As a researcher exploring the dynamic world of trading, I’ve observed an influx of trading methods in recent times. Some are tailored for newcomers, while others cater to seasoned traders. Financial instruments known as Contracts for Difference (CFDs) have garnered significant attention due to their accessibility and relevance, especially in the volatile crypto market. These financial products enable traders to make predictions about asset price changes without having to own the underlying assets outright. The extreme volatility and abundance of opportunities in the cryptocurrency sector have made CFDs an attractive choice for speculating on future price movements of virtual currencies – be it upward trends or downward corrections.

In this article, we provide a comprehensive walkthrough on the art of CFD trading. We’ll delve into the vital aspects of the subject, including selecting a reliable CFD broker, understanding the advantages of crypto CFDs, and employing effective risk management strategies for the volatile cryptocurrency market. Expect clear, precise information about crypto CFD trading, the characteristics of leading cryptocurrency CFD platforms, and the steps required to establish and manage a successful CFD trading account.

Key Takeaways:

- With the help of crypto CFDs, traders may predict market trends and profit from increasing and falling prices without holding the underlying assets.

- Understanding the trading platform, controlling risk with tools like leverage and stop losses, and regularly modifying strategies based on market research are all necessary for effective CFD trading.

- Analysis and advanced trading strategies are used to profit from short—and long-term market changes.

