-

The crypto market capitalization has increased slightly in the last 24 hours.

BTC and ETH’s price increase contributed to the increase in the market cap.

As a seasoned crypto investor, I have witnessed the market’s ups and downs over the past few years. I closely monitor the trends and price movements of major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

I’ve noticed an uptick in the total value of the crypto market lately, with a significant portion of this growth attributable to Bitcoin (BTC) and Ethereum (ETH) leading the charge. These two heavyweights have been instrumental in shaping the market’s trajectory recently.

Additionally, both assets have been experiencing significant accumulation volume recently.

Bitcoin, Ethereum contribute to market increase

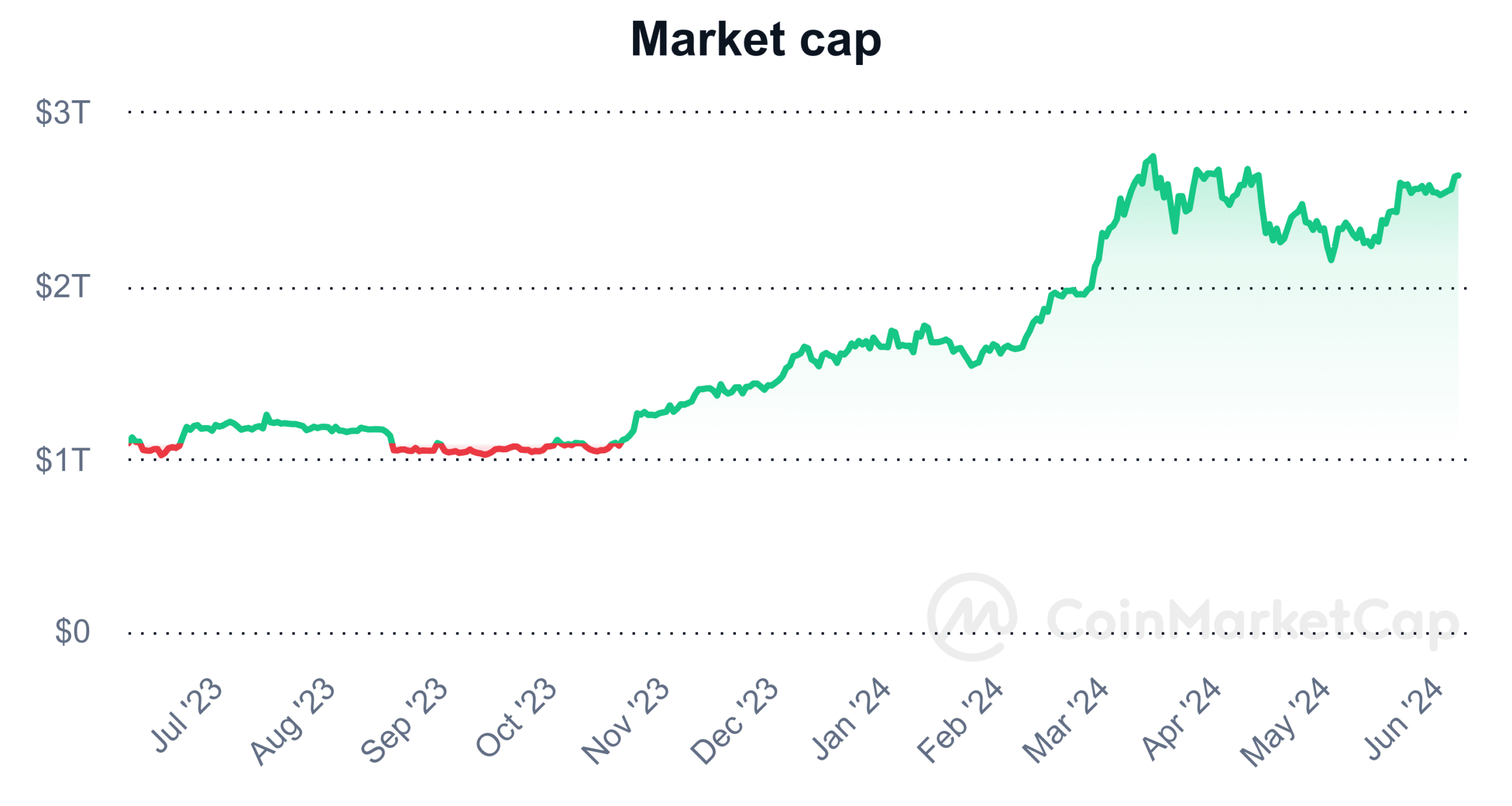

As a crypto investor, I’ve noticed an impressive 1% growth in the total value of all cryptocurrencies based on data from CoinMarketCap over the past day.

