- On-chain data showed that the sentiment around the crypto was bearish.

- Development activity improved and other indicators predicted a rise in Aptos price.

As a seasoned crypto investor with a keen eye for market trends and on-chain data, I’m keeping a close watch on Aptos [APT]. Recently, the sentiment around the crypto was bearish, but development activity improved, and other indicators predicted a rise in its price.

As a crypto investor, I’ve noticed an uptick in Aptos (APT) following recent news of their collaboration with a specific project. The token price has seen a boost, rising by 2.10% within the past 24 hours.

With this action, the token’s value was secured at $8.41. Concurrently, there was a noticeable increase in trading volume, suggesting a growing market appetite for Aptos.

The rise we observed wasn’t unexplained; rather, it could be attributed to an announcement made by IONET on the 6th of June. Specifically, IONET, a decentralized artificial intelligence computing platform, disclosed that they had entered into a partnership with Aptos on that date.

Not everyone is excited

Based on the project’s findings, Aptos was identified as the ideal layer-1 blockchain for maintaining a clear and unalterable ledger of AI assets. Consequently, IONET implemented its AI-driven solution on the Aptos cryptocurrency platform.

Ahmad Shadid, the founder and CEO of IONET, highlighted another significant factor behind their selection of Aptos for their blockchain needs. Specifically, he emphasized Aptos’ impressive speed and capacity to handle large volumes of transactions as key attractions.

At present, Aptos handles approximately 25,000 transactions each second, setting it apart as one of the select few blockchains boasting this level of processing power.

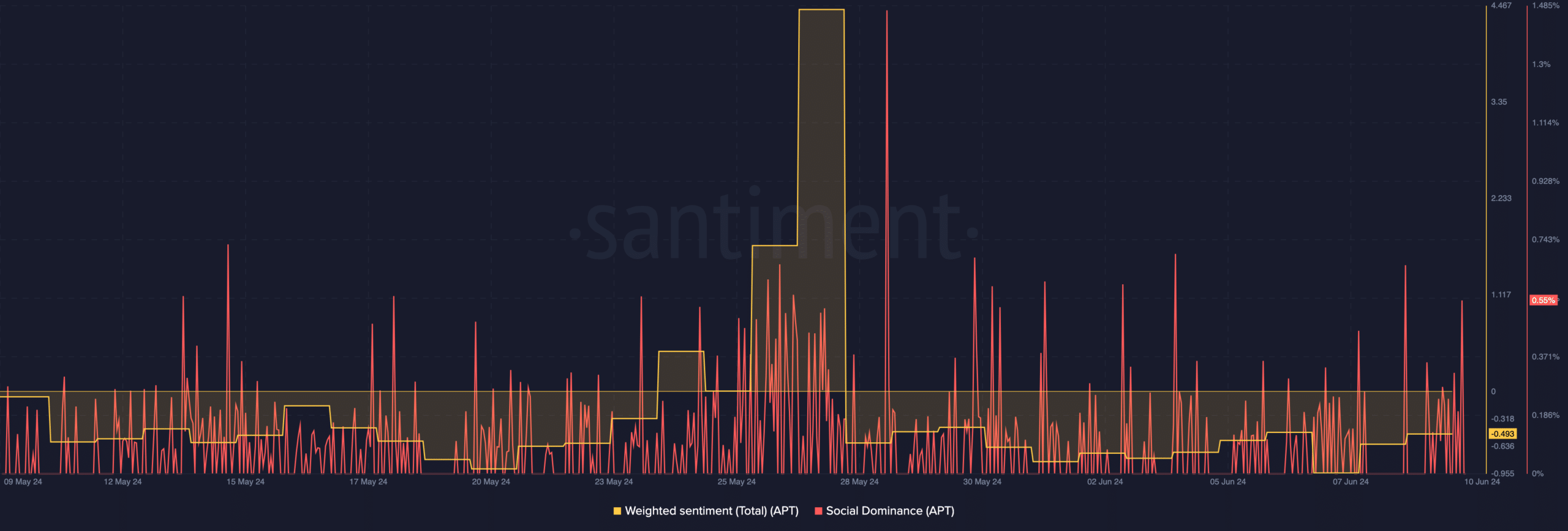

As a crypto investor, I’ve noticed that the overall sentiment towards Aptos has taken a turn for the worse recently. According to my analysis using AMBCrypto and Santiment, the weighted sentiment metric for APT is currently sitting at -0.493. This number suggests that the majority of comments and discussions surrounding Aptos are negative in tone.

