-

Activity on the Litecoin network hit a mind-blowing number, suggesting that LTC could rally.

Targets from analysis showed that the price could reach $85.

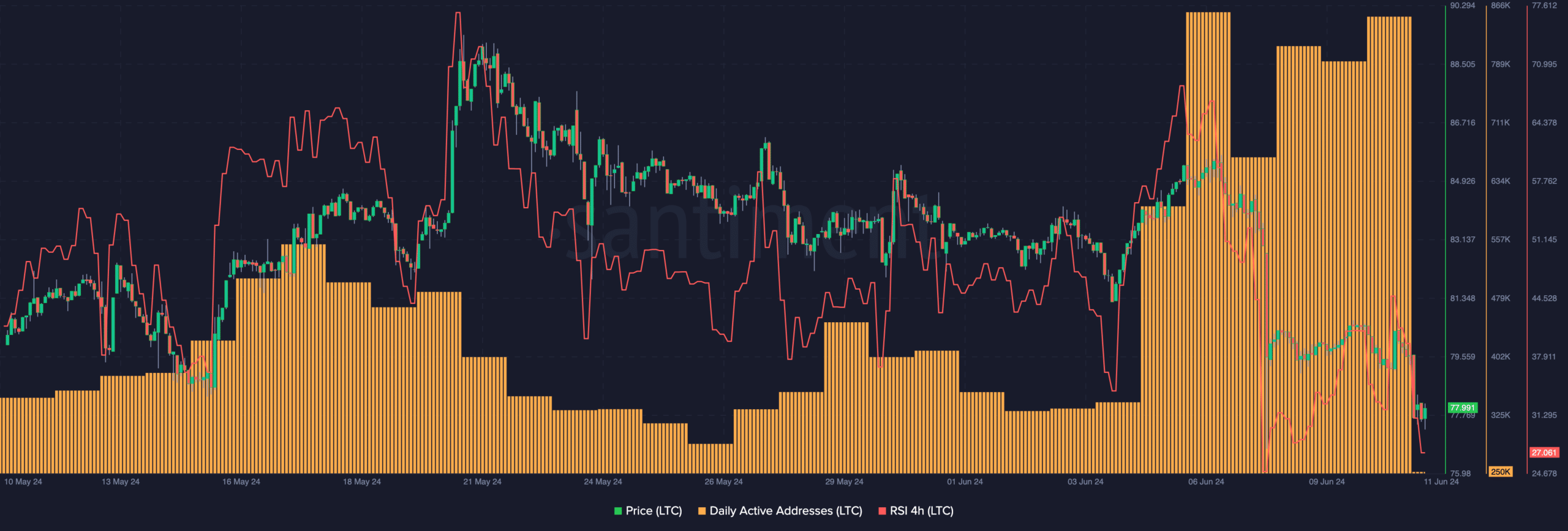

As an experienced analyst, I believe that the recent surge in activity on the Litecoin (LTC) network is a strong indication that the price could rally. The significant increase in unique addresses interacting with LTC in the last seven days suggests that sellers may be exhausted and that buyers are gaining momentum.

According to AMBCrypto’s analysis, Litecoin [LTC] is exhibiting a bullish divergence – a sign that may indicate an impending price increase. Bullish divergences occur when the cryptocurrency’s price begins to rebound while its related momentum or volume indicators continue to trend downward. This discrepancy could potentially mark the end of a downtrend and pave the way for further gains.

When the cost of a coin decreases, the oscillator reads lower, yet there’s heightened network activity. An illustration of this phenomenon can be found in Litecoin’s experience.

Based on recent data from Santiment, I’ve noticed that over 700,000 distinct Litecoin (LTC) addresses have been active within the past week.

I. In May, approximately 345,000 unique market participants were involved in successful transactions, as indicated by the total count of active addresses.

As a crypto investor, I can tell you that the significant surge in activity during the initial days of June on Litecoin outpaced the entire month of May in terms of engagement.

Are LTC sellers exhausted?

Previously, LTC experienced a significant price increase from $78.60 to $84.63 in just a few short days. Yet, this upward trend wasn’t solely based on heightened network activity.

As a crypto investor, I closely monitor various indicators to make informed decisions in the market. One such tool is the Relative Strength Index (RSI), which AMBCrypto also considered for its analysis. By examining the RSI, we can identify when an asset is overbought or oversold based on its momentum. When the RSI value reaches above 70, it suggests the asset is overbought and may be due for a correction. Conversely, when the RSI falls below 30, it indicates that the asset is oversold and could potentially experience a rebound. Therefore, keeping an eye on the RSI readings can provide valuable insights into potential price movements.

As a researcher studying market trends, I’ve observed that when an asset’s reading reaches 70 or above on the chart, it could be considered overbought among older investors. On the contrary, a reading of 30 or below indicates that a cryptocurrency was oversold based on my analysis.

