-

NEAR, RNDR and TAO prices have climbed in the past 24 hours.

However, these tokens may be unable to maintain this trend.

As a researcher with extensive experience in analyzing cryptocurrency markets, I’ve closely monitored the recent surge in AI and big data-based tokens like Near (NEAR), Render (RNDR), and Bittensor (TAO). While their prices have climbed significantly over the past 24 hours, driven by Bitcoin’s [BTC] rally above $71,000, I remain cautious about their ability to maintain this trend.

The AI token market has gained momentum after Bitcoin‘s [BTC] price climbed past the $71,000 mark.

In the last 24 hours, the total value of all AI tokens in the market has risen by 5%. Additionally, there has been a significant surge in trading activity, with a 20% increase in volume, based on data from CoinMarketCap.

In the last 24 hours, the value of select cryptocurrencies with a strong focus on AI and big data, such as Near (NEAR), Render (RNDR), and Bittensor (TAO), have experienced growth. Specifically, NEAR has seen an increase of 8%, RNDR has risen by 5%, while TAO has gained 7%.

No clear sign of a continued rally

The analysis of a token’s crucial momentum indicators, which reflect buying and selling trends, suggested that the price surge did not stem from genuine market demand.

It merely mirrors the uptick in the general cryptocurrency market in the past 24 hours.

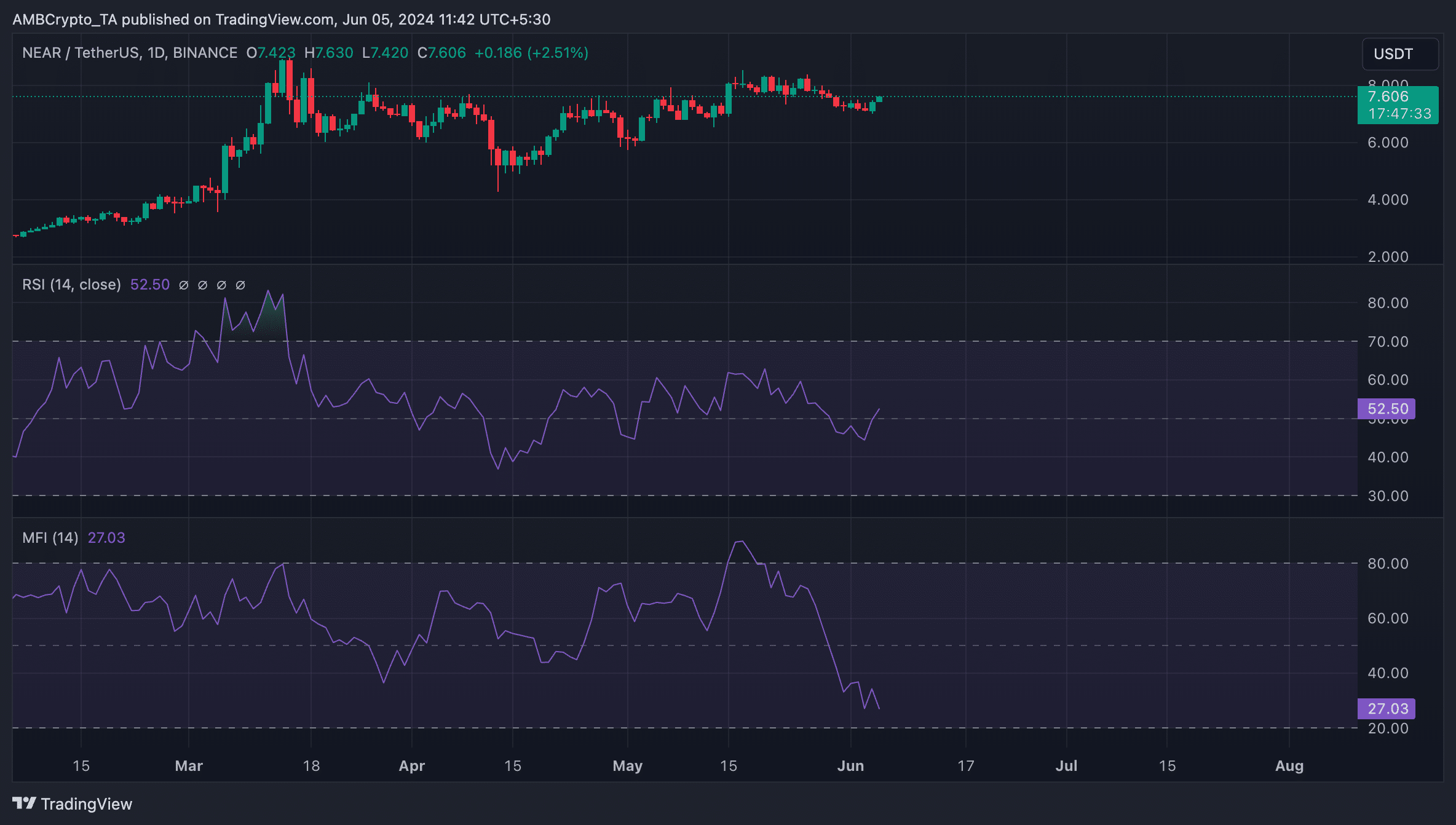

The RSI value for NEAR stood at 52.29, whereas the MFI reading was 26.96.

