-

Solana’s price was stuck at press time, with a “death cross” and bearish dominance.

Despite a bearish trend, SOL hints at the potential for recovery if bullish triggers emerge.

As an experienced analyst, I see Solana’s current predicament as a challenging one. The price action and technical indicators suggest that the bears are in control at present, with a “death cross” adding to the bearish outlook. However, it is essential not to ignore the potential for recovery if bullish triggers emerge.

As a researcher observing the cryptocurrency market, I’ve noticed an intriguing pattern with Solana (SOL) lately. Following a strong debut at the beginning of this cycle, its price has hit a plateau and exhibits unusual volatility. Neither bulls nor bears appear to have a clear upper hand, resulting in a prolonged period of indecisive price action.

From an initial observation, it appears that SOL is uncertain about its next move. Could there be a turnaround in the future? Or is this a downward spiral?

Solana’s next move

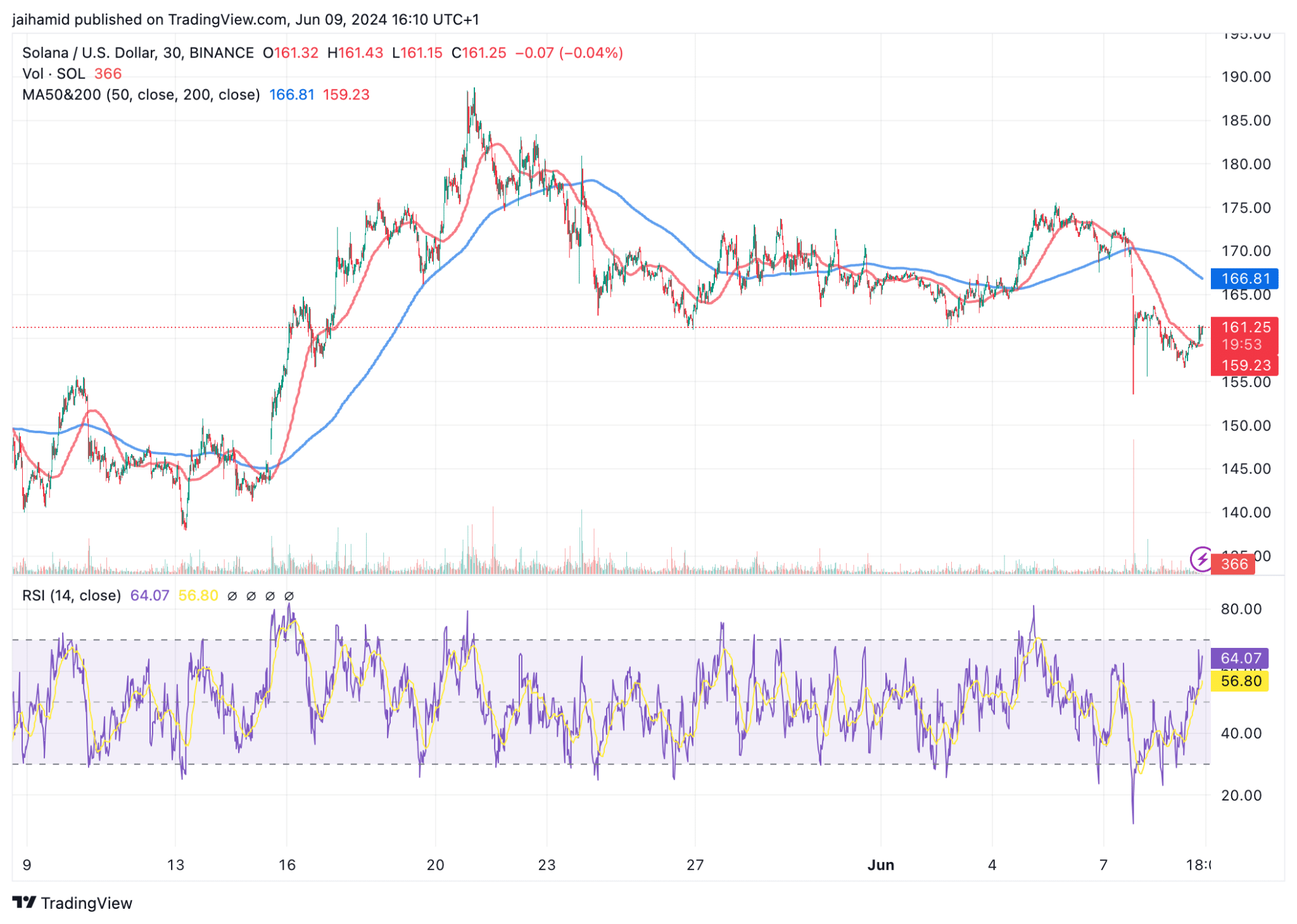

As a crypto investor, I’ve noticed that Solana (SOL) has been trading between the $158 and $173 price range for the past two weeks. More recently, a bearish technical indicator called a “death cross” occurred when the 50-day moving average dropped below the 200-day moving average on the chart. This pattern is commonly used in analysis to suggest that a downtrend may be imminent.