How to Define CFD Trading

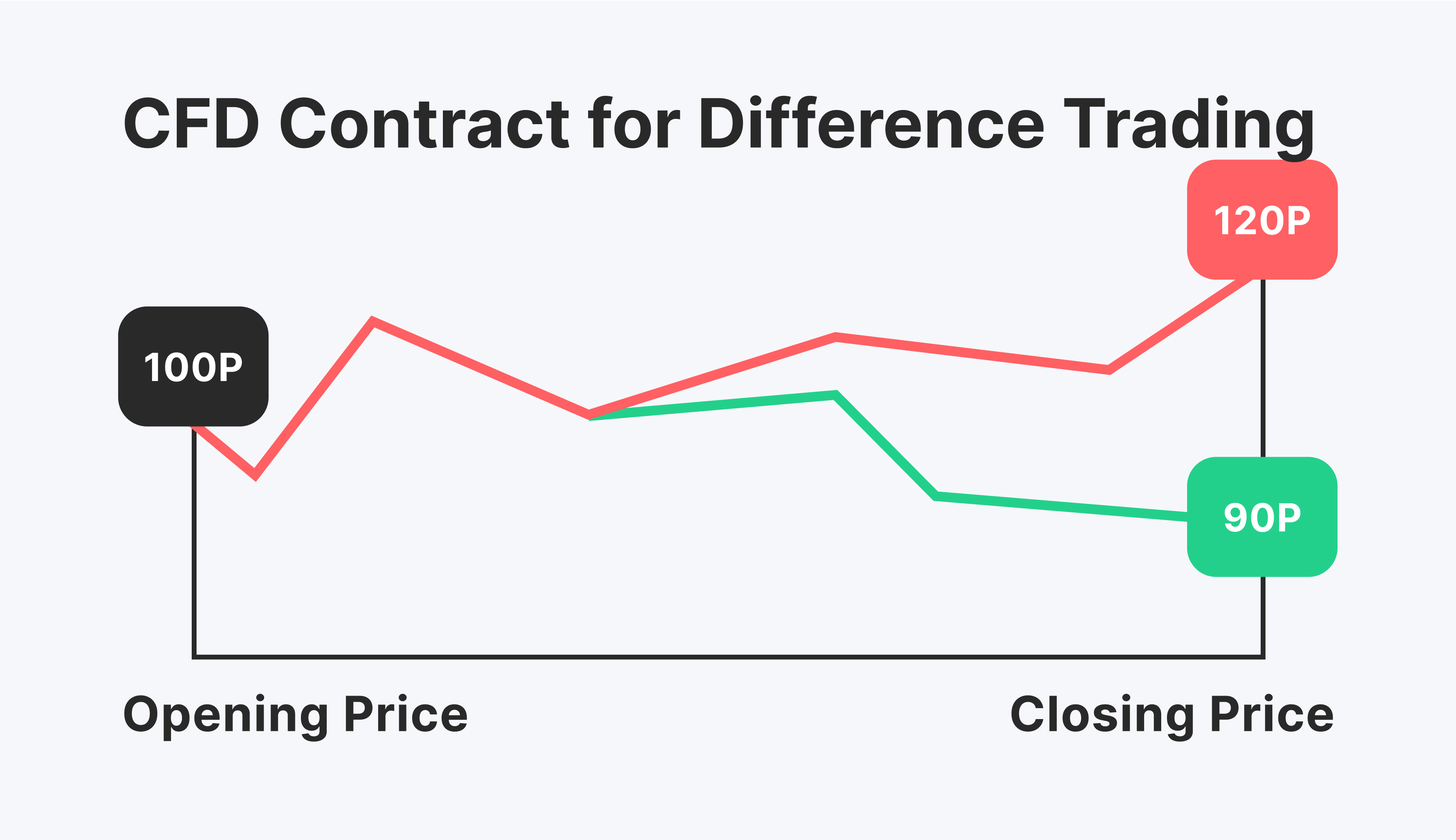

CFDs on cryptocurrencies represent contracts between traders and brokers where they wager on the price change of a specific digital currency between the contract’s initiation and expiration dates. Unlike direct crypto trading, where the trader owns the actual digital asset, in crypto CFD trading, the trader does not take possession of the cryptocurrency itself.

As a CFD analyst, I can tell you that collaborating with a CFD broker is essential for engaging in cryptocurrency trading. You’ll have two primary options as a trader: placing a “long” position to wager on the price increase or taking a “short” position to bet on the decline of a specific cryptocurrency. The ability to speculate on both rising and falling markets is a significant advantage for traders in the cryptocurrency CFD market.

As a researcher studying the world of CFD trading, I’ve come to realize that this type of trading is entirely based on speculation and relies heavily on price fluctuations. Unlike traditional trading where assets are physically exchanged, CFD trading only involves entering into a contract with a broker that represents an agreement to pay or receive the difference in the value of an asset at a specific point in time.

Brokers serve an indispensable function by granting users entry to trading platforms, offering leverage choices, and providing essential resources for effective risk control. All trading activities take place on the platform, where users can initiate, modify, and conclude positions. These systems come equipped with features to manage digital assets, monitor price fluctuations, and execute technical analysis – all vital for making astute trading judgments.

To effectively trade cryptocurrency Contracts for Difference (CFDs), it’s essential to have a solid grasp of the fundamental aspects of CFD trading and how crypto CFD platforms function.

