-

Solana has a strongly bullish market structure and $200 was highly likely.

There is one factor that needs to change before SOL can embark on a rally.

As a researcher with extensive experience in cryptocurrency market analysis, I’ve closely observed Solana (SOL) and its recent price movements. Based on my observation, Solana has a strongly bullish market structure, and $200 was highly likely. However, there is one crucial factor that needs to change before SOL can embark on a significant rally.

Recently, the Solana [SOL] blockchain experienced a spike in network usage and trading value, outpacing Ethereum [ETH] within a 24-hour timeframe.

As a researcher studying blockchain trends, I’ve observed some intriguing developments regarding active wallet usage over the past week. Specifically, there has been a noticeable uptick in the number of active wallets on the Solana network. Conversely, Ethereum’s active wallet count has seen a decrease during this same timeframe.

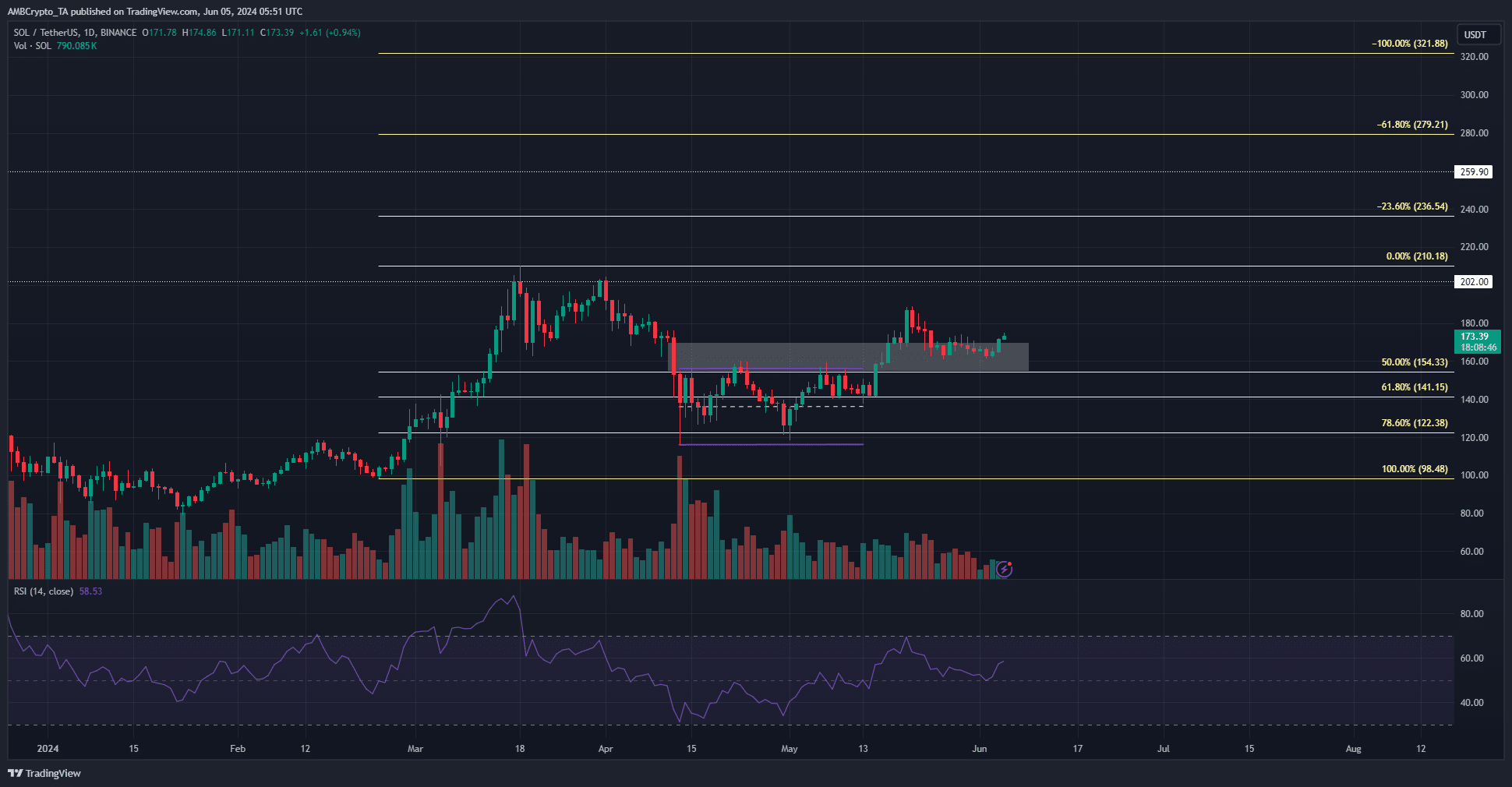

In the price chart, Solana exhibits a robustly bullish market pattern. According to Solana price forecasts, reaching $200 is a feasible goal. However, it’s intriguing to ponder how far the subsequent surge may escalate.

Exploring the Fibonacci extension levels

On the 16th of May, the price of Solana (represented by purple on the chart) surpassed its previous range, resulting in a significant increase to reach $188.9. However, following this upward trend, it retreated and reapproached the $160 level as potential support.