If the current situation persists, the desire for the token may decrease. Moreover, the recent surge in its price could potentially lose momentum. On the other hand, there has been a noticeable rise in social influence surrounding Aptos cryptocurrency.

The improvement in discourse surrounding this asset, when compared to other top 100 assets, was evident. However, this enhancement does not guarantee a forthcoming rally. Our research revealed a possible connection to IONET once more.

TVL rises but that is not all

Instead of just mentioning “apart from its partnership with Aptos,” you could say “In addition to its collaboration with Aptos, IONET’s cryptocurrency is set to debut on June 11th. With a forthcoming listing on Binance, there has been growing interest among market participants in Aptos crypto due to their association.”

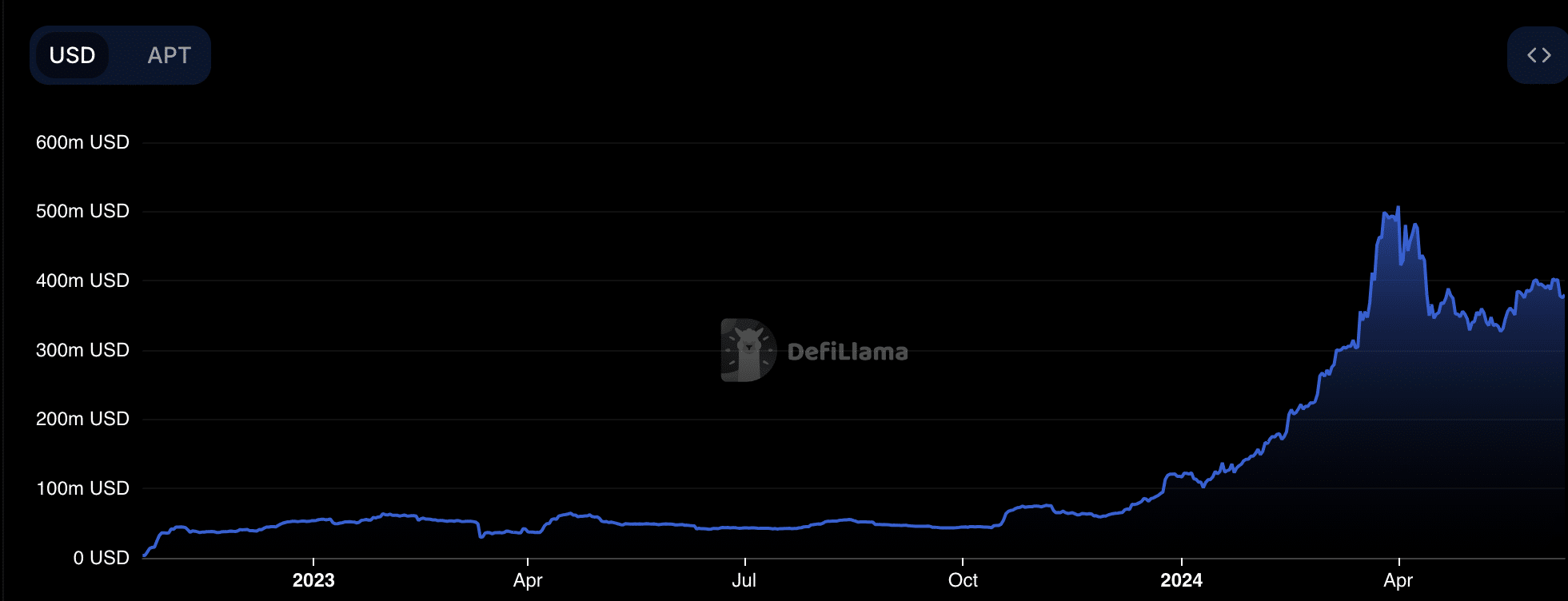

AMBCrypto analyzed another figure, which is referred to as Total Value Locked (TVL). Specifically on May 14th, the TVL of Aptos was reportedly $326.99 million based on information provided by DeFiLlama.

At the point of publication, the data indicated a rebound for the metric, which stood at $379.91 million. This improvement might be due to the substantial amount of assets being held or secured through various protocols on the blockchain.