As a crypto investor, I’ve noticed an intriguing development in the momentum indicators for the NEAR market. While the overall market sentiment hovers around neutrality, there’s been a significant shift in capital flow. My analysis reveals that investors have been pulling out substantial funds from the NEAR market.

This implies that the altcoin may experience a reversal of its latest price increases, as demand for selling grows stronger.

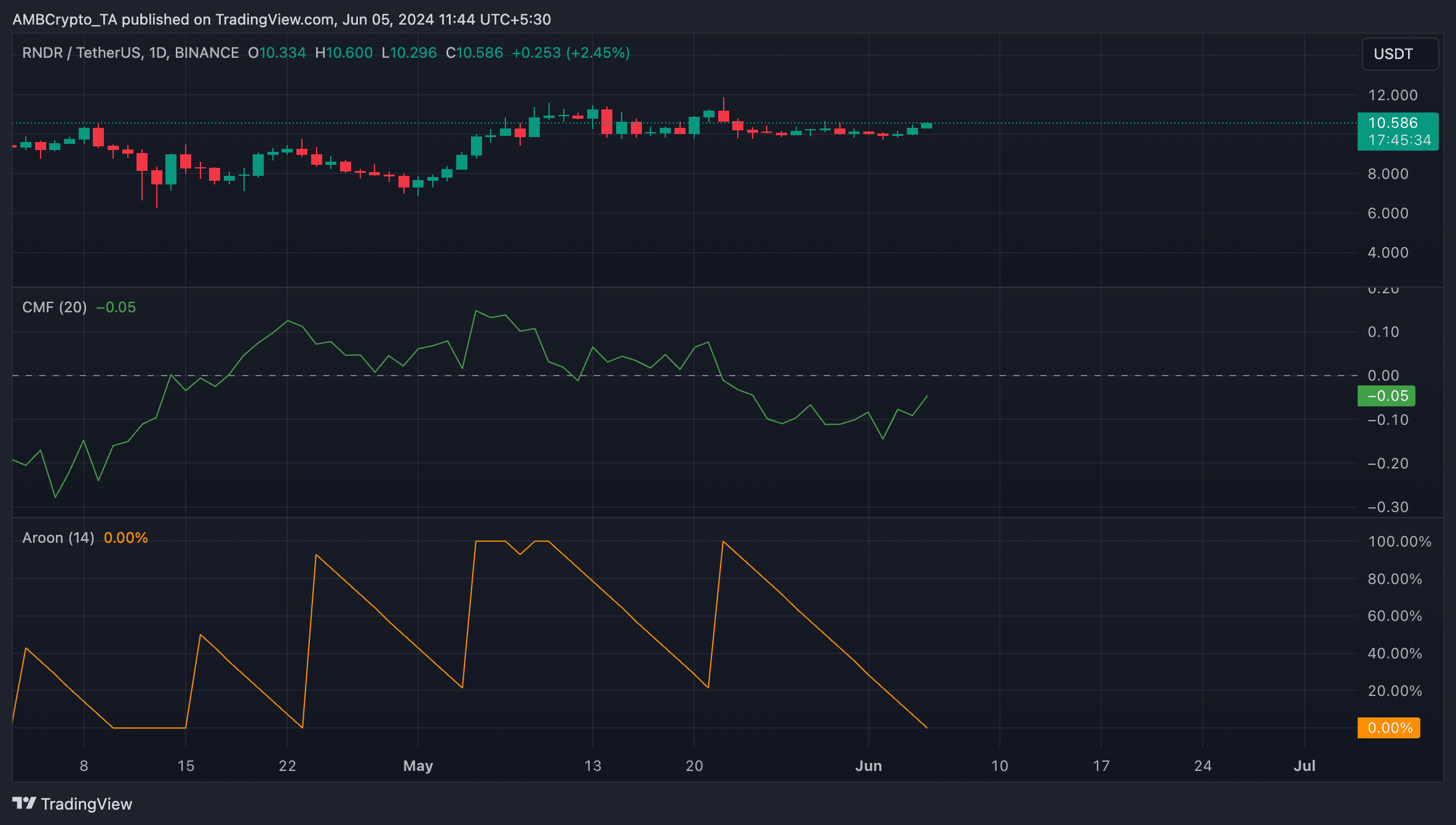

Concerning RNDR, the Chaikin Money Flow (CMF) has been observed falling beneath the zero threshold at present. This technical analysis tool measures the net money inflow and outflow in an asset’s market.

