-

The coin’s open interest hit the highest point since March, suggesting that BTC could break past $73,750.

Exchange withdrawal increased while the funding rate was positive, reinforcing the bullish bias.

As a seasoned analyst with extensive experience in cryptocurrency markets, I have closely monitored Bitcoin’s recent price action and market trends. The surge in Open Interest to its highest level since March is an encouraging sign for the bulls, as it indicates new money entering the market and a strong bullish bias. This comes at a time when Bitcoin’s price has been on an uptrend, trading above $70,000.

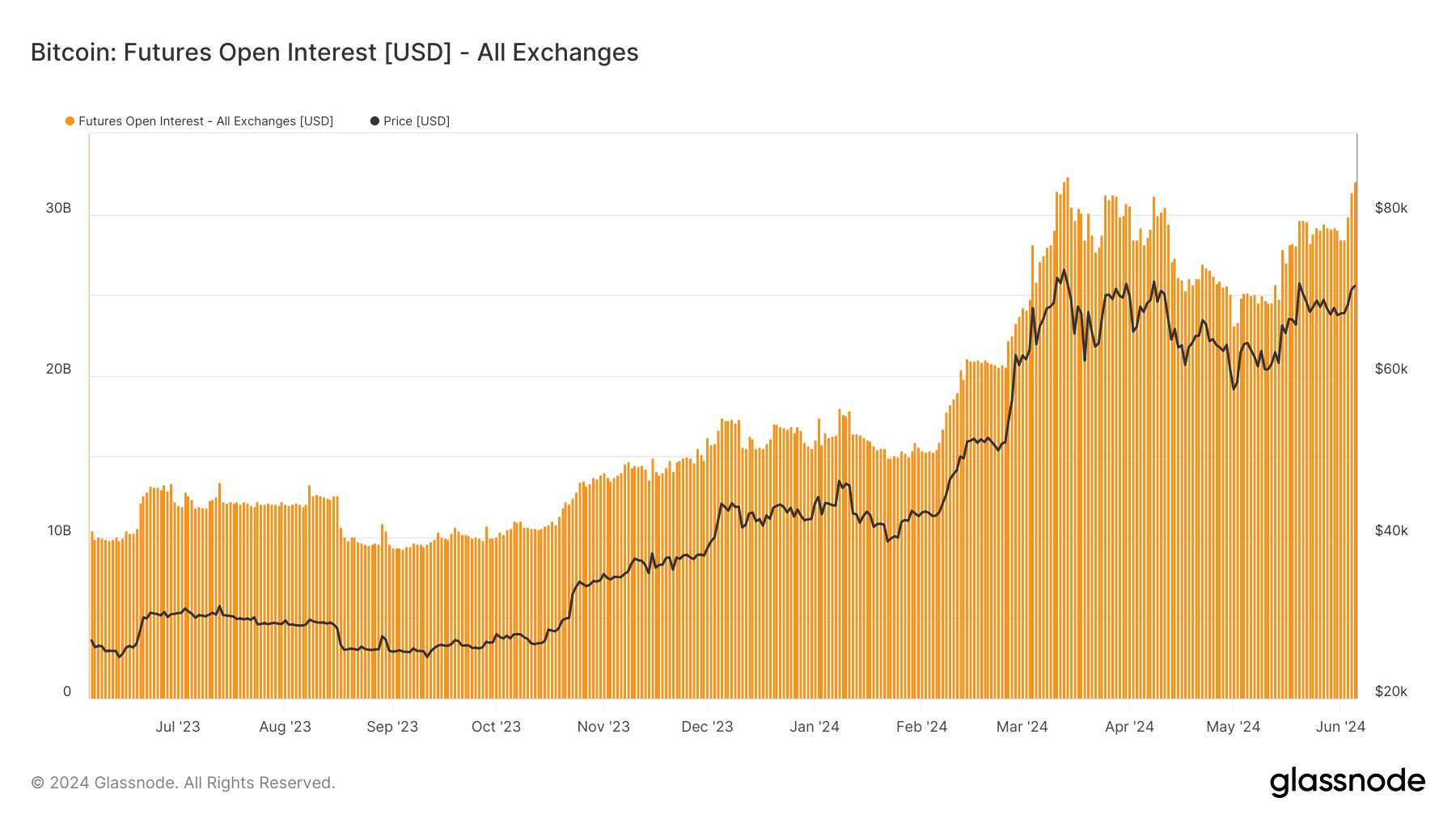

Bitcoins open interest, which last reached an record peak of $73,570, has now attained a fresh high. The current open interest stands at approximately $37.66 billion based on information from Glassnode.

The level of open interest represents the number of ongoing derivative contracts in the market. A reduction in open interest signifies that traders are progressively liquidating their positions, potentially resulting in downward pressure on prices.

An upward trend in Open Interest (OI) similar to Bitcoin’s recent surge indicates fresh capital is flowing into the market. Sustained growth could bolster Bitcoin’s price rise.

BTC aims higher, backed by exchange flow

At present, a Bitcoin transaction occurs at approximately $71,200. This price point marks a 3.89% rise over the past week. Given the growing attention towards this digital currency, it’s plausible that it may exceed its previous record high and potentially reach $80,000.

Although the optimistic forecast is intriguing, it’s crucial not to overlook the impact of exchange trading on current market prices.

