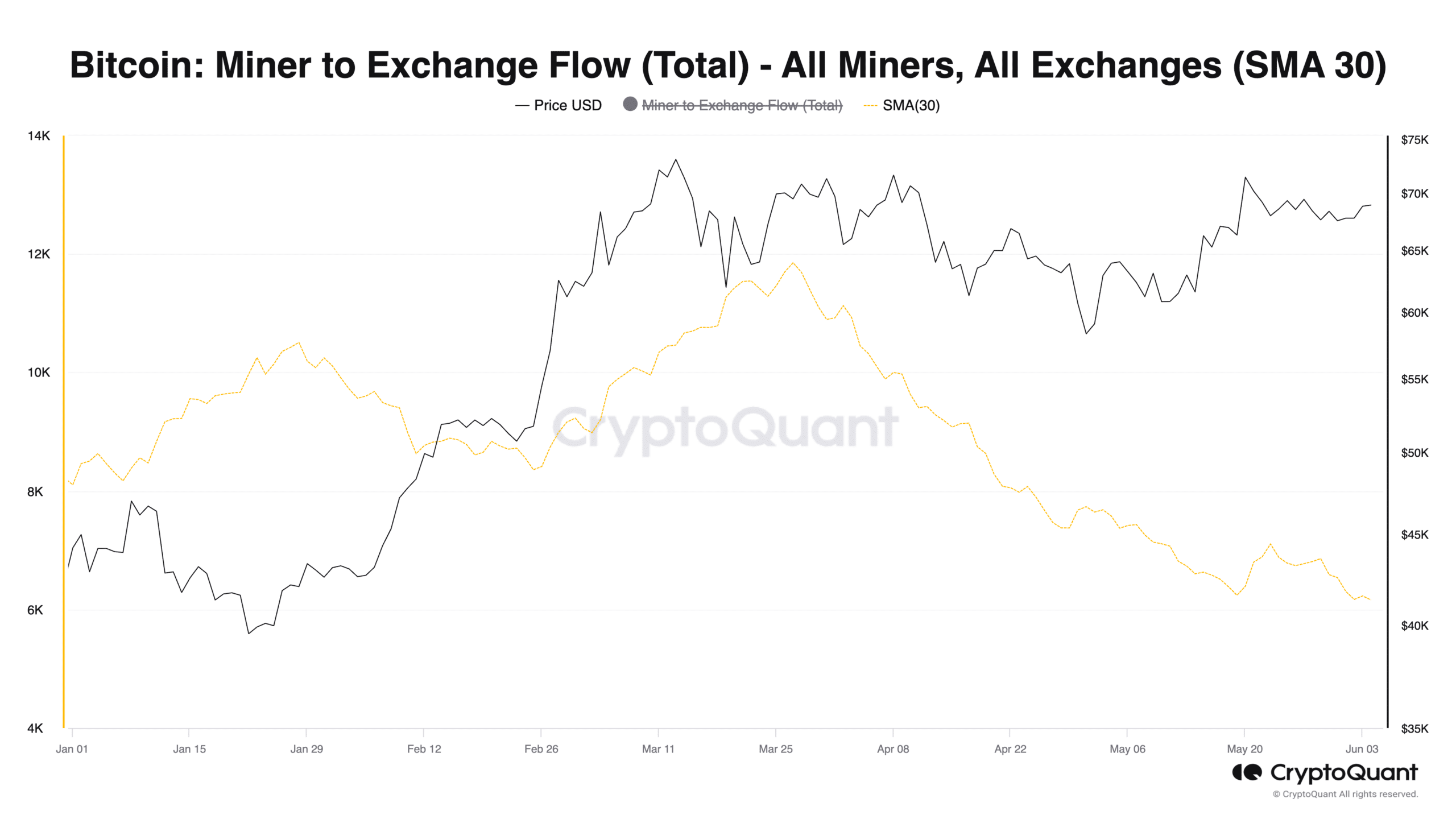

Interestingly, there has been a decline in miner-to-exchange activity in the past three months.

As an analyst examining the data from CryptoQuant, I’ve observed a significant decrease in the amount of Bitcoin (BTC) flowing from miners’ wallets to exchanges over the past 30 days. This downward trend is represented by a 48% decline from the year-to-date high of 11,853 BTC, which was reached on March 27th.

Miners aren’t necessarily the ones publicly selling their Bitcoins on exchanges. Instead, they could be disposing of their coins through private Over-the-Counter (OTC) deals.

They may be involved in over-the-counter transactions, where they transact business with buyers outside of established marketplaces or exchanges.