Difference Between Trading Cryptocurrency and Cryptocurrency CFDs

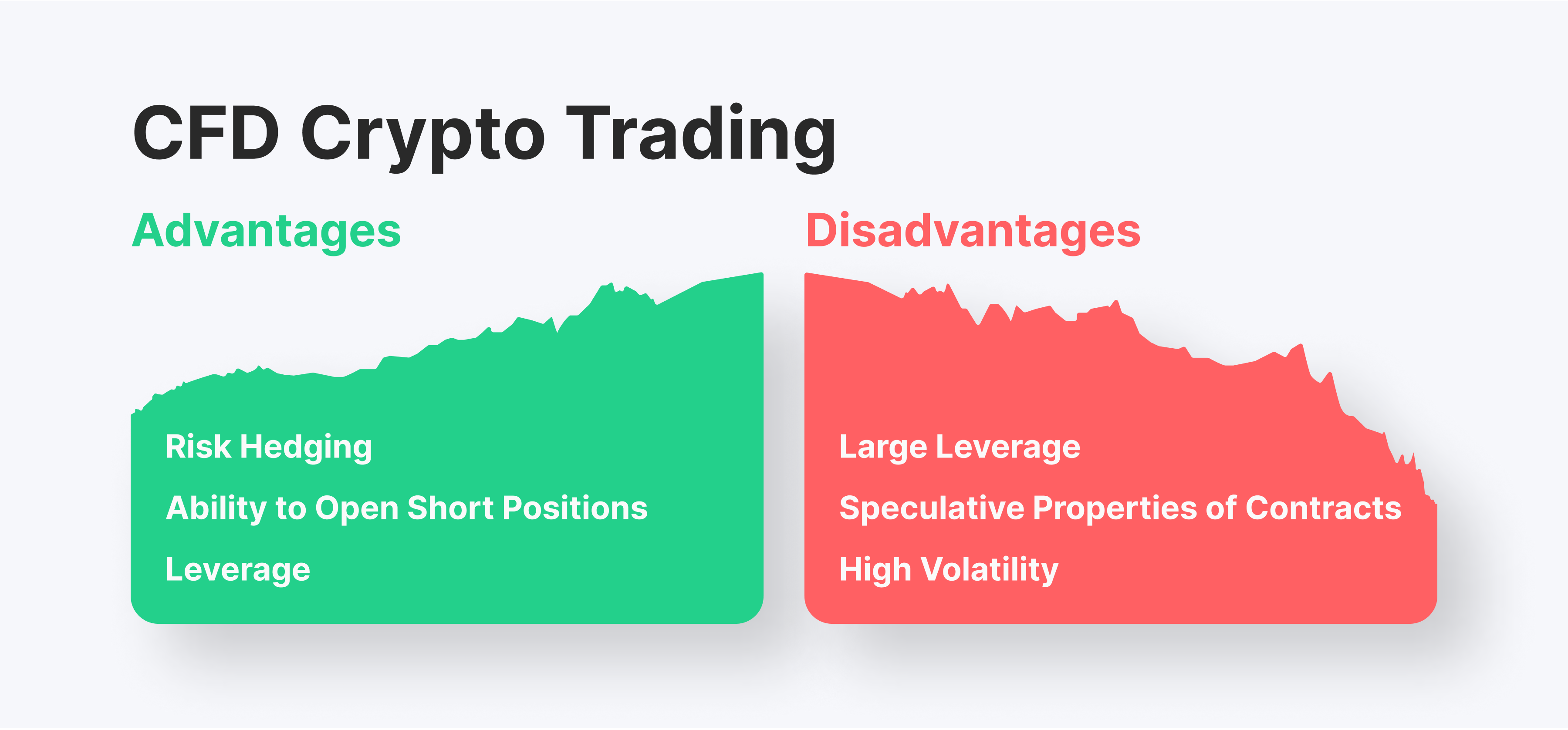

When you trade cryptos, the initial outcome is acquiring and owning digital currencies via cryptocurrency platforms. This approach allows traders to have direct control over their chosen coins, granting them certain privileges such as participating in blockchain decision-making processes. However, this ownership comes with market risks due to the volatile nature of cryptocurrencies, which can experience significant price swings.

Instead of having to actually possess the cryptocurrency itself, traders can engage in Contracts for Difference (CFDs) dealing with this digital asset. Unlike ownership, this arrangement denies traders benefits such as dividend payouts or voting rights. Instead, they place bets on price changes in the cryptocurrency market through a CFD broker on a specialized trading platform.

Trading cryptocurrency Contracts for Difference (CFDs) offers several advantages. First, you can profit by selling short or betting on falling prices, allowing you to make money even when the market is declining. Second, leverage is available with CFDs, which amplifies small price movements and enhances potential profits. Moreover, trading CFDs provides access to multiple international cryptocurrency exchanges and enables placing bets on a wide range of virtual currencies through a single platform. The convenience of this setup empowers traders to capitalize on market fluctuations swiftly and effectively from any location at any time.

Fast Fact:

I discovered that CFDs, or Contracts for Difference, originated in Britain back in 1974, specifically for the purpose of trading gold. However, their transformation into a financial derivative took place in the early 1990s with the influential Trafalgar House deal.