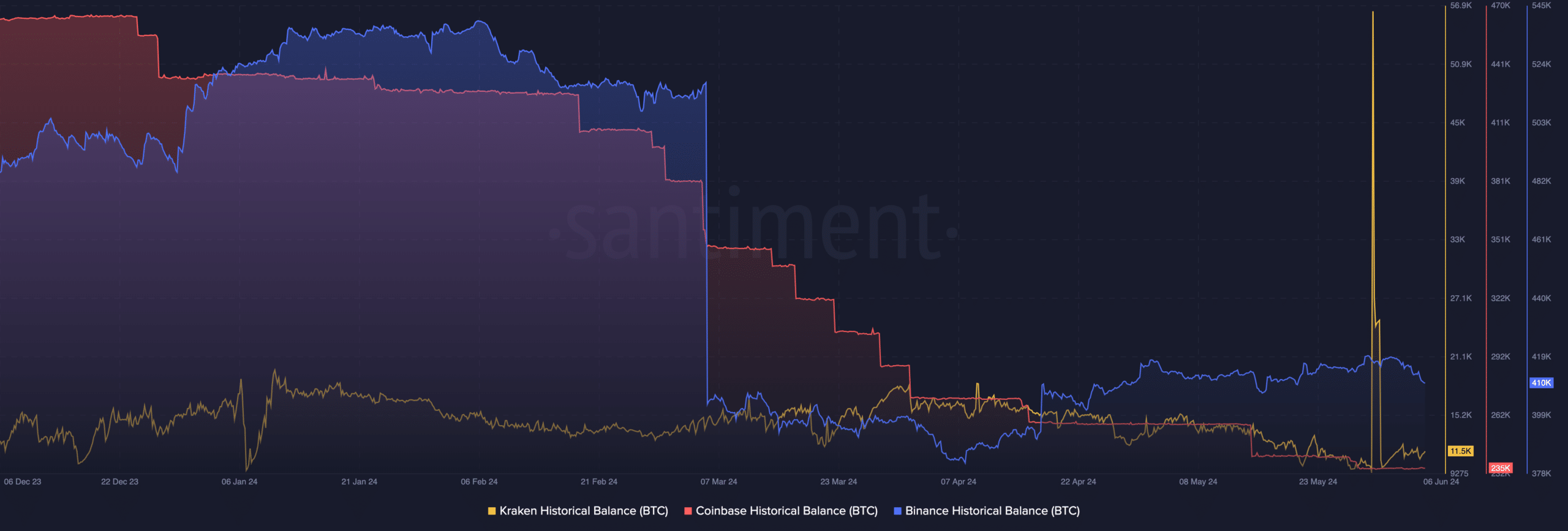

One method to approach this is by examining the quantity of a particular asset available on exchanges and the amount held off the market. Furthermore, the reserves managed by major exchanges can provide valuable insights.

According to AMBCrypto’s analysis, the historical Bitcoin balances of Binance and Coinbase decreased, suggesting that users had withdrawn their BTC from these platforms around that time. In contrast, Kraken reported an increase in Bitcoin purchases on May 30th, preceding the recent price drop.

As an analyst, I’ve observed a noteworthy trend: numerous Bitcoin holders have been actively purchasing more coins on exchanges recently and withdrawing them for long-term storage. If this pattern persists, it’s plausible that Bitcoin could withstand selling pressure, potentially leading to a new all-time high by the end of June.

Traders continue to bet on a rally

Alternatively, the forecast could be disproven if Bitcoin’s exchange supply starts to grow. This indicates that investors are cashing out their profits, potentially causing Bitcoin to relinquish its position above $70,000.

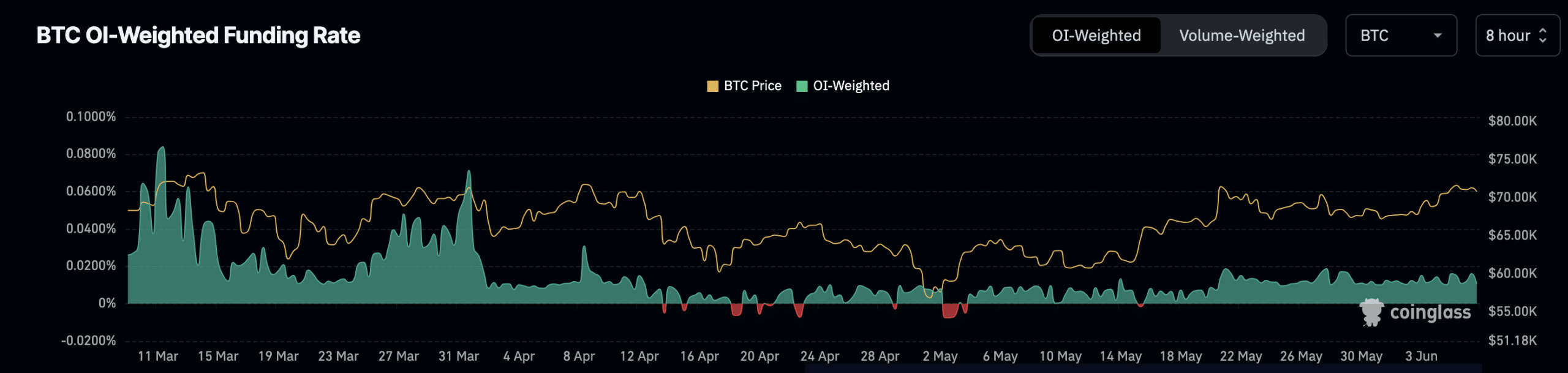

Traders appear to hold a different perspective regarding price decreases, according to the data gathered from Coinglass on Funding Rates.

Based on data from the derivatives information source, Bitcoin’s Funding Rate had a favorable value. When the figure is unfavorable, it signifies that short positions are incurring fees to maintain their positions.

In this instance, the broader sentiment is bearish.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Despite the metric’s seemingly optimistic interpretation, implying that long positions are in the lead and anticipating a Bitcoin price surge towards $74,000, those holding such positions will reap the benefits if this prediction comes to fruition.

This could also give way to $80,000 provided bears fail to nuke the uptrend.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-06-07 16:07