- Interest in Bitcoin ETFs grew significantly as inflows surged.

- Price movement remained neutral, holders stayed profitable.

As a seasoned crypto investor with a few bear market cycles under my belt, I’ve learned to keep an eye on key indicators like Bitcoin ETF inflows and AUM to gauge the broader sentiment towards BTC. The recent surge in interest, as evidenced by record-breaking inflows into Bitcoin ETFs, is an encouraging sign.

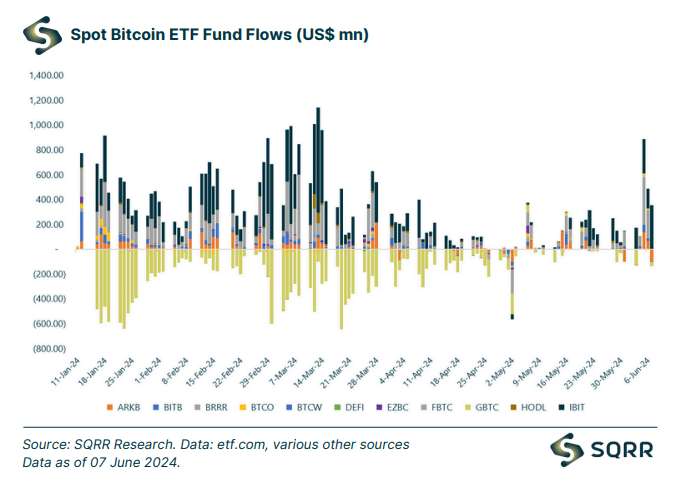

The volume of trading in Bitcoin [BTC] ETFs has significantly increased in the last month, signifying a surge in the financial sector’s appetite for Bitcoin investment.

Will Bitcoin rise?

Bitcoin ETFs surged in June, marking a record-breaking start to the month.

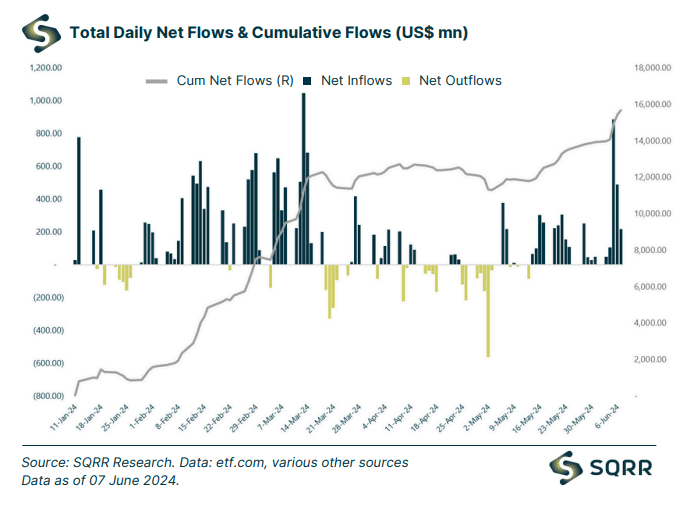

In clear and conversational terms, this robust showing was reflected in various significant indicators. These included an increase in funds being poured in, a rise in the amount of assets we manage collectively, higher trading activity levels, and personal fund sizes setting new records.

Driven by investor interest, Bitcoin ETFs collectively attracted around $1.75 billion in new investments last week.

IBIT and FBTC led the way with impressive net inflows of $1.63 billion collectively during the week. In contrast, GBTC registered as the sole fund that experienced net outflows, amounting to $-0.12 billion.

Over the past 18 days, there have been uninterrupted daily inflows into all funds amounting to an impressive total of $15.66 billion – a new record.

By the close of last week, the combined value of Bitcoin ETFs’ assets exceeded a noteworthy threshold, amounting to $62.33 billion. This notable figure underscores the mounting trust investors place in this digital asset category.