How to Trade Crypto CFDs: A Guide

As a crypto investor, I can tell you that there’s an alternative way to participate in the cryptocurrency market without actually owning the digital coins. By trading Contracts for Difference (CFDs) of cryptos, I can speculate on the price movements of various digital currencies. Leveraging the markets, I can profit from both rising and falling values. However, it’s crucial to select a reliable CFD trading platform, master the use of crypto CFDs, and hone my trading techniques before diving in.

Step 1: Choose a Reputable Broker

When it comes to trading Contracts for Difference (CFDs) on cryptocurrencies, selecting a reliable broker is a must. To ensure the safety and authenticity of your trading operations, opt for an established financial institution that regulates the brokerage. Consider the following features when making your selection:

Step 2: Understand the Platform

To become proficient in crypto trading, familiarize yourself with the use of a trading platform such as MetaTrader 4 or MetaTrater 5. Expand your knowledge base by learning about various market indicators, technical analysis tools, and customizing chart settings. Properly employing these resources is essential for making sound judgments in the unpredictable crypto market.

Step 3: Open and Close Positions

Kick off your digital currency trading adventure by selecting the desired cryptocurrency, determining the trade quantity, and applying prudence when employing leverage. To manage risks, establish stop losses and be open to receiving profit-generating orders. Regularly monitor your investments and make required modifications to minimize losses and maximize gains as market conditions shift. Conclude your trading session by executing a reverse transaction or by allowing take-profit or stop-loss instructions to execute automatically.

Step 4: Risk Management

To effectively manage risks in trading, it’s crucial to employ robust risk management strategies. Be mindful when using leverage, as excessive use can lead to amplified gains and losses. Ensure your margin levels are adequate for all open positions. Utilize the trading platform’s built-in risk management tools, such as stop losses, to minimize potential losses and shield against market instability.

To get started with trading cryptocurrencies like bitcoin in financial markets, here’s an approach: Familiarize yourself with the necessary steps and stay informed about current market situations and effective trading strategies. Prior to engaging in live trading, practice your tactics risk-free by opening a demo account.