This means that in the short-term, unfortunately, the bears are prevailing.

As a researcher observing the market trends, I’ve noticed an intriguing price pattern. Initially, there was a sudden and significant decline in price. Following this drop, however, the price action has exhibited a period of intense consolidation. Regarding the Relative Strength Index (RSI), it currently hovers around 64. This value is closer to the upper limit of the neutral zone but has not yet crossed into the overbought territory, typically defined as values above 70.

So, there is still some buying momentum, though it is not strong.

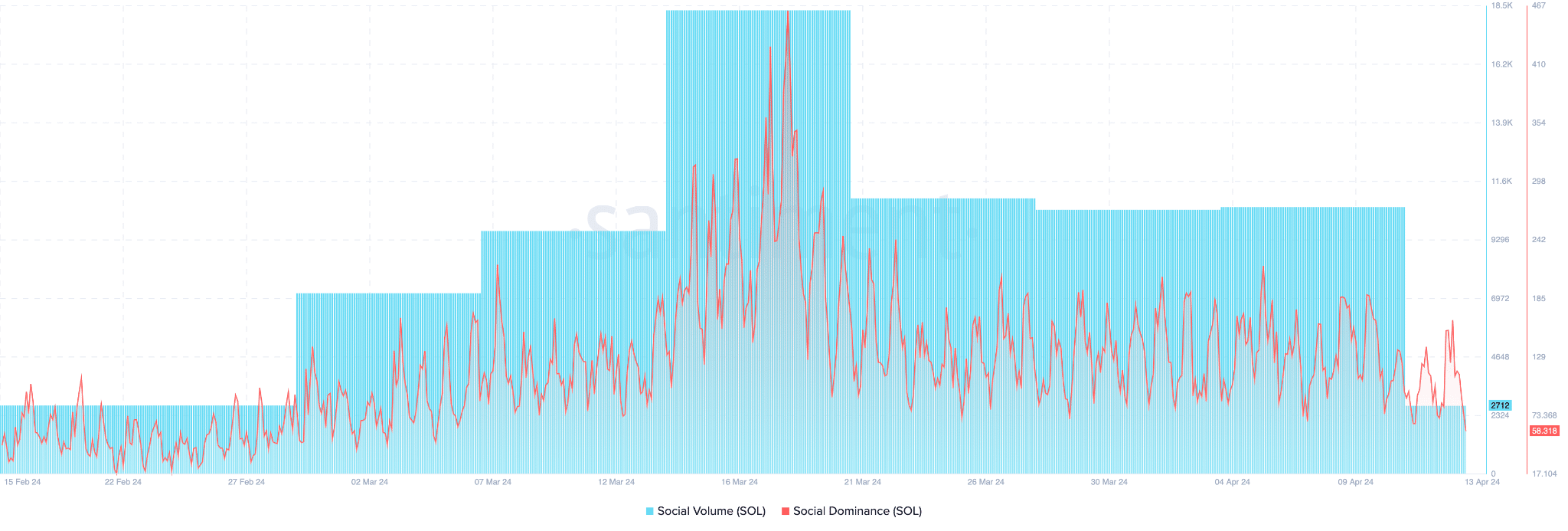

The social activity and influence of SOL within the crypto community are markedly decreasing, indicating waning enthusiasm and participation from its fan base.