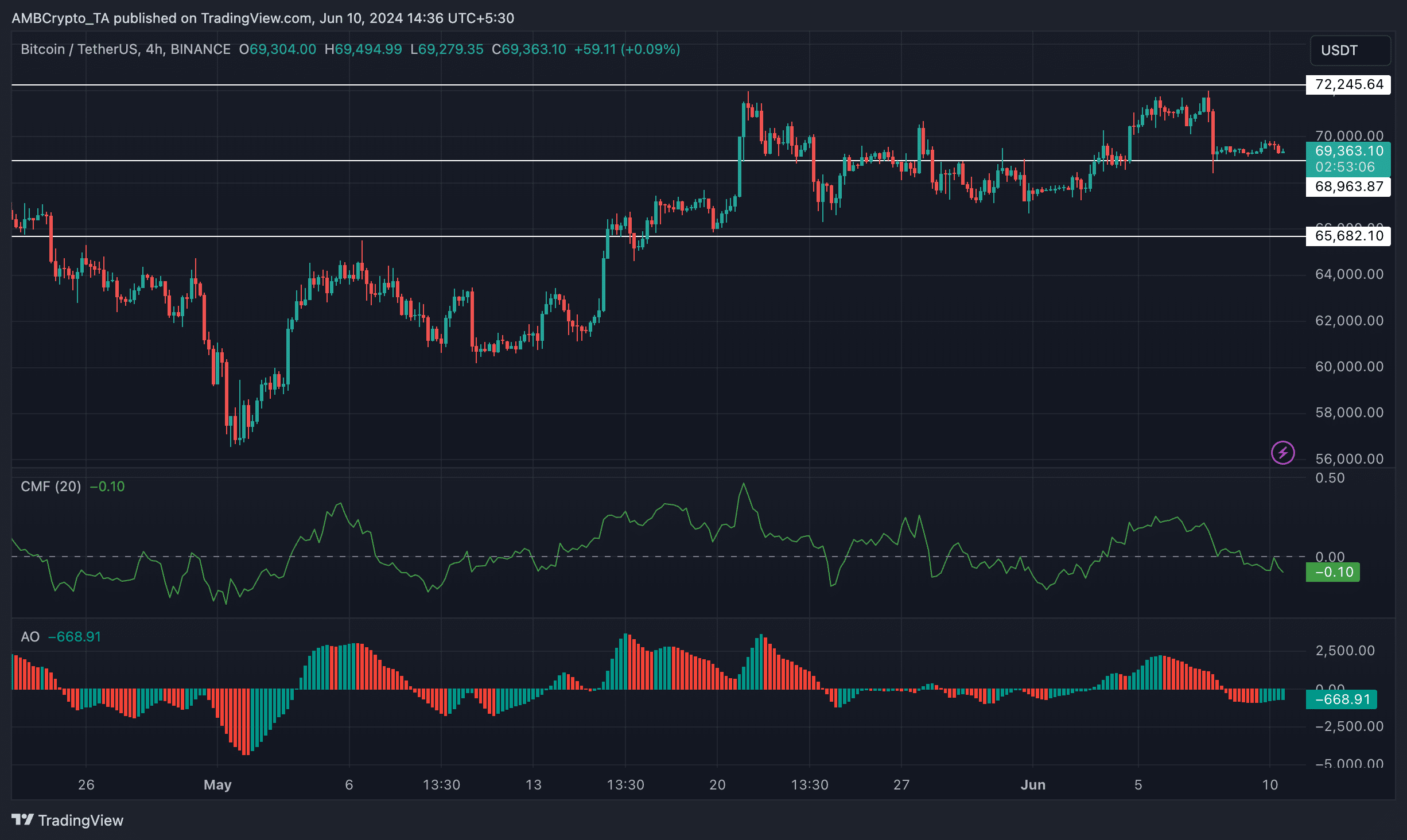

As a crypto investor, I’ve noticed that Bitcoin (BTC) has been unable to break through the $70,000 resistance level in the recent past. At the moment, BTC is priced at $69,388.69 after only a modest increase of 0.06% in the last 24 hours.