The Fibonacci retracement levels (pale yellow) showed how bullish the Solana price prediction is.

As a crypto investor, I’ve noticed that the trading volume has taken a dip over the last fortnight, likely as a result of the recent market correction. However, for the bullish trend to regain momentum and solidify our optimistic outlook, we need to see a significant surge in trading activity.

On the larger time scales, after the 78.6% Fibonacci retreatment level at $122 was successfully held, the price action has turned bullish and the next objective lies at $210.

Additionally, the $236 and $279 price points could serve as profitable exit points. Over the previous three weeks, the Relative Strength Index (RSI) on the daily chart persistently stayed above 50, implying a persistent uptrend.

The short-term sentiment was intensely bullish

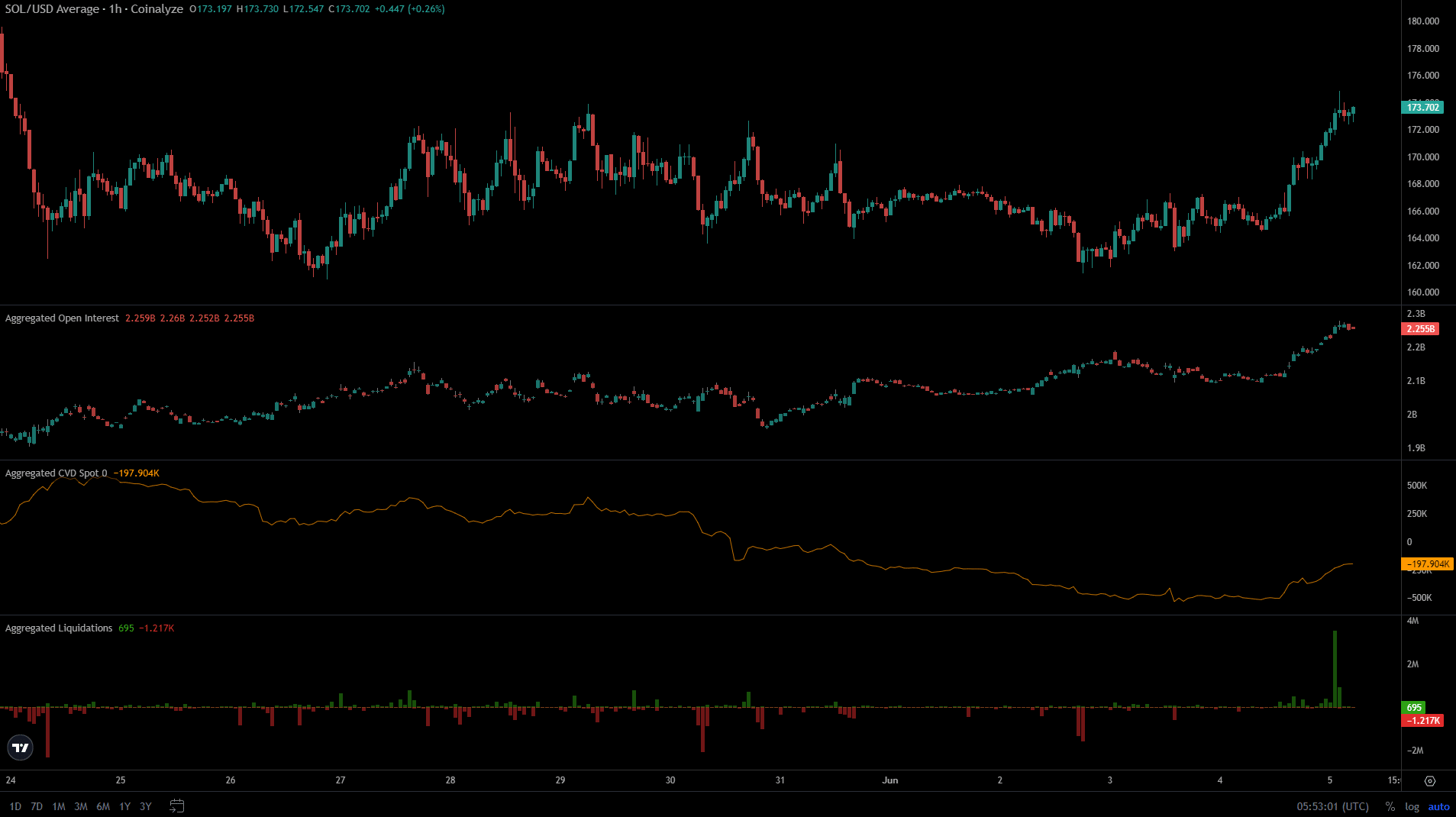

On June 2nd, Open Interest increased from $2.1 billion to $2.2 billion, but the price of SOL decreased from $168 to $162. This indicated a bearish attitude and an uptick in short selling. However, this trend reversed on June 4th.

Read Solana’s [SOL] Price Prediction 2024-25

Over the last 24 hours, there’s been a noticeable uptrend in the Open Interest (OI) and the market price, indicating a bullish outlook. Furthermore, the spot Cost-Value Differential (CVD) has turned around its previous downtrend, suggesting increased demand in the spot markets.

The move above the $170 resistance also liquidated short positions, fueling further gains.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-05 19:03