At present, the total value of all cryptocurrencies in the market exceeds $2.6 trillion. Bitcoin, being the largest player, represents more than half of this amount, with a value of approximately $1.4 trillion. Ethereum holds the second largest share, accounting for almost 18%, and is valued at around $463 billion.

As an analyst, I discovered that the market capitalization had grown by nearly a thousand billion dollars between the close of last month and the present moment.

By the end of May, the market cap had reached roughly $1.54 trillion. At present, it hovers around $2.54 trillion, signifying a significant gain of almost $1 trillion.

Bitcoin, Ethereum see increased accumulation

Based on recent data, there has been a significant uptick in the hoarding of Bitcoin and Ethereum during the last several days. This stockpiling aligns with noteworthy price fluctuations, which in turn have bolstered the total value of both markets.

Based on information from CryptoQuant, there has been a rise in the number of Bitcoin wallets containing between 1,000 and 10,000 coins.

As a seasoned crypto investor, I’ve noticed an intriguing development. The combined total of my Bitcoin wallets currently holds approximately 3.6 million coins. This significant accumulation underscores the confidence in Bitcoin’s long-term potential, even amidst recent market volatility.

After a more detailed examination, it was found that this pattern has persisted since March. Furthermore, approximately 40% of the entire Bitcoin stockpile is currently held in wallets containing 1,000 BTC or more.

As an analyst, I’ve observed a noteworthy trend in Ethereum’s market data. Specifically, there has been a significant uptick in the amount of Ethereum being amassed by larger wallets or addresses. This could be indicative of institutional investors or high net worth individuals increasing their holdings in Ethereum.

The graph shows an increasing amount of Ethereum being amassed by wallets containing between 10,000 and 100,000 ETH. These wallets now hold approximately 340,000 ETH, equivalent to over $1.3 billion in value.

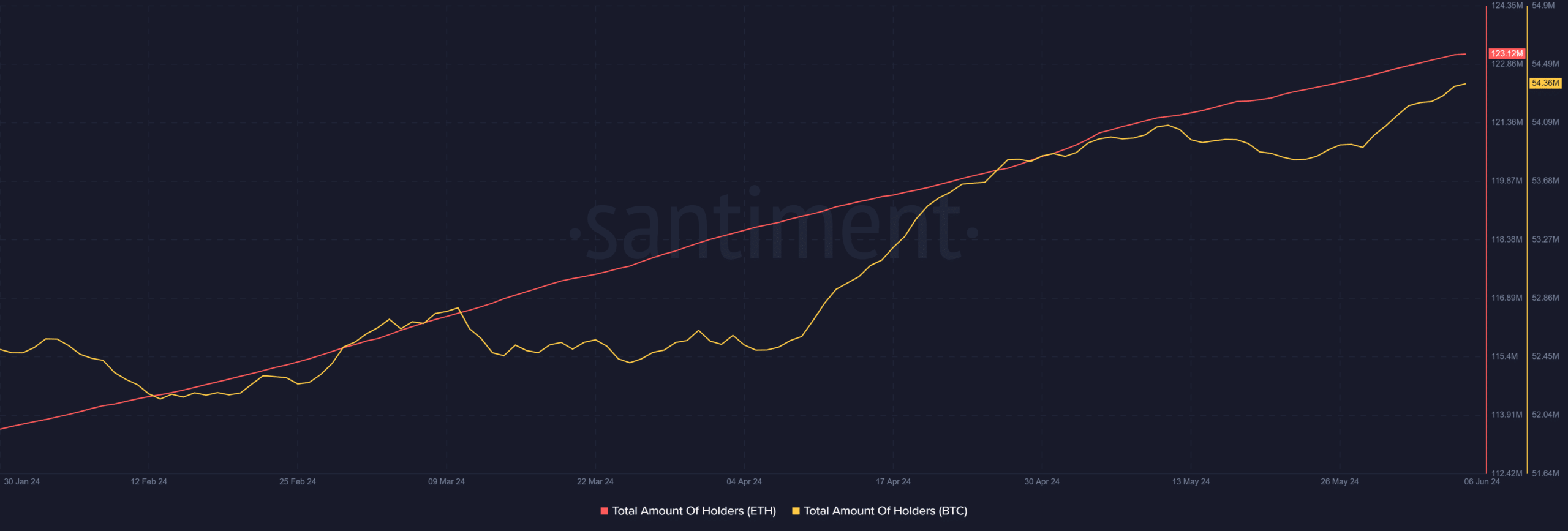

Ethereum sees more holders than Bitcoin

As a researcher studying the cryptocurrency market, I’ve observed an uptick in accumulation for both Bitcoin and Ethereum. However, it’s important to note that at present, Ethereum boasts a larger number of holders than Bitcoin.