If maintained, the value of assets secured in Aptos has the potential to reach up to $450 million, as was the case back in April. However, should trust in the platform wane, this valuation could plummet once more.

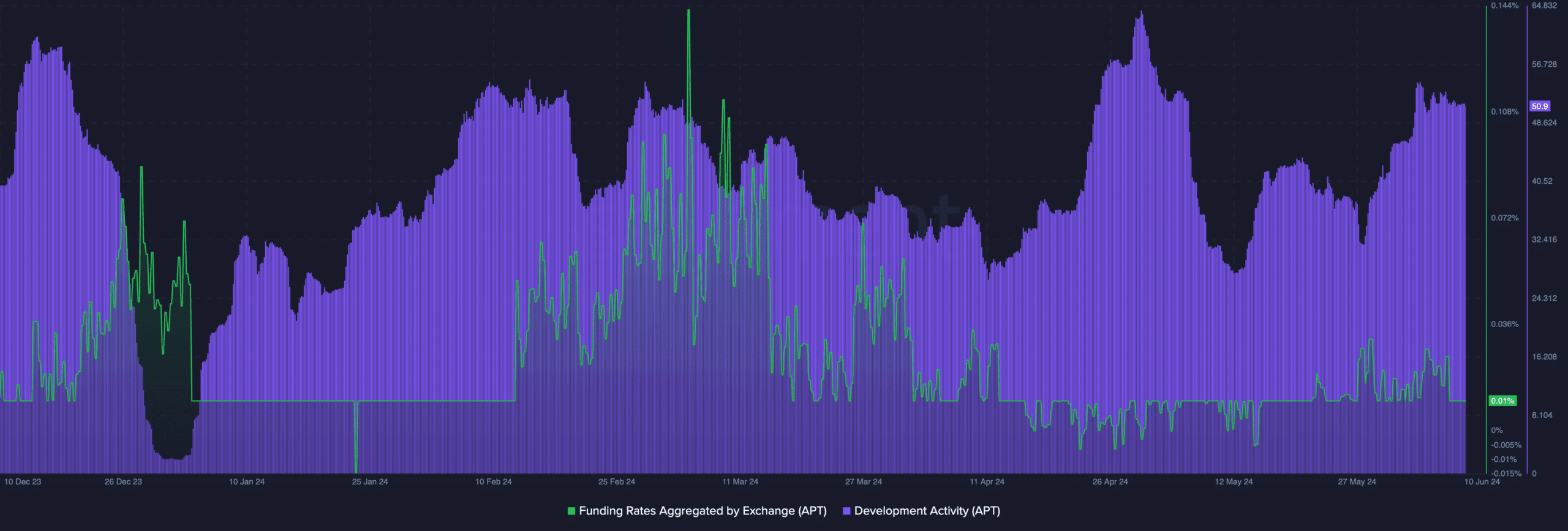

Currently, there’s a rise in development efforts on the Aptos blockchain. According to the latest data, the network activity level stands at 50.90.

For any project, this key performance indicator plays a vital role. It signifies the pace at which novel features are released into the market, thereby promoting expansion and increasing user engagement.

Will APT’s price reach $9?

If the data for Aptos crypto indicates a potential bullish signal, but the metric in question doesn’t strongly influence APT‘s price movements, then it’s uncertain if this trend will lead to further price growth.

During that period, Aptos’ funding rate stood at 0.01%, which is a positive figure but represents a decrease from its previous level a few days prior.

As an analyst, I would explain that the Funding Rate represents the fee or cost incurred for maintaining an open position in a perpetual swap contract. When the rate is positive, this signifies that the price of the perpetual contract is above the current spot market value, causing buyers to pay a premium to keep their positions open.

Alternatively, the discounted perpetual price contrasts with the higher spot price. Yet, the decline in the perpetual price alongside the rise in the APT price suggests that perpetual traders remain skeptical about an upcoming price hike.

Realistic or not, here’s APT’s market cap in SOL terms

Based on the available information, it seems that spot traders are becoming more assertive in their trading activities. Consequently, this may indicate a potential price increase for Aptos crypto.

Based on current appearances, APT‘s price may reach $9 in the near future. Yet, this scenario is contingent upon the absence of significant selling pressure.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-10 15:04