Bitcoin bulls and bears slug it out

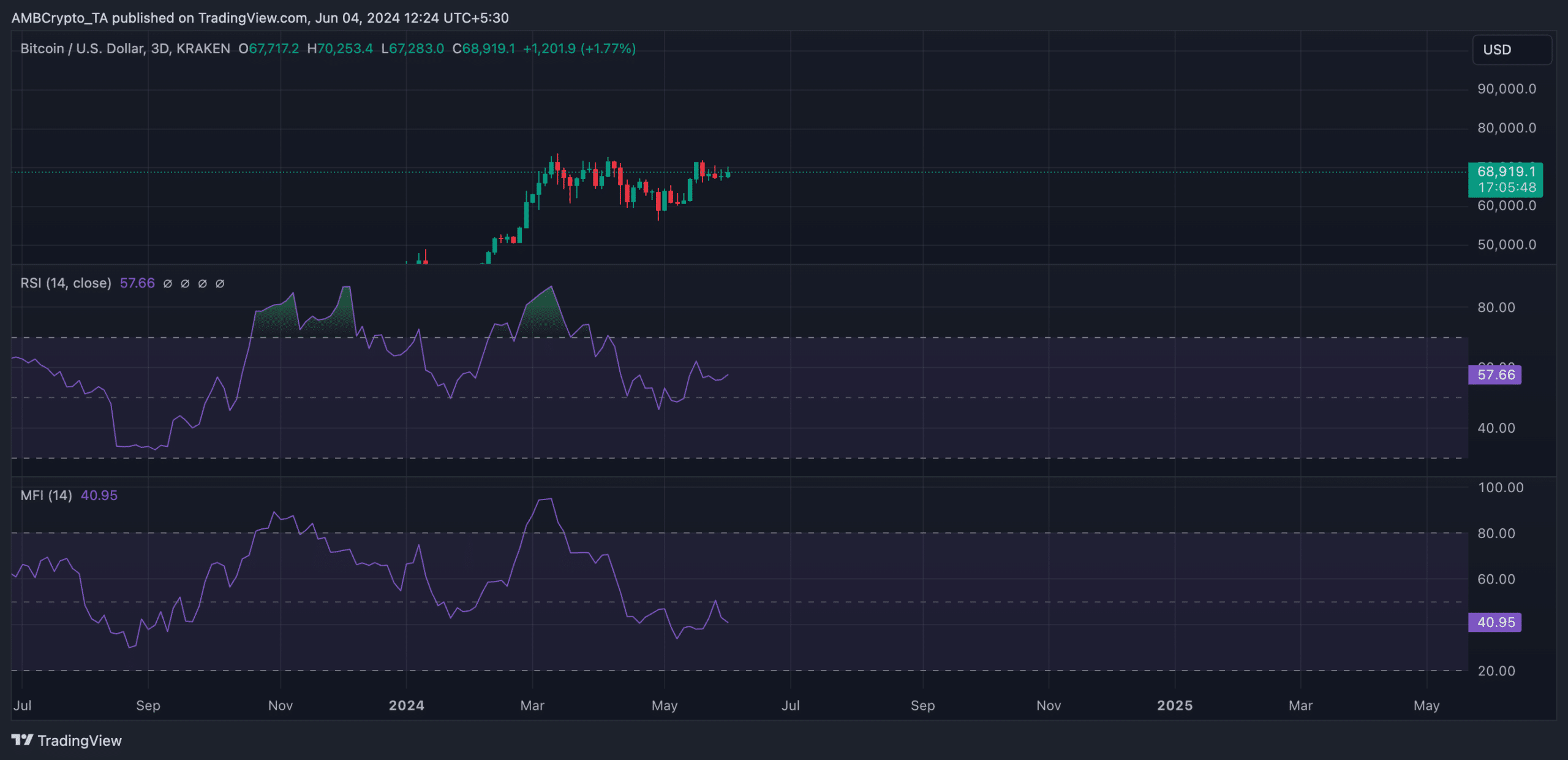

Based on information from CoinMarketCap, Bitcoin was traded at approximately $68,988 when checked. However, Bitcoin has encountered notable resistance around the $70,000 mark.

As a researcher analyzing the three-day performance of a coin, I found that its Relative Strength Index (RSI) stood at 57.72, while its Money Flow Index (MFI) was recorded at 40.95.

Is your portfolio green? Check the Bitcoin Profit Calculator

The analysis of these crucial momentum indicators revealed a complex market scenario. On one hand, there was a significant increase in purchasing power, indicating a surge in buying activity. Conversely, selling pressure was also quite prominent, suggesting active participation from sellers.

As a researcher studying the Bitcoin market, I believe that for the price to surge above $70,000, there must be a significant boost in demand from buyers that outweighs the selling pressure from profit takers.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-05 03:03