The CMF (Composite Moving Average) of RNDR currently stands at a value of -0.05. This signifies market weakness as it falls below the zero line. It implies an increase in selling pressure, which may lead to capital outflow and potential price decrease.

The Aroon Up Line of RNDR, represented by the orange line, showed no advancement, indicating a waning uptrend based on the Aroon Indicator’s assessment of trend strength and potential turning points for an asset.

If the Aroon Up Line hovers near zero, it indicates that an ongoing market trend is considered feeble, with the latest peak having been achieved quite some time in the past.

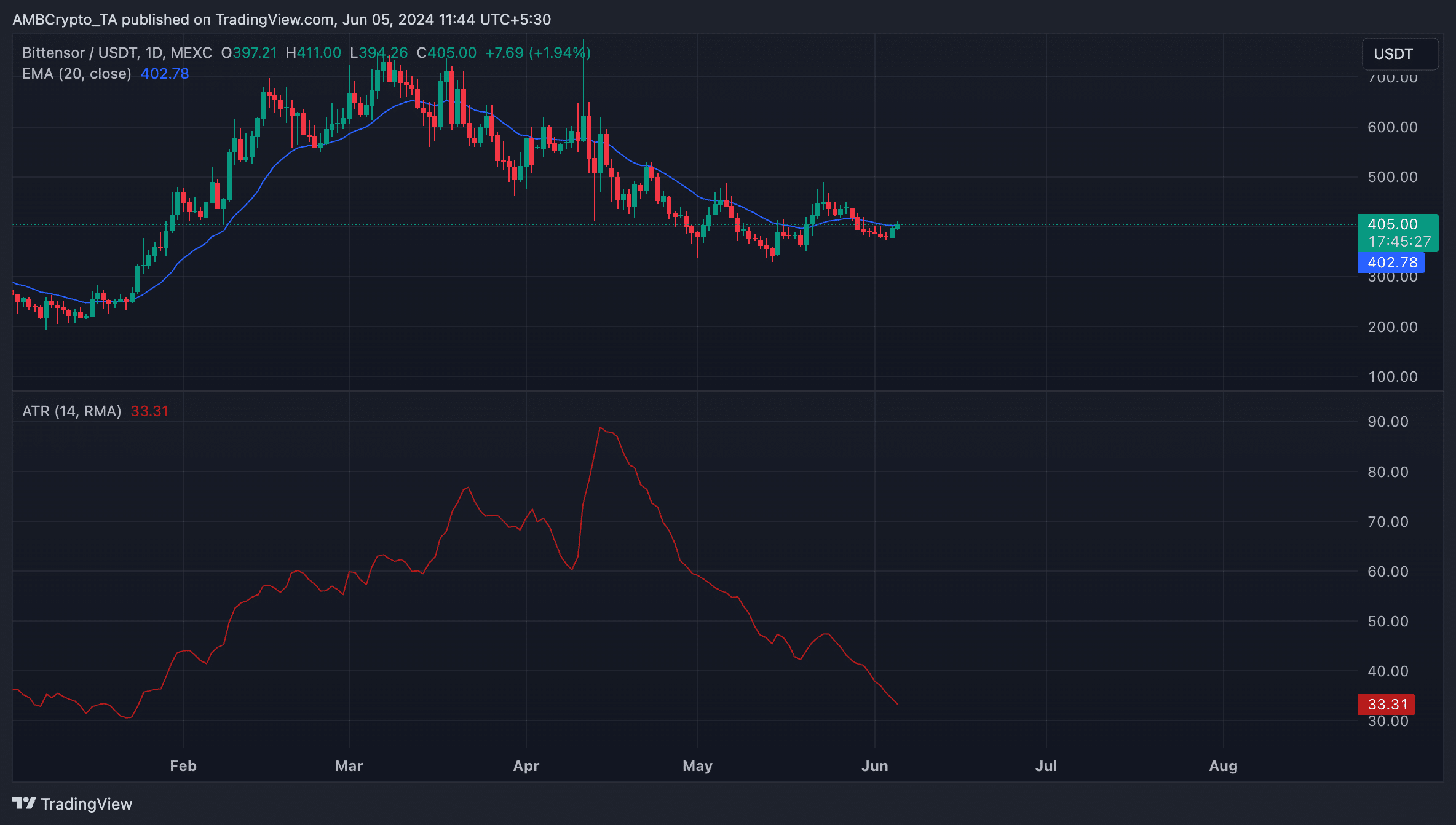

As a researcher analyzing TAO‘s stock price, I’ve found that its current trading value is relatively similar to its 20-day EMA. In simpler terms, the difference in performance between TAO and its recent average price trend isn’t significant at the moment.

When the price of an asset hovers around its significant moving average, the market experiences consolidation as the value remains within a narrow price range.

The Average True Range of TAO indicated decreasing market volatility, as confirmed by this observation.

When it declines this way, it suggests a period of indecision or consolidation in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-06-06 04:07