-

Activity across the Solana blockchain increased, but SOL’s price fell

Correlation between SOL and BTC declined as indicators revealed that SOL might drop below $160

As a seasoned crypto investor with a few battle scars and victories under my belt, I’ve learned to keep an eye on various metrics when evaluating potential investments. The recent surge in activity across the Solana blockchain piqued my interest, but the falling price of SOL left me puzzled.

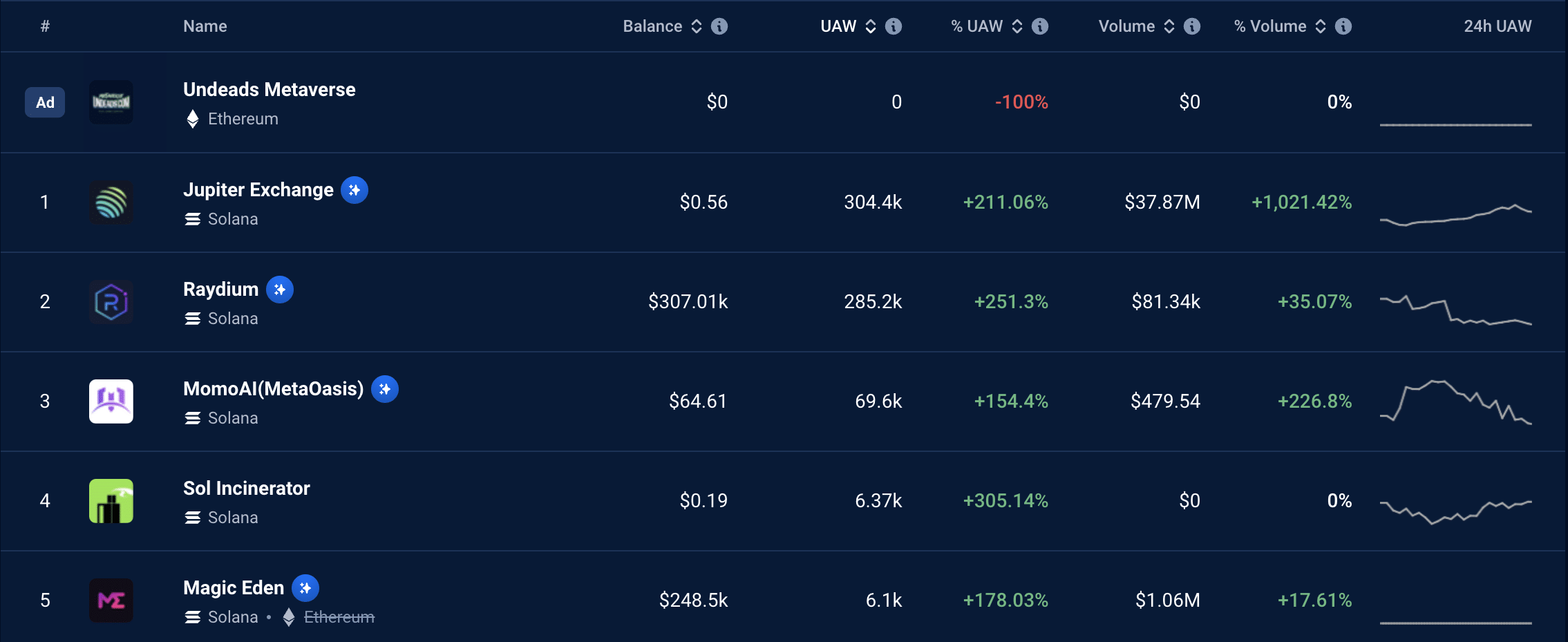

As a researcher studying the Solana blockchain, I’ve discovered some noteworthy growth in Unique Active Wallets (UAWs) over the past 24 hours. This expansion is evident from the data provided by DappRadar. Several decentralized applications, such as Jupiter, Raydium, and Magic Eden, have significantly contributed to this surge.

According to AMBCrypto’s investigation, there were approximately 307,100 Uniswap Automated Market Making (UAMM) positions on Jupiter Exchange, marking a significant increase of 251% compared to previous numbers. For Raydium, the figure rose to 285,200, and there was also a notable uptick in NFT activity. The same growth was observed for Magic Eden, with an approximate rise of 178%.

Memecoins are driving SOL up and down

As a researcher studying the recent surge in usage on Raydium and Jupiter, I’ve discovered a correlation between this trend and the increasing popularity of memecoins in the market. Upon closer examination, it appears that the memecoin craze can be traced back to GameStop (GME) and its prominent figure, Keith Gill, also known as “Roaring Kitty.”

As an analyst, I’ve noticed a significant increase in the number of derivative tokens associated with a particular trader on June 7th. Remarkably, the market capitalizations of these Solana-based tokens skyrocketed at astonishing rates during this time frame.

