- Bitcoin ETFs saw $880 million inflows on the 4th of June.

- Despite Bitcoin’s rise, Google searches for related terms remain low.

As a seasoned crypto investor who has witnessed the market’s ebb and flow since its inception, I find the recent data on Bitcoin ETF inflows and Google search trends intriguing.

Starting in January 2024, Bitcoin [BTC] Exchange-Traded Funds (ETFs) have demonstrated impressive gains.

On the fourth and fifth of June, there were significant investments totaling $1.37 billion. Specifically, $880 million flowed in on the fourth, followed by another $488.1 million on the fifth.

On June 4th, according to Farside Investors’ data, the Fidelity Wise Origin Bitcoin Fund saw the largest inflow of funds, amounting to approximately $220.6 million.

As a researcher studying the cryptocurrency market, I’ve observed an exciting development: Bitcoin has surpassed the long-awaited threshold of $70,000, reaching a price of $71,082.55 at the time of my observation.

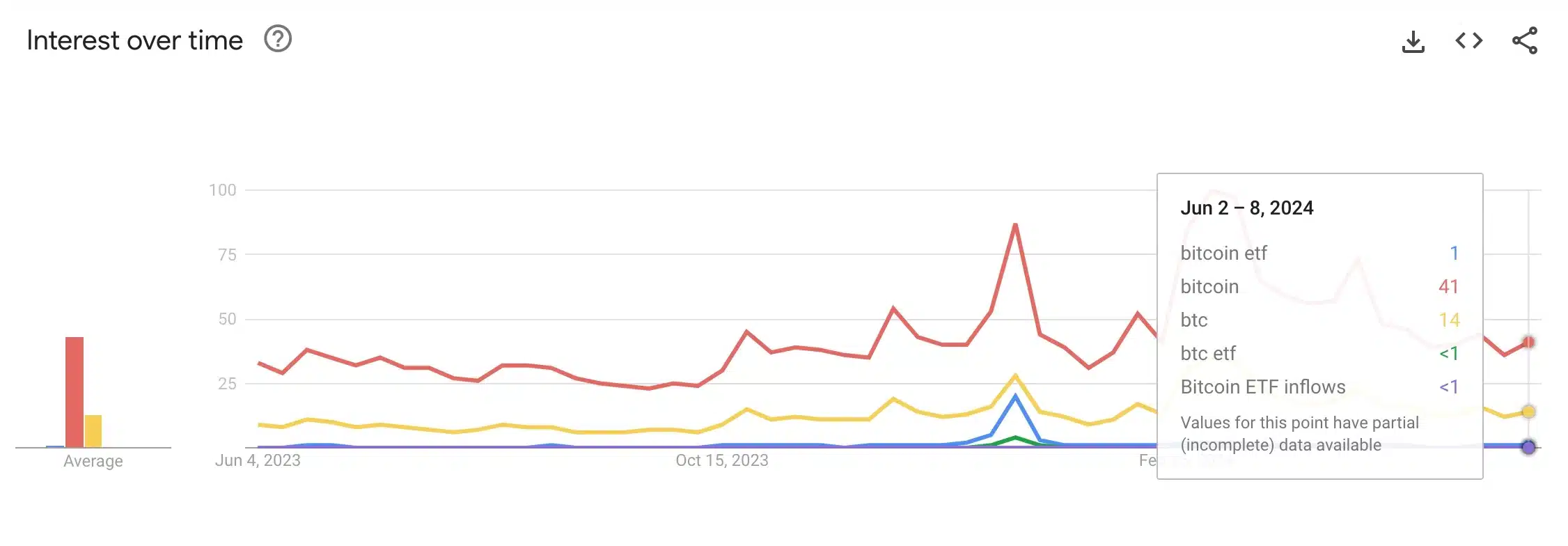

Google data shows a declining trend

It’s quite unexpected that Google search data indicated a remarkably low level of interest compared to the strong surge in searches during the 2021 bull market.

Retail investors, representing a large portion of the market, have not extensively adopted Bitcoin ETFs as yet. This could be a positive sign hinting at potential expansion in the future.

Based on Google Trends’ scoring system that indicates the relative peak popularity of search terms, “Bitcoin” and “btc” received scores of 41 and 17 out of 100. In simpler terms, “Bitcoin” was searched for more frequently than “btc,” with a score of 41 compared to 17.

As a researcher studying the trends and flows related to Bitcoin Exchange-Traded Funds (ETFs), I have observed that phrases like “bitcoin etf,” “btc etf,” and “Bitcoin ETF inflows” had a global search volume of below 1 according to my data.