Starting from May 21st, I’ve observed Bitcoin’s price action after it hit a resistance level at $72,245.64. The overall trend appeared to be flat, yet there were some concerning signs. Specifically, the Chaikin Money Flow (CMF) indicator for Bitcoin began to decrease.

This meant that the money flowing into BTC had reduced.

As an analyst, I’d interpret this observation as follows: The Awesome Oscillator (AO), a momentum indicator that compares current price movements to past prices, has shifted into negative territory for the asset under analysis.

A decrease in Bitcoin’s price could signal that the recent upward trend is weakening, implying a possible transition to a bearish market, as there may be an increase in sellers or a decrease in buyers’ interest.

What should holders do?

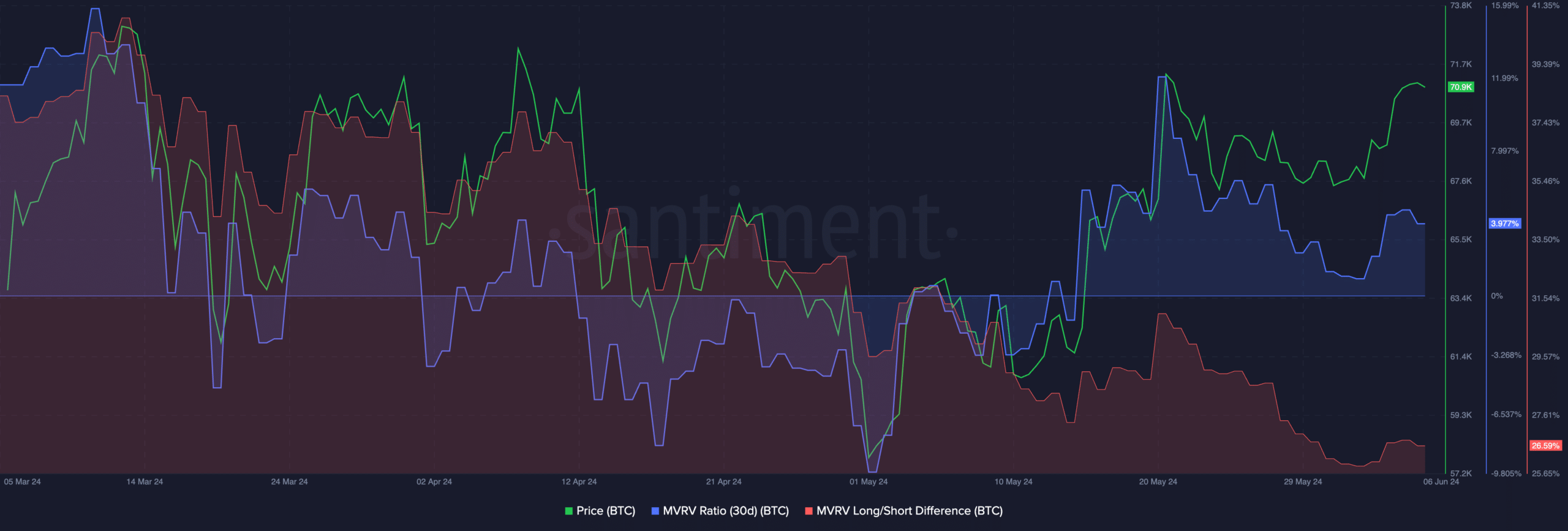

At the current moment, a majority of Bitcoin (BTC) investors were making a profit based on their purchase price, as suggested by a favorable Moving Average Realized Value (MVRV) ratio for Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher studying the Bitcoin market, I’ve noticed a considerable decrease in the long-term versus short-term difference for Bitcoin holdings. This observation suggests that there has been a notable decline in the number of investors holding Bitcoin on a short-term basis and accumulating it instead.

The attitudes and propensities of short-term investors toward buying or selling their Bitcoin holdings significantly influence its market value.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-10 14:15