Advanced Strategies for Crypto CFD Trading

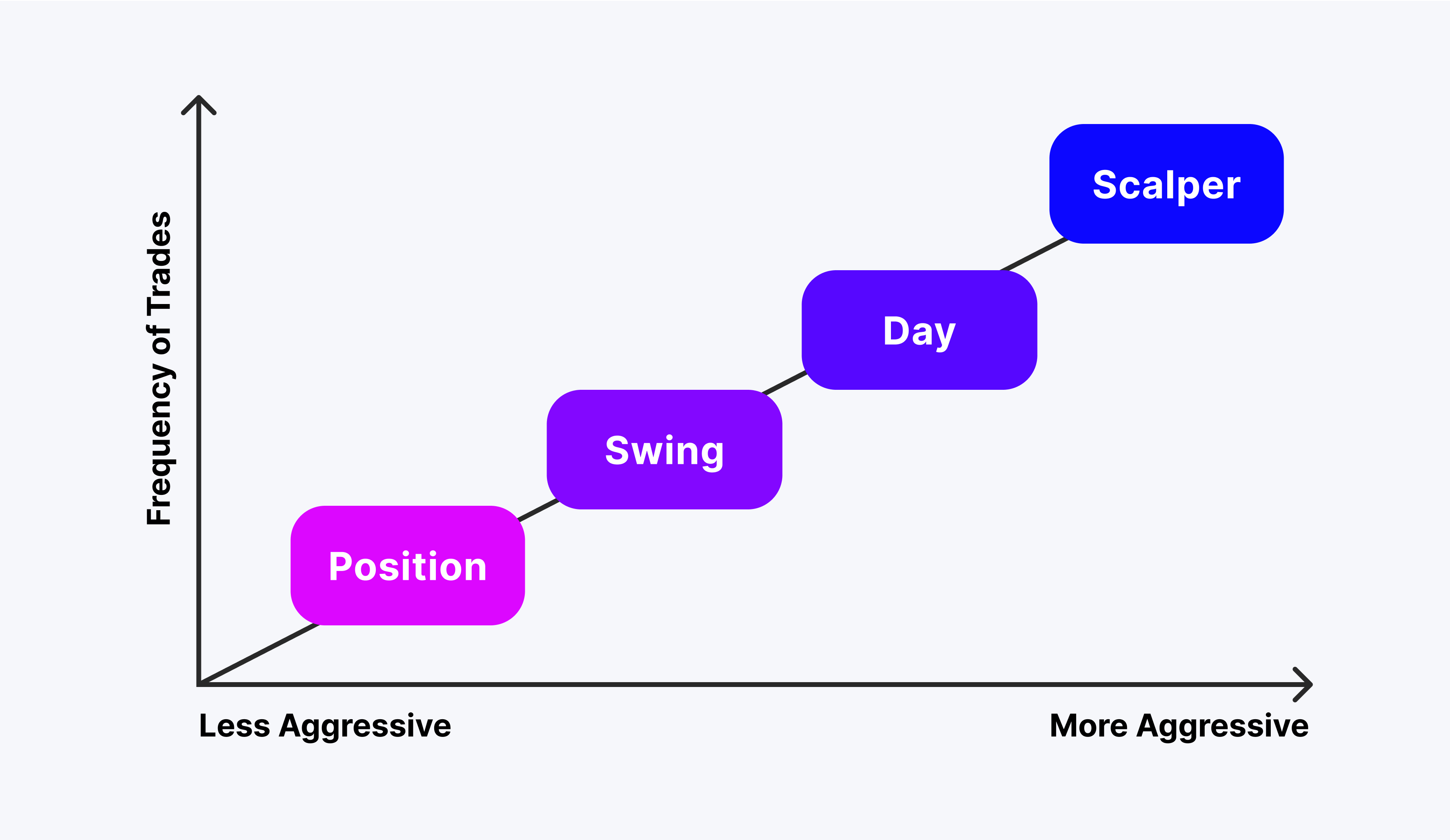

Advanced trading techniques such as scalping, swing trading, and day trading offer ways to enhance trading performance in various market conditions.

Conducting comprehensive market research is vital for the effectiveness of these methods. Technical analysis primarily relies on studying graphs and other market trends to predict future price fluctuations using past market information.

Instead of “On the other hand, fundamental analysis involves determining a cryptocurrency’s value through market news, economic reports, and other qualitative and quantitative factors,” you could say:

Final Thoughts

In this article, I’ve gone over some crucial aspects of trading cryptocurrency Contracts for Difference (CFDs). Firstly, choosing a trustworthy broker is key. Secondly, being knowledgeable about various trading platforms is important. Lastly, employing sophisticated trading techniques can enhance your experience.

As a diligent researcher and trader in the realm of cryptocurrencies, I strongly recommend adhering to prudent trading practices. These essential steps encompass thorough analysis of market trends and meticulous risk management. By harnessing your expertise and strategic planning on reputable crypto trading platforms, you’ll be able to navigate the intricacies of cryptocurrency Contracts for Difference (CFD) trading with proficiency.

FAQs:

How Do CFD trades operate?

When engaging in Contracts for Difference (CFD) trading, you execute two separate transactions: one to initiate the position and another to wrap up the trade. The opening transaction establishes your position, while the closing transaction terminates it with the CFD provider at a new price point. If you initially bought or took a long position, the subsequent transaction will be a sell, effectively reversing your initial move.

Why trade cryptocurrency CFDs?

As a researcher studying the world of cryptocurrency trading, I’d like to share an alternative way of expressing the concept of using leverage with crypto Contracts for Difference (CFDs). By employing leverage, you amplify your potential profits from smaller price shifts in the market. However, it’s essential to remember that this approach also heightens your risk since it requires less capital upfront to gain greater market exposure.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-06 19:29