-

Bitcoin speculators were reluctant to bid, based on the Open Interest stagnation.

Funding rates were only slightly positive, and BTC might not be ready to rally.

As an experienced market analyst, I’ve seen my fair share of market trends and fluctuations. Based on the current data and trends, it appears that Bitcoin speculators are hesitant, and the market is showing signs of being lethargic.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin (BTC) has managed to hold its ground above the crucial support level of $67,000. This defense of last week’s gains gives optimistic signs for bullish investors. Currently, the price hovers around $68,900. The resistance levels to watch out for lie at $71,400 and $71,600.

As a crypto investor, I’ve noticed that the trading volume has taken a significant dip, putting pressure on the bullish trend. On the bright side, short-term holders have seen their profits increase during this period. Moreover, the coin days destroyed metric has experienced a noticeable surge recently, which could potentially lead to heightened volatility in Bitcoin’s price.

Assessing the speculator sentiment

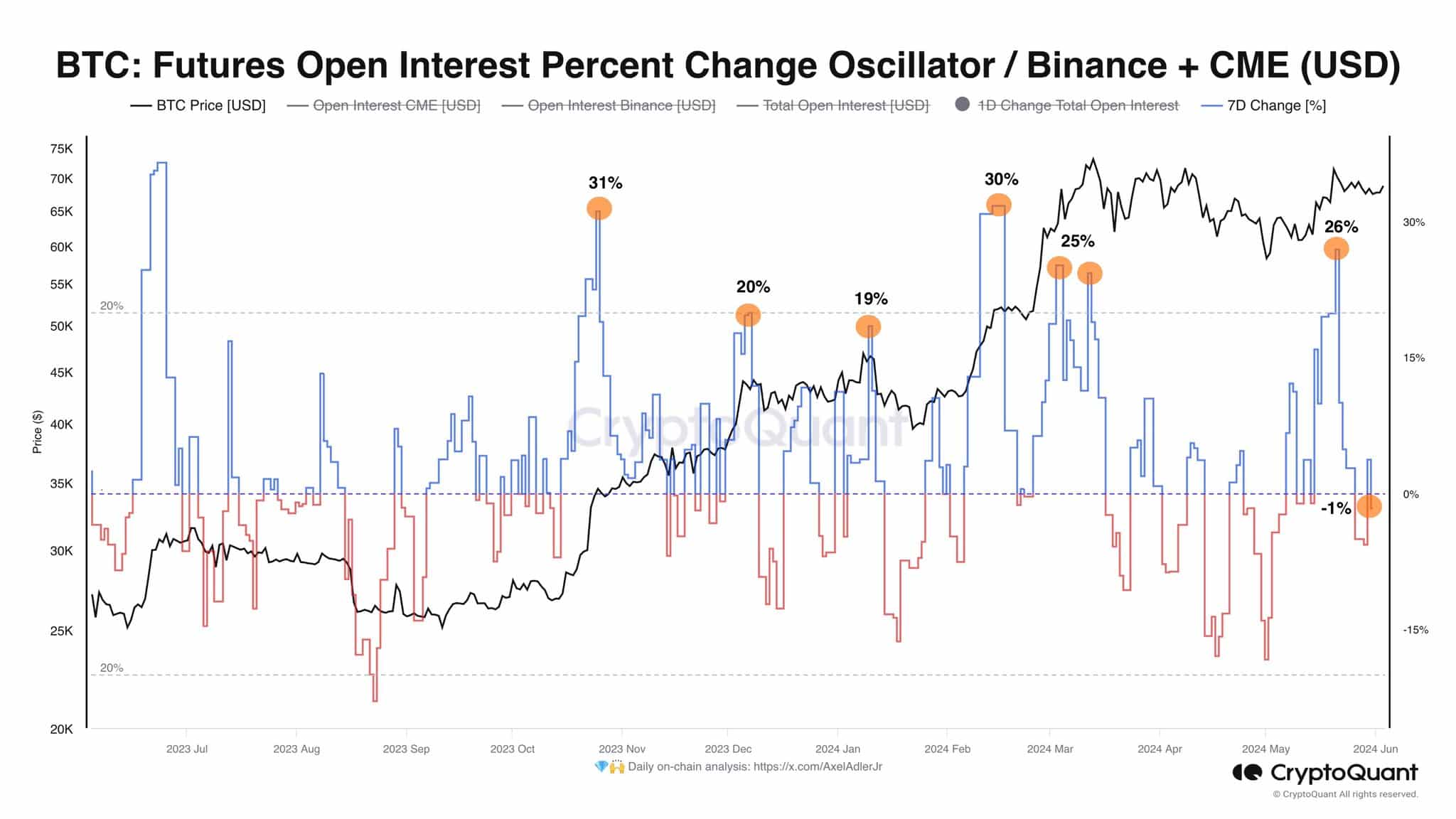

As a crypto investor, I’ve noticed an intriguing observation made by analyst Axel Adler in a recent post on X (previously known as Twitter). Despite Bitcoin surpassing the resistance level of $67,000 and showing signs of advancing further, the weekly change in Open Interest remained neutral at -1%.

