-

Hedge fund predicts that Bitcoin miners’ shares will go to zero.

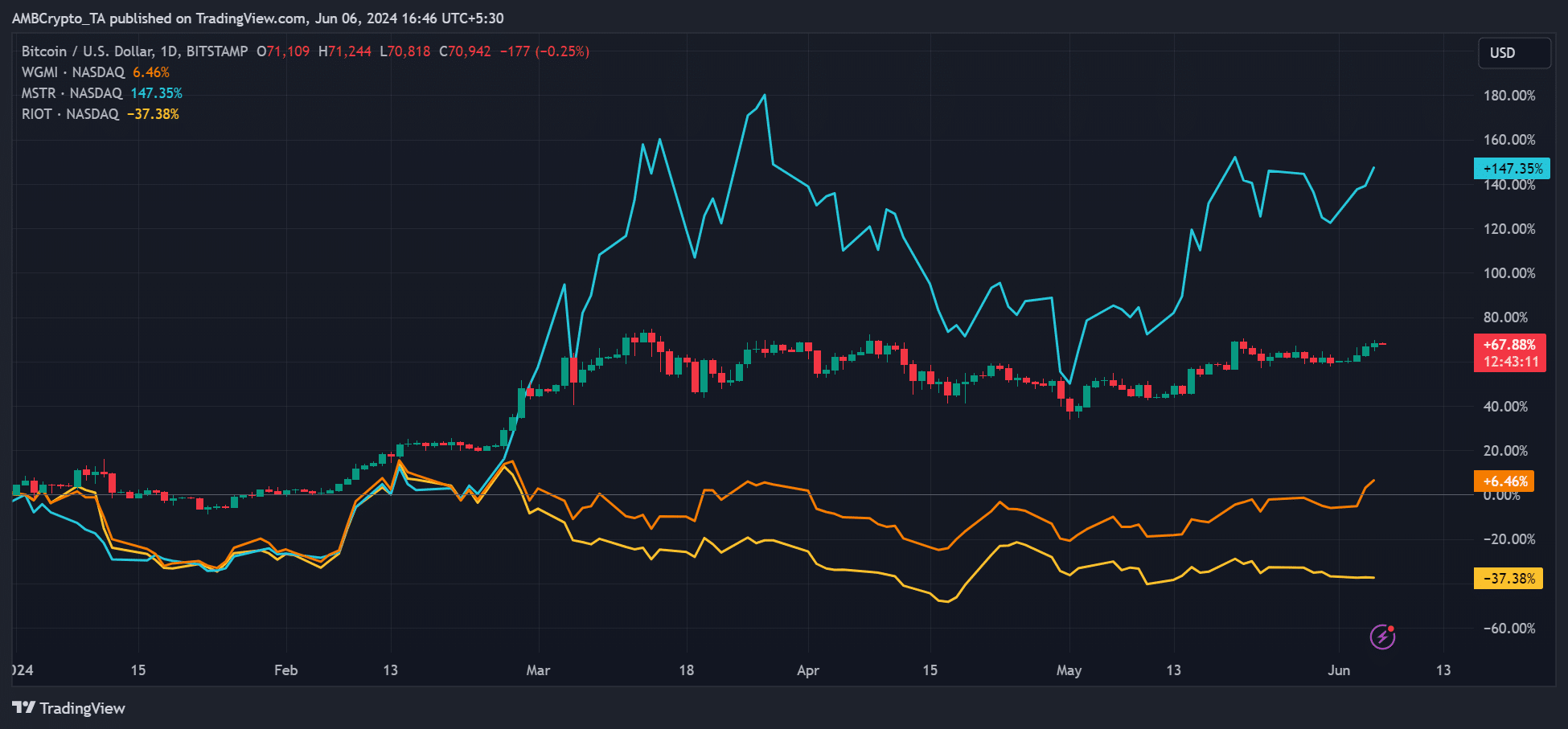

BTC and MSTR have performed better than overall BTC miner shares on a YTD basis.

As an experienced financial analyst, I believe that Kerrisdale Capital’s short strategy on Riot Platform (RIOT) and its bearish stance towards Bitcoin mining as a whole is not without merit, but it comes with significant risks and uncertainties.

Following their decision to sell short on MicroStrategy’s MSTR stock in March, Kerrisdale Capital has announced a new short strategy aimed at Bitcoin miner Riot Platform’s RIOT shares.

So, what’s the beef with RIOT? Kerrisdale Capital’s CIO Sahm Andrangi told Yahoo Finance that,

“Our investment thesis is that this sector is not going to be around in five years,’

As a crypto investor, I’ve observed that on the X platform, formerly known as Twitter, a hedge fund voiced their disappointment with Riot, labeling it as a “dysfunctional hamster wheel” and inadequate in delivering superior returns for its shareholders.

“Similar to other US-listed mining companies, Riot’s business model operates like a never-ending treadmill of cash expenditures, forcing it to constantly issue new shares to retail investors to keep the business running. Despite Bitcoin being close to its record highs after the halving event, Riot’s mining operations remain unprofitable.”

It’s intriguing that Andrangi held a strong opposition towards the Bitcoin mining industry. He labeled it as the “least intelligent business model” and forecasted its downfall, predicting it would “eventually reach a value of nothing.”

Bitcoin as a hedge against BTC miners

In a pessimistic market outlook, the hedge fund argued that Bitcoin (BTC) would consistently outperform Bitcoin miner shares. Therefore, it could serve as a protective measure against miner share losses – buying Bitcoin while selling miner shares.

As a crypto investor reflecting on recent market events, I can’t help but acknowledge the significant price surge of MicroStrategy (MSTR) since Kerrisdale Capital’s short strategy against the company in March. The stock has impressively rallied by an astounding 37%.

Some market analysts, after being alerted by this development, considered adopting a contrarian stance and expressed gratitude towards the fund for identifying bitcoin miner shares as potentially undervalued for the remainder of 2024.

Another X user outrightly wondered how flawed the fund’s strategy was.

“This brilliant individual is betting against #Bitcoin miners and Company X ($MSTR) as we approach what might be the most historic cryptocurrency bull market.”

Despite BTC underperforming miner shares like MicroStrategy (MSTR) in terms of year-to-date (YTD) returns, the investment in Bitcoin through the fund proved to be a profitable choice. Specifically, MSTR recorded impressive 147% gains, while Bitcoin had achieved 67% growth as of the latest report.

Despite a significant 37% decrease in RIOT’s performance during that timeframe, the broader Bitcoin mining sector, represented by the Bitcoin Mining and Exchange-Traded Fund (ETF) tracker based on Valkryie Bitcoin Miners (WGMI), experienced only a modest 6% increase over the same duration.

The WGMI has been climbing alongside Bitcoin’s price surge. However, it remains uncertain if the hedge fund’s prediction that Bitcoin miners will disappear will hold true.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-06 23:03