-

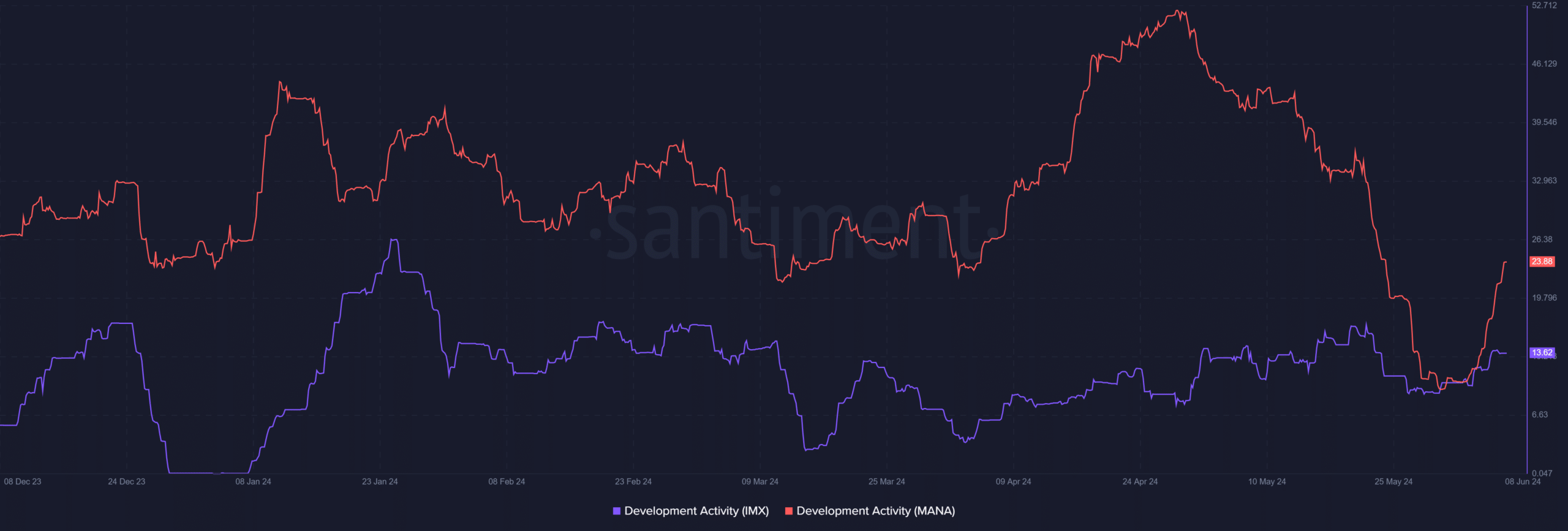

Development activity of MANA was almost twice that of IMX across a 30-day window

Network value and holder metrics were not as supportive toward Decentraland

As a long-term crypto investor with experience in the gaming sector, I have been closely monitoring the developments of Immutable (IMX) and Decentraland (MANA). Based on recent data from Santiment, I’ve noticed that MANA’s development activity was almost twice that of IMX across a 30-day window. However, network value and holder metrics were not as supportive toward Decentraland.

In the realm of top crypto assets within the gaming industry, IMX and MANA take the leading positions, with IMX boasting a market value of approximately $3 billion and MANA, which debuted in 2018, having a comparatively smaller market cap, around $800 million.

As a researcher studying the crypto space, I recently came across a post on X (formerly Twitter) by Santiment where they compared the development activity of leading gaming assets in the cryptocurrency market. Among these, MultiverseX [EGLD] stood out with a substantial lead. Decentraland, however, was not lagging far behind.

Furthermore, Decentraland’s development team has been more active than ImxToken’s. This could be an indicator for potential investors to consider increasing their investments in Decentraland.