Over the past week, there was a notable absence of market speculation, suggesting that most traders had adopted a wait-and-see approach. They seemed hesitant to take positions based on price fluctuations and showed little confidence in bullish trends. Consequently, Bitcoin could potentially form a temporary trading range around $67,000 to $71,500.

The analyst also reflected that this would need to change for Bitcoin to embark on its next trend.

The lack of bull dominance pointed toward a lethargic market

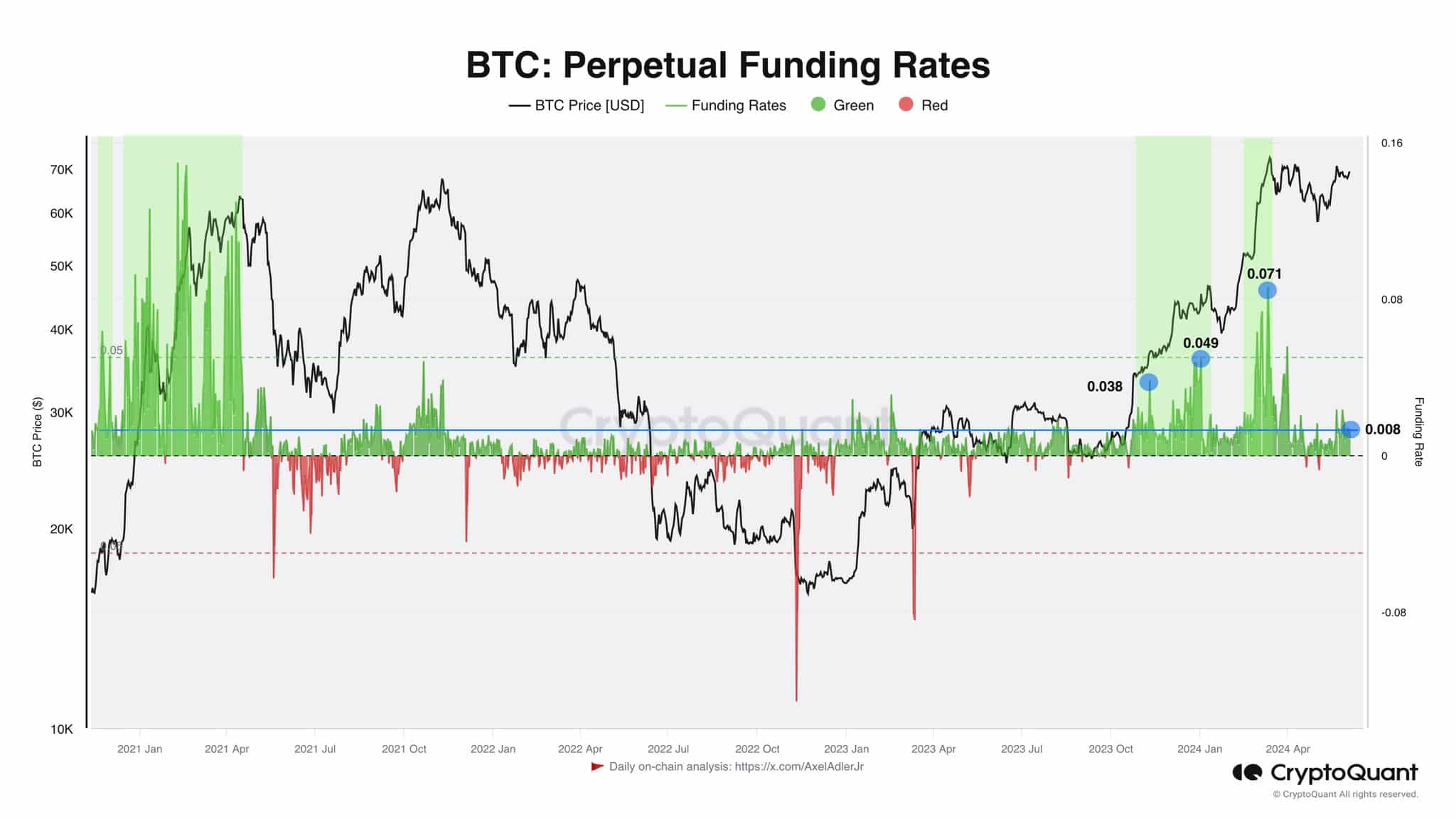

Previously, an analysis revealed that significant price escalations were followed by heightened funding rate peaks. Towards the end of 2020 and the beginning of 2021, the remarkable surge from $20,000 was marked by extended periods where funding rates touched +0.15.

Since October 2023, the rally has led the funding rate to surge past the 0.03 threshold. At present, though, it stands at 0.008.

Is your portfolio green? Check the Bitcoin Profit Calculator

The data indicated a weak commitment to buying among investors. In conjunction with the decline in Bitcoin’s weekly trading activity, it appeared that the cryptocurrency was not yet prepared to surpass the $72,000 mark.

Investors and traders need to be prepared for more rangebound price action in the coming weeks.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-05 06:15