As a crypto investor, I’ve noticed an intriguing trend based on data from Santiment. The community of Ethereum holders has experienced significant growth over the past few years, swelling to almost 123 million strong. In comparison, there are roughly 54.2 million Bitcoin holders as of now.

The count of Ethereum owners exceeds that of Bitcoin owners by a significant margin, possibly due to Ethereum’s relatively lower barrier to entry in terms of acquisition cost.

Currently, Bitcoin’s value has increased again, with predictions of further rises in the future.

As a crypto investor, I believe this price surge could draw the attention of more traders towards assets other than Bitcoin, such as Ethereum and its peers. Consequently, their prices might be influenced by this heightened interest.

How ETH, BTC have trended in the last 24 hours

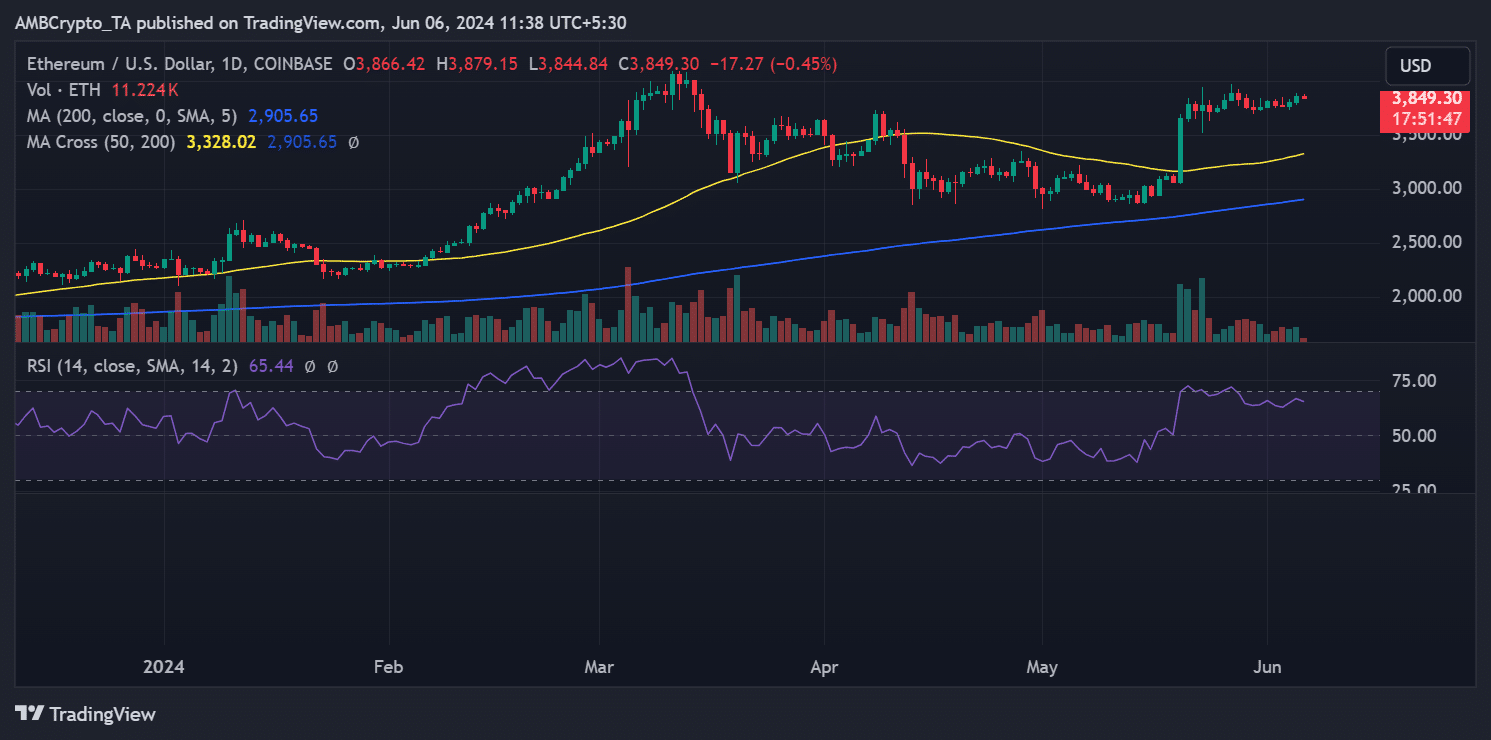

I noticed an uptick in Ethereum’s price based on AMBCrypto’s daily analysis on the 5th of June. This positive trend resulted in a 1.48% gain, pushing the cryptocurrency’s value up to approximately $3,866.

I’ve observed that Ethereum has persisted in its current price bracket despite facing some challenges recently. At present, its value remains around $3,800, registering a minimal decrease of approximately 0.6%.