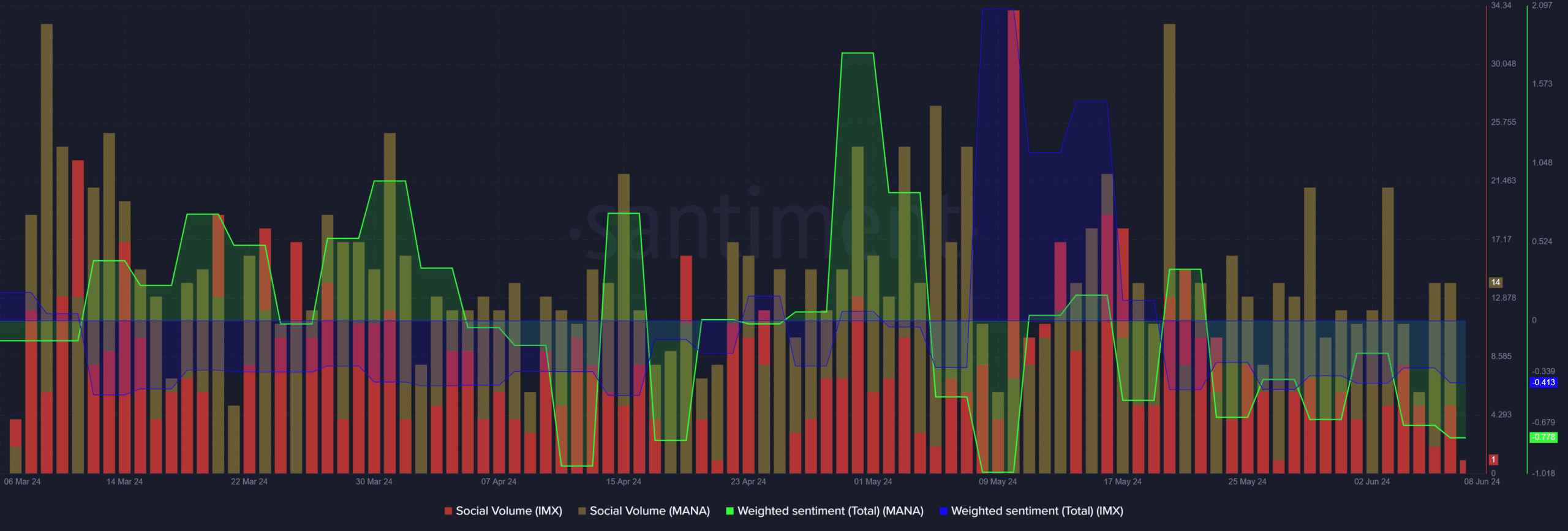

Social metrics were anemic for both tokens

As a crypto investor, I’ve been keeping an eye on the social media buzz surrounding IMX and Decentraland. According to AMBCrypto’s analysis, IMX had a slightly lower social volume than Decentraland (MANA) in terms of mentions across various social media platforms. However, both tokens have seen their social volumes decrease noticeably over the past month.

As a crypto investor, I’ve noticed that the sentiment analysis weighed heavily against MANA and IMX. Specifically, the weighted sentiment was -0.77 for MANA and -0.41 for IMX. This indicates that there was more bearish engagement than bullish enthusiasm towards these tokens. Furthermore, it seems that both tokens’ bulls have been starved of social media hype recently. As a result, a recovery may prove to be challenging at the present moment.

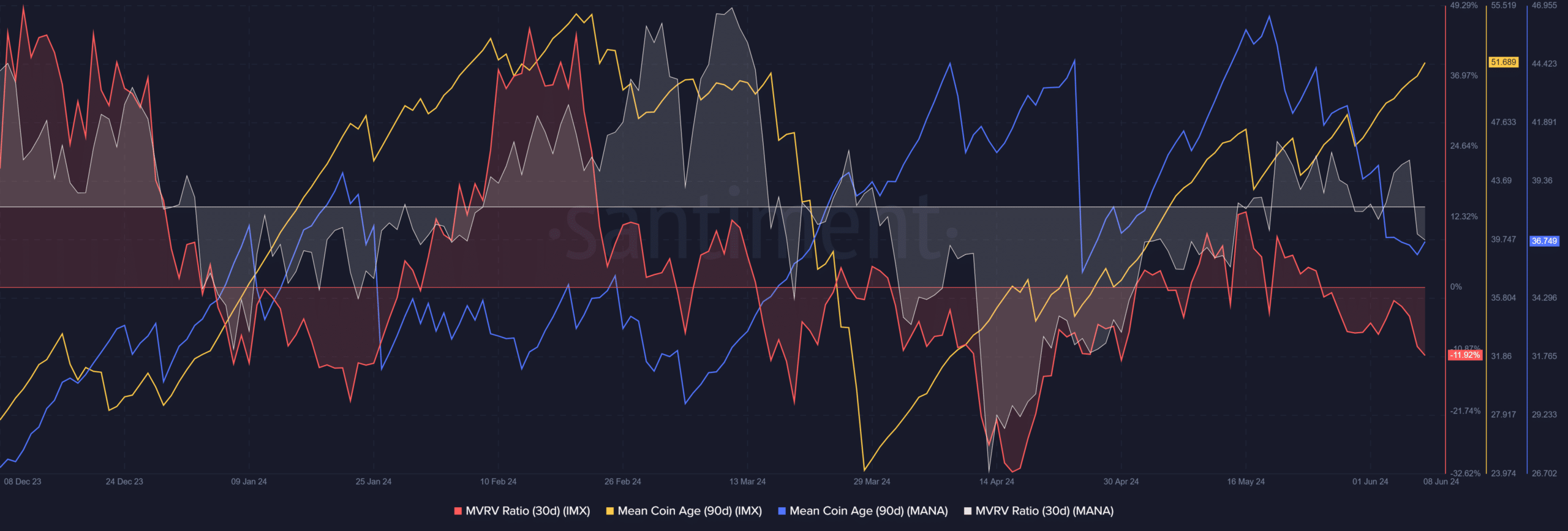

Mean coin age gave bulls some hope

In mid-May, the 30-day Moving Average to Realized Value Ratio of both tokens showed gains. However, since then, their prices have decreased. To provide some background, from April onwards, the price movements of IMX and MANA had been confined to a specific range. Notably, IMX experienced a stronger upward trend during May compared to MANA, which remained more stable within this range with price fluctuations of around 12% between its highs and lows.

The decrease in MVRV indicated that short-term investors suffered losses due to the market downturn. To identify which cryptocurrency may bounce back first, analysts looked at the mean coin age (MCA).

Since the end of March, the Market Capitalization (MCA) of Immutable X has consistently risen. In contrast, Decentraland’s Market Cap has decreased over the last fortnight. This trend suggests that IMX is undergoing an accumulation phase, while MANA experiences selling pressure and significant token transfers.

Based on current market trends, IMX is predicted to be more optimistic in the upcoming weeks compared to MANA. For swing traders, considering entering long positions between the price ranges of $1.85 and $2, as this area showed strong buying activity throughout May.

Realistic or not, here’s IMX’s market cap in BTC’s terms

MANA holders should be cautious for an additional reason. The current surge in MANA‘s value is its second bull run within a short time frame. Investors who entered the market late during the previous bull run might be holding out for higher prices to sell, aiming to make a profit or cover losses. Their actions could impede further price growth and dampen the impact of future bullish trends.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-09 05:11