-

LINK is the third cryptocurrency with the highest supply in profit.

In the last week, more LINK transactions have ended in profit than loss.

As a researcher with experience in analyzing cryptocurrency market trends, I find the current state of Chainlink (LINK) quite intriguing. Based on recent data from Santiment and other reputable sources, LINK is the third-largest cryptocurrency by supply held above its cost basis, with 86.8% of its total circulating supply in profit. This metric indicates that a majority of LINK holders are currently holding their tokens at a profit.

According to Santiment’s latest analysis, posted on X, Chainlink (LINK) occupies the third position among cryptocurrencies with the highest amount of current profits, trailing behind Bitcoin (BTC) and Ethereum (ETH).

As a crypto investor, I can explain this concept as follows: The “profit ratio” of an asset refers to the percentage of its circulating supply last sold on the blockchain at a price lower than the current market price. In other words, it indicates the proportion of coins or tokens that are being held with a profit.

Based on the information from the on-chain data provider, approximately 86.8% of Chainlink’s entire supply has been bought by token owners at prices higher than their current market value.

As a crypto investor, I can tell you that among all the cryptocurrencies I’m invested in, this altcoin ranks third. An impressive 98.3% of its total supply is currently making a profit for its holders. That’s just behind Bitcoin (BTC) and Ethereum (ETH), with their respective supplies at 100% and 95.1% in profit.

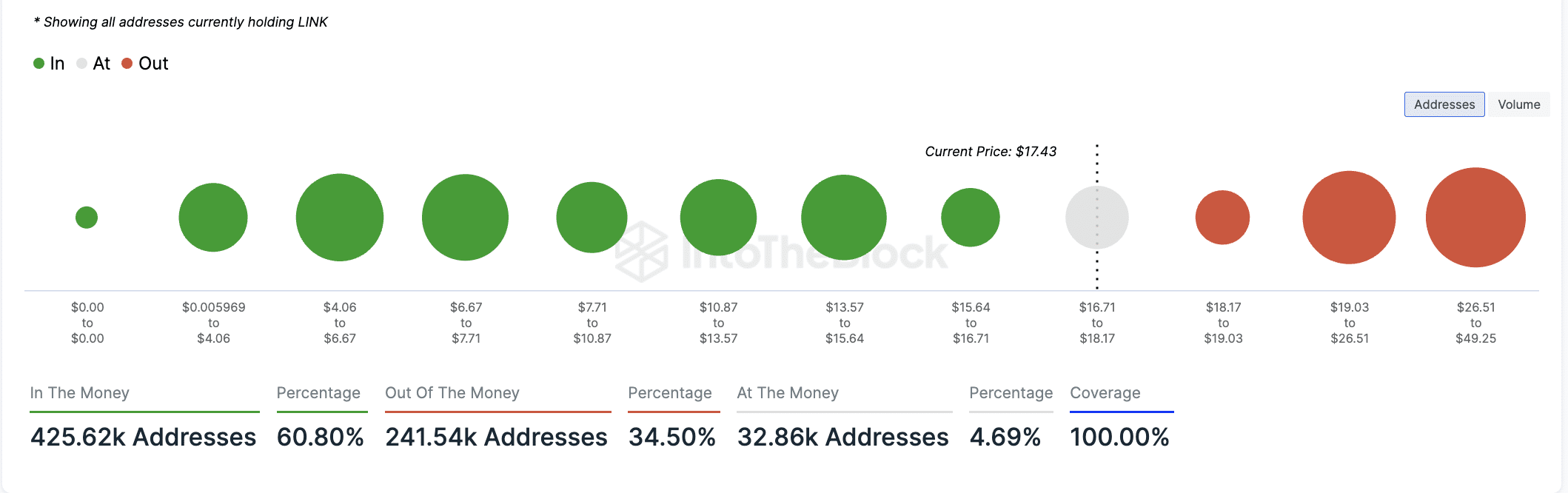

Based on the current data from IntoTheBlock, approximately 61% of all LINK token holders, equating to 425,620 addresses, are currently holding their tokens at a profit. In other words, these addresses have purchased their LINK tokens at prices lower than their current market value.