As an analyst, I’ve observed that at the current moment, Litecoin’s Relative Strength Index (RSI) on its 4-hour chart is approaching the oversold territory. This signifies that the coin has been heavily sold in the recent past and could be due for a potential price rebound. If this trend holds, Litecoin’s price might surge towards $75.

As network activity continues to rise, there’s a possibility that the coin’s price could rebound. In such a scenario, a reasonable target could be set at $85.

Another move may be in the works

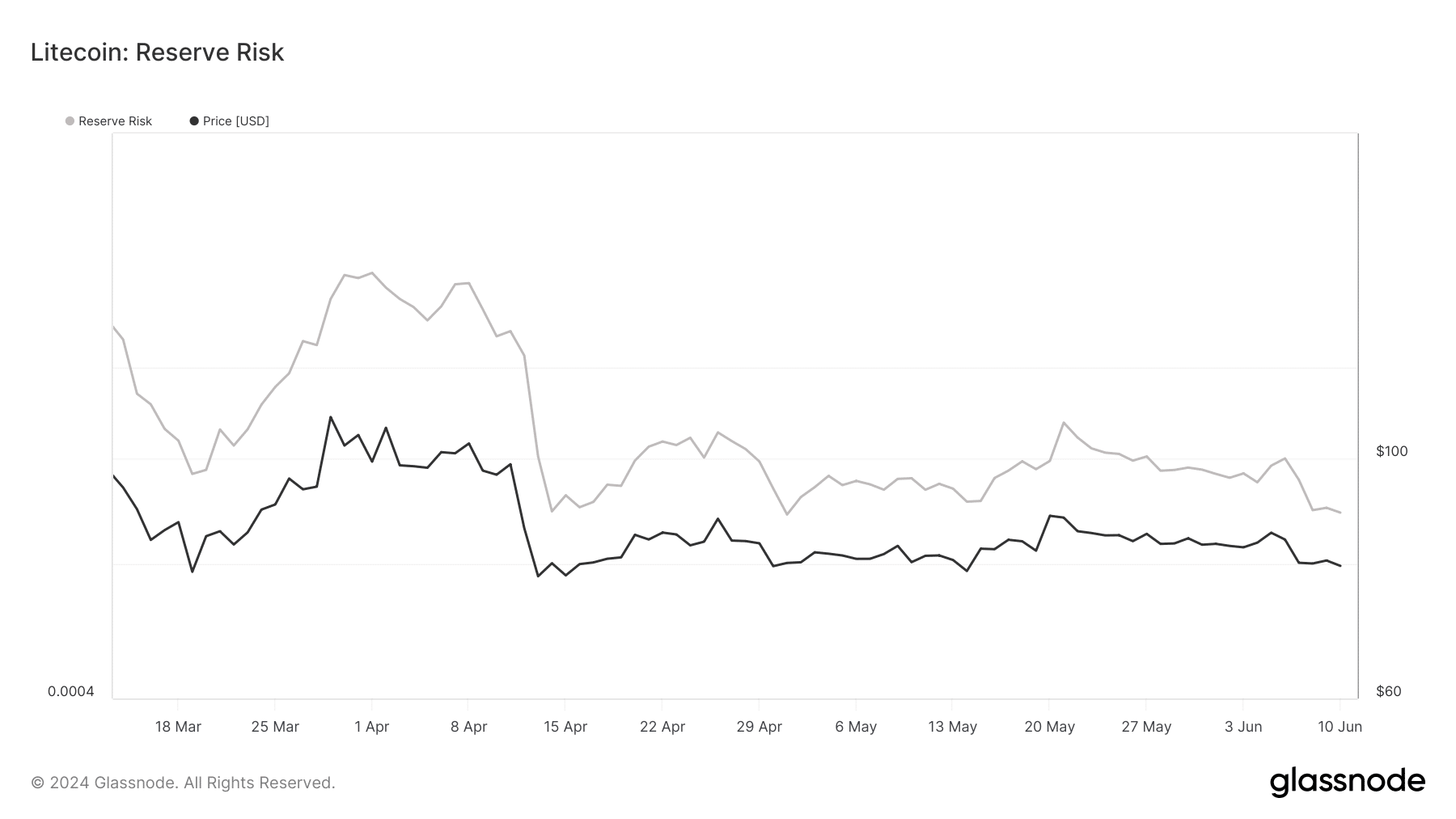

To evaluate if Long-Term Cryptocurrencies (LTC) might increase in value, AMBCrypto proposes examining the Reserve Risk as a possible indicator. The Reserve Risk quantifies the market’s conviction and assesses the potential reward against risk for an asset.

When the metric is elevated, it indicates a low level of confidence, implying a higher risk that may not be commensurate with the potential reward. Conversely, a reduced Reserve Risk contributes to increased confidence, suggesting a favorable risk-reward scenario.