The hike in this case signified a rise in the desire for Solana. Yet, at the moment of publication, Solana’s worth was priced at $162.44, reflecting a decrease of 5.44% over the previous 24 hours.

It’s important to mention that AMBCrypto identified the cause for Solana (SOL) failing to maintain an upward trend, despite rising demand.

As a researcher studying the behavior of some individuals in the crypto market, I’ve come across the term “degenerates.” These are people who actively trade highly volatile and speculative tokens with no underlying fundamentals. When dealing with memecoins or other such tokens, their strategy is not to hold them for extended periods. Instead, they wait until these tokens reach a significant profit, then exchange them for Solana’s native token or even fiat currency, depending on their preferences. This approach allows degenerates to capitalize on the volatility and speculation of these tokens while limiting their exposure to potential losses.

Lately, we’ve seen an abundance of pump-and-dump schemes, and this trend may persist. If so, Solana (SOL) could keep fluctuating in price.

Can the token bank on BTC?

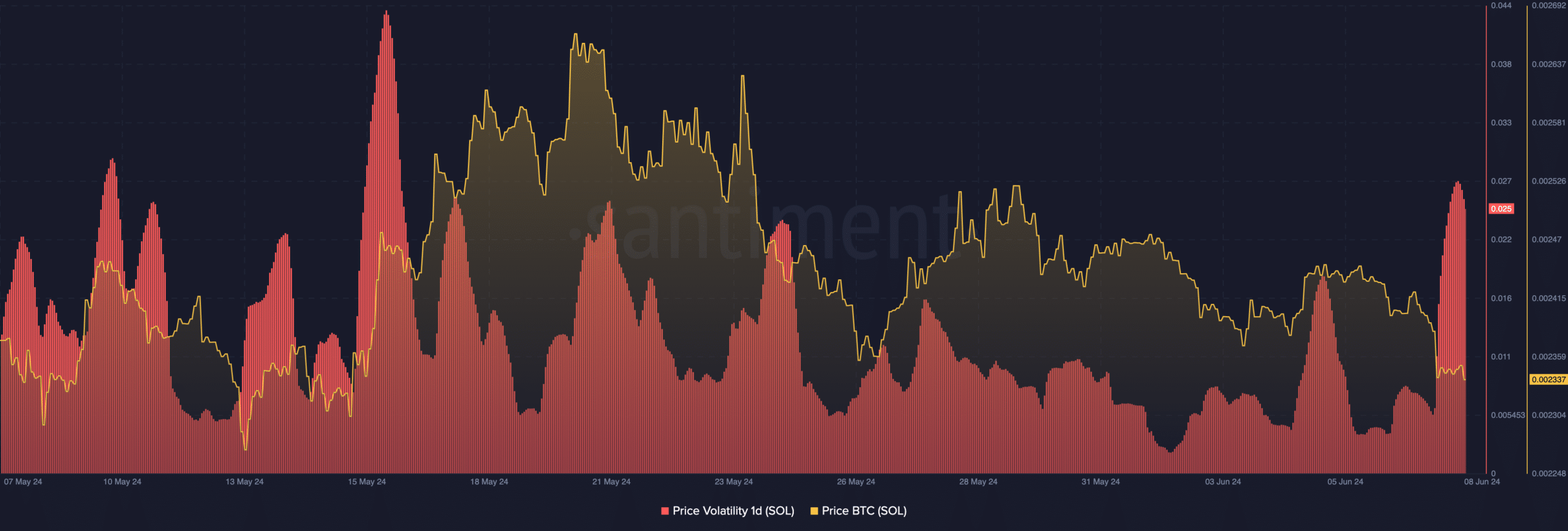

According to AMBCrypto’s analysis, the daily volatility of Solana (SOL) significantly increased. Volatility measures the speed at which a token’s price changes. Consequently, if selling pressure intensifies during volatile periods, SOL could experience price drops on the charts.

An opposing force of strong purchasing demand and significant price fluctuations might cause a price breakout for SOL. Yet, based on current indications, there’s a possibility that the price may dip below $160 in the near future.

Solana decouples from Bitcoin

As a researcher studying the factors influencing Solana’s price movements, I cannot overlook the role of Bitcoin [BTC] in the equation. The relationship between their prices has been weakening since late June, as evidenced by data from Santiment. This suggests that while Solana’s price may not always mirror Bitcoin’s, it is essential to keep an eye on Bitcoin’s price fluctuations when analyzing Solana’s trends.

Should Bitcoin surpass $71,000 once more, it doesn’t automatically mean Solana will touch $187 again. But if the market recovers broadly, price movements could mirror each other.

Is your portfolio green? Check the Solana Profit Calculator

As a researcher studying the Solana (SOL) cryptocurrency market, I can assert that the current trend does not seem promising for SOL reaching $200 in the upcoming week. However, there are optimistic forecasts suggesting that SOL could potentially hit $1,000 in the long term. To achieve this goal, it is crucial for market conditions to significantly improve.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-06-09 06:15