Execs weighs in

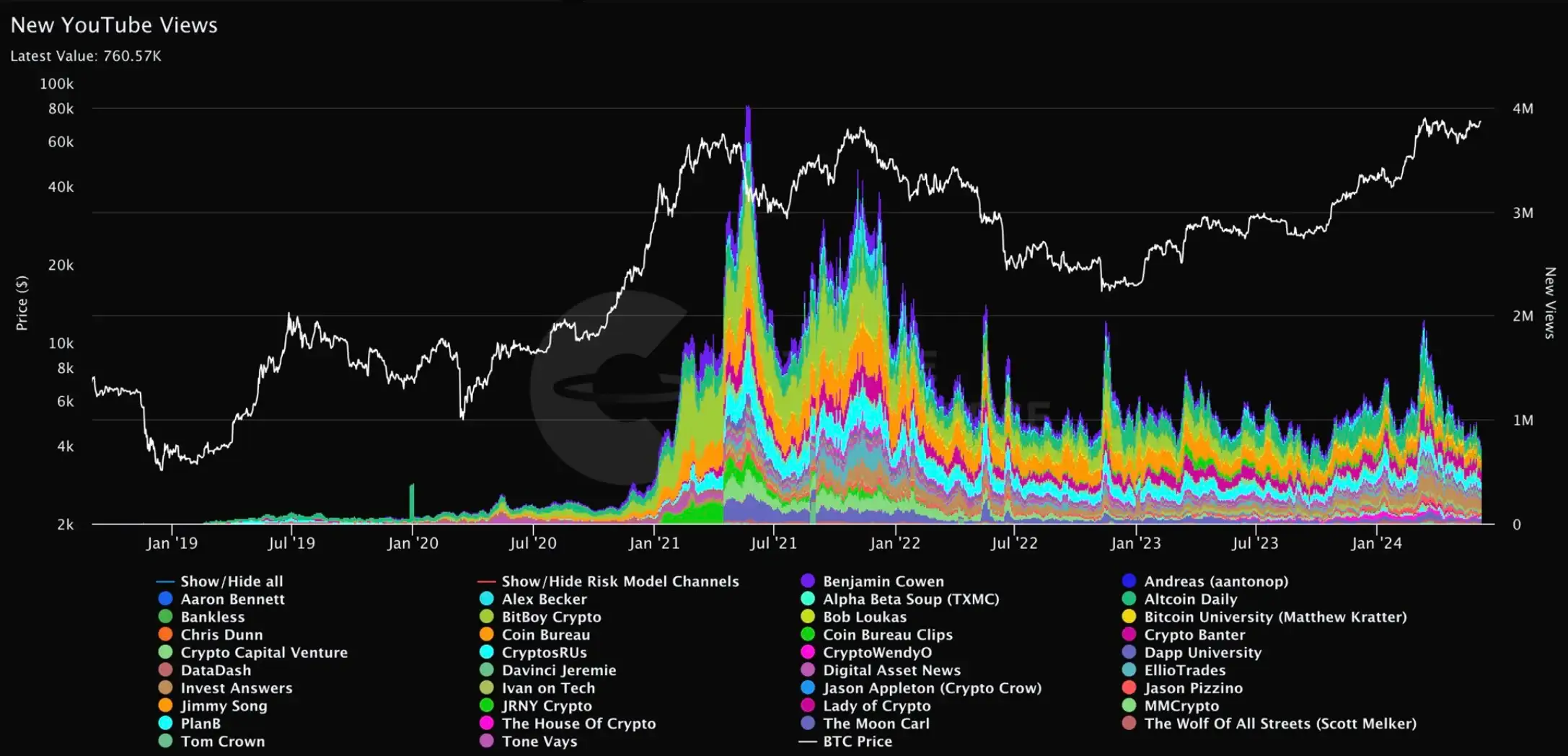

In my analysis, I’ve observed a decrease in the level of engagement with cryptocurrency-related content on YouTube compared to the heightened interest witnessed in 2021.

As a crypto investor, I’ve come to notice an intriguing correlation between the daily views of popular YouTube cryptocurrency channels and the current market state of Bitcoin (BTC). In 2021, when BTC reached $70,000, there were approximately 4 million views per day on these channels. However, by 2024, that number had dropped significantly to around 800,000 views daily. This discrepancy suggests that retail investor interest in Bitcoin has yet to fully return.

As a researcher, I’d put it this way: The market cycle we’re experiencing now presents unique difficulties for investors unlike any other bullish phases in the past, according to Deutscher’s analysis.

Furthermore, the returns from most altcoins have typically lagged behind Bitcoin’s performance, creating a discrepancy between investors’ perceptions and the real price trends.

Although the number of people searching for Bitcoin has decreased, there’s still a lot of enthusiasm within the community about it. In particular, they’re praising the acquisition of Bitcoin by various Bitcoin Exchange-Traded Funds (ETFs).

Echoing a similar sentiment, Bit Paine took to X and said,

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-06-07 09:11