As a crypto investor, I can tell you that around 241,540 Chainlink address holders find themselves in a less favorable position, as they currently hold the altcoin at a loss – representing approximately 35% of all Chainlink holders.

LINK faces a minor setback

Based on current market information, I found that LINK was priced at $17.49 at the moment of my research. However, there’s been a minor 3% decrease in its value over the last week, as reported by CoinMarketCap. This decline can be attributed to a subtle reduction in daily demand for LINK during that time frame.

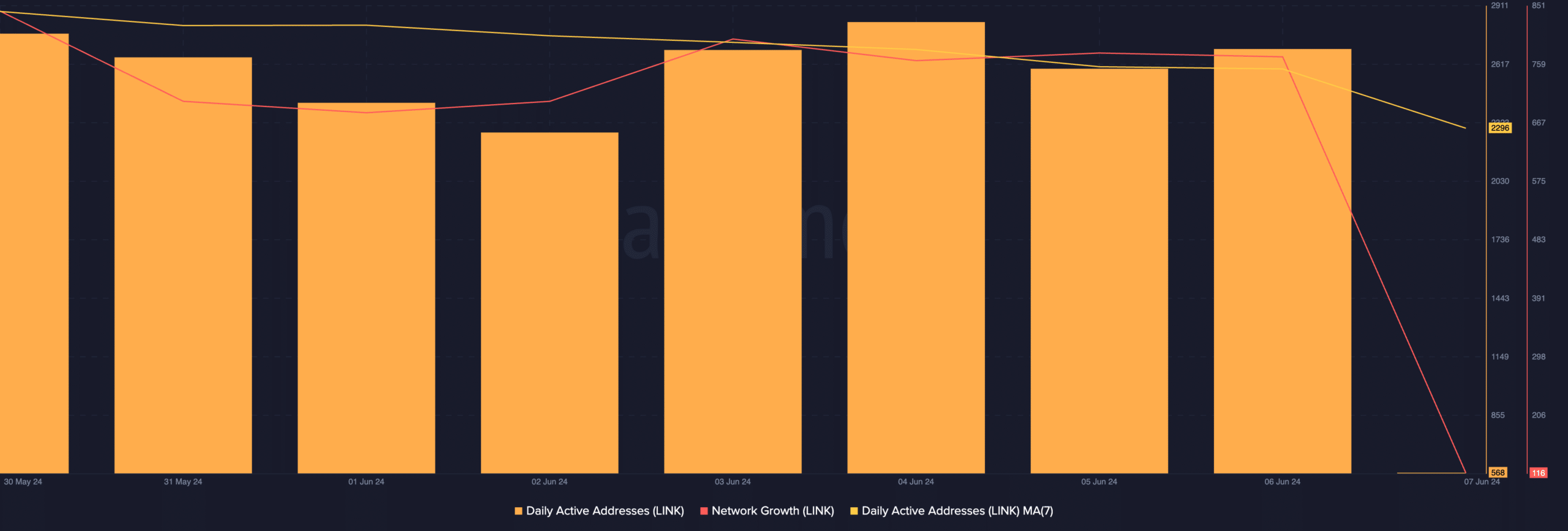

As an analyst examining on-chain data, I’ve noticed a decrease in the number of daily active addresses participating in LINK transactions over the last week. Specifically, the seven-day moving average reveals a 3% reduction in this metric.

Similarly, the interest in LINK‘s altcoin has significantly decreased. During this time frame, the number of new addresses established daily for trading LINK has dropped by approximately 10%.

As a crypto investor, I’ve noticed that the demand for LINK has decreased over the past week. This could be due to the fact that daily transactions involving this token weren’t as profitable during that time for me and possibly other investors.

The seven-day moving average of LINK‘s transaction volume profits relative to losses, as evaluated by AMBCrypto, amounted to 1.73.

Realistic or not, here’s LINK market cap in BTC’s terms

I analyzed the data and found that on average, there were 1.73 profitable transactions following each unprofitable one involving the transfer of a Link token.

The drive to earn a profit likely fueled the recent selling actions, resulting in a slight decrease in LINK‘s price over the past week.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2024-06-07 11:03