An examination of Ethereum’s Relative Strength Index (RSI) reveals that the cryptocurrency is currently experiencing a robust uptrend, with an RSI value exceeding 65 at present.

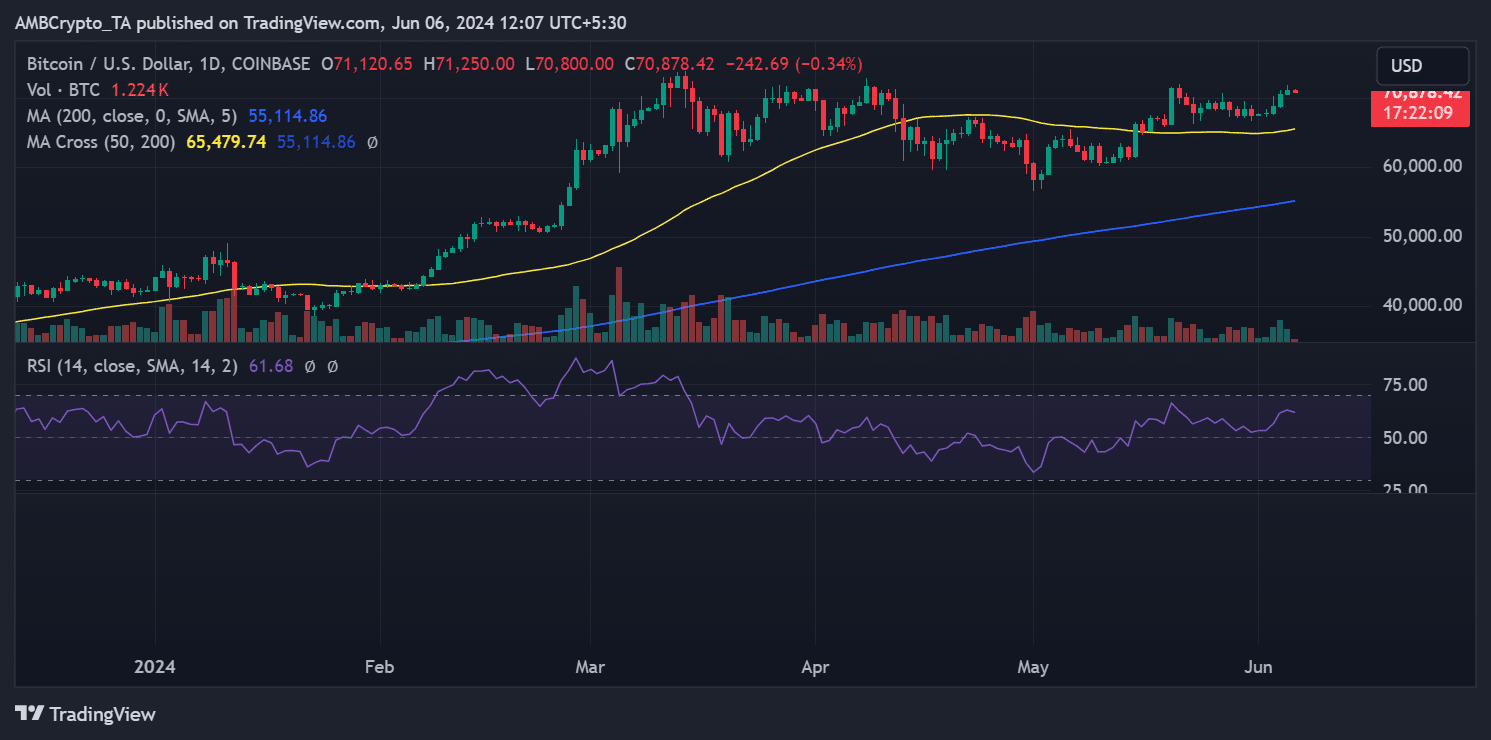

As a researcher examining Bitcoin’s price trend, I discovered that it experienced noteworthy surges in the past several days. The graphical representation revealed an uninterrupted five-day ascendancy, propelling its value from approximately $67,700 to above $71,000.

Read Bitcoin (BTC) Price Prediction 2024-25

As of June 5th’s market close, Bitcoin was valued around $71,121, representing nearly a 1% rise. Currently, its price hovers in the $70,000 area, showing a minimal decrease of less than 1%.

As a market analyst, I’ve been closely monitoring Bitcoin’s (BTC) price action and based on its Relative Strength Index (RSI), the cryptocurrency has remained in an uptrend despite the recent decline in prices. At present, BTC’s RSI stands above the 60 threshold, indicating that it is still overbought and potentially primed for a pullback or consolidation. However, the persistent bullish signal from the RSI suggests that the overall trend remains positive.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-06 15:04