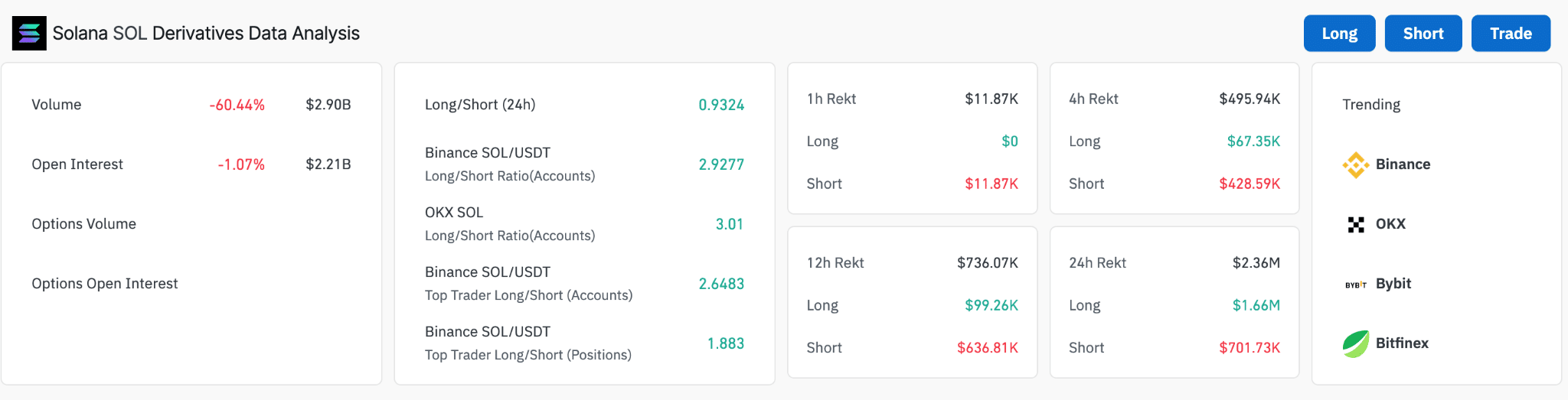

In the derivatives market, there’s no relief from the downturn. The trading volume has dropped dramatically by approximately 60.44%, amounting to only $2.90 billion. This represents a substantial decrease in market activity.

On a daily scale, the long-to-short ratio of 0.9324 indicates a minimal bias towards holding long or short positions, mirroring the market’s ambiguity regarding Solana’s potential direction.

On Binance and OKX, the long to short ratios stand out at 2.9277 and 3.01 respectively for all accounts, indicating a stronger bullish stance among traders using these platforms.

Read Solana (SOL) Price Prediction 2024-25

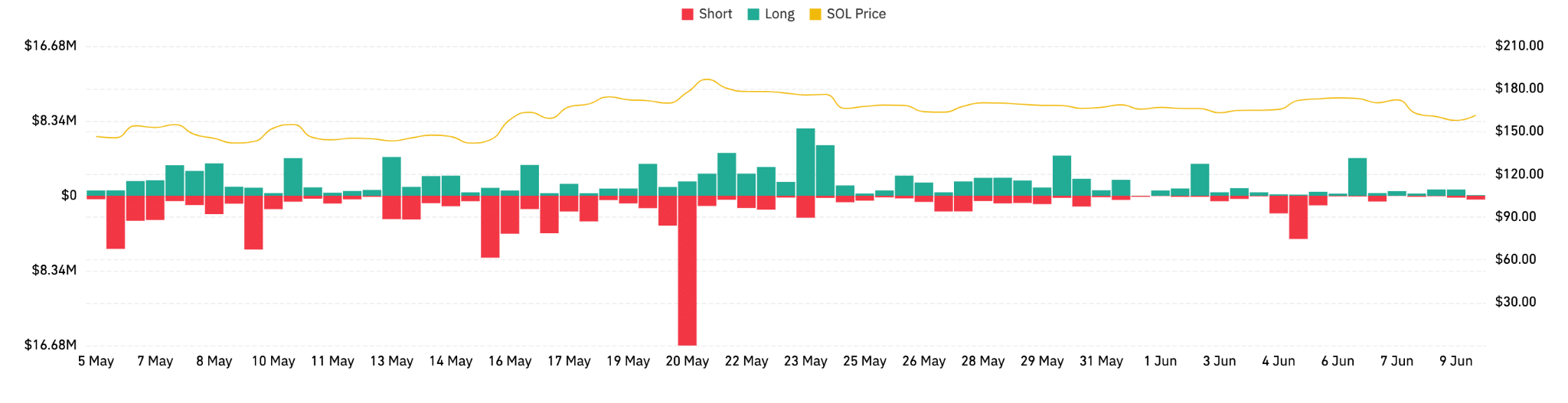

As a researcher examining market trends, I’ve noticed an intriguing pattern: the frequency of liquidations, particularly those triggered during price surges, suggests a market that is somewhat unpredictable and prone to abrupt bullish rallies. These unexpected market swings can be quite aggressive, forcing short sellers to quickly exit their positions.

In simpler terms, there could be potential for a minor market uptick if outside influences or investor optimism pick up steam.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-10 10:15