From my perspective as a crypto investor, the current value of Litecoin (LTC) at $0.00050 is quite appealing. This low reading on the meter might indicate a potential buying opportunity. However, it’s essential to consider where LTC could head in the short term.

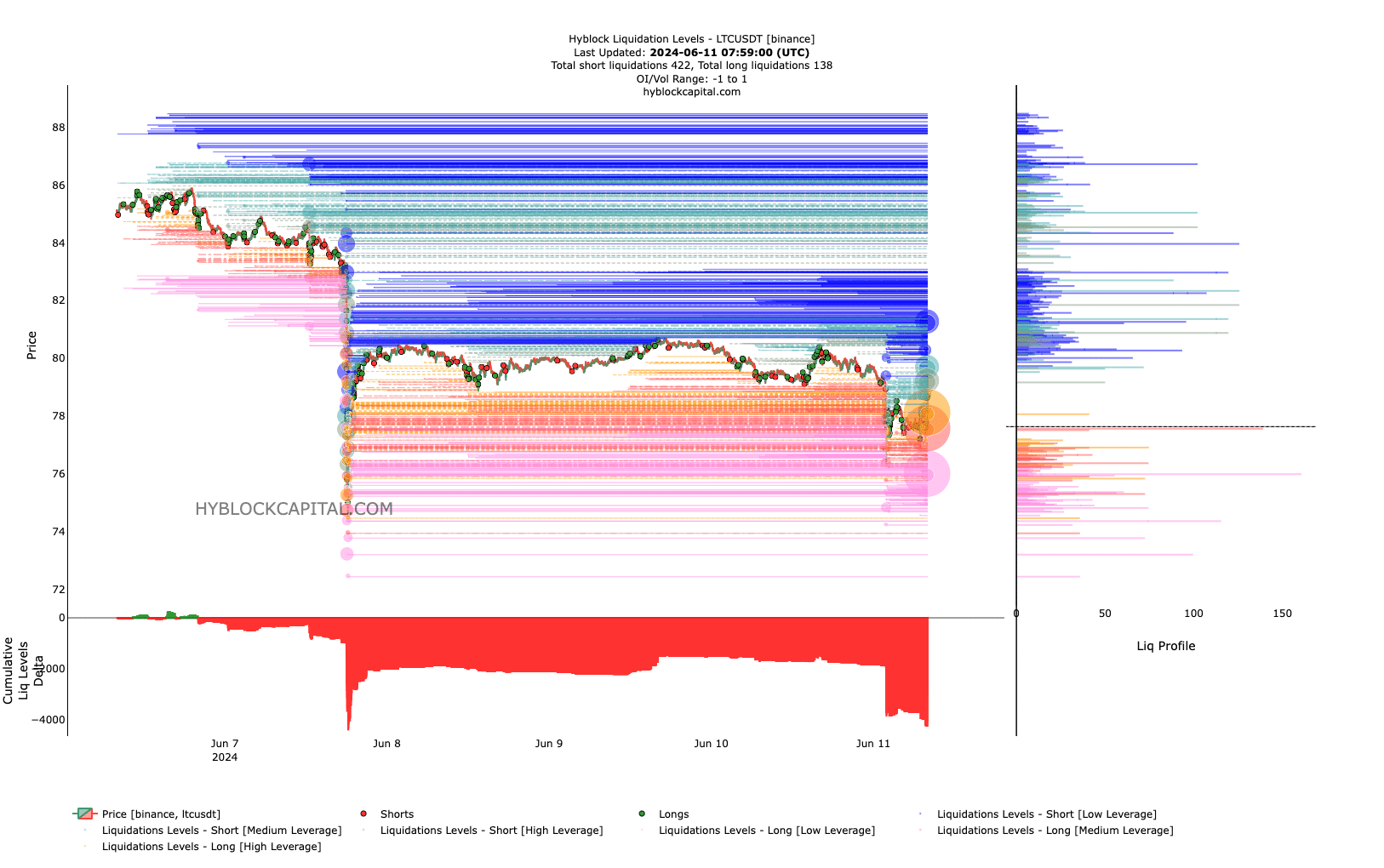

As a researcher studying market trends, I have found that analyzing liquidation levels provides valuable insights into potential price movements. These levels represent specific price points where significant sell-offs, or liquidation events, may take place. At the current moment in time, an intriguing cluster of liquidity has emerged between $80.20 and $87.65 on the price chart.

Read Litecoin’s [LTC] Price Prediction 2024-2025

As an analyst, I’d interpret this by saying: The substantial pools of available funds in the market imply that the price could potentially reach those levels. Moreover, a negative Cumulative Liquidation Levels Delta (CLLD) indicates downward pressure on price movements.

As a market analyst, I would interpret this situation as follows: If Litecoin’s price retraces after coming close to recovery, it could potentially reach beyond $85 in the upcoming weeks.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-06-11 23:04